Build Credit With Credit Cards: Proven Strategies for Success

Building credit with credit cards can be a smart financial move. Credit cards offer a practical way to establish and improve your credit score.

Credit is vital in today’s world. It affects your ability to get loans, rent apartments, and even secure certain jobs. By using credit cards responsibly, you can build a strong credit history. This means paying your bills on time, keeping your balances low, and managing your accounts wisely. Products like the Possible Card from Possible Finance offer a no-interest option with no late fees, helping you build credit without falling into debt traps. With options to unlock a $400 or $800 credit limit instantly, the Possible Card provides an accessible way to start or improve your credit journey. For more information, visit Possible Finance.

Introduction To Building Credit With Credit Cards

Building credit is crucial for financial health. Credit cards are effective tools to establish and improve your credit score. They offer a convenient way to manage expenses while demonstrating responsible credit use. This guide will help you understand the basics of building credit with credit cards.

Understanding Credit And Its Importance

Credit is a financial trust score. It shows lenders your ability to repay borrowed money. A good credit score opens doors to better loan terms and interest rates. It affects your ability to rent an apartment, get a job, or buy a car.

There are three main credit bureaus: Experian, Equifax, and TransUnion. They collect and report your credit information. Your credit score is based on payment history, credit utilization, length of credit history, new credit, and types of credit used.

Maintaining a good credit score is essential. It impacts many areas of your life. Paying bills on time and managing debts wisely are key habits for a healthy credit score.

The Role Of Credit Cards In Building Credit

Credit cards are powerful tools for building credit. Using them responsibly can boost your credit score. Here’s how:

- Payment History: Pay your credit card bills on time. This is the most important factor in your credit score.

- Credit Utilization: Keep your credit card balance low. Use less than 30% of your credit limit.

- Length of Credit History: The longer you have a credit card, the better. Keep your oldest credit card active.

- Types of Credit: Having a mix of credit types (credit cards, loans) is beneficial.

Using a credit card like the Possible Card can help build your credit. The Possible Card offers a $400 or $800 credit limit instantly. It has 0% interest and no late fees. This makes it a stress-free way to build credit.

The Possible Card has a small monthly fee, $8 or $16, but no credit check or deposit is required. This makes it accessible for many people. It helps build your credit history without the risk of debt traps.

For those needing immediate funds, the Possible Loan is another option. It allows you to borrow up to $500 instantly. There are no late or penalty fees, and you can repay in 4 installments. This also helps improve your credit history.

Both the Possible Card and Possible Loan are designed to provide financial peace of mind. They help manage finances without falling into debt. By using these tools responsibly, you can build a strong credit history.

| Feature | Possible Card | Possible Loan |

|---|---|---|

| Credit Limit | $400 or $800 | Up to $500 |

| Interest Rate | 0% | None |

| Fees | $8 or $16 monthly | None |

| Credit Check | Not required | Not required |

Using these financial tools wisely can lead to a better credit score. This opens up more financial opportunities in the future.

Key Features Of Credit Cards That Aid In Building Credit

Credit cards are powerful tools for building credit. They offer various features that help improve your credit score. Understanding these features can make a significant difference in your financial health.

Credit Limits And Their Impact

Credit limits determine how much you can borrow. Higher limits can positively impact your credit score. They reduce your credit utilization ratio. Keeping this ratio below 30% is crucial.

| Credit Limit | Recommended Usage |

|---|---|

| $400 | Use up to $120 |

| $800 | Use up to $240 |

The Possible Card offers a credit limit of $400 or $800. This helps manage your credit utilization ratio effectively.

Interest Rates And Apr Explained

Interest rates and APR (Annual Percentage Rate) are key factors. They determine the cost of borrowing. Lower rates mean less interest paid over time.

- Interest Rate: The percentage charged on borrowed money.

- APR: The yearly cost of borrowing, including interest and fees.

The Possible Card stands out with 0% interest, forever. This eliminates the risk of accumulating debt due to high-interest rates.

Reward Programs And How They Benefit Credit Scores

Reward programs offer incentives for using your card. They can indirectly benefit your credit score. Responsible usage and timely payments are key.

- Points for purchases

- Cashback offers

- Travel rewards

While the Possible Card does not mention specific reward programs, it focuses on no-interest and no late fees. This encourages responsible credit card usage.

Building credit with credit cards requires understanding and using key features wisely. The Possible Card offers a straightforward way to build credit without the pitfalls of traditional credit cards.

Proven Strategies For Building Credit With Credit Cards

Building credit can be challenging, but using credit cards wisely can help. Here are some proven strategies to build credit using credit cards effectively.

Making Timely Payments

Paying your credit card bill on time is crucial. Timely payments reflect positively on your credit report. Set reminders or automate payments to ensure you never miss a due date. This simple habit can significantly boost your credit score.

Keeping Credit Utilization Low

Credit utilization ratio is the amount of credit you use compared to your credit limit. Aim to keep this ratio below 30%. For instance, if your limit is $1,000, keep your balance below $300. Low utilization shows you manage credit responsibly.

Avoiding Multiple Hard Inquiries

Each time you apply for new credit, it results in a hard inquiry. Too many inquiries can lower your credit score. Apply for new credit sparingly and only when necessary. This strategy helps maintain a healthy credit score.

Using Secured Credit Cards To Build Credit

If you have no credit history or a poor score, consider a secured credit card. These cards require a security deposit, which acts as your credit limit. Using a secured card responsibly can help build or rebuild your credit over time.

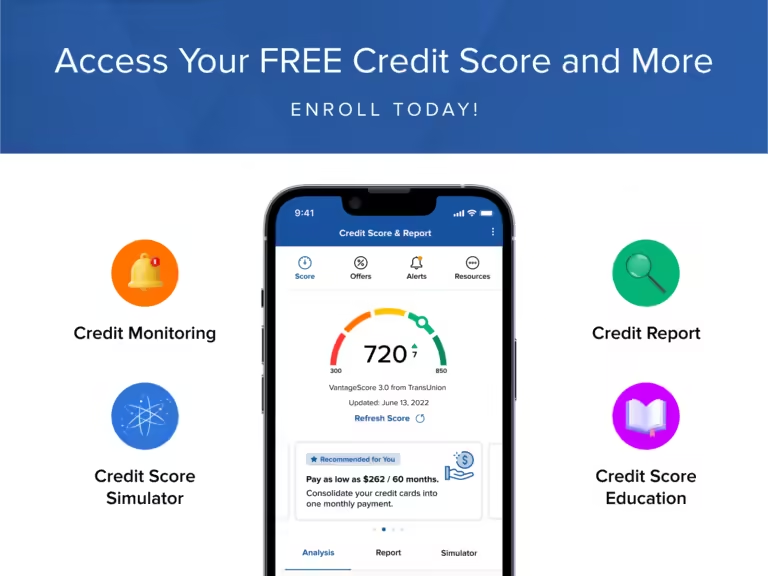

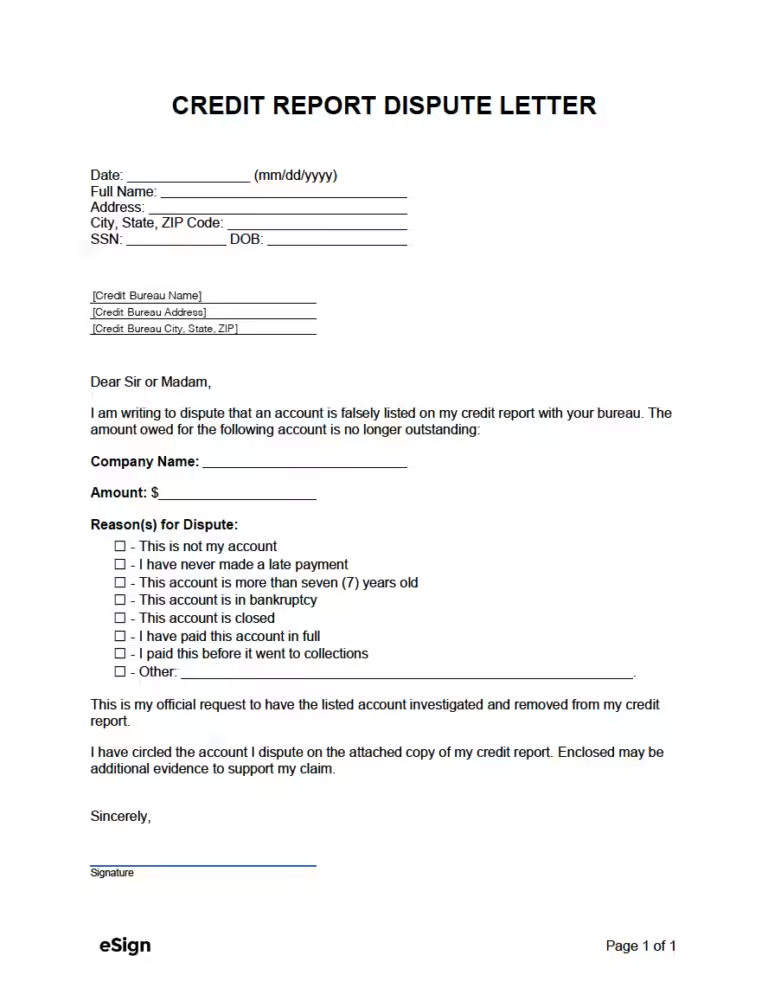

Monitoring Your Credit Report Regularly

Regularly check your credit report for errors or fraudulent activities. Correcting mistakes promptly can prevent negative impacts on your credit score. You can access your credit report for free from each of the three major credit bureaus annually.

| Strategy | Description |

|---|---|

| Timely Payments | Ensure on-time payments to boost your credit score. |

| Low Credit Utilization | Keep usage under 30% of your credit limit. |

| Avoid Hard Inquiries | Limit credit applications to maintain your score. |

| Secured Credit Cards | Use secured cards to build or rebuild credit. |

| Monitor Credit Report | Check your report regularly for errors. |

Possible Finance offers tools to help you build credit. The Possible Card provides a no-interest credit limit. The Possible Loan is a payday loan alternative that can improve your credit history.

Both products from Possible Finance help build credit without debt traps. Choose the one that fits your needs and start building your credit today.

Pricing And Affordability Of Credit Cards

Credit cards come with various costs that can affect their affordability. Understanding these costs is essential for making informed decisions. Key factors include annual fees, interest rates, and reward programs.

Understanding Annual Fees

Annual fees are charges you pay yearly for holding a credit card. These fees vary widely depending on the card’s benefits and features. For instance, the Possible Card offers a straightforward fee structure:

| Credit Limit | Monthly Fee |

|---|---|

| $400 | $8 |

| $800 | $16 |

Unlike traditional credit cards, the Possible Card avoids complicated fee structures. This transparency helps users better manage their finances.

Comparing Interest Rates And Charges

Interest rates significantly impact the cost of using a credit card. High-interest rates can lead to mounting debt if balances are not paid in full. The Possible Card stands out with its 0% interest rate, offering a unique advantage:

- No interest charges ever

- No late fees

- No hidden charges

This feature ensures users can focus on repaying their balance without worrying about interest accumulating.

Evaluating Reward Programs And Their Value

Reward programs can add significant value to a credit card. These programs typically offer points, cashback, or miles for every dollar spent. While the Possible Card does not offer traditional rewards, its benefits can be seen through:

- Credit Building: Helps build credit history with responsible use.

- Peace of Mind: No debt traps or unexpected fees.

- Accessibility: No credit check or deposit required.

These features provide a practical and straightforward approach to managing personal finances, especially for those aiming to improve their credit scores.

For more information about Possible Finance products, visit Possible Finance.

Pros And Cons Of Using Credit Cards To Build Credit

Building credit with credit cards can be a double-edged sword. While they offer a convenient way to establish and improve your credit history, they also come with their own set of risks. Understanding the pros and cons will help you make informed decisions to maintain your financial health.

Advantages Of Credit Cards

Credit cards can be powerful tools for building credit. Here are some key benefits:

- Credit History: Credit cards help establish a credit history, which is crucial for loans and mortgages.

- Credit Utilization: Keeping balances low and paying off in full can improve your credit utilization rate.

- Rewards and Benefits: Many cards offer rewards, such as cash back or travel points, which add value to your purchases.

- Convenience: Credit cards are widely accepted and can be used for online and in-person transactions.

Potential Drawbacks And Risks

While credit cards offer benefits, they also carry potential risks:

- High-Interest Rates: Carrying a balance can result in high-interest charges, making debt harder to pay off.

- Overspending: The ease of use can lead to overspending and financial strain.

- Fees: Late payment fees, annual fees, and other charges can add up quickly.

- Credit Score Impact: Missed payments or high balances can negatively affect your credit score.

Balancing Credit Card Use And Financial Health

Balancing credit card use with financial health is essential. Here are some tips:

- Pay On Time: Always pay at least the minimum payment by the due date to avoid late fees.

- Keep Balances Low: Aim to use less than 30% of your available credit to maintain a good credit utilization rate.

- Monitor Statements: Regularly check your credit card statements for any errors or fraudulent charges.

- Use Responsibly: Only charge what you can afford to pay off each month to avoid accumulating debt.

Products like the Possible Card offer a practical solution for those looking to build credit without the worry of interest or late fees. With a monthly fee and no credit check, it provides a straightforward way to access credit and improve your financial standing.

Specific Recommendations For Ideal Users

Building credit with credit cards can be a smart move when done strategically. Here are some targeted recommendations for different groups of users looking to build or rebuild their credit.

Best Practices For Students And Young Adults

Students and young adults often start with limited credit history. Using a credit card responsibly can set a strong foundation. The Possible Card is a great option:

- No interest, ever: Avoids the risk of debt accumulation.

- No late fees: Encourages timely payments without penalties.

- Helps build credit history: Reports to credit bureaus to improve your score over time.

Here are some tips:

- Start with a small credit limit: The Possible Card offers limits of $400 or $800.

- Pay on time: Set up reminders to ensure timely payments.

- Use the card for small purchases: Keep utilization low.

Guidance For Individuals With No Credit History

For individuals with no credit history, getting approved for traditional credit cards can be challenging. The Possible Card offers a solution:

| Feature | Benefit |

|---|---|

| No credit check | Accessible to those with no credit history. |

| No deposit required | Removes financial barriers to getting started. |

| Monthly fee | Predictable cost, either $8 or $16. |

Steps to take:

- Apply for the Possible Card to start your credit journey.

- Use the card for regular, small expenses.

- Pay the balance in full each month.

Advice For Rebuilding Credit After Financial Setbacks

Rebuilding credit after financial setbacks requires discipline and the right tools. The Possible Loan and Possible Card can help:

- Possible Loan: Borrow up to $500 with no late fees, paid over four installments.

- Possible Card: Offers a no-interest credit line to help manage finances better.

Recommended actions:

- Create a budget: Track expenses and income to manage payments.

- Use credit wisely: Only charge what you can afford to pay off.

- Monitor your credit: Check your credit report regularly for accuracy.

Using these tools and strategies can help you rebuild your credit score over time, offering you more financial flexibility and peace of mind.

Conclusion: Achieving Credit Success With Credit Cards

Building credit with credit cards can be a strategic move towards achieving financial stability. Credit cards like the Possible Card offer an effective way to improve your credit history without falling into debt traps. In this section, we will summarize the key points, encourage responsible credit card use, and look forward to maintaining good credit health.

Summarizing Key Points

- Credit Building: The Possible Card helps build credit history with no interest or late fees.

- Instant Credit Access: Offers credit limits of $400 or $800 instantly.

- Monthly Fee: Simple monthly fee of $8 or $16.

- No Credit Check: No credit check or deposit required.

Encouraging Responsible Credit Card Use

Using a credit card responsibly is crucial for building and maintaining good credit. Here are some tips:

- Pay your balance in full each month to avoid fees.

- Keep your credit utilization below 30% of your credit limit.

- Monitor your credit report regularly for accuracy.

- Set up automatic payments to ensure timely payments.

Looking Forward: Maintaining Good Credit Health

Maintaining good credit health requires ongoing effort. Here are steps to help you stay on track:

- Create a budget to manage your finances effectively.

- Avoid applying for multiple credit cards at once.

- Use credit monitoring tools to stay informed about your credit status.

- Seek professional advice if you encounter financial difficulties.

With the right approach, tools like the Possible Card can be a valuable asset in your journey to credit success.

Frequently Asked Questions

How Can Credit Cards Build Credit?

Using credit cards responsibly can help build credit. Make timely payments and keep balances low. This shows lenders you can manage credit.

What Is A Good Credit Utilization Ratio?

A good credit utilization ratio is below 30%. This means using less than 30% of your available credit. It helps maintain a good credit score.

How Often Should I Check My Credit Score?

Check your credit score at least once a year. Regular checks help you catch errors and monitor your progress.

Can A New Credit Card Improve My Credit Score?

A new credit card can improve your credit score. It increases your available credit, which can lower your credit utilization ratio.

Conclusion

Building credit with credit cards requires careful planning and responsible use. Start small and gradually increase your credit limit. Always pay your bills on time to avoid penalties. Monitor your credit report regularly for errors. For a simple, no-interest option, consider the Possible Card. It helps build credit without hidden fees. Remember, good credit opens doors to better financial opportunities. Stay diligent, and your credit score will improve steadily.