User-Friendly Expense Management: Simplify Your Finances Today

Managing expenses efficiently can be challenging. A user-friendly expense management system can simplify this task.

Emburse offers a robust travel and expense management solution designed to streamline financial processes. This software helps businesses plan better and enhance performance. With flexible expense management, mobile-friendly travel management, and automated payments, Emburse simplifies your financial tasks. It also provides insightful analytics to guide your decisions and ensure compliance with your policies. By reducing repetitive tasks and eliminating wasteful spending, Emburse saves time and improves cost control. Explore how Emburse can transform your expense management and help your business thrive. Discover Emburse today!

Introduction To User-friendly Expense Management

Managing expenses efficiently is crucial for both individuals and businesses. It ensures that finances are kept in check, policies are adhered to, and future planning is optimized. In this section, we delve into the concept of user-friendly expense management, highlighting its importance and benefits.

Understanding Expense Management

Expense management involves the processes and systems used to control, track, and manage spending. It includes everything from approving expenses, tracking receipts, and reimbursing employees, to analyzing spending patterns. An effective expense management system like Emburse streamlines these processes, making it easier for users to manage their finances.

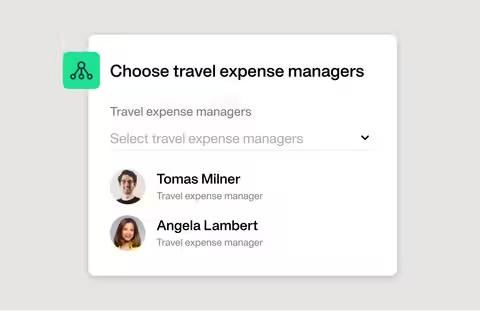

Emburse Travel and Expense Management Software Solutions provide advanced tools that automate financial processes. The software includes features such as:

- Expense Management: Flexible solutions with proactive controls and insights.

- Travel Management: Mobile-friendly solutions to drive compliance and policy adherence.

- Payments & Invoice Management: Automation of accounts payable for cost control and cash flow visibility.

- Insights & Analytics: Data-driven decision-making to uncover savings and manage cash flow.

- Audit: Identify and reduce wasteful spending.

The Importance Of Simplifying Your Finances

Simplifying your finances is essential for better financial health. A user-friendly expense management system can help in several ways:

- Time Savings: Automation reduces repetitive tasks, giving users time to plan for future initiatives.

- Compliance: Ensures adherence to policies through convenient and mobile-friendly solutions.

- Cost Control: Improved cash flow management and elimination of wasteful spending.

- Data-Driven Decisions: Empower users with insights to make informed financial decisions.

- Customizable: Highly configurable to meet evolving business needs.

Using a system like Emburse can transform how you handle expenses. It offers an innovative and efficient approach to managing finances, helping businesses plan for the future and improve performance.

For more information, visit Emburse.

Key Features Of User-friendly Expense Management Tools

Managing expenses can be a daunting task without the right tools. User-friendly expense management tools make the process simple and efficient. These tools offer features that help users track, manage, and analyze expenses effortlessly. Below are some of the key features of user-friendly expense management tools:

Automated Expense Tracking

Automated expense tracking is a game-changer for managing finances. Users can save time by automatically capturing and categorizing expenses. This feature reduces manual entry errors and ensures accuracy. It can also sync with receipts and invoices, making the tracking process seamless.

Budget Creation And Monitoring

Creating and monitoring budgets is crucial for financial control. A user-friendly tool enables easy budget creation with customizable categories. Users can set spending limits and track their progress in real-time. Alerts and notifications help users stay within their budget, preventing overspending.

Real-time Expense Reports

Real-time expense reports provide an up-to-date view of financial activities. These reports offer insights into spending patterns and help in making informed decisions. Users can generate reports with a few clicks, saving time and enhancing efficiency. The reports can be customized to focus on specific periods or categories.

Seamless Integration With Bank Accounts And Credit Cards

Integration with bank accounts and credit cards simplifies the expense management process. Users can link their accounts to automatically import transactions. This feature ensures that all expenses are captured accurately and reduces the risk of missing any transactions. It also provides a comprehensive view of finances in one place.

User-friendly Interface And Navigation

A user-friendly interface is essential for an enjoyable user experience. The tool should have a simple and intuitive design, making navigation easy. Clear menus, well-organized features, and helpful prompts enhance usability. Users can quickly access the functions they need without any confusion.

In summary, user-friendly expense management tools like Emburse offer essential features that streamline financial tasks. From automated expense tracking to real-time expense reports, these tools make managing expenses easier and more efficient.

Pricing And Affordability Breakdown

Emburse offers advanced travel and expense management solutions. Understanding the pricing structure helps businesses plan and budget effectively. This section provides a detailed look at the pricing and affordability of Emburse.

Free Vs. Paid Versions

Emburse does not explicitly mention a free version. Prospective users are encouraged to contact Emburse for detailed pricing. Paid versions provide comprehensive features, including:

- Expense Management: Flexible solutions with proactive controls.

- Travel Management: Mobile-friendly solutions for compliance.

- Payments & Invoice Management: Automated accounts payable.

- Insights & Analytics: Data-driven decision-making.

- Audit: Reduce wasteful spending.

Subscription Plans And Pricing Tiers

Emburse offers customizable pricing plans. Prospective users should contact Emburse directly for customized plans. Subscription plans vary based on:

- Company size

- Specific needs

- Number of users

Contact Emburse for a detailed pricing breakdown that suits your business requirements.

Value For Money Analysis

Emburse provides significant value through its comprehensive features. Key benefits include:

- Time Savings: Automation reduces repetitive tasks.

- Compliance: Ensures policy adherence.

- Cost Control: Improved cash flow management.

- Data-Driven Decisions: Informed financial decisions.

- Customizable: Highly configurable solutions.

Emburse is recognized by industry leaders such as G2 and TrustRadius for its effectiveness. Customer testimonials highlight its configurability and innovative technology.

Contact Emburse for a pricing plan that matches your business needs.

Pros And Cons Of User-friendly Expense Management Tools

Using user-friendly expense management tools like Emburse can greatly streamline financial processes for businesses. These tools come with numerous advantages but also present some challenges. Understanding both sides can help businesses make informed decisions.

Advantages Of Using Expense Management Tools

Expense management tools offer several benefits:

- Time Savings: Automation reduces repetitive tasks, allowing users more time for strategic planning.

- Compliance: Ensures adherence to policies with mobile-friendly solutions.

- Cost Control: Improved cash flow management and elimination of wasteful spending.

- Data-Driven Decisions: Provides insights to make informed financial decisions.

- Customizable: Highly configurable to meet evolving business needs.

Common Challenges And Limitations

Despite the benefits, there are some challenges associated with expense management tools:

- Learning Curve: Initial setup and training may take time and resources.

- Integration Issues: May not seamlessly integrate with all existing systems.

- Cost: Depending on the pricing model, costs can be significant for small businesses.

- Data Security: Ensuring data security and compliance is crucial.

- Technical Support: Quality of customer support can vary.

Choosing the right tool requires weighing these pros and cons to find a solution that aligns with your business needs.

Specific Recommendations For Ideal Users Or Scenarios

Emburse is a versatile tool designed to streamline travel and expense management. It caters to various needs, whether for personal finance, small businesses, or families. Below are some specific recommendations to help you determine if Emburse is right for your scenario.

Best For Personal Finance Management

Emburse is perfect for individuals wanting to control their personal finances. The Expense Management feature provides flexible solutions with proactive controls and insights. Users can automate repetitive tasks, saving time and ensuring adherence to financial goals. The Insights & Analytics tool empowers users with data-driven decisions, uncovering savings and better managing cash flow.

- Time Savings: Automation reduces repetitive tasks.

- Compliance: Ensures adherence to personal finance policies.

- Cost Control: Improved cash flow management.

Ideal For Small Business Owners

Small businesses benefit significantly from Emburse’s comprehensive features. The Payments & Invoice Management tool automates accounts payable, improving cost control and visibility. This automation is crucial for small businesses needing to manage cash flow effectively. Emburse also offers Travel Management solutions that are mobile-friendly, ensuring compliance with company policies even on the go.

| Feature | Benefit |

|---|---|

| Payments & Invoice Management | Automates accounts payable for cost control |

| Travel Management | Ensures compliance with company policies |

| Audit | Identify and reduce wasteful spending |

Suitable For Families And Joint Accounts

Emburse is also ideal for families managing joint accounts. The software’s customizable nature makes it easy to adapt to evolving needs. The Insights & Analytics feature helps families make informed financial decisions. Families can manage their expenses better, ensuring they stay within budget and uncover opportunities for savings.

- Customizable: Adapts to evolving family needs.

- Data-Driven Decisions: Helps make informed financial choices.

- Cost Control: Better management of family expenses.

Emburse provides advanced travel and expense management solutions for various users. Whether for personal finance, small business owners, or families, Emburse offers tools to improve financial performance through automation, compliance, and data-driven insights.

Conclusion: Simplify Your Finances Today

Managing expenses can be overwhelming. Emburse simplifies the process with its advanced software solutions. Take control of your finances now with Emburse. Let’s review the benefits and encourage you to take the next step.

Recap Of Benefits

Emburse offers a variety of features designed to help you manage your finances efficiently. Here is a quick recap of the benefits:

| Feature | Benefit |

|---|---|

| Expense Management | Flexible solutions with proactive controls and insights. |

| Travel Management | Mobile-friendly solutions for compliance and policy adherence. |

| Payments & Invoice Management | Automation for cost control and cash flow visibility. |

| Insights & Analytics | Data-driven decisions to manage cash flow. |

| Audit | Identify and reduce wasteful spending. |

Encouragement To Take Action

Don’t wait to simplify your finances. Start today with Emburse. With its user-friendly features and robust capabilities, Emburse will transform how you manage expenses.

Visit Emburse to learn more and take the first step towards financial control.

Contact Emburse support for any queries or assistance. It’s time to take action and simplify your financial management.

Frequently Asked Questions

What Is Expense Management Software?

Expense management software helps businesses track, approve, and manage employee expenses. It’s user-friendly and streamlines financial processes.

Why Use User-friendly Expense Management Tools?

User-friendly tools simplify expense tracking, reduce errors, and save time. They improve efficiency and user satisfaction.

How Does Expense Management Software Save Money?

It reduces processing costs, prevents fraud, and ensures compliance. Automation minimizes manual errors and saves resources.

Can Small Businesses Benefit From Expense Management Tools?

Yes, small businesses save time and reduce administrative costs. They benefit from improved accuracy and simplified processes.

Conclusion

Emburse simplifies expense management, saving time and boosting compliance. With its mobile-friendly solutions, businesses can manage travel and expenses efficiently. The software provides valuable insights for better financial decisions. For more information, visit Emburse and enhance your financial processes today.