Best Finance Tools: Maximize Your Financial Efficiency Today

Managing finances can be overwhelming. With numerous tasks to handle, finding the right tools is crucial.

In this blog post, we’ll explore some of the best finance tools available today. Navigating the world of finance can be complex. From managing expenses to automating payments, having effective tools can make a world of difference. The right finance tools can simplify your financial operations, save time, and provide better control over your finances. Whether you’re a small business owner, an accountant, or just someone looking to streamline your personal finances, these tools can help you achieve your goals efficiently. Let’s dive into the top finance tools that can make managing your finances easier and more effective. One such tool is the BILL Financial Operations Platform. Learn more about it here.

Introduction To The Best Finance Tools

Managing finances effectively is key to business success. The right finance tools can simplify complex tasks and improve efficiency. One such tool is the BILL Financial Operations Platform, designed to streamline various financial tasks.

Understanding The Importance Of Financial Tools

Financial tools help businesses manage expenses, control budgets, and automate payments. They ensure accurate financial data and provide insights into cash flow. These tools also reduce manual errors and save time.

Overview Of How Financial Tools Can Enhance Efficiency

Here’s how financial tools like BILL enhance efficiency:

- Accounts Payable Automation: Automates bill creation, approvals, and payments, syncing with accounting software for smooth operations.

- Spend & Expense Management: Offers credit lines, budget setting, and spend tracking with the BILL Divvy Card powered by Visa.

- Accounts Receivable Management: Streamlines invoicing and collections.

- Integrated Platform: Manages AP, AR, and expenses with a single login, automatically syncing with accounting tools.

- Mobile App: Enables financial management on the go.

Here’s a detailed look at BILL’s main features and benefits:

| Feature | Description | Benefit |

|---|---|---|

| Accounts Payable Automation | Streamlines AP processes from bill creation to payments. | Saves time and reduces manual errors. |

| Spend & Expense Management | Optimizes cash flow with credit lines and budget tracking. | Maintains control over expenses and budgets. |

| Accounts Receivable | Efficient invoicing and collections management. | Improves cash flow visibility. |

| Integrated Platform | Single login for managing all financial tasks. | Enhances operational efficiency. |

| Mobile App | Access and manage finances on the go. | Provides flexibility and convenience. |

For more details on BILL, visit their official website.

Key Features Of Top Finance Tools

Choosing the right finance tool can transform how you manage your money. The best finance tools come with various features that help you track budgets, manage expenses, and keep an eye on your investments. Below, we delve into the key features you should look for in top finance tools.

Automated Budget Tracking

Automated budget tracking is a crucial feature for any finance tool. It allows users to set a budget and monitor their spending without manual input. BILL Financial Operations Platform excels in this area with its seamless integration with leading accounting software. This feature helps users maintain control over their budgets and expenses.

Expense Categorization And Analysis

Effective expense categorization and analysis can provide insights into spending habits. BILL offers robust spend and expense management, helping users optimize cash flow. With the BILL Divvy Card powered by Visa, users can easily categorize expenses and analyze spending patterns.

Investment Tracking And Portfolio Management

Tracking investments and managing portfolios is essential for personal finance. While BILL focuses more on accounts payable and receivable, it integrates well with accounting software. This integration can indirectly assist in investment tracking by providing a clear picture of financial operations and cash flow.

Bill Payment Reminders And Automation

Automating bill payments and setting reminders can save time and prevent missed payments. BILL automates the entire accounts payable process from bill creation to approvals and payments. This feature ensures that bills are paid on time and reduces the risk of late fees.

Advanced Security Features

Security is paramount in any finance tool. BILL offers advanced security features to protect user data. With a single login for managing various financial operations, users can trust that their information is safe. The BILL Divvy Card is issued by Cross River Bank, Member FDIC, ensuring a high level of security.

| Feature | Description |

|---|---|

| Automated Budget Tracking | Set and monitor budgets with ease, integrating with accounting software. |

| Expense Categorization and Analysis | Optimize cash flow and analyze spending patterns with the BILL Divvy Card. |

| Investment Tracking and Portfolio Management | Integration with accounting software provides a clear picture of finances. |

| Bill Payment Reminders and Automation | Automate bill payments from creation to approval, ensuring timely payments. |

| Advanced Security Features | High-level security with a single login and FDIC-insured BILL Divvy Card. |

For more detailed information on the BILL Financial Operations Platform, visit their official website.

Pricing And Affordability

Finding the best finance tool can be challenging, especially if you are on a budget. Understanding the pricing and affordability of these tools helps you make informed decisions. Let’s dive into the costs and benefits of various options, including free and paid tools, premium features, and any special discounts.

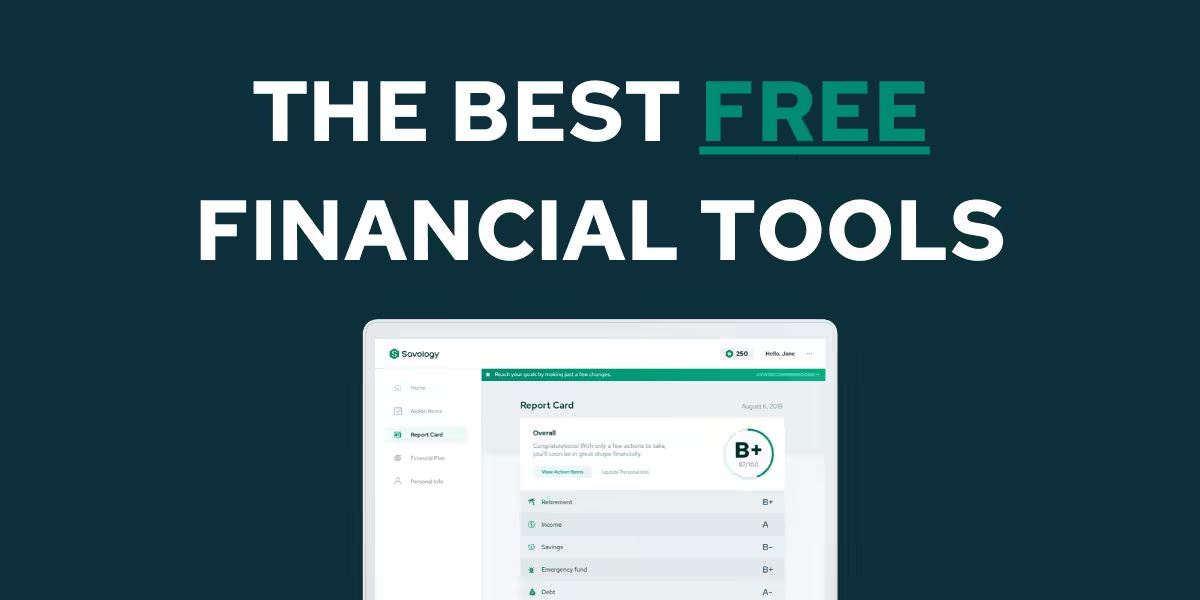

Free Vs. Paid Finance Tools

Choosing between free and paid finance tools depends on your needs. Free tools often offer basic features that are sufficient for personal finance management. They include functionalities like basic budgeting, expense tracking, and simple reporting.

- Free Tools: Ideal for individuals and small businesses with simple needs.

- Paid Tools: Provide more advanced features such as automation, integration, and comprehensive reporting.

For example, BILL Financial Operations Platform offers advanced features like accounts payable automation and spend management. These are typically part of the paid plans, ensuring enhanced efficiency and control.

Cost-benefit Analysis Of Premium Features

Investing in premium features can be beneficial. Here’s a quick analysis:

| Feature | Benefit | Cost Justification |

|---|---|---|

| Accounts Payable Automation | Streamlines bill creation to payments | Reduces manual effort and errors |

| Spend & Expense Management | Optimizes cash flow | Saves time and enhances accuracy |

| Integrated Platform | Single login for all tasks | Improves efficiency |

The benefits of these features often outweigh the costs, especially for businesses seeking to streamline operations and gain better financial control.

Special Discounts And Offers

Many finance tools offer special discounts and promotions. It’s worth exploring these to save costs.

- Seasonal Discounts: Look out for discounts during holidays and end-of-year sales.

- Bulk Purchase Offers: Some platforms offer discounts for bulk purchases or long-term subscriptions.

- Referral Programs: Earn discounts or credits by referring new users.

For the BILL Financial Operations Platform, potential users can visit the BILL website to explore current offers and pricing details. Contacting their sales team can also provide more information on available discounts and customized pricing plans.

Pros And Cons Of Popular Finance Tools

Choosing the right finance tool can transform how you manage money. From automation to detailed insights, finance tools offer a range of benefits. Yet, it’s crucial to weigh the advantages and limitations before settling on one. Let’s delve into the pros and cons of popular finance tools.

Advantages Of Using Finance Tools

Finance tools like BILL offer several key advantages:

- Efficiency: Automation saves time on repetitive financial tasks.

- Control: Maintain control over budgets and expenses with ease.

- Visibility: Gain clear insights into financial operations and cash flow.

- Integration: Seamlessly connect with popular accounting software like QuickBooks and Xero.

- Scalability: Suitable for small businesses to large enterprises.

Using finance tools also enhances the accuracy of financial data. This reduces errors caused by manual entry. Additionally, mobile apps allow you to manage finances on the go, providing flexibility and convenience.

Common Drawbacks And Limitations

Despite the many benefits, finance tools have their drawbacks:

- Cost: Some tools can be expensive, especially for small businesses.

- Learning Curve: New users may find it challenging to navigate complex features.

- Integration Issues: Not all tools integrate perfectly with existing systems.

For instance, while BILL offers extensive features, the lack of clear pricing information can be a downside. Potential users might need to contact sales for detailed pricing, which can be inconvenient.

User Feedback And Real-world Usage

User feedback often highlights the real-world applicability of finance tools. Reviews for BILL frequently mention its efficiency and seamless integration with accounting software:

“BILL has significantly reduced our time spent on financial operations. The integration with QuickBooks is flawless.”

However, some users also point out areas for improvement:

“While BILL is powerful, the initial setup was a bit overwhelming. Clearer onboarding would help.”

Overall, user feedback suggests that while finance tools like BILL are highly beneficial, they come with a learning curve and potential integration challenges. Understanding these pros and cons can help you make an informed decision.

Recommendations For Ideal Users And Scenarios

Choosing the right finance tools depends on your specific needs and scenarios. Whether you’re managing personal finances, running a small business, investing, or organizing family expenses, there are specialized tools designed to streamline and simplify these tasks. Let’s explore the best options for different user groups.

Best Tools For Personal Budgeting

For personal budgeting, Mint stands out. It provides a comprehensive overview of your financial health. Track your spending, create budgets, and set financial goals. YNAB (You Need A Budget) is another great tool. It focuses on giving every dollar a job, helping you save and pay off debt efficiently. Both tools are user-friendly and offer mobile apps for on-the-go management.

Top Picks For Small Business Owners

BILL Financial Operations Platform is ideal for small business owners. It simplifies and automates financial tasks like bill creation, payments, invoicing, and expense management. With features like accounts payable automation and spend & expense management, BILL helps optimize cash flow. It integrates seamlessly with leading accounting software like QuickBooks, Sage Intacct, and more.

Another excellent tool is QuickBooks Online. It offers robust accounting features that cater to small businesses. Manage invoices, track expenses, and generate financial reports easily. Its integration capabilities ensure your financial data is up-to-date and accurate.

Ideal Finance Tools For Investors

Investors benefit greatly from tools like Personal Capital. It offers investment tracking, retirement planning, and a clear view of your net worth. The tool provides detailed insights into your investment performance and asset allocation. For those who prefer a more hands-on approach, Morningstar is a top pick. It offers in-depth research, analysis, and ratings on stocks, mutual funds, and ETFs.

Specialized Tools For Families And Couples

Managing family finances can be challenging. Tools like Honeydue are designed to help. It allows couples to track expenses, set budgets, and manage bills together. Notifications and reminders keep both partners on the same page. Goodbudget is another useful tool. It uses the envelope budgeting system to allocate money for different spending categories, making it easier to manage household finances.

| Tool | Best For | Key Features |

|---|---|---|

| Mint | Personal Budgeting | Spending Tracking, Budget Creation, Financial Goals |

| YNAB | Personal Budgeting | Debt Payoff, Savings Goals, Budget Management |

| BILL | Small Businesses | AP Automation, Spend Management, Integration with Accounting Software |

| QuickBooks Online | Small Businesses | Invoice Management, Expense Tracking, Financial Reports |

| Personal Capital | Investors | Investment Tracking, Retirement Planning, Net Worth Analysis |

| Morningstar | Investors | Research, Analysis, Stock Ratings |

| Honeydue | Families and Couples | Expense Tracking, Bill Management, Budget Setting |

| Goodbudget | Families and Couples | Envelope Budgeting, Expense Allocation, Household Finance Management |

Frequently Asked Questions

What Are The Best Finance Tools For Budgeting?

The best finance tools for budgeting include Mint, YNAB, and PocketGuard. These tools help track expenses, create budgets, and manage money efficiently. They offer user-friendly interfaces and insightful reports.

How Do Finance Tools Help With Investment?

Finance tools like Personal Capital and Robinhood assist with investment by tracking portfolios and offering investment insights. They provide real-time data, personalized advice, and easy trading options.

Are There Free Finance Tools Available?

Yes, there are free finance tools available such as Mint and Personal Capital. These tools offer robust features for budgeting, tracking expenses, and managing investments without any cost.

What Features Should I Look For In Finance Tools?

Look for features like expense tracking, budgeting, investment management, and real-time updates. User-friendly interfaces, security measures, and personalized insights are also important to consider.

Conclusion

Choosing the right finance tools can transform your financial management. Tools like BILL Financial Operations Platform offer comprehensive solutions. They streamline tasks like bill creation, payments, and expense management. They also integrate with popular accounting software. These features save time, provide control, and improve cash flow visibility. For more detailed information, visit the BILL website. Make your financial tasks easier today.