Optimize Cash Management: Boost Efficiency and Maximize Profits

Cash management is essential for any business’s success. It ensures smooth operations and financial stability.

Effective cash management helps monitor, analyze, and optimize cash flow. It prevents cash shortages and improves financial health. This blog post will explore strategies to enhance cash management, emphasizing the importance of automation tools like BILL. BILL offers comprehensive financial operations, automating bill creation, invoicing, expense management, and budget control. Its seamless integration with popular accounting software makes it an ideal choice for businesses. Improved efficiency, enhanced control, and better visibility into financial operations are just a few benefits. Read on to discover practical tips and tools that can transform your cash management processes.

Introduction To Cash Management Optimization

Effective cash management is crucial for any business. It ensures that cash inflows and outflows are managed efficiently. This leads to better financial health and stability. Using a platform like BILL can help streamline these processes.

Understanding Cash Management

Cash management involves managing a company’s cash flow. This includes monitoring cash inflows and outflows. Efficient cash management ensures that a business has enough cash to meet its obligations. It also helps in planning for future expenses.

With BILL, companies can automate many aspects of cash management. This includes accounts payable, accounts receivable, and expense management. The platform integrates with popular accounting software. This streamlines the entire financial workflow.

The Importance Of Efficient Cash Management

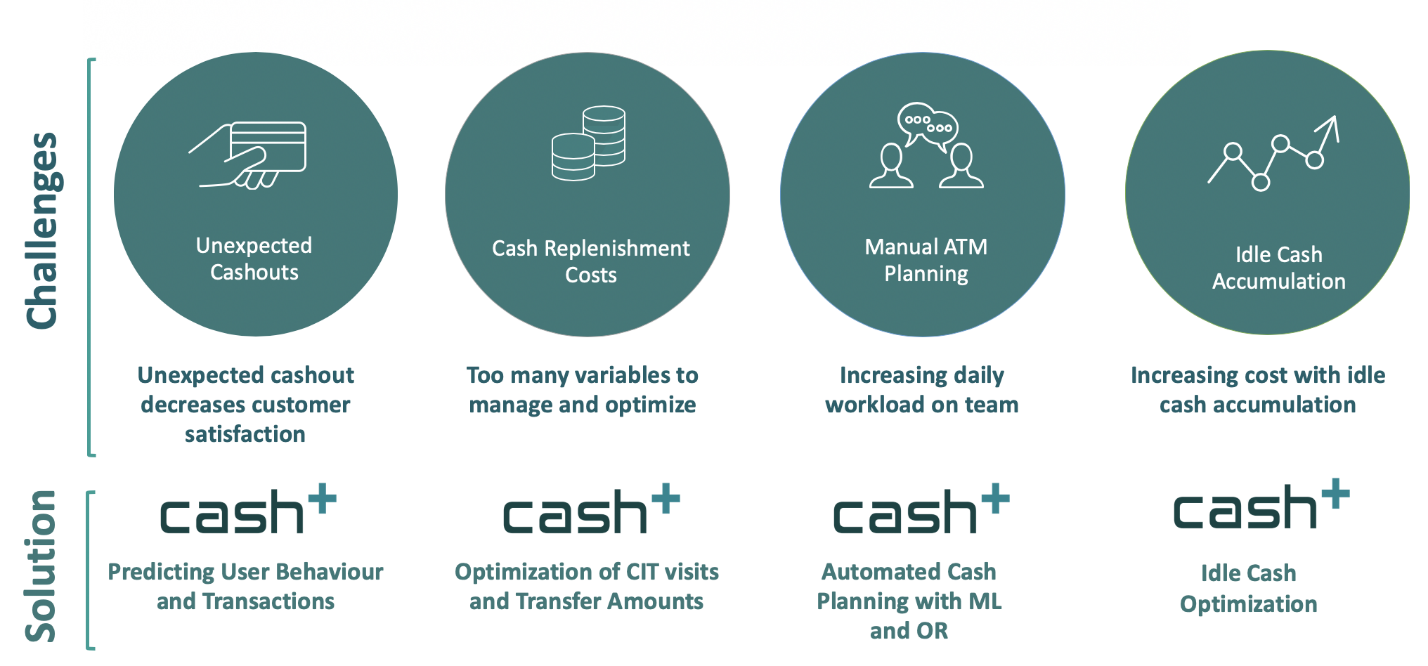

Efficient cash management is vital for several reasons:

- Operational Efficiency: Automation of financial tasks saves time and reduces errors.

- Budget Control: Tools like the BILL Divvy Card help set and track budgets.

- Visibility: Comprehensive insights into financial operations aid in better decision-making.

- Cost Savings: Users report significant monthly savings by using BILL.

- Credit Access: BILL provides business credit lines ranging from $1,000 to $5 million.

Efficient cash management also enhances a company’s ability to plan for future growth. It ensures there is enough cash on hand to seize new opportunities. With BILL, businesses can achieve this with ease.

Below is a table summarizing the main features and benefits of BILL:

| Feature | Benefit |

|---|---|

| Accounts Payable Automation | Simplifies the entire AP process from bill creation to approvals and payments. |

| Spend & Expense Management | Provides credit lines, budget setting, and spend tracking with the BILL Divvy Card. |

| Accounts Receivable Management | Streamlines invoicing and payment collections. |

| Integrated Platform | Manages AP, AR, spend, and expense with automatic syncing to accounting software. |

| Accountant Partner Program | Automates bookkeeping tasks and enables client bill pay. |

| Integrations | Connects with QuickBooks, Sage Intacct, Oracle Netsuite, Microsoft Dynamics, Xero, Slack, and HRIS. |

By using BILL, businesses can streamline their cash management processes. This leads to improved financial health and stability.

Key Features Of Effective Cash Management

Effective cash management is essential for maintaining business stability. Implementing the right strategies can improve liquidity, reduce financial risks, and ensure smooth operations. Here are some key features of effective cash management.

Automation Tools

Automation tools are crucial for efficient cash management. They help streamline financial operations, reduce errors, and save time. For instance, BILL offers comprehensive automation for accounts payable and receivable. This includes bill creation, approvals, payments, and invoicing. Automation ensures tasks are completed promptly and accurately, enhancing overall efficiency.

Cash Flow Forecasting

Cash flow forecasting helps predict future cash inflows and outflows. This allows businesses to plan accordingly and avoid cash shortages. BILL provides tools for detailed cash flow analysis. By integrating with popular accounting software, it offers real-time insights into financial health. Regular forecasting helps businesses make informed decisions and maintain liquidity.

Expense Management

Effective expense management is vital for controlling costs and maintaining budgets. BILL offers robust spend and expense management features. It includes budget setting, spend tracking, and the use of the BILL Divvy Card for managing business expenses. These tools help businesses monitor and control their spending, ensuring they stay within budget limits.

Integration with banking systems ensures seamless financial operations. BILL integrates with major banking systems and popular accounting software like QuickBooks, Sage Intacct, Oracle Netsuite, Microsoft Dynamics, and Xero. This enables automatic syncing of transactions, enhancing accuracy and efficiency. Businesses can manage their finances in one unified platform, ensuring consistency and ease of use.

In summary, effective cash management involves using automation tools, accurate cash flow forecasting, efficient expense management, and seamless integration with banking systems. These features help businesses maintain financial stability, improve efficiency, and ensure long-term success.

How Automation Tools Enhance Efficiency

Automation tools can greatly enhance the efficiency of cash management. By leveraging tools like BILL, businesses can streamline financial tasks, reduce errors, and improve overall productivity. This section explores three key benefits of using automation tools.

Reducing Manual Errors

Manual data entry is prone to errors, which can lead to significant financial discrepancies. BILL automates the accounts payable process, from bill creation to approvals and payments. This reduces the risk of human error and ensures accurate financial records. With automatic syncing to popular accounting software, the need for manual intervention is minimized, enhancing data integrity.

Saving Time On Repetitive Tasks

Repetitive tasks, such as invoicing and expense management, consume valuable time. BILL provides tools to automate these processes, allowing businesses to focus on more strategic activities. According to user reports, the platform saves an average of 12 hours monthly. This time saving can be redirected towards growth and innovation.

Improving Data Accuracy

Accurate financial data is crucial for making informed decisions. BILL ensures data accuracy by integrating with accounting software like QuickBooks, Sage Intacct, and Oracle Netsuite. This seamless integration ensures that all financial information is up-to-date and accurate. Businesses gain comprehensive visibility into their financial operations, enabling better budget and spend control.

| Feature | Benefit |

|---|---|

| Accounts Payable Automation | Simplifies AP process, reducing errors |

| Spend & Expense Management | Automates repetitive tasks, saving time |

| Integrated Platform | Improves data accuracy through seamless syncing |

Using tools like BILL not only boosts efficiency but also provides tangible benefits. These include cost savings and enhanced control over financial operations.

The Role Of Cash Flow Forecasting In Maximizing Profits

Cash flow forecasting is essential for maximizing profits. It helps businesses predict future cash needs, avoid cash shortfalls, and make strategic decisions. By analyzing past and present financial data, companies can create accurate forecasts. This practice ensures a steady cash flow, which is crucial for growth and stability.

Predicting Future Cash Needs

Businesses must predict their future cash needs to stay financially healthy. Cash flow forecasting helps identify periods of high and low cash availability. This allows companies to plan for expenses and investments.

- Analyze historical data

- Consider seasonal trends

- Account for upcoming expenses

Tools like BILL assist in this process by automating expense management and budget control.

Avoiding Cash Shortfalls

Cash shortfalls can disrupt operations and harm profitability. Forecasting helps prevent this by highlighting potential cash gaps. Businesses can then take proactive measures to maintain a positive cash flow.

| Actions | Benefits |

|---|---|

| Monitor cash flow regularly | Identify issues early |

| Adjust budgets accordingly | Maintain financial stability |

BILL’s integrated platform simplifies tracking and adjustments, ensuring businesses avoid cash shortfalls.

Strategic Decision Making

Cash flow forecasting supports strategic decision making. It provides insights into the financial health of a business. This information is crucial for planning investments and expansions.

- Evaluate financial performance

- Identify growth opportunities

- Plan for future expenses

Using BILL, businesses can streamline invoicing, payment collections, and spend tracking. This enhances visibility and control over financial operations.

Efficiency, control, and visibility are key benefits of implementing effective cash flow forecasting with BILL. These elements contribute to better financial decision making and ultimately, profit maximization.

Effective Expense Management Strategies

Optimizing cash management is crucial for any business. Effective expense management strategies can help businesses maintain financial health and achieve long-term success. Focusing on tracking and controlling expenses, identifying cost-saving opportunities, and budgeting and planning can significantly improve your financial operations.

Tracking And Controlling Expenses

Tracking expenses is the first step in managing them effectively. Using tools like BILL can simplify this process. BILL offers automated spend and expense management, allowing you to monitor where your money goes in real-time.

- Automated Tracking: BILL automatically tracks all expenses, providing a clear overview of your spending.

- Expense Reports: Generate detailed reports to analyze spending patterns and identify areas for improvement.

- Integration: Seamlessly integrates with accounting software like QuickBooks and Xero, ensuring accurate and up-to-date records.

Identifying Cost-saving Opportunities

Finding ways to save money can have a significant impact on your bottom line. BILL offers several features to help businesses identify and capitalize on cost-saving opportunities.

| Feature | Benefit |

|---|---|

| Spend Tracking | Monitor and control spending with the BILL Divvy Card. |

| Budget Setting | Set and enforce budgets to avoid overspending. |

| Credit Lines | Access business credit lines from $1,000 to $5 million. |

Budgeting And Planning

Effective budgeting and planning are essential for long-term financial success. BILL provides tools that make this process easier and more efficient.

- Budget Control: Use BILL to set and monitor budgets, ensuring you stay on track financially.

- Forecasting: Leverage BILL’s data to forecast future expenses and revenues accurately.

- Planning Tools: BILL integrates with various software, providing comprehensive planning tools to help you manage your finances effectively.

By implementing these strategies with BILL, businesses can enhance their financial operations, save time and money, and gain better control over their expenses. Visit BILL to learn more.

Integration With Banking Systems

Optimizing cash management is essential for any business. Integrating with banking systems can greatly improve efficiency. This integration allows for seamless financial operations and enhanced control over cash flow.

Real-time Updates

Real-time updates are crucial for effective cash management. With BILL, businesses can access their financial data as soon as transactions occur. This eliminates delays and ensures that businesses always have the most up-to-date information.

Here are some benefits of real-time updates:

- Immediate access to transaction data

- Accurate cash flow monitoring

- Better financial decision-making

Simplified Reconciliation

Simplified reconciliation is another advantage of integrating with banking systems. BILL automates the reconciliation process, matching transactions from bank accounts with those in the accounting system.

This integration offers:

- Reduced manual effort

- Fewer errors and discrepancies

- Faster month-end closing

Enhanced Security Measures

Enhanced security measures are vital when dealing with financial data. BILL ensures robust security by implementing multiple layers of protection. This includes encryption, secure access controls, and regular security audits.

Key security features include:

- Data encryption at rest and in transit

- Two-factor authentication

- Regular security updates and audits

By integrating with banking systems, businesses using BILL can enjoy improved efficiency, accuracy, and security. This makes cash management simpler and more effective.

Pricing And Affordability Of Cash Management Tools

Choosing the right cash management tool can impact your business’s financial health. Understanding the pricing and affordability of these tools helps make an informed decision. In this section, we will explore the cost-benefit analysis, compare different solutions, and discuss affordability for small vs large businesses.

Cost-benefit Analysis

BILL offers several benefits that justify its costs. Users report an average of 12 hours saved monthly, equating to significant time savings. Moreover, businesses using BILL save over $10,000 monthly. These savings stem from automated financial operations, reduced manual errors, and streamlined workflows. Below is a table summarizing the key benefits:

| Benefit | Description |

|---|---|

| Efficiency | Increases operational efficiency by automating financial tasks. |

| Control | Enhances budget and spend control through easy-to-use tools. |

| Visibility | Provides comprehensive visibility into financial operations. |

| Time Savings | Users report an average of 12 hours saved monthly. |

| Cost Savings | Users report an average monthly savings of over $10,000. |

| Credit Access | Offers business credit lines from $1,000 to $5 million. |

Comparing Different Solutions

When comparing cash management tools, consider the features and integrations each tool offers. BILL integrates with popular accounting software like QuickBooks, Sage Intacct, and Xero. This seamless integration simplifies financial workflows. Below is a comparison of BILL with other solutions:

- BILL: Comprehensive financial operations platform with automated AP and AR, spend management, and budget control.

- Tool A: Focuses on basic invoicing and expense tracking without advanced integrations.

- Tool B: Offers AP automation but lacks comprehensive spend management features.

- Tool C: Provides invoicing and budget control but limited integration with accounting software.

Affordability For Small Vs Large Businesses

The affordability of cash management tools varies for small and large businesses. BILL offers flexible pricing options to cater to different business sizes. Small businesses benefit from cost savings and time efficiency, while large businesses gain from enhanced control and visibility. Here is a breakdown of affordability:

- Small Businesses: Benefit from time and cost savings, making it an affordable choice.

- Large Businesses: Gain from comprehensive financial control and integration capabilities, justifying the investment.

BILL serves nearly half a million businesses, handling approximately $300 billion annually. This widespread adoption highlights its affordability and value for businesses of all sizes.

Pros And Cons Of Cash Management Solutions

Effective cash management is crucial for businesses of all sizes. Cash management solutions offer tools to streamline financial operations, but they come with their own set of advantages and challenges. Understanding these can help you make informed decisions.

Advantages Of Using Cash Management Tools

Implementing cash management solutions like BILL can significantly enhance your financial operations. Here are some key advantages:

- Efficiency: Automates financial tasks, increasing operational efficiency.

- Control: Enhances budget and spend control through intuitive tools.

- Visibility: Provides comprehensive visibility into financial operations, aiding better decision-making.

- Time Savings: Users report saving an average of 12 hours per month.

- Cost Savings: Users save an average of over $10,000 monthly.

- Credit Access: Offers business credit lines from $1,000 to $5 million.

Potential Drawbacks And Challenges

Despite the numerous benefits, cash management solutions can also present certain challenges. Consider the following potential drawbacks:

- Cost: Initial setup and subscription costs can be high.

- Complexity: Learning and integrating new systems can be time-consuming.

- Security Risks: Managing financial data online involves potential security risks.

- Dependency on Technology: System failures or internet issues can disrupt operations.

Understanding both the advantages and potential drawbacks can help you weigh the benefits against the challenges, ensuring that you choose the best cash management solution for your business needs.

Recommendations For Ideal Users And Scenarios

Optimizing cash management is crucial for different types of businesses. Each business has unique needs. BILL provides a versatile platform to meet these needs. Here are some recommendations for different users and scenarios.

Best Practices For Small Businesses

Small businesses benefit greatly from BILL‘s automation features. Here are some best practices:

- Automate Accounts Payable: Simplify bill creation, approvals, and payments to save time.

- Expense Management: Use the BILL Divvy Card for tracking spend and managing budgets.

- Accounts Receivable: Streamline invoicing and payment collections to maintain cash flow.

- Integration: Connect with accounting software like QuickBooks for seamless financial workflows.

Strategies For Large Enterprises

Large enterprises need robust solutions. BILL offers the following strategies:

- Comprehensive Financial Operations: Manage AP, AR, and expenses in one integrated platform.

- Enhanced Control: Utilize budget setting and spend tracking tools for better financial control.

- Accountant Partner Program: Automate bookkeeping tasks to reduce manual work.

- Visibility: Gain comprehensive insights into financial operations for better decision-making.

Industry-specific Recommendations

Different industries have specific requirements. BILL caters to these needs:

| Industry | Recommendation |

|---|---|

| Retail | Use automated invoicing and payment collections to manage high transaction volumes. |

| Healthcare | Integrate with accounting software for streamlined expense and spend management. |

| Construction | Utilize spend tracking tools to monitor project budgets and expenses. |

| Professional Services | Automate AP and AR to save time and ensure timely payments. |

Each business type can optimize cash management with BILL‘s tailored solutions. This ensures efficiency, control, and visibility in financial operations.

Frequently Asked Questions

What Is Cash Management In Business?

Cash management involves handling a company’s cash flow efficiently. It ensures liquidity, reduces risks, and enhances profitability. Effective cash management helps businesses meet their financial obligations and invest in growth opportunities.

Why Is Cash Management Important?

Cash management is crucial for maintaining business stability. It ensures sufficient liquidity for daily operations, minimizes financial risks, and supports strategic investments. Proper cash management helps businesses avoid insolvency and seize growth opportunities.

How Can Businesses Optimize Cash Flow?

Businesses can optimize cash flow by managing receivables, controlling expenses, and forecasting cash needs. Implementing efficient invoicing and payment processes also helps. Regularly reviewing financial statements and adjusting strategies ensures optimal cash flow management.

What Are Common Cash Management Tools?

Common cash management tools include cash flow forecasting, budgeting software, and automated payment systems. These tools help businesses monitor and control their cash flow effectively. Using banking services like sweep accounts and lockbox services also aids in efficient cash management.

Conclusion

Optimizing cash management brings significant advantages. Efficient financial operations save time and money. Tools like BILL simplify these tasks. They automate bill creation, invoicing, and expense management. This ensures you stay in control of your budget. Interested in learning more? Check out BILL here. Consider it for your business needs. Better cash management starts today.