Expense Management For Small Business: Boost Profits With Ease

Managing expenses is crucial for small businesses. It ensures financial health and growth.

Small business owners often face challenges in keeping track of expenses. Effective expense management can help streamline operations and improve cash flow. It involves tracking, analyzing, and optimizing spending to reduce unnecessary costs. With the right tools, like Emburse Travel and Expense Management Software Solutions, businesses can automate these processes, enhance compliance, and gain valuable insights. This not only saves time but also provides a clear view of financial health. In this blog, we’ll explore the importance of expense management and how using the right software can make a significant difference. For more details, check out Emburse.

Introduction To Expense Management For Small Businesses

Effective expense management is crucial for small businesses. It helps ensure financial health and sustainability. Managing expenses can be challenging, but with the right tools and strategies, businesses can streamline operations and improve profitability.

The Importance Of Effective Expense Management

Small businesses need to manage their expenses efficiently to stay competitive. Proper expense management allows for better cash flow management and helps in avoiding unnecessary costs. It also aids in budgeting and forecasting, ensuring that businesses can plan for the future with confidence.

Using tools like Emburse can help small businesses automate their expense processes. This includes tracking travel expenses, managing invoices, and making data-driven decisions. Automated systems reduce manual errors and save time, allowing business owners to focus on growth strategies.

Common Challenges Faced By Small Businesses

Small businesses often face several challenges in managing expenses. These include:

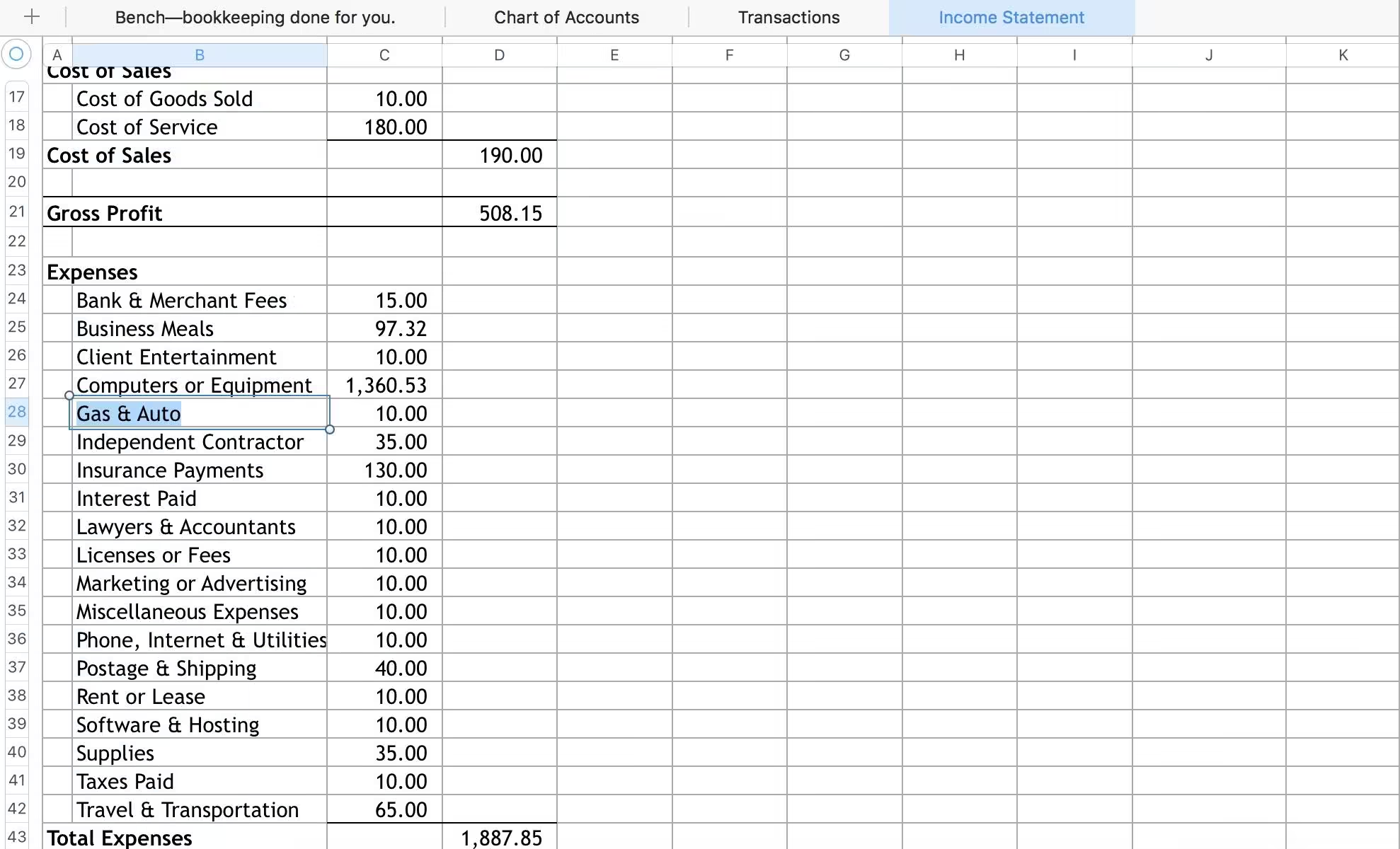

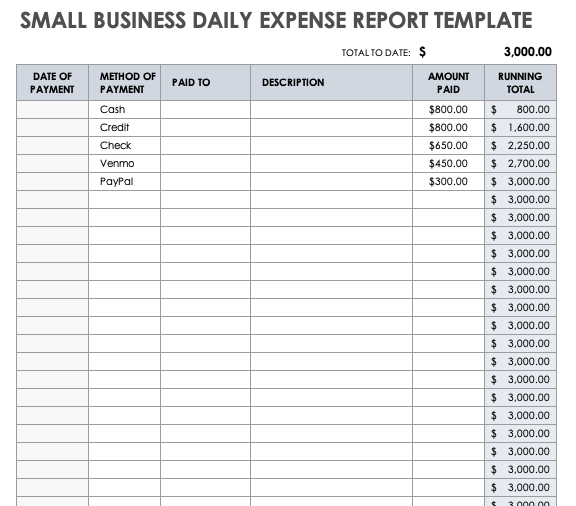

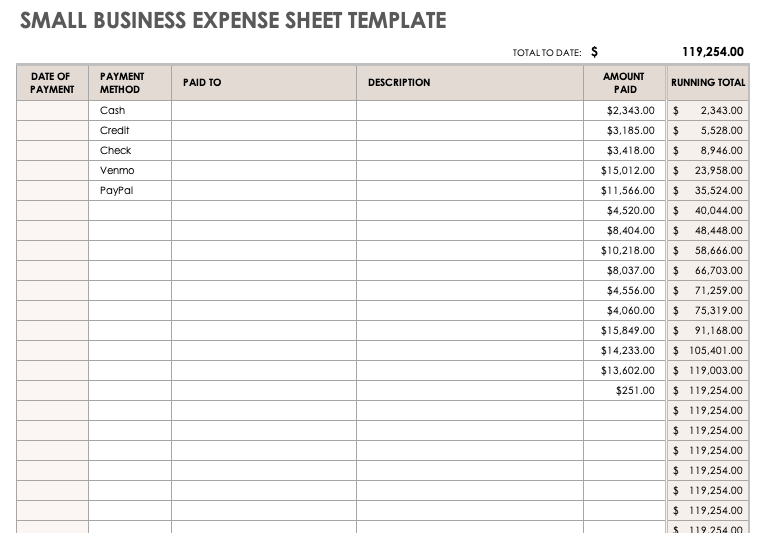

- Manual Processes: Relying on spreadsheets and paper receipts is time-consuming and prone to errors.

- Lack of Real-Time Data: Without real-time expense tracking, businesses struggle to make informed decisions.

- Compliance Issues: Keeping up with ever-changing regulations can be difficult, leading to potential compliance risks.

- Cash Flow Management: Poor expense tracking can result in cash flow problems, impacting the ability to pay bills and invest in growth.

To address these challenges, small businesses can leverage Emburse’s solutions. Emburse offers future-proofed and mobile-capable expense management tools that are designed to enhance compliance and efficiency.

With features like AP Automation and real-time analytics, businesses can simplify their payment processes and gain valuable insights into their spending patterns. This not only helps in reducing wasteful spending but also ensures better financial control.

Key Features Of Expense Management Tools

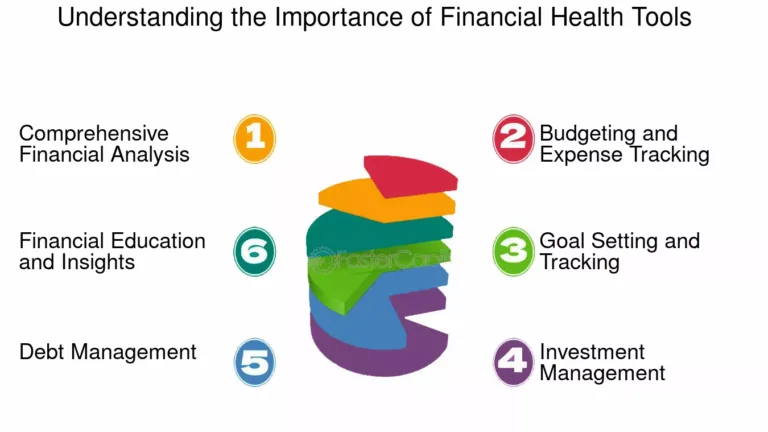

Effective expense management is essential for small businesses. It helps control costs, improve compliance, and enhance efficiency. Tools like Emburse offer various features to streamline these processes.

Automated Expense Tracking

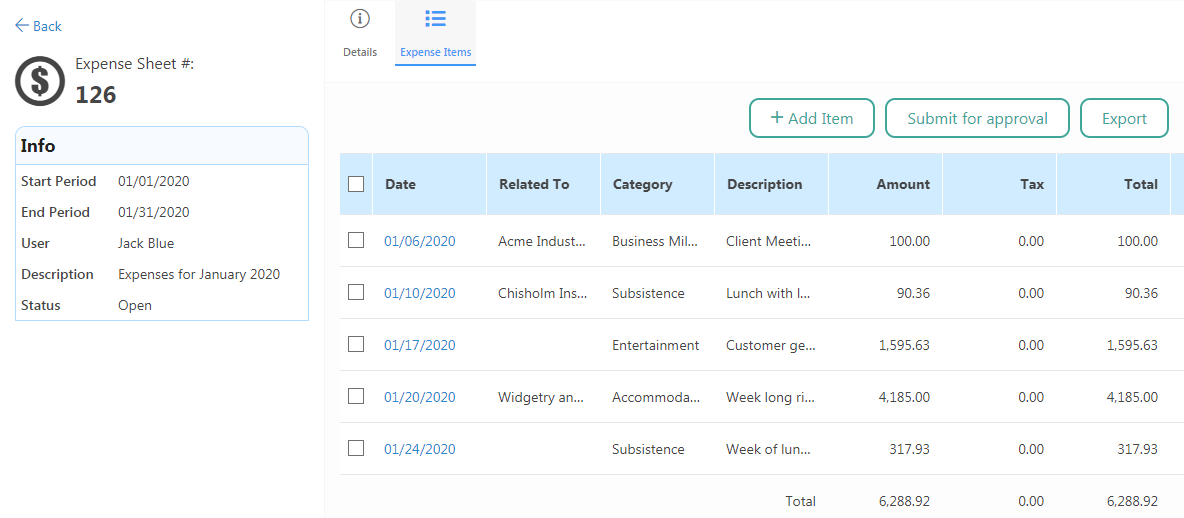

Automated expense tracking reduces manual entry and errors. This saves time and ensures accurate data. With Emburse, expenses are automatically captured and categorized.

- Receipts are scanned and digitized instantly.

- Expenses are matched with transactions automatically.

- Real-time notifications for unusual spending.

Real-time Reporting And Analytics

Real-time reporting and analytics provide insights into spending patterns. Small businesses can track expenses as they occur. This helps in making informed decisions quickly.

Emburse offers detailed reports and analytics. Users can monitor cash flow and anticipate future spending. This feature helps identify and reduce wasteful spending.

Integration With Accounting Software

Integration with accounting software simplifies financial management. Emburse integrates seamlessly with popular accounting tools. This ensures data flows smoothly between systems.

Benefits include:

- Automatic synchronization of expense data.

- Reduced manual data entry.

- Improved accuracy in financial records.

Mobile Accessibility

Mobile accessibility is crucial for on-the-go expense management. Emburse offers a mobile-friendly application. Users can manage expenses from anywhere, anytime.

Key features:

- Submit and approve expenses via mobile.

- Real-time expense tracking.

- Access reports and analytics on the go.

Customizable Expense Categories

Customizable expense categories allow businesses to tailor the tool to their needs. Emburse provides flexible categorization options. This ensures expenses are organized in a way that makes sense for the business.

Benefits include:

- Better tracking of different expense types.

- Improved financial reporting accuracy.

- Enhanced compliance with company policies.

How Each Feature Benefits Small Businesses

Small businesses can greatly benefit from using Emburse’s travel and expense management software solutions. Each feature is designed to address specific pain points and enhance overall business efficiency. Below, we delve into how these features can support small businesses.

Time Savings Through Automation

Emburse automates travel, expense, and payment workflows. This automation reduces manual data entry and repetitive tasks. Small businesses can allocate saved time to more strategic activities. Emburse’s automated processes ensure accurate and timely expense reporting. This minimizes errors and streamlines operations.

Enhanced Decision-making With Real-time Insights

With Emburse, small businesses gain access to real-time data insights. These insights empower business owners to make informed decisions. Real-time analytics help monitor cash flow and anticipate future spending. Small businesses can identify wasteful spending and optimize their budgets effectively.

Streamlined Accounting Processes

Emburse offers simplified and streamlined payment and purchasing processes. This feature improves cash flow management and reduces administrative burden. Automated accounts payable (AP) processes ensure timely payments and efficient vendor management. Small businesses can maintain compliance and financial accuracy with ease.

Flexibility And Convenience With Mobile Access

Emburse’s 100% mobile-capable solutions provide flexibility and convenience. Business owners can manage expenses on-the-go using their mobile devices. This capability ensures that expense reporting and approvals are not delayed. Mobile access enhances productivity and supports remote work environments.

Tailored Solutions With Customizable Categories

Emburse allows businesses to configure expense categories according to their needs. This customization ensures that the system aligns with existing and evolving business requirements. Customizable categories help in accurate expense tracking and reporting. Small businesses can tailor the solution to fit their specific operational processes.

Pricing And Affordability Of Expense Management Tools

Choosing the right expense management tool is crucial for small businesses. Understanding the pricing and affordability of these tools helps businesses make informed decisions. Emburse offers a range of solutions tailored for various business needs. Let’s dive into the different pricing models and options available.

Subscription Models And Pricing Tiers

Emburse provides multiple subscription models to cater to different business sizes and requirements:

- Book Enterprise: Comprehensive features for large enterprises.

- Book Professional: Ideal for growing businesses.

- Expense Enterprise: Advanced expense management for large organizations.

- Expense Professional: Suitable for smaller businesses needing robust solutions.

- Invoice Enterprise: Streamlined invoicing for enterprise-level operations.

- Invoice Professional: Efficient invoicing for small to medium businesses.

- Go: Basic features for startups or small teams.

- Pay Enterprise: Comprehensive payment solutions for large-scale needs.

- Spend: Focused on managing spending effectively.

Each tier provides different levels of functionality and support, ensuring that businesses only pay for what they need.

Cost-benefit Analysis For Small Businesses

Small businesses must weigh the costs against the benefits of using Emburse. Here are some key benefits to consider:

| Feature | Benefit |

|---|---|

| Automated Processes | Reduces manual work and errors. |

| Data-Driven Decisions | Enables informed decision-making. |

| Mobile Capability | Allows expense management on-the-go. |

| Security | Minimizes risk with global compliance. |

By investing in Emburse, small businesses can save time and improve efficiency, ultimately leading to cost savings in the long run.

Free Vs. Paid Options

Emburse offers both free and paid options. Here’s a breakdown:

- Free Options: Basic features suitable for startups or businesses with minimal expense management needs. Limited functionality and support.

- Paid Options: Enhanced features and support. Suitable for growing businesses needing advanced functionalities.

While free options can help businesses get started, paid options provide more comprehensive tools and support, ensuring a better return on investment.

Choosing between free and paid options depends on your business size, needs, and budget. Evaluate your requirements carefully to make the best decision.

Pros And Cons Of Using Expense Management Tools

Expense management tools like Emburse offer businesses innovative solutions to streamline travel and expense processes. These tools come with their own set of advantages and limitations, which can impact their overall effectiveness for small businesses.

Advantages Of Streamlined Expense Management

Using expense management tools provides numerous advantages that can significantly benefit small businesses:

- Automated Processes: These tools automate travel, expense, and payment workflows, saving time and reducing manual errors.

- Real-Time Insights: Businesses can make informed decisions with real-time data insights, managing cash flow and anticipating future expenses.

- Compliance and Security: They ensure compliance with global security and data processing requirements, minimizing risk.

- Mobile Capability: 100% mobile-capable solutions allow employees to manage expenses on the go, increasing convenience.

- Customizability: Configurable to meet evolving business needs, these tools offer flexibility and adaptability.

Potential Drawbacks And Limitations

Despite their advantages, expense management tools have some potential drawbacks:

- Cost: The pricing details for products like Emburse can be complex, potentially leading to higher costs for small businesses.

- Learning Curve: Implementing new software may require training, which can be time-consuming and challenging for employees.

- Customization Complexity: While customizable, configuring the software to match specific business needs can be complex.

- Limited Refund Policies: No specific refund or return policies were provided, which may pose a risk for some businesses.

User Feedback And Real-world Usage

User feedback provides valuable insights into the real-world usage of expense management tools:

| User | Feedback |

|---|---|

| Melissa Grant | Highlights innovation and evolving technology, emphasizing the software’s forward-thinking approach. |

| Esther Song | Praises the agile and accommodating approach, noting the software’s flexibility and responsiveness to user needs. |

| Athena Gazikas | Emphasizes the impact of data insights on future planning, highlighting the software’s analytical capabilities. |

| Jen Woloski | Notes improved visibility and real-time expense tracking, which enhances financial oversight. |

Overall, expense management tools like Emburse offer significant benefits but also come with certain limitations. Understanding these can help businesses make informed decisions.

Recommendations For Ideal Users And Scenarios

Emburse provides innovative travel and expense management solutions. This software is ideal for businesses aiming to enhance efficiency and compliance. It is designed to automate processes and offer mobile-friendly applications. Emburse helps organizations plan for the future with proactive controls and insights.

Best Practices For Implementing Expense Management Tools

Implementing Emburse effectively can save time and money. Here are some best practices:

- Start with Training: Ensure all employees understand the tool’s features.

- Set Clear Policies: Define expense policies and communicate them clearly.

- Leverage Automation: Use automation to streamline expense reporting and approvals.

- Monitor Compliance: Regularly review compliance reports to identify any issues.

- Utilize Analytics: Use data insights to make informed financial decisions.

- Seek Feedback: Regularly gather user feedback to improve the process.

Industries And Business Types That Benefit Most

Emburse is versatile and benefits a range of industries. Some of the top industries include:

| Industry | Benefits |

|---|---|

| Finance | Improves cash flow and automates repetitive tasks. |

| Legal | Enhances compliance and provides detailed audit trails. |

| Healthcare | Streamlines payment and purchasing processes. |

| Travel | Automates travel expense reporting and compliance. |

Tips For Maximizing Tool Efficiency

To get the most out of Emburse, follow these tips:

- Customize Settings: Adjust settings to match your business needs.

- Integrate with Other Systems: Ensure Emburse works with your existing software.

- Use Mobile Features: Take advantage of the mobile capabilities for on-the-go reporting.

- Regularly Update: Keep the software updated to benefit from new features.

- Analyze Data: Regularly review analytics to optimize spending.

By following these tips, businesses can enhance efficiency and improve compliance. Emburse provides the tools and insights needed to manage expenses effectively.

Conclusion: Boosting Profits With Effective Expense Management

Effective expense management can significantly enhance small business profitability. With the right tools and strategies, managing expenses becomes simpler and more efficient. One such tool is Emburse, offering comprehensive solutions for travel and expense management.

Recap Of Key Benefits

Emburse offers several key benefits that can help small businesses:

- Future-Proofed Solutions: Stay ahead with forward-thinking technology.

- Automated Processes: Enhance efficiency by automating workflows.

- Data-Driven Decisions: Make informed decisions with real-time data insights.

- Security: Minimize risk with global security and data processing compliance.

- Customizability: Configure solutions to meet evolving business needs.

- Mobile Capability: Manage expenses on-the-go with mobile-friendly solutions.

Final Thoughts And Encouragement To Small Business Owners

Small business owners must embrace effective expense management to boost profits. Tools like Emburse provide innovative solutions that streamline processes, reduce wasteful spending, and offer valuable insights. By automating travel, expense, and payment workflows, businesses can save time and resources.

For those looking to improve their expense management, consider exploring the features and benefits of Emburse. Their solutions can help you plan for the future, enhance compliance, and provide the convenience needed in today’s fast-paced business environment.

Remember, managing expenses efficiently is crucial for your business growth. Use the right tools to stay ahead and ensure financial success.

Frequently Asked Questions

What Is Expense Management?

Expense management involves tracking, managing, and controlling business expenses. It helps improve financial efficiency and reduce unnecessary costs.

Why Is Expense Management Important For Small Businesses?

Effective expense management ensures financial stability. It helps small businesses reduce costs, improve cash flow, and make informed financial decisions.

How Can Small Businesses Track Expenses?

Small businesses can track expenses using accounting software, spreadsheets, or expense management tools. Consistent tracking is key.

What Are Common Expense Management Mistakes?

Common mistakes include failing to track expenses, ignoring small costs, and not setting budgets. Avoid these to save money.

Conclusion

Effective expense management is crucial for small business success. It boosts efficiency and controls costs. Utilizing tools like Emburse can simplify these processes. Their solutions automate expenses, provide valuable insights, and ensure compliance. This helps businesses save time and money. To explore their offerings, visit the Emburse website. Implementing the right strategies and tools can lead to better financial health for your business. Start managing expenses effectively today for a brighter tomorrow.