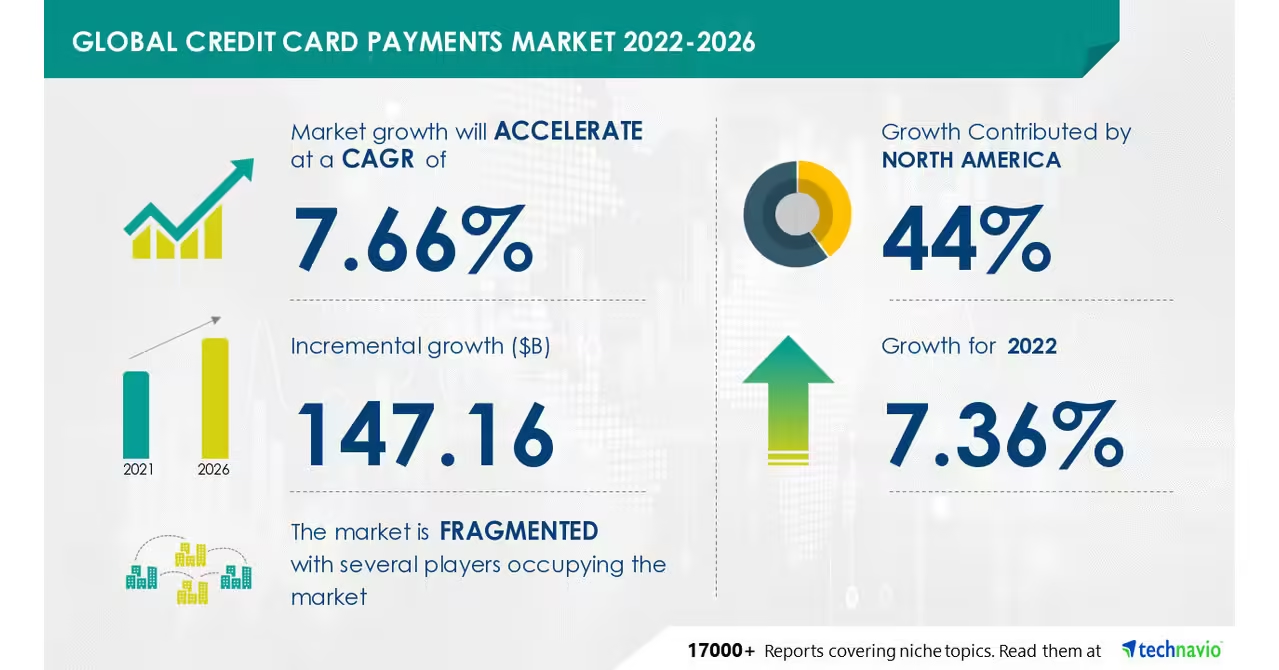

Credit Card Market Trends: Essential Insights for 2024

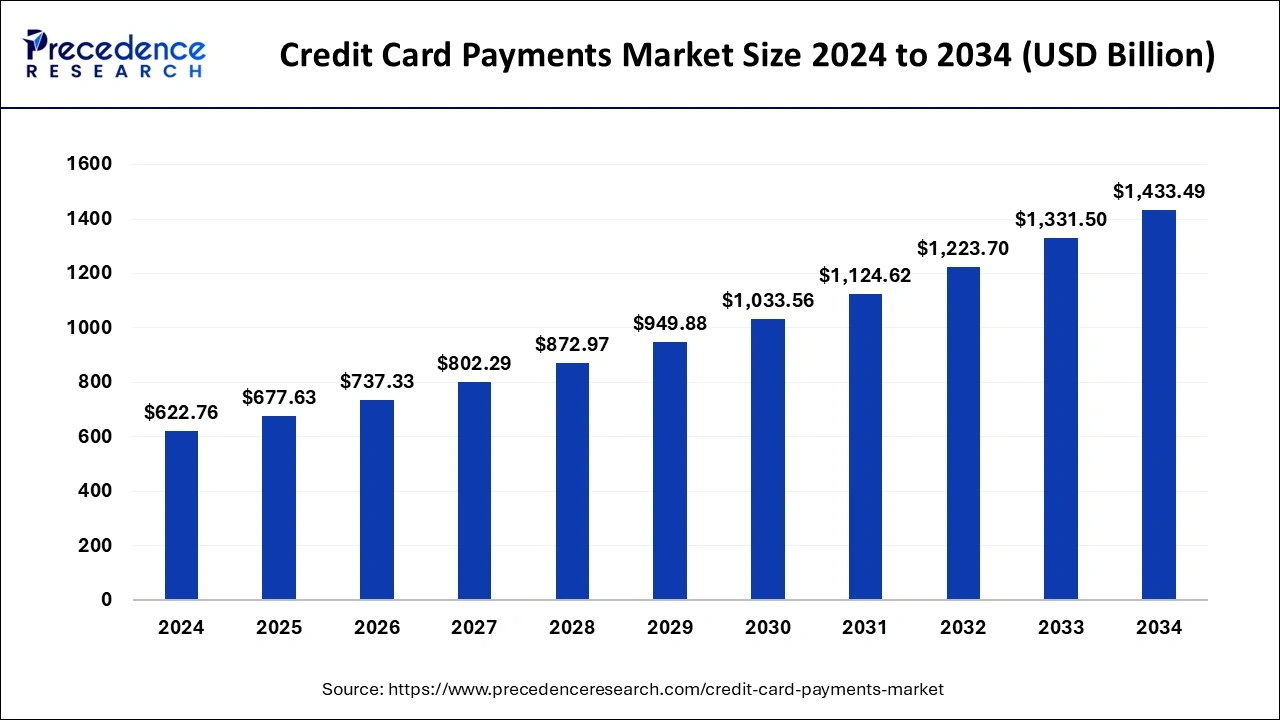

The credit card market is always evolving. Staying updated on trends can help you make informed decisions.

In recent years, credit card usage has increased significantly. With new technologies and changing consumer habits, the market is seeing some exciting trends. From rewards programs to digital wallets, the landscape is shifting. Understanding these trends can help you choose the best options for your financial needs. Credit card companies are now offering more flexible repayment plans and lower fees. Innovative products like the Possible Card provide unique benefits, such as no interest and no late fees. Exploring these trends can lead to better financial health and credit scores. Stay informed to make the best choices for your wallet. For more information on innovative credit products, check out Possible Finance.

Introduction To Credit Card Market Trends

The credit card market is constantly evolving. Keeping up with these trends is crucial for both consumers and financial institutions. This section will provide an in-depth look at the current trends in the credit card industry. Understanding these trends can help make informed decisions and adapt to market changes.

Overview Of The Credit Card Industry

The credit card industry encompasses a wide range of products and services. These include traditional credit cards, rewards cards, and alternative financing options. One example of an alternative financing product is the Possible Card. It offers no interest and no debt traps, with a focus on financial peace of mind.

Key features of the Possible Card include:

- Credit limit of $400 or $800

- 0% interest forever

- No late fees

- Monthly fee of $8 or $16

Benefits of the Possible Card include:

- Immediate credit limit unlock

- No credit check or deposit required

- Flexible payments

- Helps build credit history

Understanding the range of products available can help consumers choose the best options for their financial needs. Additionally, financial institutions can tailor their offerings to meet market demands.

Purpose Of Understanding Market Trends

Grasping market trends in the credit card industry is essential for several reasons:

- Informed Decision-Making: Consumers can make better choices about which credit cards to use.

- Competitive Edge: Financial institutions can stay ahead by adapting to trends.

- Risk Management: Understanding trends can help mitigate financial risks.

The Possible Card serves as a prime example of innovation in the credit card market. Its unique features and benefits align with current market trends, emphasizing flexibility and financial responsibility.

By staying informed about the latest trends, both consumers and financial institutions can navigate the credit card market more effectively. This knowledge leads to better financial health and more strategic business decisions.

Key Features Shaping The Credit Card Market In 2024

The credit card market is evolving rapidly. In 2024, several key features will shape its landscape. Understanding these trends can help consumers make informed decisions and companies stay competitive.

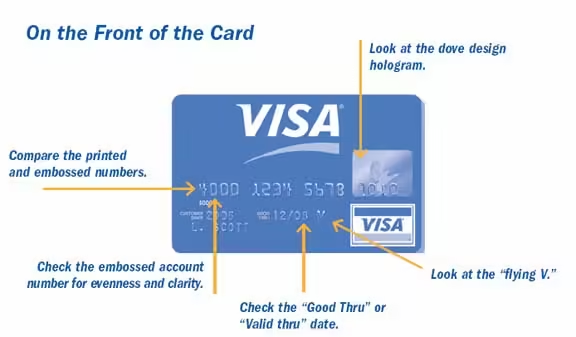

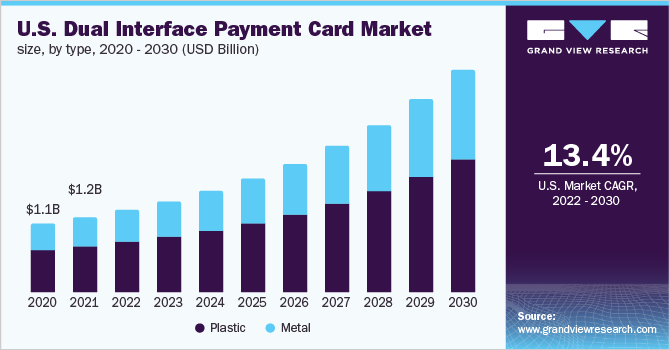

Technological advancements are transforming the credit card industry. Contactless payments and biometric authentication are becoming standard. These technologies offer convenience and enhanced security. For example, many cards now feature fingerprint or facial recognition technology.

Artificial Intelligence (AI) is also playing a significant role. AI helps in detecting fraud and analyzing spending patterns. This ensures a better user experience and reduces the risk of fraudulent transactions.

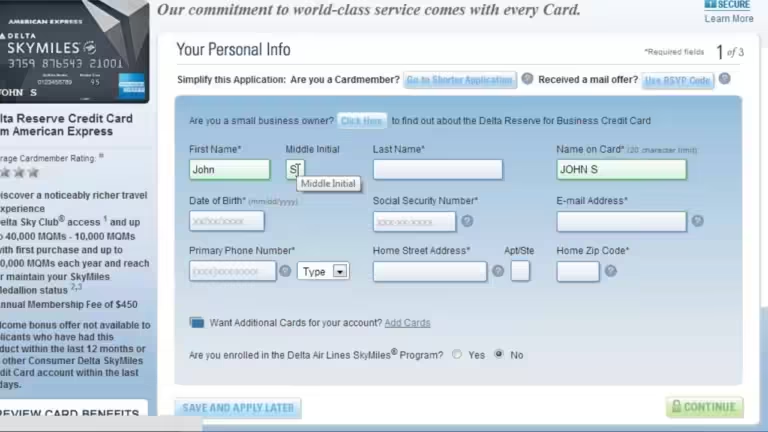

Consumer behavior is shifting towards more digital and mobile-first approaches. People prefer managing their finances through apps. This trend is leading to an increase in mobile wallet adoption and digital-only credit cards.

Sustainability is another focus area. Consumers are opting for eco-friendly card options. These cards are made from recycled materials, aligning with the growing environmental consciousness.

Regulatory changes continue to impact the credit card market. Governments are introducing new laws to protect consumers. These regulations aim to ensure transparency and fair practices.

Compliance with data protection laws is crucial. GDPR and CCPA guidelines must be followed. Companies need to ensure they handle consumer data responsibly and securely.

The market is seeing the emergence of new credit card products. These products focus on transparency and consumer-friendly terms. For instance, the Possible Card offers 0% interest and no late fees. This card helps in building credit without the risk of falling into debt traps.

| Product Name | Main Features | Benefits | Monthly Fee |

|---|---|---|---|

| Possible Card |

|

|

$8 or $16 |

Such products are designed to offer financial peace of mind. They provide a safer alternative for consumers looking to build or rebuild their credit history.

Technological Advancements And Innovations

The credit card market is evolving with rapid technological advancements and innovations. These changes are reshaping how we use and interact with credit cards. From contactless payments to AI-driven fraud detection, technology is enhancing convenience and security.

Contactless Payments And Digital Wallets

Contactless payments are gaining popularity. They offer a quick and secure way to pay. Simply tap your card or phone to a reader. No need for physical contact. Digital wallets like Apple Pay and Google Wallet make this process seamless.

| Feature | Benefits |

|---|---|

| Convenience | Quick, easy, and hygienic transactions |

| Security | Tokenization protects card details |

| Accessibility | Compatible with most smartphones |

Ai And Machine Learning In Fraud Detection

AI and machine learning are transforming fraud detection. These technologies analyze patterns in transaction data. They identify suspicious activities in real-time. This reduces the risk of fraud and enhances security for cardholders.

Key benefits include:

- Real-time monitoring

- Accurate fraud detection

- Reduced false positives

Blockchain Technology And Security Enhancements

Blockchain technology is enhancing credit card security. It offers a decentralized way to store and verify transactions. This reduces the risk of data breaches. Blockchain ensures that transaction data is immutable and transparent.

Benefits of blockchain in credit card security:

- Enhanced data security

- Improved transparency

- Reduced fraud risk

In conclusion, technological advancements are reshaping the credit card market. From contactless payments to AI and blockchain, these innovations offer enhanced convenience and security.

Shifts In Consumer Behavior

The credit card market is witnessing significant shifts in consumer behavior. These changes are driven by evolving preferences and technological advancements. Let’s delve into some key trends shaping the market today.

Increase In Online Shopping And E-commerce

The rise of online shopping has transformed consumer spending habits. More people are using credit cards for e-commerce transactions. This shift is driven by the convenience of shopping from home and the availability of exclusive online deals.

According to recent data:

- Over 70% of consumers prefer using credit cards for online purchases.

- E-commerce sales have surged by 30% in the past year.

Credit card companies are responding by enhancing security features and offering rewards for online spending. These changes aim to attract and retain customers in the digital shopping era.

Demand For Personalized Rewards And Offers

Consumers are increasingly seeking personalized rewards and offers. They want credit card benefits that match their spending habits and lifestyle.

Key trends include:

- Customized cashback rewards on groceries, travel, and dining.

- Exclusive discounts and promotions tailored to individual preferences.

Companies like Possible Finance are leading the way by offering unique benefits. For example, the Possible Card provides flexible payment options and helps build credit history. This personalization enhances customer satisfaction and loyalty.

Growing Preference For Sustainable And Ethical Choices

There is a growing preference for sustainable and ethical choices among consumers. They want to support companies that prioritize environmental and social responsibility.

Recent trends include:

- Increased interest in credit cards that support eco-friendly initiatives.

- Preference for companies with ethical business practices.

Credit card issuers are responding by launching green card programs and partnering with sustainable brands. These efforts align with the values of modern consumers and promote a positive brand image.

Understanding these shifts in consumer behavior is crucial for staying competitive in the credit card market. By addressing these trends, companies can better meet customer needs and drive growth.

Regulatory Changes And Compliance

The credit card market is evolving rapidly, driven by new regulations and compliance requirements. These changes aim to enhance consumer protection, ensure data privacy, and streamline cross-border transactions. Understanding these regulatory shifts is crucial for both credit card issuers and users.

Impact Of New Financial Regulations

New financial regulations are reshaping the credit card industry. These rules focus on transparency, fair practices, and consumer protection. For instance, the Dodd-Frank Wall Street Reform and Consumer Protection Act introduced measures to prevent predatory lending.

Credit card companies now have to ensure that fees and interest rates are clearly disclosed. They must also offer more flexible repayment options. This benefits consumers by reducing the risk of debt traps. It also encourages responsible borrowing and spending.

Compliance With Data Privacy Laws

With the rise in digital transactions, data privacy has become a top priority. Regulations like the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) require companies to protect user data. Credit card issuers must implement robust security measures to safeguard personal information.

They must also provide clear privacy policies and obtain consent before collecting data. Non-compliance can result in hefty fines and damage to reputation. Therefore, staying compliant with these laws is not optional but a necessity.

Global Standardization And Cross-border Transactions

As globalization increases, standardizing regulations for cross-border transactions is essential. The Payment Services Directive 2 (PSD2) in Europe is one example. It aims to create a more integrated and secure payment ecosystem. This directive facilitates easier and safer international transactions.

Credit card companies must adapt to these global standards to remain competitive. They need to ensure seamless and secure transactions across borders. This involves collaborating with international regulatory bodies and adopting standardized protocols.

Understanding these regulatory changes and compliance requirements is critical for navigating the evolving credit card market. Staying informed and adapting to these shifts can lead to better consumer protection, enhanced data security, and smoother international transactions.

Emergence Of New Credit Card Products

The credit card market is evolving rapidly. New products are making waves, offering features that cater to modern financial needs. These innovations aim to provide flexibility, security, and user convenience. Below, we’ll explore some of the latest trends in credit card offerings.

Introduction Of Crypto-based Credit Cards

Crypto-based credit cards are now gaining popularity. These cards allow users to spend cryptocurrency for everyday purchases. The transactions convert crypto into fiat currency at the point of sale. This feature appeals to crypto enthusiasts looking for seamless ways to utilize their digital assets.

| Feature | Description |

|---|---|

| Spending Crypto | Convert crypto to fiat for purchases |

| Rewards | Earn crypto cashback on transactions |

| Security | Enhanced security with blockchain technology |

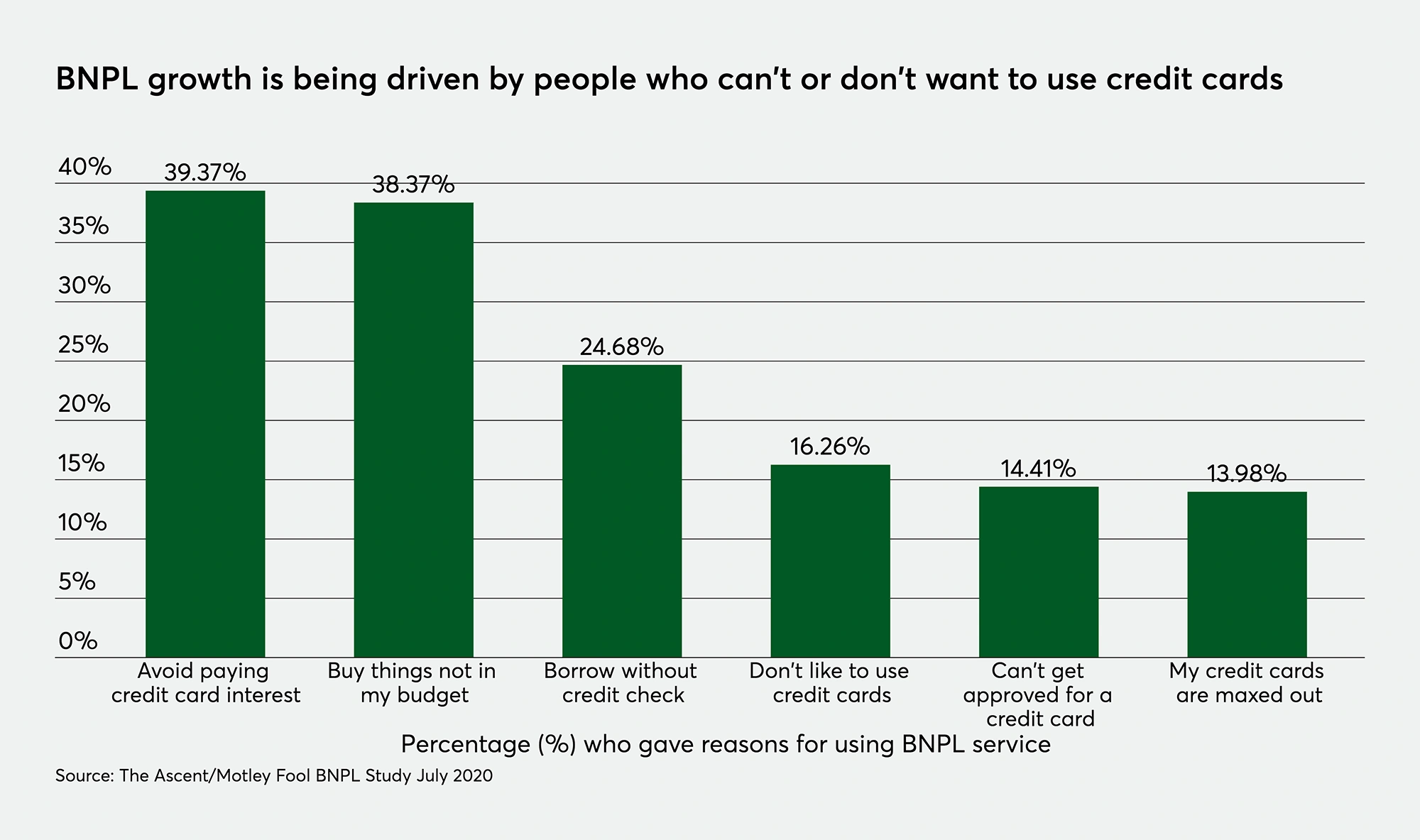

Buy Now, Pay Later (bnpl) Integration

BNPL options are now integrated into credit cards. This means you can split your purchases into smaller, manageable payments. Credit cards with BNPL integration offer instant credit decisions. Users benefit from flexible repayment terms without the need for separate BNPL accounts.

- Split payments into installments

- Instant credit decisions

- No separate BNPL account needed

Flexible Credit Card Plans And Subscriptions

Credit cards are now offering more flexible plans and subscriptions. For instance, the Possible Card provides a credit limit of $400 or $800. It has a 0% interest rate and no late fees. Users pay a monthly fee of $8 or $16. This card helps build credit history with on-time payments.

Flexible credit cards like the Possible Card focus on financial peace of mind. They provide immediate credit limit unlocks and do not require credit checks or deposits. These features make them accessible to a broader audience.

Here are some key details of the Possible Card:

| Feature | Description |

|---|---|

| Credit Limit | $400 or $800 |

| Interest Rate | 0% forever |

| Fees | No late fees, $8 or $16 monthly fee |

| Benefits | Immediate credit limit unlock, no credit check or deposit required |

Pricing And Affordability Breakdown

Understanding the pricing and affordability of credit cards is crucial. This includes annual fees, interest rates, rewards programs, and hidden costs. This section will help you navigate these aspects effectively.

Annual Fees And Interest Rates

Annual fees and interest rates are two major factors affecting affordability. Some credit cards, like the Possible Card, offer a 0% interest rate and have a monthly fee of either $8 or $16. This fee structure ensures no hidden interest charges, making it easier to manage.

Here’s a quick comparison table:

| Credit Card | Annual Fee | Interest Rate | Monthly Fee |

|---|---|---|---|

| Possible Card | None | 0% | $8 or $16 |

Comparison Of Reward Programs

Reward programs vary greatly among credit cards. While some cards offer cash back, others provide points or miles. The Possible Card focuses on building credit history without complex reward schemes. This simplicity can be beneficial for those new to credit cards.

- Cash Back

- Points

- Miles

- Credit Building (Possible Card)

Hidden Costs And Charges To Consider

Hidden costs can make a seemingly affordable credit card expensive. The Possible Card stands out with no late fees and no penalty fees. This transparency helps in avoiding unexpected charges.

- Late Fees: $0 (Possible Card)

- Penalty Fees: $0 (Possible Card)

- Other Hidden Charges: None (Possible Card)

Pros And Cons Of Current Market Trends

Understanding the pros and cons of current credit card market trends helps consumers make informed decisions. The trends include technological integration, changing consumer behavior, and new regulations. Each trend offers its own set of advantages and challenges.

Advantages Of Technological Integration

Technological integration in the credit card industry offers several benefits:

- Enhanced Security: Advanced encryption and biometric authentication improve security.

- Convenience: Digital wallets and mobile payments make transactions faster.

- Personalized Offers: AI-driven analytics provide personalized rewards and offers.

For example, products like Possible Card offer flexible payments and no interest, making it easier for users to manage their finances.

Challenges Posed By Consumer Behavior Shifts

Consumer behavior is constantly evolving, presenting challenges such as:

- Increased Debt: Easy access to credit can lead to higher debt levels.

- Security Concerns: More digital transactions can increase the risk of fraud.

- Shift to Digital: Traditional banks may struggle to keep up with digital-first consumers.

For instance, Possible Finance addresses some of these challenges by offering no late fees and helping users build credit history with its Possible Loan product.

Opportunities And Risks Of New Regulations

New regulations in the credit card market present both opportunities and risks:

| Opportunities | Risks |

|---|---|

| Consumer Protection: Enhanced regulations can protect consumers from predatory practices. | Compliance Costs: Companies may face higher costs to comply with new regulations. |

| Market Stability: Stricter rules can lead to a more stable credit market. | Restricted Innovation: Over-regulation might stifle innovation in financial products. |

Products like the Possible Card benefit from regulations that promote transparency and fair practices, ensuring financial peace of mind for users.

Specific Recommendations For Ideal Users Or Scenarios

Understanding which credit card suits your needs can be challenging. Here, we’ll break down the top credit card choices for various scenarios. Whether you travel frequently, shop online, or are new to credit cards, we have the best recommendations for you.

Best Credit Cards For Frequent Travelers

For those who travel often, the right credit card can make all the difference. Look for cards that offer travel rewards, no foreign transaction fees, and travel insurance. Here are some top picks:

| Credit Card | Key Features |

|---|---|

| Possible Card |

|

| XYZ Travel Card |

|

Top Choices For Online Shoppers

Online shoppers need credit cards that offer cashback rewards, purchase protection, and fraud alerts. Here are some excellent choices:

| Credit Card | Key Features |

|---|---|

| Possible Card |

|

| ABC Cashback Card |

|

Ideal Options For First-time Credit Card Users

First-time credit card users need a card with low fees, simple terms, and credit-building benefits. These cards are perfect for beginners:

| Credit Card | Key Features |

|---|---|

| Possible Card |

|

| DEF Starter Card |

|

Frequently Asked Questions

What Are Current Trends In Credit Cards?

Current trends include increased rewards programs, contactless payments, and enhanced security features. Credit card companies focus on personalized offers and digital integration.

How Is Technology Impacting Credit Cards?

Technology is enhancing security and convenience. Contactless payments, mobile wallets, and AI-based fraud detection are becoming standard features.

Are Rewards Programs Changing?

Yes, rewards programs are becoming more attractive. Companies offer higher cash back, travel points, and exclusive perks to attract customers.

What Security Features Are New?

New security features include biometric authentication, tokenization, and real-time fraud alerts. These advancements aim to protect users from identity theft and fraud.

Conclusion

The credit card market trends are evolving rapidly. Consumers now seek more flexible options. Products like the Possible Loan and Possible Card offer unique benefits. They help build credit history without hidden fees. Consider exploring these options for better financial health. Interested in learning more? Check out Possible Finance. Stay informed and make smart credit choices. Your financial well-being matters.