Efficient Expense Reporting: Streamline Your Financial Management

Expense reporting can be a daunting task for many businesses. But it doesn’t have to be.

Efficient expense reporting not only saves time but also helps in better financial planning. Emburse offers innovative solutions that streamline this process, ensuring accuracy and compliance. In today’s fast-paced business world, managing expenses efficiently is crucial. With Emburse Travel and Expense Management Software Solutions, companies can automate and simplify their expense reporting. This software helps businesses by providing flexible solutions tailored to different industries, ensuring compliance, and offering valuable insights. By automating repetitive tasks, Emburse saves valuable time for finance teams. It also helps in controlling costs and improving cash flow. Discover how Emburse can transform your expense reporting process. Visit Emburse to learn more.

Introduction To Efficient Expense Reporting

Efficient expense reporting is crucial for any business aiming for streamlined financial management. By adopting advanced software solutions, companies can save time, reduce errors, and gain better financial insights. This article will delve into the essentials of efficient expense reporting and highlight its importance in modern business operations.

What Is Expense Reporting?

Expense reporting involves tracking and documenting business expenses. This includes costs incurred during travel, client meetings, or other business-related activities. Detailed reports ensure accurate financial records and reimbursement processes.

An efficient expense reporting system like Emburse automates these tasks. It minimizes manual entry, reduces errors, and speeds up the approval process. Users can easily upload receipts, categorize expenses, and submit reports via mobile-friendly solutions.

Importance Of Streamlined Financial Management

Streamlined financial management is key to maintaining a healthy cash flow. It helps businesses make informed decisions based on real-time data. A robust system like Emburse’s ensures compliance with travel and expense policies, reducing the risk of fraud and overspending.

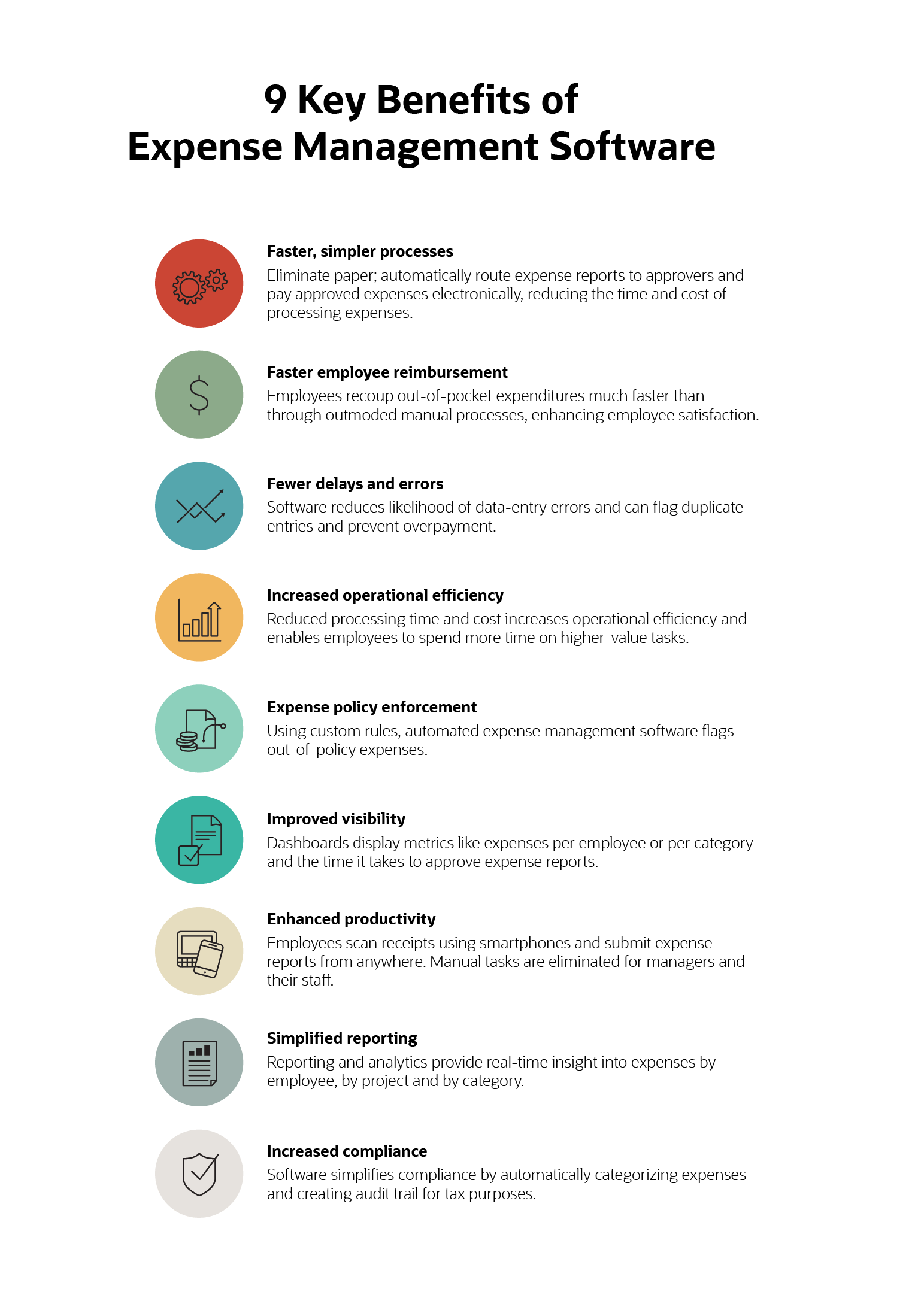

Key benefits of using efficient expense reporting software include:

- Efficiency: Automates repetitive tasks, saving time for finance teams.

- Compliance: Ensures adherence to travel and expense policies.

- Cost Control: Provides better visibility and control over expenses.

- Innovation: Future-proof solutions that adapt to evolving business needs.

- Security: Meets global security requirements to minimize risk.

With Emburse, businesses can leverage advanced analytics to manage cash flow, reduce wasteful spending, and make data-driven decisions. This not only improves financial planning but also boosts overall business efficiency.

Key Features Of Efficient Expense Reporting Tools

Efficient expense reporting tools offer a range of features that simplify and streamline the expense management process. These features help users save time, ensure compliance, and gain better control over their finances. Below are some key features to look for in expense reporting tools.

Automated Data Entry

Automated data entry minimizes manual effort and reduces errors. With Emburse, users can simply upload receipts, and the software extracts relevant details such as date, amount, and merchant. This automation speeds up the reporting process and ensures accurate data.

Real-time Expense Tracking

Real-time expense tracking allows users to monitor expenses as they occur. Emburse provides real-time insights into spending patterns, helping businesses to make informed decisions and stay within budget. This feature is essential for maintaining financial control and ensuring compliance with company policies.

User-friendly Interface

A user-friendly interface is crucial for ensuring that all employees can easily navigate the system. Emburse offers an intuitive design that simplifies the process of submitting, approving, and managing expenses. The software is easy to use, even for those who are not tech-savvy.

Integration with financial software streamlines the entire expense management process. Emburse integrates seamlessly with various accounting and ERP systems, allowing for smooth data transfer and better financial planning. This integration ensures that all expense data is consolidated in one place, making it easier to manage and analyze.

Mobile Accessibility

Mobile accessibility is essential for employees who travel frequently. Emburse offers a mobile-friendly solution that allows users to capture receipts, submit expense reports, and approve expenses on the go. This feature ensures that the expense reporting process is not delayed, regardless of the user’s location.

Benefits Of Automated Data Entry

Emburse’s travel and expense management software offers numerous advantages. One of the key features is automated data entry. This technology enhances productivity and accuracy in managing expenses.

Time Savings For Employees

Automated data entry significantly reduces the time employees spend on expense reporting. Manual entry can be time-consuming and tedious. By automating this process, employees can focus on more valuable tasks.

Consider this: a manual report might take an hour to complete. With Emburse’s automated solutions, the same task can be done in minutes. This efficiency translates to more time for productive work.

Reduction In Human Errors

Manual data entry is prone to mistakes. Typos, incorrect amounts, and data misinterpretation are common errors. Automated data entry minimizes these errors by using advanced algorithms to ensure accuracy.

For instance, Emburse uses intelligent data capture to extract information directly from receipts and invoices. This reduces discrepancies and ensures that financial records are accurate.

Simplified Receipt Management

Managing receipts can be a hassle. Employees often misplace or forget to submit them. Emburse simplifies this with mobile-friendly solutions that allow users to capture and upload receipts on the go.

The software also organizes receipts by matching them with expenses automatically. This makes the entire process seamless and efficient. Employees no longer need to worry about lost receipts or delayed submissions.

In summary, automated data entry with Emburse provides significant benefits. It saves time, reduces errors, and simplifies receipt management, making expense reporting more efficient and accurate.

Advantages Of Real-time Expense Tracking

Tracking expenses in real-time brings numerous benefits to any business. It helps streamline financial operations and provides immediate insights. Here are the key advantages of real-time expense tracking.

Enhanced Budget Control

Real-time expense tracking allows for enhanced budget control. Businesses can monitor their spending as it happens. This reduces the risk of overspending. You can set alerts for when expenses approach budget limits. This proactive approach helps maintain financial discipline.

Immediate Insight Into Spending Patterns

Having immediate insights into spending patterns is crucial. Real-time tracking shows where the money is going instantly. You can identify wasteful spending and areas needing cost reduction. This visibility helps in making informed decisions quickly.

Improved Financial Forecasting

Real-time data improves financial forecasting. Accurate and up-to-date information helps predict future expenses. This improves the accuracy of financial plans and budgets. It also helps in adjusting strategies to meet financial goals efficiently.

Emburse offers solutions that support these advantages. Their tools ensure compliance, enhance efficiency, and provide deep insights. With Emburse, businesses can manage cash flow and reduce wasteful spending effectively.

Why A User-friendly Interface Is Essential

A user-friendly interface is the backbone of any efficient expense reporting system. It ensures that employees across all levels can navigate and use the system without frustration. This ease of use leads to higher adoption rates and a smoother onboarding process. Let’s dive into the specifics of why a user-friendly interface is so crucial for expense reporting software.

Ease Of Use For All Employees

An intuitive interface means that even non-tech-savvy employees can submit their expense reports with ease. This is particularly important in diverse teams where technological proficiency varies. A system like Emburse, which offers mobile-friendly solutions, ensures that employees can manage their expenses on the go. This flexibility reduces the time spent on administrative tasks and increases overall productivity.

Quick Onboarding Process

A user-friendly interface significantly shortens the onboarding process. With clear navigation and simple instructions, new users can quickly understand how to use the system. This is particularly beneficial for companies with high turnover rates. The quicker employees can get up to speed, the more efficient the expense reporting process becomes. Emburse provides dedicated training resources to further streamline this process.

Increased Adoption Rates

When an expense reporting system is easy to use, employees are more likely to adopt it. High adoption rates mean that the system can provide more accurate data and insights. This is crucial for making data-driven decisions and improving financial planning. With Emburse’s advanced analytics, companies can better manage their cash flow and reduce wasteful spending.

In summary, a user-friendly interface in expense reporting software like Emburse ensures ease of use for all employees, a quick onboarding process, and increased adoption rates. This leads to a more efficient, compliant, and cost-effective expense management system.

Integration With Financial Software

Efficient expense reporting hinges on seamless integration with financial software. Emburse stands out by offering advanced solutions that ensure smooth data exchange and centralized financial oversight.

Seamless Data Synchronization

Emburse integrates effortlessly with existing financial systems. This seamless data synchronization reduces manual entry and errors. Data flows smoothly between platforms, ensuring accuracy and efficiency. This integration automates tasks, saving valuable time for finance teams.

Centralized Financial Management

Centralized financial management is crucial for effective expense reporting. Emburse provides a single platform to manage all financial activities. This centralization simplifies expense tracking, travel bookings, and payment processing. It enhances visibility and control over financial operations.

| Feature | Benefit |

|---|---|

| Expense Management | Proactive controls and insights |

| Travel Management | Ensures compliance and convenience |

| Payments & Invoice | Improves cash flow |

Enhanced Reporting Capabilities

Enhanced reporting capabilities are a cornerstone of Emburse. The software offers comprehensive insights and analytics. These tools help manage cash flow and reduce wasteful spending. With Emburse, making data-driven decisions becomes straightforward. The advanced reporting features support compliance and financial planning.

- Efficiency: Automates repetitive tasks

- Compliance: Ensures adherence to policies

- Cost Control: Provides visibility over expenses

Emburse’s integration with financial software optimizes expense reporting. It ensures efficient, compliant, and insightful financial management.

Mobile Accessibility For On-the-go Reporting

In today’s fast-paced world, mobile accessibility is crucial for effective expense reporting. Employees often need to report expenses while traveling. Emburse offers a mobile-friendly solution that addresses this need efficiently.

Convenience For Traveling Employees

Traveling employees face unique challenges. Emburse simplifies these challenges by providing a mobile app that allows them to report expenses from anywhere. This convenience ensures that employees do not need to wait until they are back in the office to submit their expenses.

- Submit expenses on-the-go

- Access travel itineraries easily

- Reduce the risk of losing receipts

This mobile accessibility enhances productivity and ensures timely expense reporting, which is critical for both employees and finance teams.

Real-time Expense Reporting

Real-time expense reporting is a game-changer for businesses. Emburse’s mobile app allows employees to report expenses as soon as they are incurred. This feature ensures that the finance team has up-to-date information on company spending.

Benefits of real-time expense reporting:

- Immediate visibility into spending

- Better cash flow management

- Enhanced compliance with company policies

Real-time reporting also helps in identifying and addressing any discrepancies promptly, ensuring accurate financial records.

Instant Receipt Capture

Keeping track of receipts while traveling can be challenging. Emburse simplifies this with instant receipt capture. Employees can take a photo of their receipts and upload them directly through the mobile app.

| Feature | Benefit |

|---|---|

| Photo Capture | Quick and easy upload |

| Cloud Storage | Secure and accessible storage |

| Integration | Seamless integration with expense reports |

This feature eliminates the need for keeping physical receipts and reduces the risk of losing them. It also speeds up the expense reporting process, allowing for more efficient management.

For more information, visit Emburse.

Pricing And Affordability

Finding the right expense reporting tool can be challenging. Pricing and affordability play a crucial role. Understanding the cost and value of each tool helps make an informed decision.

Cost Breakdown Of Popular Tools

When evaluating expense reporting tools, it is essential to understand the cost structure. Here is a breakdown of some popular tools:

| Tool | Basic Plan | Pro Plan | Enterprise Plan |

|---|---|---|---|

| Emburse | Contact for pricing | Contact for pricing | Contact for pricing |

| Concur | $8/user/month | $12/user/month | Custom pricing |

| Expensify | $5/user/month | $9/user/month | Custom pricing |

Comparing Features And Prices

Comparing the features and prices of different tools is crucial. Below is a comparison of some key features:

- Emburse: Comprehensive travel and expense management, mobile-friendly, automation of payments, advanced analytics.

- Concur: Expense tracking, travel booking, invoice management, compliance tools.

- Expensify: Receipt scanning, mileage tracking, expense approval workflows, integrations.

While the pricing might vary, focusing on the features that meet your needs is essential.

Return On Investment Considerations

Evaluating the return on investment (ROI) is important. Here are some considerations:

- Efficiency: How much time does the tool save for your finance team?

- Compliance: Does the tool help adhere to policies and regulations?

- Cost Control: Does it provide visibility and control over expenses?

- Security: Does it meet global security and data processing requirements?

Considering these factors helps determine the true value of the investment in an expense reporting tool.

Pros And Cons Based On Real-world Usage

Emburse has gained a reputation for its efficient expense reporting solutions. Users have shared their experiences, highlighting both the strengths and weaknesses. Let’s delve into the pros and cons based on real-world usage.

Common User Praises

Many users appreciate the efficiency Emburse brings to their processes. They value how it automates repetitive tasks, saving significant time for finance teams. The expense management feature stands out for its flexibility and proactive controls tailored to various industries.

- Efficiency: Automates repetitive tasks, saving time.

- Compliance: Ensures adherence to travel and expense policies.

- Cost Control: Provides better visibility and control over expenses.

Users also highlight the travel management solutions. The mobile-friendly approach ensures compliance and convenience, making it easier to book and manage travel plans on the go. The insights & analytics tools are praised for helping manage cash flow, reduce wasteful spending, and support data-driven decisions.

Frequently Cited Drawbacks

Despite its strengths, some users mention a few drawbacks. One common concern is the lack of detailed pricing information on the website. Users need to contact Emburse for specific pricing, which can be inconvenient.

- Pricing Information: Not explicitly mentioned on the website.

- Refund Policies: Lack of clear information on refund or return policies.

Another frequently cited drawback is the need for more transparent refund and return policies. Users prefer having this information readily available to make informed decisions. Some also find the initial setup and customization process somewhat complex, requiring a learning curve.

Lessons From User Experiences

Users have learned valuable lessons from using Emburse. They suggest investing time in training and utilizing the dedicated customer support and training resources provided by Emburse. This helps in overcoming the initial setup complexities.

For better cost control, users recommend leveraging the insights & analytics tools fully. These tools can significantly reduce wasteful spending and improve financial planning.

- Training: Essential for overcoming setup complexities.

- Support: Utilize dedicated customer support and training resources.

- Analytics: Leverage tools for better cost control and financial planning.

Users also suggest being proactive in reaching out to Emburse for detailed pricing and policy information. This ensures clarity and helps in making well-informed decisions.

Specific Recommendations For Ideal Users

Emburse offers tailored solutions for various user groups. Whether you run a small business, manage a large enterprise, or work as a freelancer, Emburse has tools designed to meet your specific needs. Below are some detailed recommendations for different types of users.

Best For Small Businesses

Small businesses benefit greatly from Emburse’s expense management solutions. These features provide flexible controls and insights tailored to your needs. Automating repetitive tasks saves time, enabling you to focus on growth. Additionally, the software ensures compliance with travel and expense policies. This is crucial for small businesses where every dollar counts.

- Automates repetitive tasks to save time.

- Ensures compliance with travel and expense policies.

- Provides better visibility and control over expenses.

Ideal For Large Enterprises

For large enterprises, Emburse offers advanced analytics and innovative technology. These tools help manage cash flow, reduce wasteful spending, and make data-driven decisions. The software also automates accounts payable processes, improving cash flow and streamlining payment processes.

| Features | Benefits |

|---|---|

| Advanced Analytics | Manage cash flow and reduce wasteful spending. |

| Accounts Payable Automation | Improve cash flow and streamline payment processes. |

| Proactive Controls | Ensure compliance and financial planning. |

Perfect For Freelancers And Contractors

Freelancers and contractors will find Emburse’s mobile-friendly travel solutions invaluable. These features ensure compliance and convenience, which is crucial for those always on the move. The software also provides tools to manage cash flow and reduce wasteful spending, essential for maintaining a healthy financial status.

- Mobile-friendly travel solutions for compliance and convenience.

- Tools to manage cash flow and reduce wasteful spending.

- Innovative technology that adapts to evolving business needs.

Emburse stands out with its innovative, customizable, and secure solutions. It is a reliable partner for businesses looking to optimize their travel and expense management processes.

Conclusion: Streamlining Your Financial Management

Efficient expense reporting is vital for any business. Emburse offers comprehensive travel and expense management software solutions to help streamline this process. By implementing these tools, businesses can improve efficiency, compliance, cost control, and innovation.

Recap Of Key Benefits

- Efficiency: Automates repetitive tasks, saving time for finance teams.

- Compliance: Ensures adherence to travel and expense policies.

- Cost Control: Provides better visibility and control over expenses and cash flow.

- Innovation: Future-proof solutions that adapt to evolving business needs.

- Security: Meets global security and data processing requirements to minimize risk.

Final Thoughts On Implementing Expense Reporting Tools

Implementing Emburse travel and expense management software can transform how businesses handle expenses. The automation of accounts payable, travel booking, and invoice processing simplifies financial management. The advanced analytics provide valuable insights to make data-driven decisions and reduce wasteful spending.

Businesses can contact Emburse directly for pricing details and to discuss specific needs. The dedicated customer support and training resources ensure a smooth transition and effective use of the tools. With industry recognition from G2, TrustRadius, and Money, Emburse stands out as a reliable partner in optimizing travel and expense management processes.

Frequently Asked Questions

What Is Expense Reporting?

Expense reporting is the process of documenting and tracking business expenses. Employees submit receipts and details of their expenditures. This ensures accurate reimbursement and financial tracking.

Why Is Efficient Expense Reporting Important?

Efficient expense reporting saves time and reduces errors. It ensures accurate financial records, aids in budget management, and streamlines reimbursement processes.

How Can Technology Improve Expense Reporting?

Technology automates expense reporting, making it faster and more accurate. Mobile apps and software can track, categorize, and submit expenses with ease.

What Are Common Challenges In Expense Reporting?

Common challenges include lost receipts, manual entry errors, and delayed submissions. These issues can lead to inaccurate financial records and delayed reimbursements.

Conclusion

Efficient expense reporting is crucial for every business. Tools like Emburse simplify this process. They streamline expense management, travel booking, and payment automation. This saves time and ensures compliance. Interested in improving your expense reporting? Check out Emburse for comprehensive solutions. Start optimizing your business today and gain better control over your financial planning.