Financial Independence With Credit Cards: Unlock Your Wealth Today

Achieving financial independence is a goal many strive for. Credit cards can be a powerful tool in this journey.

But how can you use them wisely to gain financial freedom? Credit cards offer convenience and flexibility. They can help manage expenses, build credit, and even provide rewards. The key is to use them responsibly. This means understanding the terms and avoiding debt traps. One product that stands out in this space is the Possible Card from Possible Finance. Designed to offer financial stability, it has no interest or late fees, making it a solid choice for those looking to improve their credit history. By leveraging the right credit card, you can take a significant step towards financial independence.

Introduction To Financial Independence With Credit Cards

Financial independence means having enough income to cover living expenses without needing to work. Credit cards can be a powerful tool to achieve this goal if used wisely. Understanding how to use credit cards effectively can help you reach financial independence faster.

Understanding Financial Independence

Financial independence is the ability to support oneself without relying on employment income. It provides the freedom to pursue passions and hobbies. Key components include:

- Savings: Building a robust savings account.

- Investments: Growing wealth through investments.

- Debt Management: Reducing and managing debt efficiently.

Achieving financial independence involves disciplined saving, smart investing, and effective debt management.

Role Of Credit Cards In Achieving Financial Independence

Credit cards, when used responsibly, can aid in achieving financial independence. Here are a few ways:

- Building Credit: Regular, on-time payments help build a strong credit history.

- Managing Expenses: Tracking spending with credit cards can help in budgeting.

- Rewards Programs: Taking advantage of cash back or reward points.

The Possible Card by Possible Finance is an excellent option to consider. Here are its main features:

| Feature | Description |

|---|---|

| Credit Limit | Instantly unlock a $400 or $800 limit¹ |

| Application | Quick process with no credit check or deposit |

| Interest | 0% interest, forever |

| Fees | No late fees, ever; $8 or $16 monthly fee |

| Credit Building | Helps build your credit history |

Possible Card offers instant funds, no hidden costs, flexible payments, and credit improvement opportunities. These benefits make it a great tool for financial independence.

Key Features Of Credit Cards For Financial Independence

Choosing the right credit card can be a key step towards financial independence. Understanding the features of credit cards helps you make informed decisions. Let’s explore some essential features.

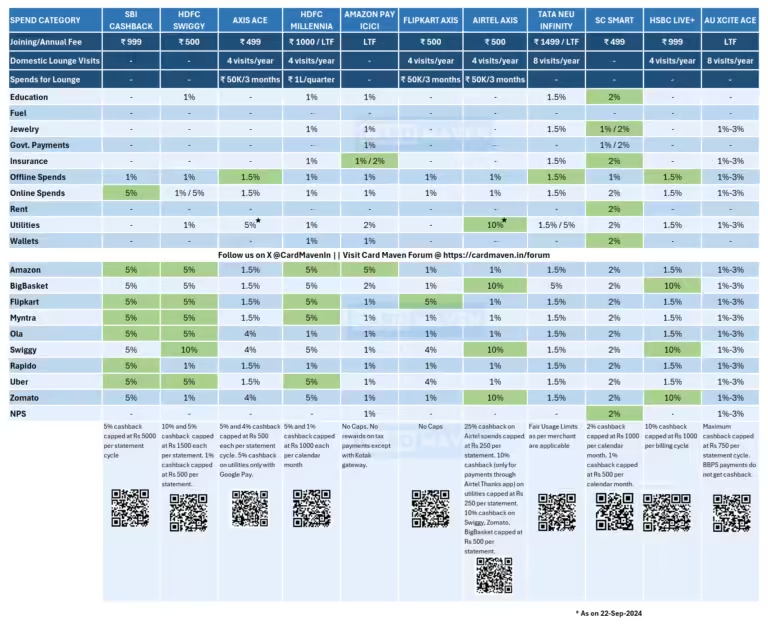

Reward Programs And Cashback Benefits

Many credit cards offer reward programs and cashback benefits. These programs reward you for everyday spending. You can earn points, miles, or cash back on purchases. For instance, if you spend on groceries or gas, you could receive a percentage back. This can accumulate over time, providing savings or rewards for future use.

| Type | Details |

|---|---|

| Points | Earn points for each dollar spent, redeemable for travel, gifts, or credits |

| Miles | Earn miles for travel-related spending, redeemable for flights, hotels, etc. |

| Cashback | Receive a percentage of your spending back as cash |

Low-interest Rates And Balance Transfers

Credit cards with low-interest rates and balance transfer options can save you money. Low-interest rates reduce the cost of borrowing. This helps you manage your finances better. Balance transfers allow you to move high-interest debt to a card with lower rates. This can help you pay off debt faster.

- Low-Interest Rates: Lower APR saves you money on interest charges.

- Balance Transfers: Move high-interest balances to lower-rate cards.

For example, the Possible Card offers 0% interest, making it an attractive option for managing debt.

Credit Score Improvement And Management Tools

Using credit cards responsibly can improve your credit score. Many cards offer tools for managing and monitoring your credit. These tools help you track your spending and payment history. On-time payments can build a positive credit history.

- Credit Building: Timely payments can improve your credit score.

- Management Tools: Access to tools for tracking and managing credit.

The Possible Card, for instance, helps improve your credit history with on-time payments.

Pricing And Affordability Breakdown

Understanding the costs associated with credit cards is crucial for financial independence. This section will break down the pricing and affordability aspects of credit cards. We will cover annual fees, interest rates, hidden costs, charges, and compare different credit card offers.

Annual Fees And Interest Rates

Credit cards often come with annual fees and interest rates. These costs can impact your overall financial health.

| Card Type | Annual Fee | Interest Rate |

|---|---|---|

| Standard Credit Card | $0 – $99 | 15% – 25% |

| Rewards Credit Card | $50 – $150 | 18% – 27% |

| The Possible Card | $8 or $16 monthly fee | 0% interest |

The Possible Card stands out with its 0% interest and a manageable monthly fee of $8 or $16. This can be a cost-effective option for those seeking to avoid interest charges.

Hidden Costs And Charges

Many credit cards have hidden costs and charges that can catch users off-guard. These may include late fees, foreign transaction fees, and balance transfer fees.

- Late Fees: Charges applied when payments are not made on time.

- Foreign Transaction Fees: Fees for using the card abroad, usually 1%-3% of each transaction.

- Balance Transfer Fees: Fees for transferring balances from one card to another, typically 3%-5% of the amount transferred.

The Possible Card has no late fees and no hidden costs, making it a transparent and user-friendly option.

Comparing Different Credit Card Offers

Comparing different credit card offers can help you find the best fit for your needs. Consider factors like fees, interest rates, and benefits.

| Feature | Standard Card | Rewards Card | The Possible Card |

|---|---|---|---|

| Annual Fee | $0 – $99 | $50 – $150 | $8 or $16 monthly |

| Interest Rate | 15% – 25% | 18% – 27% | 0% |

| Hidden Fees | Yes | Yes | No |

| Credit Limit | Varies | Varies | $400 or $800 |

The Possible Card offers a clear pricing structure with no hidden fees and a straightforward monthly fee. This makes it a reliable option for managing your finances and building credit history.

Pros And Cons Of Using Credit Cards

Credit cards offer both benefits and drawbacks. Understanding these can help you manage your finances better. Below, we explore the advantages and disadvantages of using credit cards.

Advantages Of Credit Cards

- Convenience: Credit cards are easy to carry and use anywhere.

- Rewards: Many credit cards offer cash back, points, or travel rewards.

- Build Credit: Responsible use helps improve your credit score.

- Purchase Protection: Credit cards often provide protection on purchases.

- Emergency Funds: Access to funds in emergencies without needing cash.

Disadvantages And Risks Of Credit Cards

- High Interest Rates: Carrying a balance can lead to high interest charges.

- Debt Accumulation: Easy access can lead to overspending and debt.

- Fees: Late payments and annual fees can add up.

- Credit Score Impact: Mismanagement can negatively affect your credit score.

- Fraud Risk: Credit cards are targets for fraud and identity theft.

Real-world Usage Examples

Let’s consider some real-world examples to understand the impact of credit cards:

| Scenario | Outcome |

|---|---|

| Using The Possible Card | Access $400 or $800 credit limit instantly with no interest or late fees. |

| Travel Rewards | Earn points on purchases, redeem for flights and hotels. |

| Emergency Car Repair | Use credit card for unexpected repairs, pay off over time. |

| Online Shopping | Purchase protection and easier returns for online purchases. |

The Possible Card can be a good option for those seeking financial independence. It offers an instant credit limit, no interest, and no late fees. This makes it easier to manage monthly payments and improve your credit score.

Specific Recommendations For Ideal Users

Finding the right credit card can be a game changer for achieving financial independence. Whether you are a beginner, a frequent traveler, or a business owner, there is a perfect card for you. Let’s explore the best options tailored to your needs.

Best Credit Cards For Beginners

Beginners need a card that is easy to get approved for and helps build credit. The Possible Card is an excellent choice for those with bad credit or no credit history.

| Card | Features |

|---|---|

| Possible Card |

|

Credit Cards For Frequent Travelers

Frequent travelers need cards with travel rewards, no foreign transaction fees, and travel insurance. Here are some top picks:

- Chase Sapphire Preferred: Offers 2x points on travel and dining, and no foreign transaction fees.

- Capital One Venture Rewards: Provides 2x miles on every purchase, and a Global Entry/TSA PreCheck fee credit.

Credit Cards For Business Owners

Business owners require cards that offer cash back, high credit limits, and expense tracking. Consider these options:

- American Express Blue Business Cash: 2% cash back on all eligible purchases up to $50,000 per calendar year.

- Chase Ink Business Preferred: Earn 3x points on travel and select business categories.

Whether you are starting out, traveling frequently, or running a business, choosing the right credit card is crucial. The Possible Card offers a great starting point for beginners, providing instant funds and no interest, while others cater to specific needs like travel rewards and business expenses.

Frequently Asked Questions

How Can Credit Cards Help Achieve Financial Independence?

Credit cards can help achieve financial independence by managing cash flow, earning rewards, and building credit. Responsible use avoids debt.

What Are The Benefits Of Using Credit Cards Wisely?

Using credit cards wisely offers benefits like rewards, cashback, and building a good credit score. Avoid high-interest debt.

Is It Possible To Save Money With Credit Cards?

Yes, you can save money with credit cards through rewards, cashback, and zero-interest promotions. Timely payments are crucial.

How Do Credit Card Rewards Work?

Credit card rewards work by earning points or cashback on purchases. These can be redeemed for travel, merchandise, or statement credits.

Conclusion

Achieving financial independence with credit cards is possible. The key lies in responsible usage and wise choices. Consider alternatives like The Possible Card. It offers no interest or late fees, making it a smart choice. With manageable monthly fees and credit-building benefits, it’s an excellent option for those seeking financial stability. Remember, the journey to financial independence starts with informed decisions and disciplined habits. Take control of your finances today and move toward a more secure future.