Apply For Credit Card Online: Quick Approval and Easy Steps

Applying for a credit card online is convenient and fast. You can compare options, apply, and get approval from home.

In today’s digital age, applying for a credit card online is easier than ever. With just a few clicks, you can access various credit card options, each designed to meet different financial needs. Whether you are looking to build your credit history or need quick access to funds, online applications offer a hassle-free solution. One such option is the Possible Card by Possible Finance. This card provides an instant credit limit with no credit checks and zero interest. It is a great choice for those with bad credit or no credit history. Read on to learn more about how you can apply for a credit card online and the benefits of choosing the Possible Card for your financial needs. Apply for the Possible Card now and take control of your financial future.

Introduction To Online Credit Card Applications

In today’s digital age, applying for a credit card online has become increasingly popular. This modern approach offers convenience and speed, making it easier for individuals to access financial products like the Possible Card from Possible Finance.

The Shift To Digital: Why Apply Online?

Shifting to online applications has numerous advantages. The primary benefit is the ease of access. You can apply for the Possible Card from the comfort of your home. No need to visit a bank or financial institution.

Online applications also save time. The process is streamlined and requires fewer steps. You can complete the application in minutes, without waiting in long queues.

Additionally, applying online provides instant feedback. You quickly know if you qualify for the Possible Card. This instant response helps you plan your finances better.

Benefits Of Online Credit Card Applications

Applying for a credit card online, like the Possible Card, offers several benefits:

- Quick Access to Funds: With the Possible Card, you get a credit limit of $400 or $800 instantly¹.

- No Credit Check: The application process does not require a credit check, making it accessible to more people.

- 0% Interest: The Possible Card offers 0% interest, forever. This means you only pay a monthly fee of $8 or $16.

- No Late Fees: There are no late fees, providing peace of mind if you miss a payment.

- Build Credit History: Timely payments can help improve your credit score over time.

Overall, online credit card applications are convenient and user-friendly. They offer immediate access to financial products without the hassle of traditional methods.

For more information on the Possible Card and other financial products, visit Possible Finance.

Key Features Of Online Credit Card Applications

Applying for a credit card online offers many advantages. These include speed, ease of use, and security. Below are the key features you can expect from online credit card applications.

Quick Approval Process

The online application process for credit cards is designed to be fast. With platforms like Possible Finance, you can receive instant approval for Possible Loan or Possible Card. This means you can get funds quickly and improve your credit history efficiently.

User-friendly Interface

Most online credit card application platforms have a user-friendly interface. This ensures a smooth application process. For example, Possible Finance offers a simplified application with no credit check or deposit required for the Possible Card. This makes it accessible even for those with bad credit.

Secure Data Handling

Security is a top priority. Online credit card applications use advanced encryption to protect your personal and financial information. Possible Finance ensures all data is handled securely, giving you peace of mind.

Instant Eligibility Check

An instant eligibility check is a common feature. This helps you know if you qualify for a credit card without impacting your credit score. For instance, Possible Finance allows you to see if you are eligible for the Possible Card instantly, with no hidden fees or interest rates.

By applying online, you can enjoy the benefits of quick approval, a user-friendly interface, secure data handling, and instant eligibility checks. This makes the process of getting a credit card convenient and efficient.

Step-by-step Guide To Applying For A Credit Card Online

Applying for a credit card online is convenient and straightforward. Follow this step-by-step guide to ensure a smooth application process. We’ll walk you through each step, from researching the right card to submitting your application.

Step 1: Research And Choose The Right Card

Begin by researching different credit cards to find one that fits your needs. Consider the Possible Card by Possible Finance. It offers a credit limit of $400 or $800 instantly, with no credit check or deposit required. This card has 0% interest forever and no late fees. Plus, it helps build your credit history.

Evaluate the features and benefits of various cards. Look for cards with low fees and favorable terms. The Possible Card has a simple monthly fee of $8 or $16, depending on your credit limit.

Step 2: Gather Necessary Documents

Before starting your application, gather all necessary documents. You’ll need:

- Personal identification (e.g., driver’s license, passport)

- Proof of income (e.g., pay stubs, tax returns)

- Bank account information

Having these documents ready will make the application process quicker and smoother.

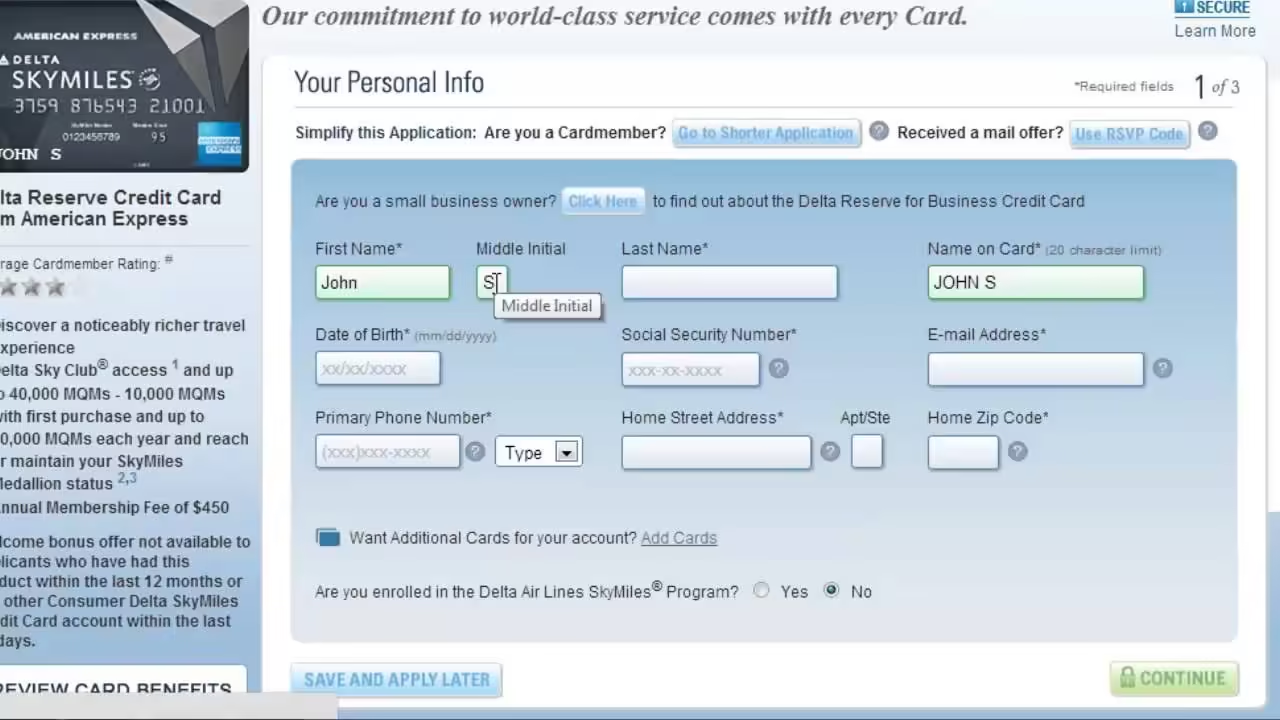

Step 3: Fill Out The Online Application Form

Visit the Possible Finance website to apply for the Possible Card. Fill out the online application form with your personal information. Ensure all details are accurate to avoid any delays in processing.

The form will ask for:

- Full name

- Address

- Social Security Number

- Employment details

- Monthly income

Double-check your information before submitting the form.

Step 4: Submit And Wait For Approval

After completing the application form, submit it online. The approval process may take some time. Possible Finance will review your application and notify you of the decision.

If approved, you’ll receive your Possible Card shortly. Remember, using the card responsibly and making timely payments will help improve your credit history.

For any questions or concerns, contact the Support Team at support@PossibleFinance.com.

Pricing And Fees

When applying for a credit card online, it is crucial to understand the various pricing and fees associated with it. Knowing these details helps you make an informed decision and avoid unexpected costs.

Annual Fees

Many credit cards charge an annual fee for the privilege of using the card. The Possible Card stands out by not having an annual fee. Instead, it has a monthly fee, which can be more manageable for some users.

- Possible Card Monthly Fee: $8 or $16, depending on the credit limit.

Interest Rates

Interest rates are a significant factor in the cost of a credit card. High interest rates can lead to substantial debt if you carry a balance. Remarkably, the Possible Card offers a 0% interest rate forever, making it an attractive option for those looking to avoid interest charges.

Hidden Charges To Watch Out For

Credit cards often have hidden charges that can catch you by surprise. The Possible Card is transparent with its fees, ensuring there are no hidden charges. Here are some common hidden charges to watch out for with other cards:

- Late Payment Fees: Charges incurred for missing a payment deadline.

- Over-the-Limit Fees: Fees for exceeding your credit limit.

- Foreign Transaction Fees: Extra charges for transactions made in foreign currencies.

The Possible Card eliminates late fees and hidden charges, providing a straightforward and user-friendly experience.

Pros And Cons Of Applying For A Credit Card Online

Applying for a credit card online offers a mix of benefits and drawbacks. Understanding these pros and cons can help you make an informed decision. Below, we will explore the main advantages and disadvantages of applying for a credit card online.

Pros: Convenience And Speed

Applying for a credit card online is highly convenient. You can complete the application from the comfort of your home. There is no need to visit a bank or financial institution.

The process is also very fast. Most online applications take only a few minutes to complete. Approval can be instant or take just a few hours.

This convenience is evident with Possible Financial Inc.’s Possible Card. The application is straightforward and quick. There is no need for a credit check or deposit.

| Feature | Details |

|---|---|

| No Credit Check | The Possible Card does not require a credit check. |

| Instant Credit Limit | Get a credit limit of $400 or $800 instantly. |

| 0% Interest | Enjoy 0% interest forever. |

Clearly, the Possible Card simplifies the application process. It also provides quick access to funds, making it a convenient choice.

Cons: Potential Security Risks

Despite the convenience, applying for a credit card online has potential security risks. Your personal information may be at risk of being stolen or misused.

To minimize these risks, ensure the website you are using is secure. Look for “https” in the URL and verify the site’s legitimacy.

With the Possible Card, your security is a priority. They use secure encryption methods to protect your data. But always stay vigilant and aware of potential online threats.

In summary, applying for a credit card online, like the Possible Card, offers convenience and speed. But be cautious of potential security risks. By understanding these pros and cons, you can make an informed decision.

Ideal Users For Online Credit Card Applications

Applying for a credit card online is convenient for many. It’s fast, easy, and accessible. But who benefits the most from this method? Let’s explore the ideal users for online credit card applications.

Tech-savvy Individuals

Tech-savvy individuals find online credit card applications seamless. They are comfortable navigating digital platforms. Using Possible Finance, they can apply for the Possible Card without hassle. They appreciate the ease of applying from their devices.

Many tech enthusiasts prefer the Possible Card because it offers no credit check. They can get instant credit limits of $400 or $800. With a simplified online process, there’s no need to visit a bank. Tech-savvy users can complete the process in minutes.

People Looking For Quick Approval

People who need quick approval find online applications ideal. The Possible Card provides instant decisions. No waiting for days or weeks. With a credit limit of up to $800, users can access funds swiftly.

Applicants benefit from no late fees and 0% interest forever. This makes the Possible Card attractive for those who need funds urgently. The streamlined application process ensures fast approval.

Consumers Seeking A Variety Of Options

Consumers looking for diverse options find online applications beneficial. Possible Finance offers both the Possible Card and Possible Loan. Users can choose based on their needs. The Possible Loan allows borrowing up to $500 instantly.

Both products help build credit history. They offer flexible repayment plans and no hidden fees. Consumers appreciate the transparency and variety. The online platform simplifies comparing and selecting the best option for their financial needs.

Frequently Asked Questions

How To Apply For A Credit Card Online?

Applying online is simple. Visit the credit card issuer’s website. Fill out the application form with your personal and financial details. Submit the form.

What Documents Are Needed To Apply Online?

You typically need your identification proof, income proof, and address proof. Ensure all documents are valid and up-to-date. Upload them during the application process.

How Long Does Online Application Approval Take?

Approval times vary. It can take minutes to a few days. Some issuers provide instant approval. Others may take longer for verification.

Can I Track My Online Application Status?

Yes, most issuers allow you to track your application online. Use the reference number provided during the application submission.

Conclusion

Applying for a credit card online is simple and convenient. Possible Finance offers two main products: The Possible Card and Possible Loan. Both options provide quick access to funds with no hidden fees. They also help build credit history with timely payments. Check out Possible Finance for more details. Enjoy the benefits of a hassle-free application process. Improve your financial health today. Start building your credit with Possible Finance’s flexible solutions. Your financial future is within reach. Apply now and take control of your personal finance journey.