Expense Management Comparison: Best Tools & Software Reviewed

When managing expenses, choosing the right tool is crucial. Emburse offers comprehensive solutions, but how does it stack up?

Comparing expense management tools helps you find the best fit for your needs. Whether you’re a small business or a large corporation, understanding the strengths and weaknesses of different options saves time and money. This comparison will highlight key features, benefits, and potential drawbacks. By examining tools like Emburse, you can make an informed decision. Ready to dive in? Let’s explore how various expense management solutions measure up and discover which one aligns with your business goals. For more information on Emburse, visit their website.

Introduction To Expense Management Tools

Expense management tools have become essential for businesses today. They help in tracking, managing, and controlling business expenses efficiently. These tools are designed to simplify the complex process of expense reporting and provide valuable insights into spending patterns. One of the leading solutions in this space is Emburse Travel and Expense Management Software Solutions.

What Is Expense Management?

Expense management involves the systematic process of tracking, approving, and reimbursing employee expenses. This can include travel costs, office supplies, and other business-related expenditures. By using expense management tools, businesses can automate this process, ensuring accuracy and compliance with company policies.

Importance Of Expense Management For Businesses

Effective expense management is crucial for businesses for several reasons:

- Cost Control: Helps in monitoring and controlling expenses, preventing overspending.

- Compliance: Ensures all expenses adhere to company policies and regulatory requirements.

- Efficiency: Streamlines the expense reporting process, saving time and reducing manual errors.

- Insights: Provides valuable data and analytics to make informed financial decisions.

Tools like Emburse offer innovative solutions to manage these aspects efficiently. Their platform includes features like automated savings, policy adherence, and comprehensive analytics.

| Feature | Details |

|---|---|

| Expense Management | Flexible solutions with proactive controls and insights |

| Travel Management | Compliance through convenience with mobile-friendly solutions |

| Payments & Invoice | Automate accounts payable, improve cash flow |

| Insights & Analytics | Audit to reduce wasteful spending, manage cash flow |

| Security | Global security standards to minimize risk |

For businesses looking to streamline their expense management processes, Emburse provides a comprehensive and customizable solution. By leveraging such tools, companies can achieve greater efficiency, compliance, and financial insight.

Key Features Of Top Expense Management Tools

Choosing the right expense management tool is crucial for businesses. The best tools offer a range of features that streamline processes, save time, and provide valuable insights. Below are the key features you should look for in top expense management tools.

Automated Expense Tracking

Automated expense tracking simplifies the process of monitoring and categorizing expenses. Emburse provides flexible solutions with proactive controls and insights, ensuring every transaction is accounted for. This feature minimizes manual data entry, reducing errors and saving valuable time.

Receipt Scanning And Ocr

Receipt scanning and Optical Character Recognition (OCR) technology allow users to quickly convert receipts into digital data. Emburse supports this feature, making it easy to capture receipt information on the go. Users can simply take a photo of their receipts, and the OCR technology will extract the necessary details, streamlining expense reporting.

Integration With Accounting Software

Integration with accounting software is essential for seamless financial management. Emburse integrates with various accounting platforms, ensuring that expense data flows smoothly into your accounting system. This integration helps maintain accurate financial records and simplifies the reconciliation process.

Mobile Accessibility

Mobile accessibility enables employees to manage their expenses anytime, anywhere. Emburse offers mobile-friendly travel and expense solutions, allowing users to track expenses, scan receipts, and submit reports directly from their smartphones. This feature enhances convenience and ensures compliance with company policies even when on the move.

Reporting And Analytics

Comprehensive reporting and analytics capabilities provide valuable insights into spending patterns. Emburse offers robust analytics tools that help businesses audit expenses, identify wasteful spending, and make data-driven decisions. These insights are crucial for managing cash flow and anticipating future expenditures.

Top Expense Management Tools Reviewed

Managing expenses can be a daunting task for any business. This is where expense management tools come in handy. They help streamline the process, ensuring every dollar is accounted for. Here, we review the top expense management tools available today.

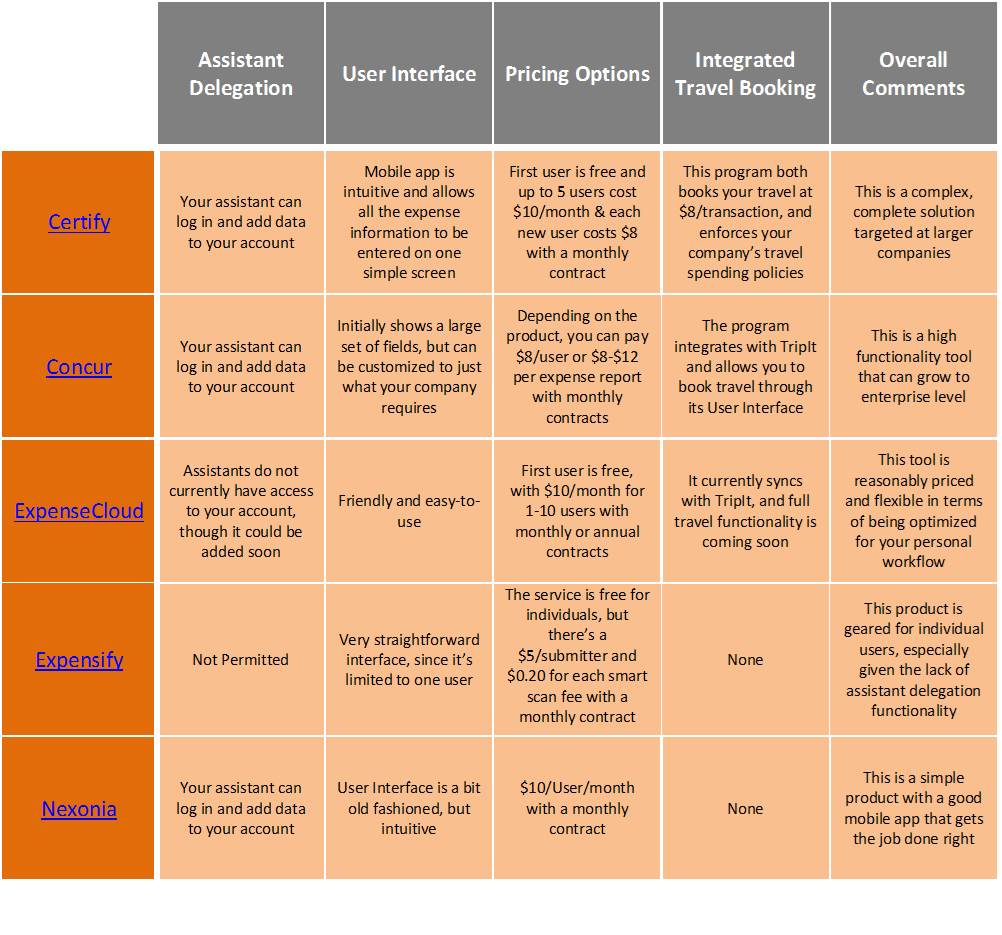

Tool 1: Expensify

Expensify is a popular choice among businesses for managing expenses. It offers features such as receipt scanning, expense reporting, and integration with various accounting software. Expensify is known for its user-friendly interface and robust mobile app, making it easy for employees to track expenses on the go.

- Receipt Scanning: Capture receipts via mobile app

- Expense Reporting: Generate detailed reports

- Integrations: Seamless integration with accounting software

Tool 2: Concur

Concur is a comprehensive expense management solution designed for businesses of all sizes. It offers advanced features like travel booking, expense reporting, and automated approval workflows. Concur is ideal for companies looking for an all-in-one solution to manage travel and expenses.

- Travel Booking: Book travel arrangements within the platform

- Expense Reporting: Detailed and customizable reports

- Automated Workflows: Streamline approval processes

Tool 3: Zoho Expense

Zoho Expense is another excellent tool for managing expenses. It offers features like receipt scanning, automated expense reporting, and multi-currency support. Zoho Expense is known for its ease of use and affordability, making it a great option for small to medium-sized businesses.

- Receipt Scanning: Scan and upload receipts easily

- Automated Reporting: Generate reports automatically

- Multi-Currency Support: Handle expenses in multiple currencies

Tool 4: Quickbooks Online

QuickBooks Online is a well-known accounting software that also offers expense management features. It allows businesses to track expenses, create invoices, and manage cash flow. QuickBooks Online is ideal for businesses already using QuickBooks for their accounting needs.

- Expense Tracking: Keep track of all expenses

- Invoice Creation: Create and send invoices

- Cash Flow Management: Monitor and manage cash flow

Tool 5: Rydoo

Rydoo is a modern expense management tool that focuses on simplicity and efficiency. It offers features like receipt scanning, expense reporting, and real-time insights. Rydoo is perfect for businesses looking for a straightforward and efficient expense management solution.

- Receipt Scanning: Scan receipts quickly

- Expense Reporting: Generate comprehensive reports

- Real-Time Insights: Access expense data in real-time

| Tool | Main Features |

|---|---|

| Expensify | Receipt Scanning, Expense Reporting, Integrations |

| Concur | Travel Booking, Expense Reporting, Automated Workflows |

| Zoho Expense | Receipt Scanning, Automated Reporting, Multi-Currency Support |

| QuickBooks Online | Expense Tracking, Invoice Creation, Cash Flow Management |

| Rydoo | Receipt Scanning, Expense Reporting, Real-Time Insights |

Pricing And Affordability Breakdown

Choosing the right expense management software involves understanding pricing and affordability. This section provides a breakdown of the pricing for various popular expense management solutions. Let’s dive into the details.

Expensify Pricing

Expensify offers a range of plans to cater to different business needs. Here’s a quick overview:

- Free Plan: Ideal for individuals and small teams, offering essential features.

- Collect Plan: $5 per user per month, focused on receipt and expense management.

- Control Plan: $9 per user per month, includes advanced policy enforcement and approval workflows.

Concur Pricing

Concur provides customized pricing based on your specific requirements. For a general idea:

- Small Business: Approximately $8 per report.

- Enterprise Solutions: Requires a custom quote to match complex needs.

Contact Concur’s sales team for an accurate quote.

Zoho Expense Pricing

Zoho Expense offers three main plans:

- Free Plan: Suitable for up to 3 users, with basic features.

- Standard Plan: $5 per user per month, includes advanced features like multi-currency support.

- Premium Plan: $8 per user per month, offers enhanced features like custom approvals and advanced analytics.

Quickbooks Online Pricing

QuickBooks Online integrates expense management within its accounting software. Pricing plans include:

- Simple Start: $25 per month, suitable for basic needs.

- Essentials: $50 per month, offers additional features like bill management.

- Plus: $80 per month, includes project tracking and inventory management.

Rydoo Pricing

Rydoo offers flexible plans to suit various business sizes:

- Team Plan: $7 per user per month, includes basic expense management features.

- Growth Plan: $9 per user per month, includes advanced features like mileage tracking.

- Enterprise Plan: Custom pricing based on specific business needs.

Rydoo also provides a free trial for new users.

For more detailed information on each plan and to explore more options, visit the respective websites or contact their sales teams directly.

Pros And Cons Of Each Tool

Choosing the right expense management tool for your business can be challenging. Each tool has its own strengths and weaknesses. Below, we compare some of the most popular expense management tools, highlighting their pros and cons.

Expensify Pros And Cons

| Pros | Cons |

|---|---|

|

|

Concur Pros And Cons

| Pros | Cons |

|---|---|

|

|

Zoho Expense Pros And Cons

| Pros | Cons |

|---|---|

|

|

Quickbooks Online Pros And Cons

| Pros | Cons |

|---|---|

|

|

Rydoo Pros And Cons

| Pros | Cons |

|---|---|

|

|

Specific Recommendations For Ideal Users

Choosing the right expense management tool can be challenging. Different types of users have unique needs. Here are specific recommendations based on business size and type.

Best For Small Businesses

Emburse offers tailored vertical expense solutions perfect for small businesses. The platform’s flexibility and proactive controls help small businesses manage expenses efficiently. Key features include:

- Flexible Solutions: Adaptable to unique business requirements.

- Proactive Controls: Ensure policy compliance and control costs.

- Automation: Save time with automated expense reporting and approvals.

Best For Large Enterprises

For large enterprises, Emburse provides robust solutions to streamline travel and manage expenses on a large scale. The platform’s advanced features cater to complex organizational structures. Key features include:

- Comprehensive Travel Management: Ensure compliance and cost savings.

- Automated Accounts Payable: Improve cash flow with secure payments.

- Insights & Analytics: Gain valuable insights to reduce wasteful spending.

Best For Freelancers And Contractors

Freelancers and contractors need simple and efficient expense management tools. Emburse provides mobile-friendly solutions that are easy to use and manage. Key features include:

- Mobile-Friendly Solutions: Manage expenses on the go.

- Secure Reimbursements: Ensure timely and secure payments.

- Data Insights: Make informed decisions with clear data analytics.

Best For Startups

Startups require flexible and scalable expense management solutions. Emburse offers customizable tools that grow with the business. Key features include:

- Customizable Solutions: Adapt to evolving business needs.

- Automation: Streamline processes and save valuable time.

- Data-Driven Decisions: Empower startups with actionable insights.

Frequently Asked Questions

What Is Expense Management?

Expense management is the process of tracking, analyzing, and controlling business expenses. It helps in budgeting and cost optimization.

Why Is Expense Management Important?

Expense management is important for financial control and ensuring profitability. It helps in identifying unnecessary expenditures and improving cost efficiency.

What Are Common Expense Management Tools?

Common expense management tools include software like Expensify, QuickBooks, and Concur. These tools automate tracking and reporting.

How Does Expense Management Software Work?

Expense management software automates expense tracking, approval workflows, and reporting. It integrates with accounting systems for accurate financial data.

Conclusion

Choosing the right expense management solution is vital for business growth. Each platform offers unique features to meet diverse needs. Emburse stands out with its innovative and flexible solutions. It streamlines travel, manages expenses, and ensures compliance. Consider your organization’s specific requirements before making a decision. For more details on Emburse’s offerings, visit their website. Make informed choices to optimize your expense management process and drive efficiency.