Possible Finance Features: Unlock Financial Freedom Today

Managing personal finances can be tricky. Finding the right tools can make a big difference.

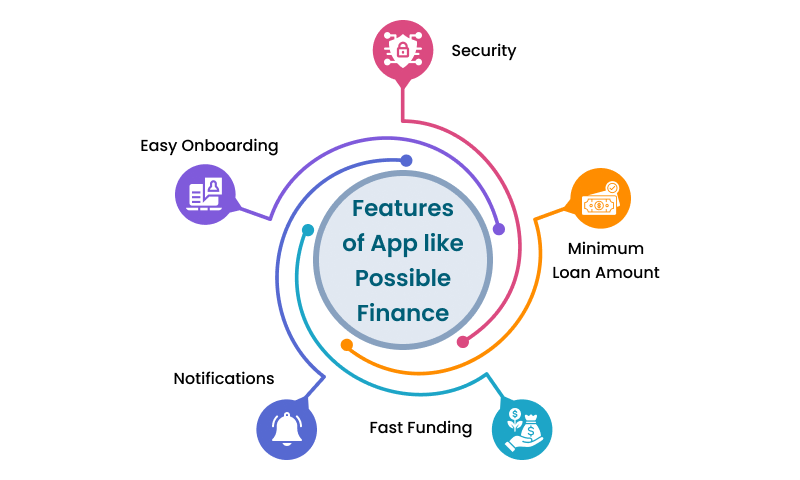

Possible Finance offers unique financial products designed to help improve your financial health. With their Possible Loan and Possible Card, you can access funds quickly and easily. These products aim to bypass the common issues found with traditional payday loans and credit cards. Whether you need a small loan or a flexible credit card, Possible Finance could be the solution you’re looking for. Let’s explore the features that set these products apart. Check out Possible Finance for more details: Possible Finance.

Introduction To Financial Freedom

Achieving financial freedom is a dream for many. It means having control over your finances without stress about unexpected expenses. With Possible Finance, you can take meaningful steps towards this goal.

Understanding Financial Freedom

Financial freedom involves more than just having money. It means being free from the worry of debt and having the ability to make choices that allow you to enjoy life. This freedom requires a solid understanding of your financial situation and the tools to manage it effectively.

Possible Finance’s products, such as the Possible Card and Possible Loan, are designed to help you gain this understanding. They offer benefits like instant access to funds and no hidden fees, making it easier to manage your finances.

The Importance Of Financial Tools

Using the right financial tools is essential for achieving financial freedom. These tools can help you budget, save, and plan for the future. Possible Finance provides innovative products to support these goals.

| Product | Features | Benefits |

|---|---|---|

| Possible Loan |

|

|

| Possible Card |

|

|

These products are designed to improve your financial health and provide quick access to funds. They are simple to use, with no hidden fees or interest. This transparency helps you manage your money more effectively.

To start your journey towards financial freedom, consider how Possible Finance can help you. With the right tools, you can achieve financial stability and peace of mind.

Key Features Of Finance Tools

Finance tools like Possible Card and Possible Loan can significantly improve financial health. They offer various features that help manage money, reduce debt, and build credit. Understanding these key features can enhance your financial literacy and decision-making.

Effective budgeting and expense tracking are essential for managing personal finances. The Possible Finance app provides tools to track your income and expenses easily. You can categorize spending, set limits, and receive alerts when you’re close to exceeding your budget. This helps in making informed financial decisions and avoiding unnecessary expenses.

While Possible Finance primarily focuses on credit and loans, it is crucial to understand the importance of investment management. Many finance tools offer features to help manage and grow your investments. This includes monitoring stock portfolios, mutual funds, and other investment vehicles. Proper investment management ensures a diverse portfolio and long-term financial stability.

Debt can be overwhelming, but tools like Possible Finance can create effective debt reduction plans. Possible Loan offers flexible repayment plans in four installments. There are no late or penalty fees, making it easier to manage and pay off debt. This feature is designed to help improve your credit history over time.

Setting and achieving savings goals is vital for financial security. Finance tools often provide options to automate savings. You can set specific goals, like saving for a vacation or emergency fund, and automate transfers to your savings account. This ensures consistent savings without the need for manual deposits.

Maintaining a good credit score is crucial. Possible Finance helps build credit history with its Possible Card and Possible Loan products. Regular payments on these products are reported to credit bureaus, helping improve your credit score. Many finance tools offer credit score monitoring features, providing updates and tips on how to improve your score.

Possible Finance is committed to helping users with bad credit improve their financial health through responsible borrowing and timely repayments.

Budgeting And Expense Tracking

Managing finances can be challenging, but Possible Finance offers tools that make budgeting and expense tracking simple and effective. By incorporating these features into your financial routine, you can gain better control over your spending and improve your financial health.

How Budgeting Helps Control Spending

Budgeting is essential for controlling spending. It allows you to allocate your income to various expenses, ensuring that you don’t overspend. Possible Finance enables you to set a budget easily and stick to it.

- Identify essential and non-essential expenses.

- Set spending limits for different categories.

- Track progress and adjust your budget as needed.

By using Possible Finance’s budgeting tools, you can save more and avoid financial pitfalls.

Tools For Categorizing Expenses

Categorizing expenses helps in understanding where your money goes. Possible Finance provides tools to categorize your expenses efficiently.

| Category | Description |

|---|---|

| Housing | Rent, mortgage, utilities |

| Food | Groceries, dining out |

| Transportation | Fuel, public transport, car maintenance |

| Entertainment | Movies, hobbies, leisure activities |

With these categories, you can see where to cut back and where to allocate more funds.

Real-time Expense Tracking Benefits

Real-time expense tracking provides several benefits. Possible Finance allows you to track your expenses as they happen.

- Immediate insight into spending habits.

- Quick identification of overspending areas.

- Prompt adjustments to stay within budget.

This feature helps in making informed financial decisions and avoiding unnecessary expenses.

Incorporating budgeting and expense tracking through Possible Finance can greatly improve your financial health. Start using these features to manage your money better.

Investment Management

Investment management is a crucial feature offered by Possible Finance. This service helps users make informed decisions about their investments. It provides tools and insights to optimize their financial portfolios.

Automated Investment Recommendations

Possible Finance uses advanced algorithms to provide automated investment recommendations. These recommendations are tailored to individual financial goals. The system analyzes market trends and personal data to suggest suitable investment options. This feature helps users make smarter investment choices without extensive financial knowledge.

Portfolio Diversification Tools

Portfolio diversification is essential for reducing risk. Possible Finance offers portfolio diversification tools to help users spread their investments across various assets. These tools provide insights into different investment categories. Users can balance their portfolios with a mix of stocks, bonds, and other financial products.

| Asset Class | Recommended Percentage |

|---|---|

| Stocks | 40% |

| Bonds | 30% |

| Real Estate | 20% |

| Cash | 10% |

Risk Assessment Features

Understanding and managing risk is vital in investment. Possible Finance provides risk assessment features to help users evaluate the potential risks of their investments. The system assesses various factors like market volatility and personal financial stability. Users receive detailed risk reports, helping them make informed decisions.

With Possible Finance, users can confidently manage their investments. The tools and insights provided ensure a balanced and well-informed investment strategy.

Debt Reduction Plans

Debt can be a heavy burden, but with Possible Finance, reducing it becomes manageable. Their debt reduction plans offer a structured approach to help you regain financial stability. From paying off debt faster to consolidating it, Possible Finance provides the tools you need to succeed.

Strategies For Paying Off Debt Faster

Paying off debt quickly requires a solid strategy. Possible Finance suggests the following methods:

- Snowball Method: Focus on paying off the smallest debts first. This builds momentum and motivation.

- Avalanche Method: Target debts with the highest interest rates first. This saves money on interest in the long run.

- Extra Payments: Make additional payments whenever possible. This reduces the principal faster.

Utilize these strategies to accelerate your debt repayment journey.

Debt Consolidation Options

Consolidating debt can simplify your finances. Possible Finance offers debt consolidation options to combine multiple debts into one. This can lead to:

- Single Monthly Payment: Easier to manage and track.

- Lower Interest Rates: Potentially reduce the overall interest paid.

- Improved Credit Score: Consistent payments can boost your credit.

Consider consolidating your debts to streamline your payments and reduce financial stress.

Interest Rate Comparison Tools

Understanding interest rates is crucial in debt management. Possible Finance offers interest rate comparison tools that help you:

- Compare Rates: Easily compare rates from various lenders.

- Evaluate Offers: Assess different loan offers to find the best deal.

- Make Informed Decisions: Choose loans with the most favorable terms.

Use these tools to make smarter financial decisions and save money over time.

Savings Goals And Automation

Managing finances can be challenging, but Possible Finance offers tools to help you save efficiently. Their savings goals and automation features make it easier to set and achieve financial objectives. This section explores how you can utilize these features to improve your financial health.

Setting And Achieving Savings Goals

With Possible Finance, you can set specific savings goals. Whether it’s for a vacation, a new gadget, or a special occasion, defining your goals helps you stay focused. Here’s how to get started:

- Identify your financial goals.

- Set a target amount for each goal.

- Determine a timeline to achieve your goals.

Tracking your progress is easy with Possible Finance. You can see how much you’ve saved and how close you are to reaching your goal. This motivation keeps you on track.

Automated Savings Plans

Automating your savings can be a game-changer. With Possible Finance, you can set up automated transfers to your savings account. This means a portion of your income automatically goes towards your savings goals. Here’s how it works:

- Choose the amount you want to save regularly.

- Set the frequency of transfers (weekly, bi-weekly, or monthly).

- Relax and watch your savings grow.

Automated savings take the guesswork out of saving. You don’t have to remember to transfer money manually. This consistency is key to building a healthy savings habit.

Emergency Fund Planning

An emergency fund is crucial for financial stability. Possible Finance helps you set up and maintain an emergency fund. Here’s how to create an effective emergency fund plan:

| Step | Action |

|---|---|

| 1 | Determine the amount needed for emergencies. |

| 2 | Set a monthly savings target. |

| 3 | Automate your emergency fund contributions. |

Having an emergency fund provides peace of mind. It ensures you have funds available for unexpected expenses. This preparedness is invaluable in maintaining financial health.

With Possible Finance’s savings goals and automation features, managing your money becomes simpler and more effective. Start setting your goals today and watch your financial stability grow.

Credit Score Monitoring

Credit score monitoring is a crucial feature of Possible Finance. It helps you keep track of your credit health and make informed financial decisions. Regular monitoring can provide insights into your credit behavior and alert you to any changes or potential issues.

Importance Of Monitoring Your Credit Score

Monitoring your credit score is vital for maintaining financial health. It allows you to:

- Identify errors in your credit report.

- Understand how your financial actions impact your credit.

- Catch signs of identity theft early.

- Improve your credit score proactively.

Consistent credit score monitoring can help you avoid surprises when applying for loans or credit cards. It also empowers you to take control of your financial future.

Tools For Improving Credit Score

Possible Finance offers several tools to help improve your credit score:

| Tool | Description |

|---|---|

| Possible Loan | Borrow up to $500 with a repayment plan in 4 installments. Helps build credit history. |

| Possible Card | Instant credit limit of $400 or $800 without a credit check. Helps build credit history with 0% interest. |

These tools are designed to provide quick access to funds while improving your credit score with responsible usage and on-time payments.

Alerts For Credit Changes

Possible Finance provides alerts for any changes in your credit score. These alerts can notify you about:

- New accounts opened in your name.

- Changes in your credit limits.

- Late payments affecting your score.

- Potential fraudulent activities.

Receiving timely alerts helps you address issues promptly, ensuring your credit score remains healthy and accurate.

Pricing And Affordability

Understanding the pricing and affordability of financial tools is crucial. Possible Finance offers transparent pricing with features designed to improve your financial health. Let’s dive into the details.

Cost Of Popular Finance Tools

- Borrow up to $500 instantly^

- No late or penalty fees

- Repayment plan in 4 installments‡

- Instant credit limit of $400 or $800¹

- No credit check or deposit required

- 0% interest, forever

- No late fees

- Monthly fee of $8 or $16

Free Vs. Paid Features

Possible Finance offers a mix of free and paid features to suit different needs:

| Feature | Free | Paid |

|---|---|---|

| Instant Credit Limit | No | Yes ($400 or $800) |

| No Late Fees | Yes | Yes |

| 0% Interest | Yes | Yes |

| Monthly Fee | No | Yes ($8 or $16) |

Value For Money Analysis

Possible Finance provides value by offering:

- Quick access to funds

- No hidden fees or interest

- Flexible repayment plans

These features help improve financial health and credit history. The monthly fee of $8 or $16 for the Possible Card is reasonable. It offers significant benefits like no credit check and 0% interest.

Pros And Cons Of Finance Tools

Finance tools like Possible Card and Possible Loan offer unique benefits and challenges. Understanding these can help you make informed decisions.

Advantages Of Using Finance Tools

Finance tools, especially Possible Finance, provide a variety of benefits:

- Quick access to funds: Borrow up to $500 instantly^.

- No hidden fees: No late or penalty fees.

- Flexible repayment plans: Repay in four installments‡.

- Credit building: Helps build credit history.

- No credit checks: Instant credit limit of $400 or $800¹ with no credit check or deposit required.

- No interest: 0% interest, forever.

Potential Drawbacks To Consider

Despite the benefits, there are potential drawbacks:

- Monthly fees: Possible Card has a monthly fee of $8 or $16.

- Eligibility: Products are subject to approval and are not guaranteed.

- State-specific terms: Loan amounts and terms vary by state.

- Limited refund policies: No specific refund or return policies mentioned.

User Experiences And Reviews

Users often share mixed experiences with finance tools:

- Many appreciate the quick access to funds and no hidden fees.

- Some users report that the monthly fee can be a drawback, especially if not using the card often.

- Others highlight the ease of building credit history with timely payments.

- A few users mention the importance of understanding state-specific terms and eligibility criteria.

Overall, finance tools like Possible Finance can provide significant benefits, but it is essential to consider the potential drawbacks and read user reviews.

Recommendations For Ideal Users

Possible Finance offers tools and resources for a variety of users. Whether you are a beginner or an experienced user, Possible Finance has features tailored to your needs. Let’s explore the best tools for different types of users.

Best Tools For Beginners

For those new to personal finance, Possible Finance provides simple yet effective tools to get started.

- Possible Loan: Borrow up to $500 instantly, with a flexible repayment plan in 4 installments.

- Possible Card: An instant credit limit of $400 or $800 with no credit check or deposit required.

- No late or penalty fees, making it easier to manage finances without stress.

- Helps build credit history, which is crucial for financial growth.

These features ensure that beginners can access funds quickly and start building their credit history without the pressure of hidden fees or interest.

Advanced Features For Experienced Users

Experienced users seeking more advanced features will find Possible Finance useful as well.

- Possible Card: Offers a monthly fee of $8 or $16 with 0% interest forever.

- No late fees, allowing for smooth financial management.

- Access to higher credit limits, aiding in larger financial goals.

- Helps improve credit history with consistent usage and on-time payments.

These features provide experienced users with the tools they need to manage their finances efficiently and strategically.

Tools For Specific Financial Goals

Possible Finance also caters to users with specific financial goals.

| Goal | Recommended Tool | Feature Highlights |

|---|---|---|

| Building Credit | Possible Card | Instant credit limit, no credit check, helps build credit history |

| Quick Access to Funds | Possible Loan | Borrow up to $500 instantly, flexible repayment plan |

| Avoiding Fees | Possible Card | No interest, no late fees, transparent monthly fee |

These tools are designed to help users achieve their specific financial goals effectively and efficiently.

Visit Possible Finance to explore these features and find the best fit for your needs.

Conclusion: Unlock Your Financial Freedom

Understanding your financial options is critical. Possible Finance offers a unique set of features designed to help you manage your finances better. Let’s summarize the key points and provide final thoughts on achieving financial freedom with Possible Finance.

Summary Of Key Points

| Feature | Description |

|---|---|

| Possible Loan | Borrow up to $500 instantly, no late or penalty fees, repayment in 4 installments, helps build credit history. |

| Possible Card | Instant credit limit of $400 or $800, no credit check or deposit, 0% interest, no late fees, helps build credit history. |

- Quick access to funds: Funds disbursement typically occurs within minutes of approval.

- No hidden fees: No interest or late fees, making it easier to manage your budget.

- Credit improvement: Both products help build your credit history with on-time payments.

- Simple repayment plans: Flexible plans that fit your financial situation.

- Availability: Available even with bad credit, subject to eligibility and approval.

Final Thoughts On Achieving Financial Freedom

Achieving financial freedom requires careful planning and the right tools. Possible Finance provides easy access to funds and helps build credit. The Possible Loan and Possible Card offer clear benefits without hidden fees. These products are designed to improve your financial health over time.

Possible Finance stands out with no credit checks, instant access to credit, and simple repayment plans. The Possible Loan and Possible Card are practical solutions for managing your finances effectively and improving your credit history. Unlock your financial freedom with Possible Finance today.

Frequently Asked Questions

What Are Common Finance Features?

Common finance features include budgeting tools, expense tracking, and investment management. They also offer real-time notifications, bill payment reminders, and credit score monitoring.

How Do Finance Apps Help With Budgeting?

Finance apps help with budgeting by categorizing expenses, setting spending limits, and providing visual charts. They also send alerts when nearing budget limits.

Why Are Expense Trackers Important?

Expense trackers are important because they help monitor spending habits, identify savings opportunities, and ensure financial goals are met. They provide detailed reports.

What Is Investment Management In Finance Apps?

Investment management in finance apps involves tracking investment portfolios, analyzing performance, and providing insights. They also offer tools for making informed investment decisions.

Conclusion

Possible Finance products offer a practical solution for quick funding needs. Both the Possible Card and Possible Loan help build credit without hidden fees. They are user-friendly and cater to those with bad credit. Ready to improve your financial health? Explore more about Possible Finance today.