Emburse Reviews: Unveiling the Best Expense Management Tool

Exploring travel and expense management software? Emburse might be the solution you need.

This platform offers innovative tools for managing expenses, travel, payments, and invoices. Emburse is designed to streamline processes and ensure compliance, making it an essential tool for finance teams. With features like mobile-friendly travel solutions, automated accounts payable, and insightful analytics, Emburse helps businesses save time and control costs. It provides flexible solutions tailored to meet industry-specific needs, allowing for better decision-making and future planning. Whether you’re looking to enhance visibility over spending or ensure adherence to policies, Emburse offers customizable, user-friendly options to meet your business requirements. Discover more about Emburse and see how it can benefit your organization by visiting their official website.

Introduction To Emburse

Emburse is a powerful tool in the world of credit cards, personal finance, and travel. This software is designed to make managing travel and expenses easier. It helps finance teams streamline their processes and plan for the future. Let’s dive into the details.

What Is Emburse?

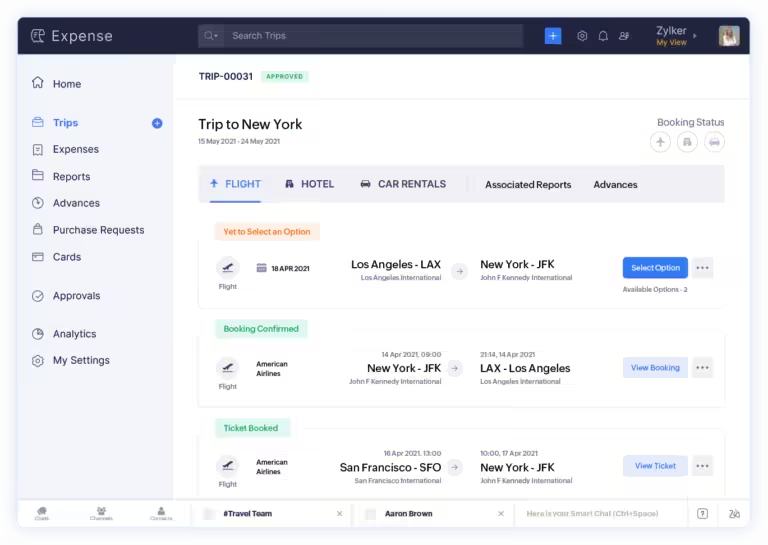

Emburse offers innovative travel and expense management software solutions. It aims to simplify and automate complex financial tasks. This software ensures compliance and empowers finance teams. With features like expense management, travel management, payments & invoice, and insights & analytics, Emburse covers all the essential aspects of financial management.

Purpose And Vision

The purpose of Emburse is to provide time-efficient and user-friendly solutions. It helps businesses control costs and make data-driven decisions. Emburse’s vision includes future-proofing finance teams through innovation. The software is highly customizable to meet unique business needs and evolving requirements. The goal is to empower finance teams to innovate and plan effectively for the future.

Key Features Of Emburse

Emburse offers an array of features designed to streamline travel and expense management. These features ensure compliance, enhance efficiency, and provide valuable insights. Below, we explore the key functionalities that make Emburse a leading choice for finance teams.

Automated Expense Reporting

Automated expense reporting is one of Emburse’s standout features. This functionality minimizes manual entry, reducing errors and saving time. Users can capture and submit expenses quickly, ensuring timely reimbursements and accurate financial records.

- Reduces manual data entry

- Minimizes errors

- Ensures timely reimbursements

Real-time Data Integration

With real-time data integration, Emburse allows finance teams to have up-to-date information at their fingertips. This feature supports immediate decision-making and provides a comprehensive view of company spending.

- Immediate access to data

- Supports quick decision-making

- Comprehensive spending overview

Mobile Accessibility

Emburse offers mobile-friendly solutions that ensure users can manage expenses on the go. This feature is particularly beneficial for employees who travel frequently, allowing them to submit expenses and access reports from their mobile devices.

- Manage expenses on the go

- Submit expenses via mobile devices

- Access reports anytime, anywhere

Policy Compliance And Enforcement

Ensuring adherence to company policies is simplified with Emburse’s policy compliance and enforcement tools. These features help maintain consistency and control over spending, reducing the risk of non-compliance.

- Maintain policy adherence

- Ensure consistent spending practices

- Reduce non-compliance risks

Analytics And Reporting Tools

Emburse’s analytics and reporting tools provide deep insights into spending patterns. These tools help finance teams identify areas for cost savings, manage cash flow effectively, and make data-driven decisions.

- Identify cost-saving opportunities

- Manage cash flow

- Make informed decisions

Pricing And Affordability

Understanding the pricing and affordability of Emburse is crucial for potential users. This section breaks down the key components, ensuring you have all the necessary details to make an informed decision.

Subscription Plans

Emburse offers various subscription plans tailored to different business needs. Each plan is designed to provide maximum value, whether you are a small business or a large enterprise.

- Basic Plan: Suitable for small businesses with essential features.

- Standard Plan: Ideal for growing businesses needing advanced features.

- Enterprise Plan: Comprehensive solution for large organizations with customizable options.

For specific pricing, interested customers are encouraged to contact Emburse directly through their website.

Cost Vs. Value Analysis

When evaluating Emburse, it is essential to consider both the cost and the value it provides. Here’s a breakdown of what you get:

| Feature | Value |

|---|---|

| Expense Management | Proactive controls and insights tailored to your industry. |

| Travel Management | Mobile-friendly solutions ensuring compliance and convenience. |

| Payments & Invoice | Automated accounts payable improving cash flow and controlling costs. |

| Insights & Analytics | Tools to manage cash flow and make data-driven decisions. |

The value provided by these features often outweighs the costs, making Emburse a wise investment for many businesses.

Free Trial And Discounts

Emburse understands the need for businesses to test the software before committing. They offer a free trial period, allowing users to explore the features and benefits.

- Free Trial: Users can experience the software without any initial cost.

- Discounts: Special discounts may be available for long-term commitments or bulk purchases.

For the latest offers and detailed pricing, reach out to Emburse’s sales team at hi@emburse.com.

Pros And Cons Of Emburse

Emburse offers a range of travel and expense management solutions. These tools help finance teams streamline operations, enhance compliance, and control costs. In this section, we will explore the pros and cons of Emburse based on user feedback and reviews.

Advantages Based On User Feedback

- Time Efficiency: Users appreciate the time saved with automated processes and mobile capabilities.

- Compliance: The software ensures adherence to policies through user-friendly solutions.

- Cost Control: Enhanced visibility and control over spending is a significant benefit.

- Data-Driven Decisions: Tools for insights and analytics help shape future strategies and uncover savings.

- Customization: The software is highly configurable to meet unique and evolving business needs.

- Mobile-Friendly: The travel management solutions are designed for convenience and compliance on the go.

Areas For Improvement

- Pricing Information: Users find the lack of transparent pricing details frustrating.

- Support Response: Some users report slower response times from support.

- Refund Policies: Clearer information on refund or return policies is needed.

- Integration: A few users mention challenges with integrating the software with existing systems.

Understanding these pros and cons can help potential users make informed decisions about using Emburse’s travel and expense management solutions.

Ideal Users And Scenarios

Emburse is a comprehensive travel and expense management software designed to streamline financial processes. Its flexibility and robust features make it suitable for various business sizes and industries. Here, we will explore the ideal users and scenarios for Emburse.

Best For Small To Medium Businesses

Small to medium businesses (SMBs) benefit greatly from Emburse. The platform’s expense management and travel management features are tailored to meet the unique needs of these businesses.

- Time Efficiency: SMBs can save time with automated processes and mobile capabilities.

- Cost Control: Enhanced visibility and control over spending.

- Customization: Highly configurable to meet evolving business needs.

With Emburse, SMBs can ensure compliance and manage expenses more effectively, helping them plan for growth.

Suitability For Large Enterprises

Large enterprises require robust systems to manage complex financial processes. Emburse provides automation of accounts payable, ensuring timely reimbursements and payments.

- Compliance: Ensure adherence to policies with user-friendly solutions.

- Data-Driven Decisions: Utilize insights and analytics for strategic planning.

- Scalability: Solutions that grow with the enterprise.

Large enterprises benefit from the platform’s comprehensive insights and analytics, enabling them to identify wasteful spending and make data-driven decisions.

Specific Use Cases And Industries

Emburse caters to various industries, providing tailored solutions to meet specific needs.

| Industry | Use Case |

|---|---|

| Healthcare | Managing travel expenses for medical professionals and ensuring compliance. |

| Education | Automating expense reports for faculty and staff, managing budgets. |

| Legal | Tracking billable hours and expenses for legal professionals. |

By providing flexible and customizable solutions, Emburse helps various industries streamline their financial processes.

Conclusion: Is Emburse Right For You?

The decision to choose Emburse depends on your needs in travel and expense management. Evaluating its features can help determine if it aligns with your requirements. Let’s summarize the key points and offer final recommendations.

Summary Of Key Points

- Expense Management: Emburse offers flexible solutions tailored to industry-specific needs with proactive controls and insights.

- Travel Management: Mobile-friendly travel solutions ensure compliance and convenience.

- Payments & Invoice: Automates accounts payable to improve cash flow and control costs.

- Insights & Analytics: Tools to identify wasteful spending and make data-driven decisions.

- Time Efficiency: Saves time with automated processes and mobile capabilities.

- Compliance: Ensures adherence to policies with user-friendly solutions.

- Cost Control: Enhances visibility and control over spending.

- Customization: Highly configurable to meet unique business needs.

Final Recommendations

Emburse is ideal for businesses seeking to streamline travel and expense management. Its robust features in expense management, travel solutions, payment automation, and insights provide comprehensive support. The software’s emphasis on time efficiency, compliance, and cost control can help organizations manage their finances more effectively.

For those needing a customizable solution, Emburse’s highly configurable platform can adapt to evolving business needs. While specific pricing information is not provided, potential users should contact Emburse directly for detailed pricing.

Overall, Emburse is well-suited for companies looking to enhance their financial management processes. For more information, visit their official website or reach out to their support team.

Frequently Asked Questions

What Is Emburse?

Emburse is a software platform for expense management and accounts payable automation. It helps streamline financial processes.

How Does Emburse Work?

Emburse automates expense reporting and invoice processing. It uses AI to categorize expenses and approve payments.

Who Uses Emburse?

Emburse is used by businesses of all sizes. It’s popular among finance teams for its efficiency.

What Are Emburse’s Key Features?

Emburse offers real-time expense tracking, receipt scanning, and policy compliance. It also integrates with popular accounting software.

Conclusion

Emburse offers an excellent solution for managing travel and expenses. Its features streamline processes and ensure compliance. Finance teams can make data-driven decisions with confidence. Save time and control costs with Emburse’s automated tools. Customization options meet various business needs. Interested in learning more? Visit Emburse for detailed information.