Square Mobile Payments: Revolutionizing Your Business Transactions

In today’s fast-paced world, efficient payment solutions are essential for business success. Square Mobile Payments offers a versatile and user-friendly system for businesses of all sizes.

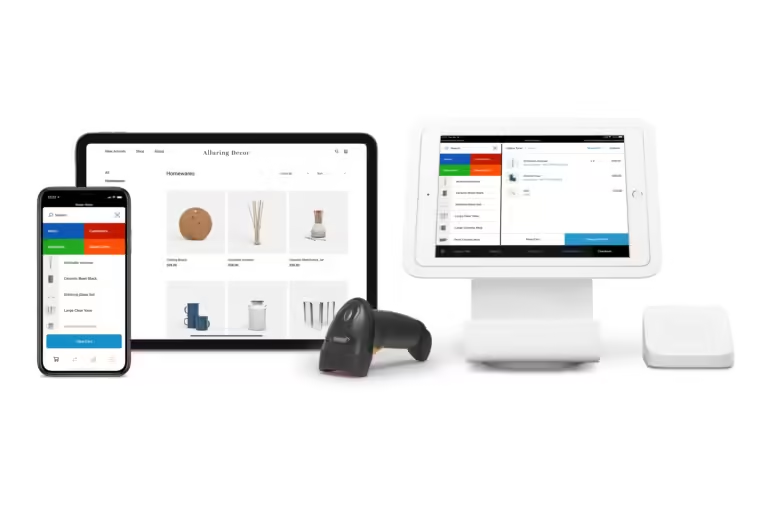

Square provides a range of tools designed to streamline transactions and manage business operations. From the Square Register, a complete point-of-sale package, to the portable Square Terminal, and the versatile Square Stand, these solutions cater to various business needs. With integrated software for payments, payroll, and banking, Square supports over 4 million businesses worldwide. Whether you run a restaurant, retail store, beauty salon, or fitness center, Square has specialized solutions to help you grow. Ready to simplify your business operations? Learn more about Square’s offerings here.

Introduction To Square Mobile Payments

Square Mobile Payments offers businesses a simple and effective way to accept payments. With a wide range of tools and services, Square supports millions of businesses worldwide. From retail shops to beauty salons, Square caters to diverse business needs. Explore what makes Square a trusted choice for businesses globally.

What Is Square Mobile Payments?

Square Mobile Payments is a part of Square’s comprehensive business solutions. It allows businesses to accept credit card payments using mobile devices. This service is ideal for businesses on the go. With Square Mobile Payments, you can use your smartphone or tablet to process transactions. This makes it easy to accept payments anywhere, anytime.

Purpose And Vision Of Square

Square aims to empower businesses of all sizes. Their vision is to provide simple, yet powerful tools for business success. Square’s products include:

- Square Register: A complete point-of-sale package.

- Square Terminal: A portable and powerful point-of-sale device.

- Square Stand: A 180º rotating countertop stand.

Square also offers integrated software solutions for payments, payroll, and more. Their banking services include Square Checking and the Square Debit Card. All these tools help businesses manage their operations efficiently.

Square supports over 4 million businesses worldwide. They provide specialized solutions for various business types, including:

- Food & Beverage

- Retail

- Beauty Salons

- Fitness

- Professional Services

For more information or to get started with Square’s products and services, visit the Square website.

Key Features Of Square Mobile Payments

Square Mobile Payments offers a range of features designed to streamline transactions and enhance user experience. These features make it an essential tool for businesses across various sectors. Let’s explore some of the key features.

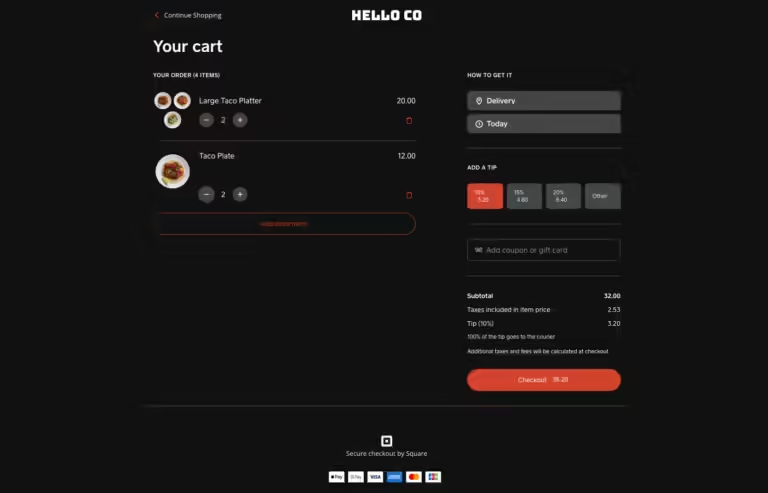

User-friendly Interface

Square Mobile Payments boasts a user-friendly interface that is easy to navigate. Even first-time users can quickly understand how to process payments. The app is designed with simplicity in mind, ensuring that all essential functions are accessible with just a few taps.

- Intuitive design

- Easy-to-read buttons and labels

- Accessible for users with various levels of tech-savviness

Quick And Secure Transactions

One of the standout features of Square Mobile Payments is its ability to handle quick and secure transactions. Speed and security are critical for both businesses and customers. Square ensures that transactions are completed swiftly, without compromising security.

| Transaction Speed | Security Features |

|---|---|

| Instant processing | End-to-end encryption |

| Real-time updates | Secure card reader technology |

Versatility Across Devices

Square Mobile Payments works seamlessly across various devices, offering versatility that caters to different business needs. Whether you are using a smartphone, tablet, or Square’s own hardware, the app provides consistent performance.

- Compatible with iOS and Android

- Works with Square Terminal, Stand, and Register

- Ensures consistent user experience

Integrated Analytics And Reporting

Understanding business performance is crucial. Square Mobile Payments includes integrated analytics and reporting tools. These tools help businesses track sales, manage inventory, and gain insights into customer behavior.

- Real-time sales data

- Customizable reports

- Inventory management

- Customer insights

These features make Square Mobile Payments a comprehensive solution for modern businesses. From user-friendly design to advanced analytics, it equips businesses with the tools needed for success.

Pricing And Affordability

Choosing the right payment solution for your business is crucial. Square offers competitive pricing and value. Let’s explore its pricing structure, compare costs with competitors, and understand the value it brings.

Transparent Pricing Structure

Square stands out with its transparent pricing structure. There are no hidden fees or long-term contracts. Square charges a flat rate for each transaction:

- Card-present transactions: 2.6% + 10¢ per transaction

- Card-not-present transactions: 2.9% + 30¢ per transaction

- Square Invoice payments: 2.9% + 30¢ per invoice

Additional features like payroll and banking services have their own pricing but follow the same transparent approach.

Comparing Costs With Competitors

How does Square’s pricing stack up against its competitors? Here’s a quick comparison:

| Service | Square | Competitor A | Competitor B |

|---|---|---|---|

| Card-present transactions | 2.6% + 10¢ | 2.75% | 2.7% + 15¢ |

| Card-not-present transactions | 2.9% + 30¢ | 3.5% + 15¢ | 3.2% + 25¢ |

| Invoice payments | 2.9% + 30¢ | 3.0% + 25¢ | 2.9% + 20¢ |

Square’s rates are competitive, often lower or similar to other leading payment processors.

Value For Money

Beyond low fees, Square offers exceptional value for money. Here are some benefits:

- Integrated Solutions: Payments, payroll, and banking in one place.

- Support for Multiple Industries: Tailored solutions for retail, food, beauty, and more.

- Extensive Hardware Options: From registers to portable terminals.

Square’s all-in-one platform supports over 4 million businesses. This makes it an ideal choice for many business types.

For more information, visit Square’s official website.

Pros And Cons Of Square Mobile Payments

Square Mobile Payments offers a range of features that can benefit small businesses. It’s important to understand both the advantages and potential drawbacks before deciding if it’s the right solution for you. Below, we’ll explore the pros and cons of using Square Mobile Payments.

Advantages For Small Businesses

Square Mobile Payments provides several advantages for small businesses:

- User-friendly Interface: Easy to set up and use.

- Portability: Accept payments anywhere with the Square Terminal.

- Comprehensive Solutions: Integrated software for payments, payroll, and more.

- Cost-Effective: No long-term contracts or hidden fees.

- Diverse Business Support: Specialized solutions for restaurants, retail, beauty, and services.

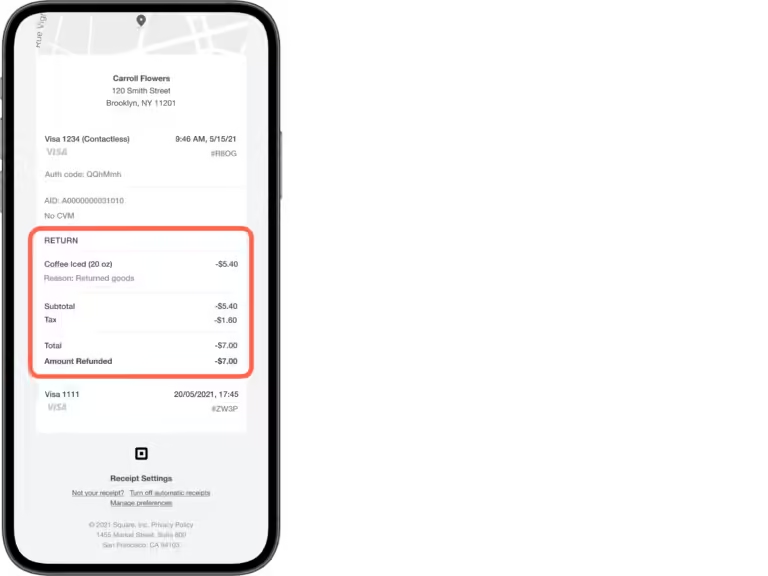

Potential Drawbacks

Despite its many benefits, Square Mobile Payments has some drawbacks:

- Transaction Fees: Fees for each transaction can add up.

- Internet Dependence: Requires a reliable internet connection for processing payments.

- Limited Customer Support: Some users report challenges with customer service response times.

- Refund Policy: Lack of detailed refund or return policies.

User Testimonials And Reviews

Feedback from users can offer valuable insights. Here are some user testimonials:

“Square has transformed the way we do business. The ease of use is unmatched.”

– John D., Small Business Owner

“The transaction fees are a bit high, but the convenience is worth it.”

– Sarah L., Retail Store Manager

“Customer support could be better, but overall, Square is a solid choice.”

– Mike R., Restaurant Owner

For more information or to get started with Square’s products and services, visit the Square website.

Specific Recommendations For Ideal Users

Square Mobile Payments offers diverse solutions for various business types. It is crucial to identify the ideal users to maximize the benefits of these services. Below are specific recommendations for those users.

Best Scenarios For Implementation

Square is ideal for businesses that need flexible and reliable payment solutions. Here are some scenarios where Square shines:

- Pop-up shops and markets: Use the portable Square Terminal for seamless transactions on the go.

- Restaurants: Utilize the Square Register for efficient order management and payment processing.

- Retail stores: The Square Stand provides a sleek countertop solution with a 180º rotating stand for customer convenience.

- Beauty salons: Integrated software solutions help manage appointments, payments, and customer relationships.

Industries Benefitting The Most

Several industries benefit significantly from Square’s offerings. The main industries include:

| Industry | Benefits |

|---|---|

| Food & Beverage | Efficient order and payment processing with Square Register and Terminal. |

| Retail | Sleek, customer-friendly point-of-sale solutions with Square Stand and Register. |

| Beauty Salons | Comprehensive scheduling, payment, and customer management systems. |

| Fitness | Integrated solutions for membership payments and management. |

| Professional Services | Streamlined invoicing, payments, and banking services. |

Tips For Maximizing Benefits

To get the most out of Square Mobile Payments, consider the following tips:

- Leverage all features: Utilize the full suite of tools including Square Banking, point-of-sale systems, and integrated software solutions.

- Train your staff: Ensure employees are well-versed in using Square devices and software for smooth operations.

- Customize your setup: Tailor the Square system to fit your specific business needs and workflow.

- Monitor analytics: Use Square’s analytics to track sales, customer behavior, and business performance.

- Stay updated: Regularly check for software updates and new features to keep your system current and efficient.

Frequently Asked Questions

What Is Square Mobile Payments?

Square Mobile Payments is a service that allows businesses to accept credit card payments via mobile devices.

How Does Square Mobile Payments Work?

Square Mobile Payments works by connecting a card reader to your mobile device, enabling credit card transactions.

Is Square Mobile Payments Secure?

Yes, Square Mobile Payments is secure. It uses encryption and follows industry standards to protect payment information.

What Devices Are Compatible With Square?

Square Mobile Payments is compatible with iOS and Android devices, including smartphones and tablets.

Conclusion

Square Mobile Payments offers a practical solution for diverse business needs. Its tools, like the Square Register and Terminal, simplify sales. Over 4 million businesses trust Square’s services. For detailed features and pricing, visit the official Square website. Start enhancing your business operations with Square’s comprehensive solutions today. For more information, explore Square.