Simplify Expense Reporting: Streamline Your Business Finances

Managing expenses can be a daunting task for any business. Ensuring accuracy and compliance often feels overwhelming.

Simplifying expense reporting can save time and reduce stress for finance teams. With numerous tools and software available today, choosing the right one can make all the difference. One such solution is Emburse, a platform offering innovative travel and expense management solutions. Emburse helps businesses automate processes, gain insights, and prepare for future expenses. With its mobile-friendly interface and customizable features, Emburse ensures compliance and efficiency. This blog will explore how Emburse can streamline your expense reporting, helping your business stay ahead. For more information on Emburse, visit their website.

Introduction To Simplifying Expense Reporting

Managing expenses is a crucial task for any business. The process can be complex and time-consuming. Emburse Travel and Expense Management Software Solutions aims to simplify this. The platform offers tools to streamline expense management, travel management, payments, AP automation, and insights & analytics. This blog post explores how businesses can benefit from simplifying expense reporting with Emburse.

Why Expense Reporting Is Crucial For Businesses

Expense reporting helps businesses track and manage their spending. It ensures financial accuracy and compliance. Here are some key reasons why expense reporting is essential:

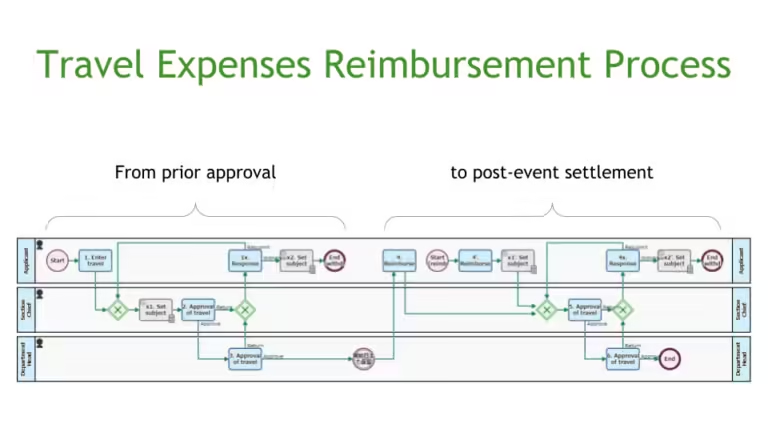

- Financial Control: Accurate expense reports help monitor and control costs.

- Compliance: Ensures adherence to policies and regulations.

- Reimbursement: Facilitates timely and secure reimbursements.

- Decision-Making: Provides insights for better financial planning.

The Challenges Of Traditional Expense Reporting

Traditional expense reporting methods come with many challenges. These include:

| Challenge | Description |

|---|---|

| Manual Processes | Time-consuming and prone to errors. |

| Lack of Automation | Difficulty in tracking and managing expenses. |

| Compliance Issues | Hard to ensure policy adherence. |

| Data Security | Risk of data breaches and inaccuracies. |

Emburse addresses these challenges through its innovative solutions. The platform automates processes, ensures compliance, and provides real-time insights.

Key Features Of Modern Expense Reporting Tools

Modern expense reporting tools like Emburse offer several key features that streamline the entire process. These features help businesses save time, ensure compliance, and provide valuable insights. Below, we explore some of the most important functionalities.

Automated Receipt Scanning

Emburse offers automated receipt scanning to simplify expense reporting. Users can snap a photo of their receipts, and the software automatically extracts and categorizes the information. This reduces manual data entry and minimizes errors.

Integration With Accounting Software

Seamless integration with accounting software ensures that expense data flows smoothly into your financial systems. Emburse integrates with popular accounting platforms, providing a unified view of your finances. This integration helps in maintaining accurate records and simplifies the reconciliation process.

Real-time Expense Tracking

With real-time expense tracking, Emburse allows users to monitor their spending as it happens. This feature provides up-to-date information on expenses, helping managers to make informed decisions quickly. Real-time tracking also aids in identifying and addressing any discrepancies immediately.

Mobile Accessibility

Mobile accessibility is a crucial feature for modern businesses. Emburse’s mobile-friendly solutions ensure that users can manage their expenses on the go. The mobile app allows for quick receipt capture, expense submission, and approval, making the entire process more efficient.

Customizable Expense Categories

Emburse provides customizable expense categories to fit the unique needs of your business. Users can create and manage categories that align with company policies and reporting requirements. This customization ensures that expense reports are relevant and easy to analyze.

To learn more about how Emburse can simplify your expense reporting, visit their official website.

Pricing And Affordability Of Expense Reporting Tools

Choosing the right expense reporting tool can be crucial for any business. Understanding the pricing and affordability of these tools helps in making an informed decision. Emburse provides a variety of pricing options that cater to different business needs. Let’s dive into the specifics of their pricing models and how they benefit both small and large businesses.

Subscription Models And Pricing Tiers

Emburse offers flexible subscription models designed to fit the unique needs of various businesses. Here are some typical pricing tiers:

- Basic Plan: Ideal for startups and small businesses. It offers essential features like mobile expense solutions and basic travel management.

- Pro Plan: Suitable for growing businesses. Includes advanced features such as AP automation and data-driven insights.

- Enterprise Plan: Best for large corporations. Provides comprehensive solutions, including fully customizable travel management apps and robust analytics.

For detailed pricing information, businesses can contact Emburse directly. They offer tailored quotes to meet specific business requirements.

Cost-benefit Analysis For Small And Large Businesses

Conducting a cost-benefit analysis is essential for both small and large businesses. It helps in understanding the value provided by expense reporting tools like Emburse.

Small Businesses:

- Reduced administrative burden by automating repetitive tasks.

- Enhanced compliance and savings through user-friendly solutions.

- Mobile-capable expense solutions for on-the-go management.

Large Businesses:

- Comprehensive control of costs and cash flow visibility.

- Future spend anticipation through data-driven decision-making.

- Customizable solutions to meet evolving business needs.

Both small and large businesses benefit from the time efficiency provided by Emburse, allowing finance teams to focus on strategic planning.

For more information on how Emburse can help streamline your expense reporting process, visit their official website.

Pros And Cons Of Using Expense Reporting Tools

Expense reporting tools like Emburse offer businesses a streamlined solution for managing expenses, travel, and payments. These tools promise to automate processes, ensure compliance, and provide valuable insights. But, like any tool, they come with their advantages and limitations.

Advantages Of Automation And Efficiency

One of the major benefits of using expense reporting tools is automation. Automating repetitive tasks saves time and reduces the burden on finance teams. With Emburse, businesses can focus on strategic planning rather than manual entry.

- Time Efficiency: Automates repetitive tasks and allows for strategic planning.

- Compliance: Ensures adherence to policies and drives automated savings.

- Data Security: Meets global security and data processing requirements.

- Customizable Solutions: Configurable to meet evolving business needs.

Emburse’s mobile-capable solutions enhance convenience, allowing users to manage expenses on the go. Additionally, insights and analytics from the platform help in data-driven decision-making and uncover potential savings across all spend categories.

Potential Drawbacks And Limitations

Despite the numerous benefits, there are some potential drawbacks to consider. Implementing expense reporting tools can sometimes be challenging due to initial setup and integration complexities.

- Initial Setup: Setting up the system may require significant time and resources.

- Integration Issues: Integrating with existing systems can be complex.

- Learning Curve: Employees may need time to adapt to new tools.

- Cost: Pricing details are not always clear and may require contacting the provider for tailored quotes.

Another limitation is the potential for technical issues, which can disrupt the workflow if not addressed promptly. While Emburse offers comprehensive support, businesses must be prepared for occasional hiccups.

Understanding both the advantages and drawbacks of expense reporting tools can help businesses make informed decisions. By weighing these factors, companies can determine if a tool like Emburse aligns with their needs and goals.

Specific Recommendations For Ideal Users Or Scenarios

Expense reporting can be complex. Different businesses have unique needs. Here are tailored recommendations for small businesses, large enterprises, and freelancers or consultants.

Best Tools For Small Businesses

Small businesses need cost-effective and user-friendly tools. Emburse offers several features that can help.

- Mobile-Capable Expense Solutions: Manage expenses on the go with ease.

- Proactive Controls and Insights: Make informed decisions with real-time data.

Emburse provides flexible solutions that are easy to adopt. Small businesses can automate their processes and focus on growth.

Recommended Solutions For Large Enterprises

Large enterprises have complex needs. Emburse offers customizable solutions to meet these requirements.

| Feature | Benefit |

|---|---|

| Automate Accounts Payable | Reduce manual entry and errors. |

| Control Costs | Gain visibility into cash flow. |

| Compliance and Security | Meet global security standards. |

With Emburse, large enterprises can streamline their expense and travel management. This helps in efficient planning and execution.

Top Picks For Freelancers And Consultants

Freelancers and consultants need simple and efficient tools. Emburse provides the perfect solutions.

- Mobile-Friendly Solutions: Manage expenses from anywhere.

- Timely and Secure Reimbursements: Ensure quick payments.

- Data-Driven Decision Making: Uncover savings and plan for the future.

Emburse helps freelancers and consultants manage their finances effectively. This ensures they can focus on their core work without hassle.

For more details, visit the Emburse website or contact their support team.

Frequently Asked Questions

How To Simplify Expense Reporting?

Simplify expense reporting by using automated software. It reduces manual tasks and errors. Additionally, it speeds up the process and offers real-time insights.

What Are The Benefits Of Automated Expense Reporting?

Automated expense reporting saves time and reduces errors. It provides real-time tracking and improves compliance. Additionally, it enhances employee satisfaction.

How Does Expense Reporting Software Work?

Expense reporting software automates data entry and approval processes. It integrates with accounting systems for seamless tracking. Moreover, it offers real-time insights and analytics.

Why Is Expense Reporting Important For Businesses?

Expense reporting is crucial for financial transparency and budgeting. It helps in identifying spending patterns. Furthermore, it ensures compliance with company policies.

Conclusion

Simplifying expense reporting boosts productivity and reduces errors. Emburse offers solutions to streamline this process. Automate tasks, ensure compliance, and gain insights. Save time and focus on growth. Achieve better control over expenses with Emburse. Visit their site to explore features and benefits. Implement smarter expense management today.