Expense Management System: Streamline Your Business Finances

Managing expenses can be a hassle for any business. An effective expense management system simplifies this process.

In today’s fast-paced business environment, controlling costs and ensuring compliance are critical. This is where Emburse comes in. With Emburse’s travel and expense management software, finance teams can plan effectively and save time. This innovative tool offers flexible, automated solutions that enhance compliance and streamline processes. It also provides valuable insights and analytics to manage cash flow and anticipate future spending. Experience the benefits of an efficient expense management system with Emburse. Check out their solutions here.

Introduction To Expense Management Systems

Managing expenses efficiently is crucial for any business. An Expense Management System streamlines this process. It ensures compliance, controls costs, and simplifies the workflow. Let’s dive into what an Expense Management System is and why it is important.

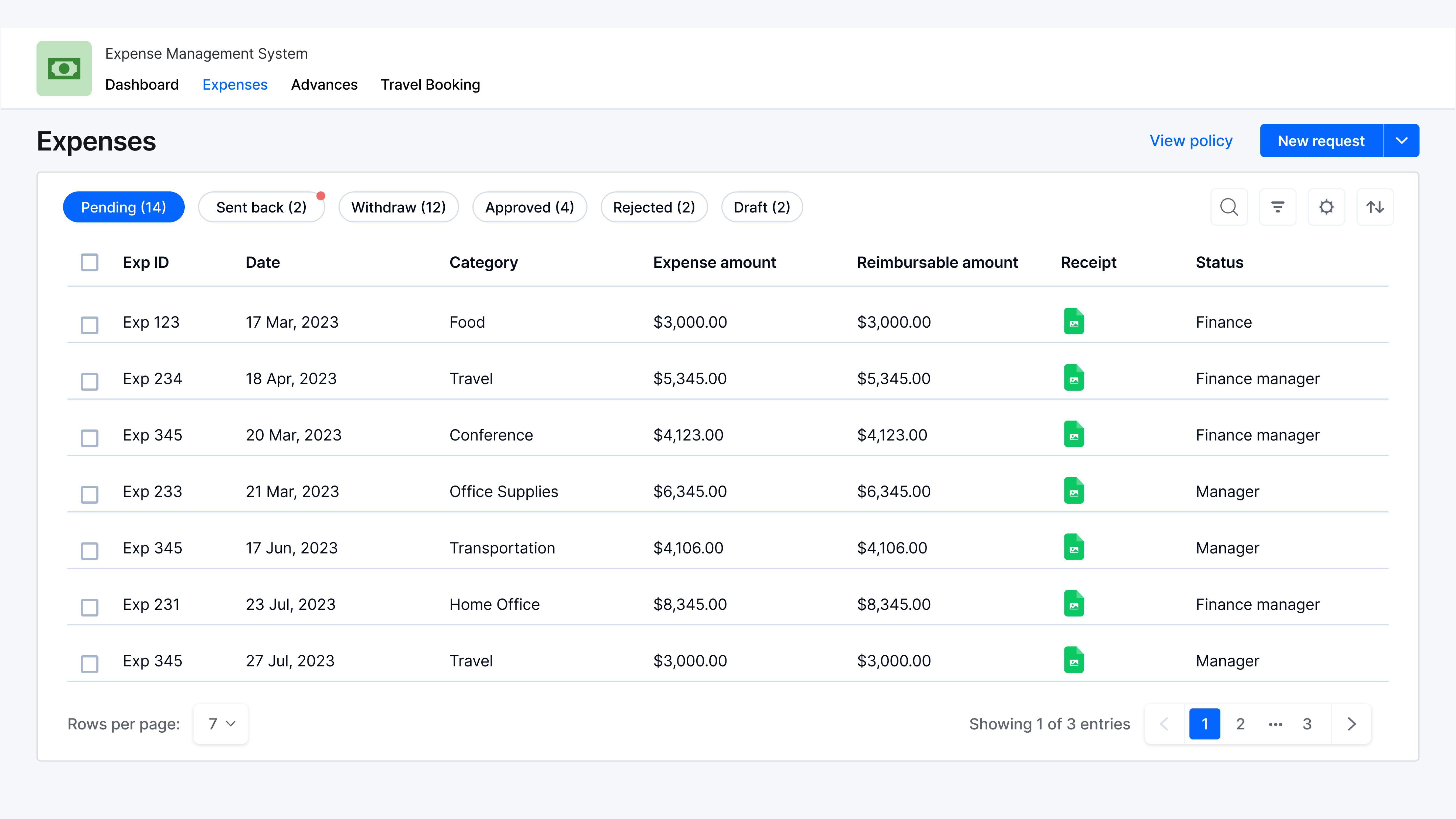

What Is An Expense Management System?

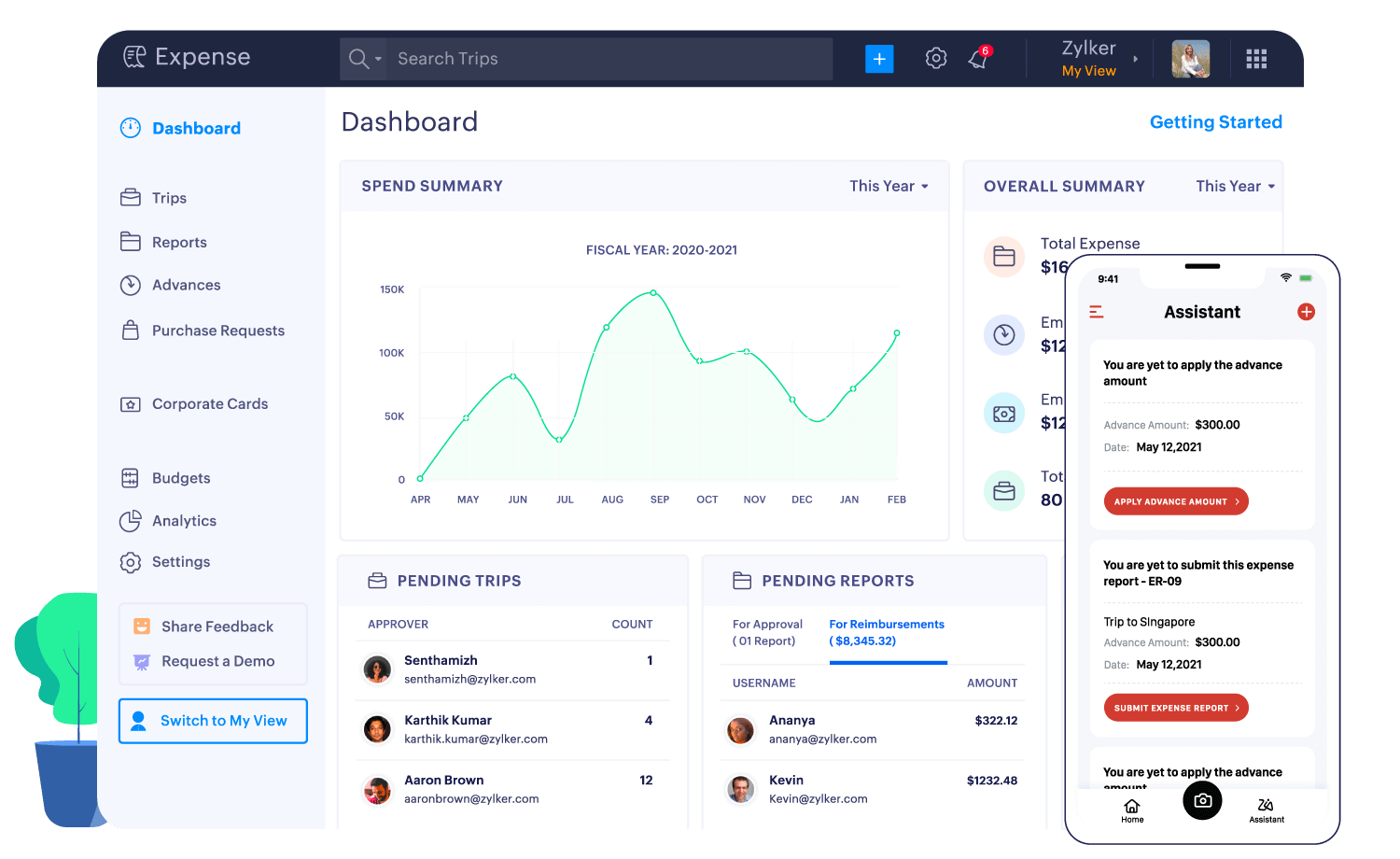

An Expense Management System is software designed to manage and track business expenses. It automates the process of submitting, approving, and reimbursing expenses. This system provides a centralized platform for managing expense reports, ensuring accuracy, and offering real-time insights into spending patterns.

| Feature | Description |

|---|---|

| Expense Management | Flexible solutions with proactive controls and insights. |

| Travel Management | Mobile-friendly solutions to drive policy adherence and compliance. |

| Payments & Invoice | Improve cash flow and eliminate repetitive tasks. |

| Insights & Analytics | Manage cash flow and anticipate future spending. |

Purpose And Importance Of Expense Management

The primary purpose of an Expense Management System is to streamline expense reporting. It ensures that all expenses are tracked accurately and consistently. This system helps businesses maintain compliance with financial regulations and internal policies.

- Enhance Compliance: Ensures adherence to company policies and regulatory requirements.

- Control Costs: Provides visibility into spending, helping to identify and reduce unnecessary expenses.

- Simplify Processes: Automates the submission, approval, and reimbursement of expenses.

- Real-Time Insights: Offers analytics for better decision-making and planning.

Emburse, a leading provider in this field, offers innovative solutions to enhance compliance and streamline processes. With products like Expense Enterprise, Go, and Invoice Professional, Emburse caters to various business needs. The platform’s flexibility and automation help finance teams plan better and achieve success through partnerships.

For more information, visit the official website: Emburse

Key Features Of An Expense Management System

Managing expenses can be time-consuming and complex. An effective expense management system like Emburse simplifies this process. It offers a range of features designed to streamline operations, enhance compliance, and control costs. Let’s explore the key features of an expense management system.

Automated Expense Tracking

Automated expense tracking helps reduce manual entry errors and saves time. With Emburse, expenses are recorded automatically, ensuring accuracy and efficiency. The system categorizes expenses, matches receipts, and alerts users about policy violations.

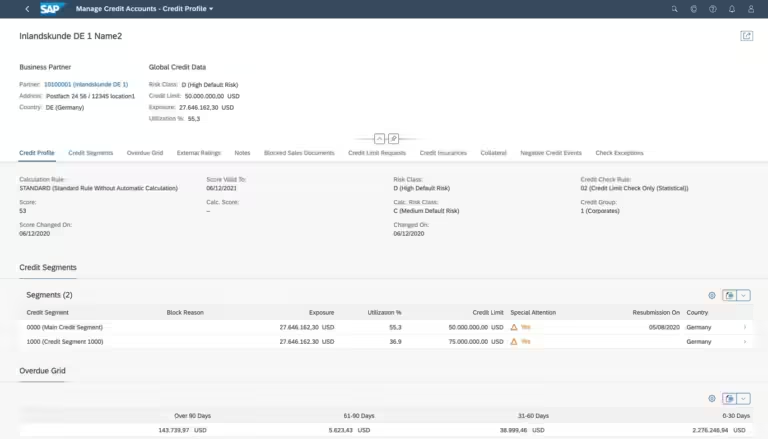

Real-time Reporting And Analytics

Real-time reporting provides valuable insights into spending patterns. Emburse offers detailed analytics to help finance teams manage cash flow and forecast future expenses. The system generates reports instantly, enabling quick decisions based on current data.

Integration With Other Financial Tools

Integration with other financial tools is crucial. Emburse connects seamlessly with various accounting software and ERP systems. This ensures data consistency and enhances financial planning. Users can link their credit card transactions directly to the system, simplifying the reconciliation process.

Mobile Accessibility

Mobile accessibility allows users to manage expenses on the go. Emburse’s mobile app enables employees to capture receipts, submit expenses, and approve reports from their smartphones. This feature ensures timely submissions and approvals, even when employees are traveling.

Policy Compliance And Control

Policy compliance is vital for any organization. Emburse enforces compliance through customizable policy rules. The system automatically flags any non-compliant expenses, ensuring adherence to company policies. This feature helps maintain control over spending and reduces the risk of fraud.

By leveraging these key features, Emburse offers a comprehensive solution for managing expenses efficiently. Finance teams can gain better insights, enhance compliance, and streamline their processes.

How Each Feature Benefits Your Business

Using an expense management system like Emburse can transform your business operations. Each feature of Emburse is designed to improve efficiency, reduce costs, and provide valuable insights. Let’s explore how these features benefit your business.

Improved Accuracy And Reduced Errors

An automated expense management system significantly reduces human errors. Emburse’s flexible solutions with proactive controls ensure data is accurate and consistent. This accuracy helps in preventing costly mistakes and ensures reliable financial records.

Enhanced Financial Visibility

Emburse provides real-time insights into your financial operations. The analytics feature helps manage cash flow and anticipate future spending. You can identify wasteful spending and make data-driven decisions to uncover savings. This enhanced visibility allows for better financial planning and strategy development.

Seamless Financial Workflow

With Emburse, you can automate accounts payable and streamline payment and purchasing processes. This seamless workflow improves cash flow and eliminates repetitive tasks. The integration of travel management solutions ensures policy adherence and compliance, making the entire financial process more efficient.

Convenient On-the-go Management

Emburse offers mobile-friendly travel solutions. This convenience allows your team to manage expenses on the go. Whether traveling or working remotely, employees can easily submit and track expenses. This flexibility enhances productivity and ensures timely expense management.

Ensuring Compliance And Reducing Fraud

Emburse helps enhance compliance with automated solutions. The system’s audit feature identifies and reduces wasteful spending. Additionally, proactive controls and insights ensure adherence to policies, reducing the risk of fraud. Maintaining compliance protects your business and builds trust with stakeholders.

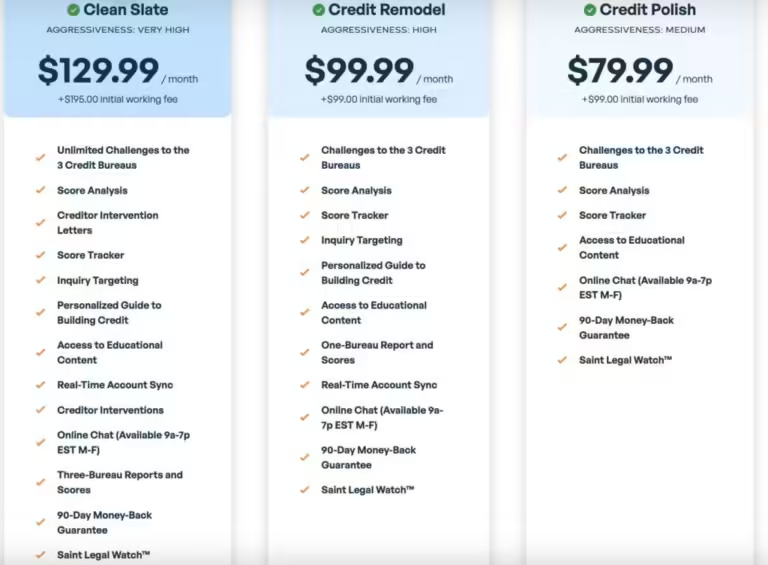

Pricing And Affordability

Understanding the pricing and affordability of expense management systems is crucial for businesses of all sizes. Emburse offers a range of solutions tailored to meet diverse needs. Let’s dive into the pricing models, cost-benefit analysis, and affordable options for small businesses.

Overview Of Pricing Models

Emburse provides various pricing models to cater to different business requirements. The products include:

- Book Enterprise

- Book Professional

- Captio

- Cards

- Expense Enterprise

- Expense Professional

- Go

- Invoice Enterprise

- Invoice Professional

- Pay Enterprise

- Reshop

- Spend

- Travel Source

Additionally, Emburse offers several product add-ons such as AI Audit, Analytics Pro, Source, Travel Analytics, and Travel Audit. These add-ons enhance the core functionalities.

Cost-benefit Analysis

Investing in Emburse can bring significant benefits. Here are some key advantages:

- Enhanced compliance and control over expenses.

- Automated processes that save time and reduce manual errors.

- Improved cash flow management with seamless payment and invoice solutions.

- Data-driven insights for better decision-making and uncovering savings.

While the initial investment might seem substantial, the long-term savings and efficiency gains often outweigh the costs.

Affordable Options For Small Businesses

Small businesses can benefit from Emburse’s flexible pricing options. The “Expense Professional” and “Invoice Professional” plans are designed to be cost-effective while offering essential features.

Some affordable add-ons include:

- AI Audit for reducing wasteful spending.

- Analytics Pro for detailed insights.

With these options, small businesses can enjoy the benefits of advanced expense management without breaking the bank.

Pros And Cons Of Expense Management Systems

Implementing an Expense Management System like Emburse can transform the way businesses handle travel, payments, and expenses. While these systems offer a host of advantages, there are also potential challenges to consider. Let’s delve into the pros and cons of using such systems.

Advantages Of Implementing An Expense Management System

Expense Management Systems offer numerous benefits that can significantly improve financial operations:

- Flexible Solutions: Systems like Emburse provide proactive controls and insights to manage expenses effectively.

- Automated Processes: Automation helps eliminate repetitive tasks, improving efficiency and compliance.

- Enhanced Compliance: Mobile-friendly travel solutions ensure adherence to company policies.

- Better Cash Flow: Automated accounts payable processes enhance cash flow visibility and control.

- Data-Driven Decisions: Advanced analytics offer insights to manage cash flow and anticipate future spending.

These advantages make managing expenses less time-consuming and more accurate, allowing finance teams to focus on strategic planning.

Potential Drawbacks And Challenges

Despite the many benefits, there are some challenges associated with Expense Management Systems:

- Initial Setup and Training: Implementing a new system requires time and training, which can be resource-intensive.

- Cost: While systems like Emburse offer various pricing options, the cost can be a concern for smaller businesses.

- Integration Issues: Integrating the system with existing software can pose technical challenges.

- User Adoption: Employees may resist change, affecting the system’s effectiveness.

Addressing these challenges involves planning, investment, and ensuring user-friendly interfaces to encourage adoption.

Recommendations For Ideal Users And Scenarios

The Emburse Travel and Expense Management Software is a versatile tool that fits various business needs. It is particularly valuable for specific user groups and scenarios. Below, we outline the ideal users and situations where this software shines.

Best For Small To Medium-sized Businesses

Emburse is an excellent choice for small to medium-sized businesses. These businesses often have limited resources and need a solution that can automate expense tracking and provide real-time insights.

| Business Size | Why Choose Emburse |

|---|---|

| Small Businesses | Automates tasks, improves cash flow, and simplifies compliance. |

| Medium Businesses | Offers flexibility, control, and data-driven insights for growth. |

Industries That Benefit The Most

Certain industries see the most benefit from using Emburse. These include:

- Legal Services: Enhances compliance and reduces administrative tasks.

- Finance: Provides detailed analytics for better financial planning.

- Travel: Streamlines travel expense management and policy adherence.

- Consulting: Tracks expenses efficiently and improves client billing accuracy.

Scenarios Where An Expense Management System Is Essential

An expense management system like Emburse is essential in various scenarios:

- High Volume of Transactions: Automates expense reports and audits to save time.

- Frequent Business Travel: Manages travel expenses and ensures compliance with travel policies.

- Multiple Departments: Provides a centralized system to track and control department spending.

- Need for Compliance: Ensures adherence to financial regulations and company policies.

Emburse offers a comprehensive solution that helps businesses manage expenses efficiently and plan for the future.

Frequently Asked Questions

What Is An Expense Management System?

An Expense Management System helps businesses track, audit, and manage employee expenses. It automates expense reporting, approval workflows, and reimbursement processes. This system ensures accurate financial records.

How Does An Expense Management System Work?

An Expense Management System allows employees to submit expenses digitally. Managers can review and approve these submissions. The system tracks and categorizes expenses, making financial management easier.

Why Use An Expense Management System?

Using an Expense Management System reduces manual errors and saves time. It provides real-time expense tracking and helps in budget management. It also ensures compliance with company policies.

What Features Should An Expense Management System Have?

An effective Expense Management System should have receipt scanning, approval workflows, policy compliance, expense categorization, and integration with accounting software. Mobile accessibility is also important.

Conclusion

An expense management system is essential for effective financial control. It simplifies tracking expenses and improves compliance. Emburse offers innovative solutions designed for flexibility and automation. These features help finance teams plan for the future and streamline processes. Want to enhance your expense management? Explore Emburse for more details.