Best Expense Management Tools: Streamline Your Finances Today

Managing expenses is crucial for any business. It ensures financial health and growth.

In today’s fast-paced world, keeping track of expenses can be overwhelming. Thankfully, there are tools designed to simplify this task. Expense management tools help businesses monitor spending, streamline processes, and maintain compliance. They offer features like automated payments, real-time insights, and customizable solutions. These tools are essential for efficient financial management. Using the right expense management tool can save time, reduce errors, and provide valuable data. Let’s explore some of the best options available, including the highly recommended Emburse.

Introduction To Expense Management Tools

Managing expenses is crucial for any business. Efficient expense management tools can streamline this process, ensuring compliance and saving time. In this section, we explore what these tools are and their importance.

What Are Expense Management Tools?

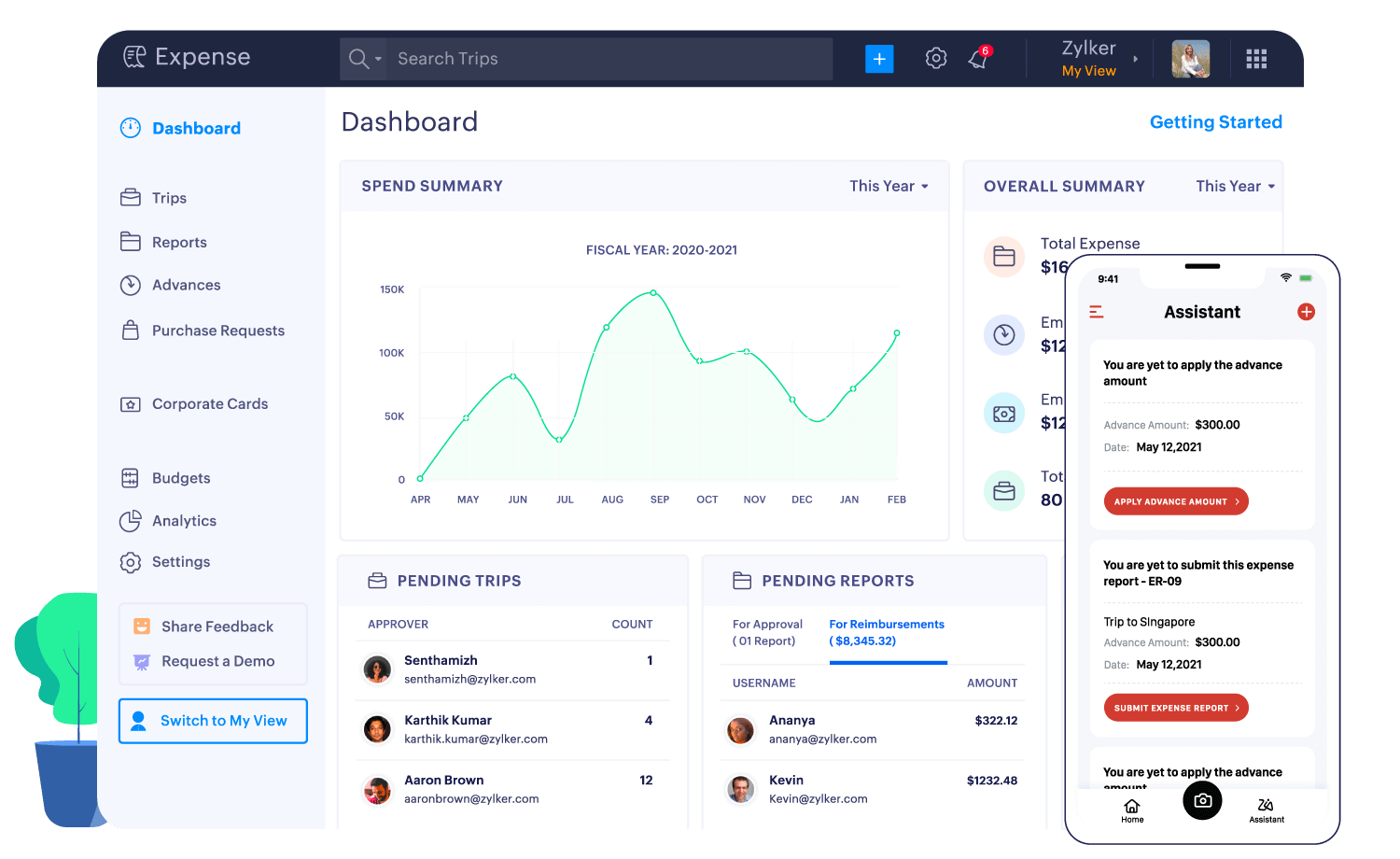

Expense management tools are software solutions designed to help businesses track, control, and analyze their expenses. They automate the entire process, from capturing receipts to generating expense reports.

One popular tool in this category is Emburse. Emburse offers flexible and proactive expense management solutions. These tools provide insights and help businesses plan effectively.

The Importance Of Managing Expenses Efficiently

Efficient expense management is vital for several reasons:

- Cost Control: Helps in reducing wasteful spending.

- Compliance: Ensures adherence to company policies and regulatory requirements.

- Time-Saving: Automates processes to save time for finance teams.

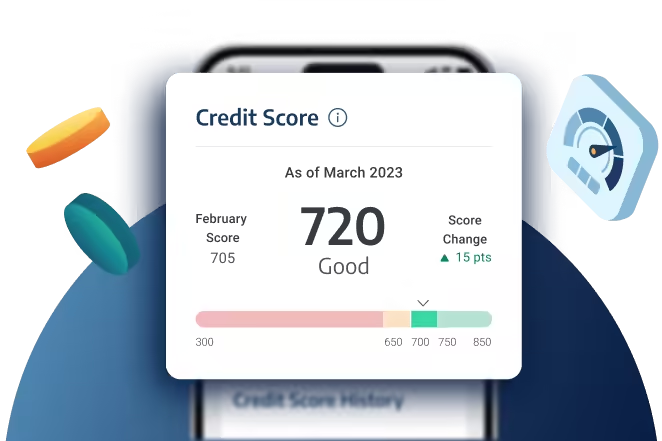

- Data Insights: Provides valuable insights for better decision-making.

- Cash Flow Management: Improves cash flow visibility through automated payments.

Emburse stands out with its mobile-friendly solutions and robust analytics. It helps businesses stay ahead by providing time to plan for future needs. The tool also ensures compliance and drives user adoption through automated solutions.

| Feature | Benefit |

|---|---|

| Expense Management | Proactive controls and insights |

| Travel Management | Mobile-friendly and policy adherence |

| Payments & Invoice | Automates accounts payable |

| Insights & Analytics | Data-driven decision making |

| Audit | Reduces wasteful spending |

For more details, visit the Emburse website or contact their support team.

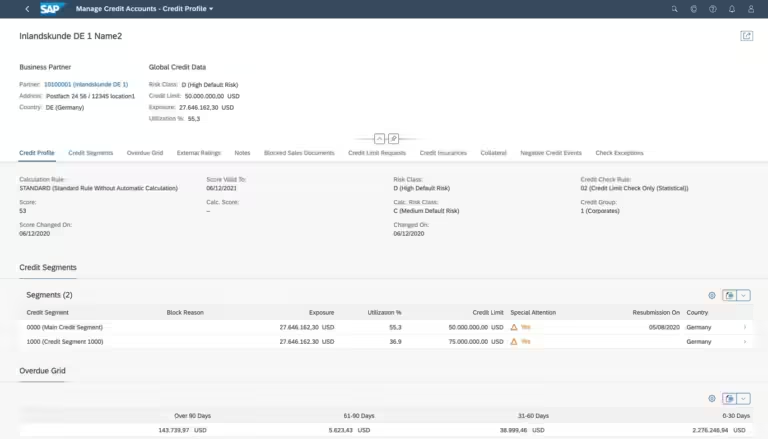

Key Features Of Top Expense Management Tools

Expense management tools streamline financial processes, ensuring efficient and compliant expense tracking. Understanding the key features of these tools helps businesses select the best solution for their needs.

Automated Expense Tracking

Automated expense tracking is a crucial feature. It records expenses automatically, reducing manual input and errors. This feature saves time and ensures accuracy in financial records.

Receipt Scanning And Storage

Receipt scanning and storage allows users to capture receipts using their mobile devices. The tool then stores these images in a centralized system for easy access and reference. This feature helps maintain organized records and simplifies auditing processes.

Budgeting And Forecasting

Budgeting and forecasting tools enable finance teams to plan and allocate resources effectively. These tools provide insights and projections based on historical data, helping businesses make informed financial decisions.

Real-time Expense Reporting

Real-time expense reporting offers instant visibility into spending patterns. Users can generate detailed reports that highlight where and how funds are being used. This feature aids in monitoring budgets and identifying cost-saving opportunities.

Integration With Financial Software

Integration with financial software ensures seamless data flow between expense management tools and other financial systems. This integration reduces the need for manual data entry and enhances the accuracy of financial information.

| Feature | Description |

|---|---|

| Automated Expense Tracking | Records expenses automatically, reducing manual input and errors. |

| Receipt Scanning and Storage | Capture and store receipt images for easy access and reference. |

| Budgeting and Forecasting | Provides insights and projections for effective resource allocation. |

| Real-time Expense Reporting | Offers instant visibility into spending patterns with detailed reports. |

| Integration with Financial Software | Ensures seamless data flow and enhances financial information accuracy. |

Emburse, a leading expense management tool, incorporates these features to help businesses innovate, mitigate risks, and prepare for the future. For more details, visit the Emburse website.

Pricing And Affordability Breakdown

Understanding the pricing and affordability of expense management tools is crucial for businesses. This section covers the cost structures of various tools, helping you make an informed decision.

Free Vs. Paid Options

Expense management tools typically come in two categories: free and paid options.

- Free Tools: Ideal for small businesses or startups. They offer basic features but might lack advanced functionalities.

- Paid Tools: Suitable for larger businesses. These tools provide comprehensive features and better support.

Free tools might include basic expense tracking, while paid tools often offer advanced features such as:

- Proactive controls and insights

- Mobile-friendly travel solutions

- Automated accounts payable

- Data-driven insights

- Audit tools

Subscription Plans And Pricing Tiers

Most expense management tools offer subscription plans with different pricing tiers to cater to various business needs. Emburse, for instance, provides customized pricing plans. Users need to contact Emburse directly for detailed pricing information.

Here’s a typical breakdown of subscription plans:

| Plan | Features | Price |

|---|---|---|

| Basic | Basic expense tracking, limited users | Free |

| Standard | Advanced tracking, mobile access, standard support | Starts from $10/user/month |

| Premium | Full access to all features, premium support | Custom pricing |

Value For Money: What To Consider

When choosing an expense management tool, consider the following:

- Feature Set: Ensure the tool provides all necessary features, such as expense management, travel management, and audit tools.

- Scalability: The tool should grow with your business and adapt to evolving needs.

- Support and Training: Look for tools with robust customer support and training resources.

- Customization: The ability to configure the tool to meet specific business requirements is essential.

- Compliance: Ensure the tool helps with compliance and policy adherence.

Evaluating these factors will help you determine the true value for money offered by each tool.

Pros And Cons Of Using Expense Management Tools

Expense management tools offer businesses a way to control and streamline their spending. These tools provide numerous benefits, but they also come with certain limitations. Below, we discuss the advantages and potential drawbacks of using expense management tools.

Advantages Of Expense Management Tools

Using expense management tools like Emburse can provide several benefits:

- Innovation and Time Management: Emburse helps businesses stay ahead and plan for future needs.

- Compliance and Convenience: Automated solutions ensure compliance and drive user adoption.

- Cash Flow Visibility: Improved cash flow management through automated payments and reimbursements.

- Data-Driven Decisions: Detailed analytics empower users to make informed decisions.

- Customizability: Configurable solutions to meet evolving business needs.

These tools can also enhance efficiency by automating tedious tasks and providing data-driven insights.

Potential Drawbacks And Limitations

Despite their many benefits, expense management tools may also have some drawbacks:

- Cost: The pricing for tools like Emburse can vary and may be high for small businesses.

- Learning Curve: Employees may need time to adapt to new software.

- Customization Needs: Some businesses might require specific customizations that could be complex.

- Data Security: Though tools like Emburse ensure high security, data breaches are always a risk.

- Integration Issues: Integrating with existing systems can sometimes be challenging.

Businesses should weigh these pros and cons to determine if an expense management tool suits their needs.

Specific Recommendations For Ideal Users

Choosing the right expense management tool depends on your unique needs. Here, we provide specific recommendations for different user categories. From small businesses to large enterprises, and even personal finance management, we have you covered.

Best For Small Businesses

Emburse is ideal for small businesses looking for flexible solutions and proactive controls. With its expense management and travel management features, Emburse helps streamline processes and ensure compliance.

- Expense Management: Flexible and proactive controls.

- Travel Management: Mobile-friendly for compliance and policy adherence.

- Payments & Invoice: Automates accounts payable to improve cash flow.

Small businesses benefit from the customizability of Emburse, allowing them to adapt to evolving needs.

Best For Freelancers And Contractors

Freelancers and contractors need tools that are easy to use and provide quick insights into their finances. Emburse offers mobile-friendly solutions that allow users to track expenses on the go.

- Mobile-Friendly: Perfect for managing expenses anywhere.

- Insights & Analytics: Data-driven insights to anticipate future spend.

- Cash Flow Visibility: Manage cash flow with automated payments.

Freelancers can make data-driven decisions with detailed analytics provided by Emburse.

Best For Large Enterprises

Large enterprises require robust and scalable solutions. Emburse offers comprehensive tools for audit, compliance, and customizability.

- Audit: Identify and reduce wasteful spending.

- Compliance: Ensure adherence to company policies.

- Customizability: Configure solutions to meet large-scale needs.

Emburse’s automated solutions drive user adoption and enhance organizational efficiency.

Best For Personal Finance Management

For personal finance management, Emburse provides data-driven insights and cash flow visibility. Users can manage their finances effectively with automated payments and reimbursements.

- Insights & Analytics: Make informed decisions with detailed data.

- Cash Flow Visibility: Improved management through automation.

- Payments & Invoice: Streamline purchasing and improve cash flow.

Emburse’s tools help individuals stay ahead by providing time to plan for future needs.

Frequently Asked Questions

What Are Expense Management Tools?

Expense management tools help businesses track, manage, and report expenses efficiently. They automate expense processing, saving time and reducing errors.

How Do Expense Management Tools Work?

These tools capture expense data, categorize it, and generate reports. They integrate with accounting systems for seamless financial management.

Why Use Expense Management Tools?

They streamline expense tracking, improve accuracy, and save time. These tools also help in maintaining budget control and compliance.

What Features To Look For In Expense Management Tools?

Look for automation, integration, mobile access, and reporting features. These features enhance usability and efficiency.

Conclusion

Choosing the right expense management tool is crucial for business success. With many options available, finding the perfect fit can be challenging. Emburse stands out for its robust features and user-friendly interface. The software offers efficient expense tracking, travel management, and insightful analytics. It also ensures compliance and improves cash flow visibility. For a comprehensive solution, consider exploring Emburse. Make informed financial decisions and streamline your expense processes today.