Online Credit Card Management: Simplify Your Finances Today

Managing your credit cards online can simplify your financial life. It offers convenience, control, and security.

In today’s fast-paced world, staying on top of your credit card accounts is crucial. With online credit card management, you can easily monitor transactions, pay bills, and manage your spending from anywhere. Possible Finance offers a seamless solution for this need. Their products, Possible Loan and Possible Card, are designed to provide quick access to funds while helping you build your credit history. The Possible Card comes with a credit limit of $400 or $800, no interest, and no late fees. The Possible Loan allows you to borrow up to $500 with a fair repayment plan. Both products offer transparent terms and are user-friendly, making online credit card management straightforward and stress-free. To learn more, visit Possible Finance.

Introduction To Online Credit Card Management

Managing credit cards online has become essential for many. It offers convenience and control over your finances. Through online platforms, you can monitor your spending, make payments, and manage multiple cards effortlessly. Let’s explore the basics and importance of online credit card management.

What Is Online Credit Card Management?

Online credit card management refers to using digital tools to manage your credit card activities. This includes:

- Checking your balance and transactions

- Making payments

- Setting up alerts

- Monitoring your credit score

Possible Finance, for example, offers the Possible Card that you can manage online. It has features like no late fees and no interest, making it user-friendly.

Why Is It Important For Your Finances?

Online credit card management is crucial for several reasons:

- Convenience: Access your account anytime, anywhere.

- Real-time Monitoring: Keep track of your spending instantly.

- Improved Financial Health: Make timely payments to build your credit score.

Using products like the Possible Card can help improve your financial health. It offers:

| Feature | Details |

|---|---|

| Credit Limit | $400 or $800 |

| Interest | 0% |

| Fees | No late fees, Monthly fee of $8 or $16 |

| Credit Check | Not required to apply |

Managing such a card online ensures transparency and ease of use.

Key Features Of Online Credit Card Management Tools

Managing your credit card online can be a breeze with the right tools. Online credit card management tools offer various features that make it easy to keep track of your spending, monitor transactions, and maximize rewards. Let’s explore some of the key features you can expect.

Real-time Transaction Monitoring

Real-time transaction monitoring allows you to see your transactions as they happen. This feature helps you stay on top of your spending and detect any unauthorized transactions immediately. It also provides a clear overview of your financial activities, ensuring you always know where your money is going.

Automated Bill Payments

Automated bill payments take the hassle out of remembering due dates. This feature ensures that your bills are paid on time, every time, helping you avoid late fees and maintain a good credit score. Set up recurring payments and let the system handle the rest.

Spending Analysis And Budgeting Tools

Understanding your spending habits is crucial for financial health. Spending analysis and budgeting tools provide detailed insights into your expenses. These tools help you categorize spending, set budgets, and track your progress, making it easier to manage your finances effectively.

Fraud Detection And Alerts

Protecting your financial information is a top priority. Fraud detection and alerts are essential for safeguarding your account. These features monitor for suspicious activity and send you instant alerts if anything unusual is detected, allowing you to take immediate action.

Rewards And Cashback Tracking

Maximizing the benefits of your credit card is easier with rewards and cashback tracking. This feature keeps track of your earned rewards and cashback, ensuring you never miss out on any benefits. It also helps you plan your spending to maximize these rewards.

| Feature | Benefit |

|---|---|

| Real-Time Transaction Monitoring | See transactions as they happen |

| Automated Bill Payments | Avoid late fees and maintain credit score |

| Spending Analysis and Budgeting Tools | Understand and manage expenses |

| Fraud Detection and Alerts | Protect your financial information |

| Rewards and Cashback Tracking | Maximize card benefits |

Using these key features, Possible Loan and Possible Card offer an efficient way to manage your credit card activities. With no interest or late fees, these tools are designed to help users access money quickly and build their credit history. For more details, visit Possible Finance.

Pricing And Affordability Of Online Credit Card Management Tools

Managing credit cards online can be both convenient and cost-effective. Pricing and affordability of these tools vary widely. Understanding the different pricing models helps users make informed decisions. This section explores the types of tools available, their costs, and the value they provide.

Free Vs. Paid Tools

Online credit card management tools come in two main types: free and paid. Free tools are great for basic needs. They offer essential features like tracking expenses and due dates. Paid tools, on the other hand, provide advanced options. These include detailed reports, alerts, and customer support.

| Feature | Free Tools | Paid Tools |

|---|---|---|

| Expense Tracking | Basic | Advanced |

| Alerts and Reminders | Limited | Comprehensive |

| Customer Support | Community-based | 24/7 Support |

Subscription Plans And Costs

Subscription plans for paid tools vary. They are usually billed monthly or annually. For instance, Possible Finance offers the Possible Card with a monthly fee of $8 or $16. This fee covers all services, including 0% interest and no late fees.

- Possible Loan: Borrow up to $500 with no late fees.

- Possible Card: Credit limits of $400 or $800, with a monthly fee.

Some tools offer tiered plans. Higher tiers provide more features. Users can choose the plan that fits their needs and budget.

Value For Money

Value for money depends on the features provided. Paid tools like the Possible Card offer significant value. They help build credit history without hidden fees. For a small monthly fee, users get access to essential financial tools.

Key benefits include:

- Quick access to funds.

- No hidden fees or penalties.

- Flexible repayment options.

- Improved credit score with on-time payments.

Free tools may be sufficient for basic needs. Paid tools offer more comprehensive features, providing better value for those serious about managing their finances.

Pros And Cons Of Using Online Credit Card Management Tools

Online credit card management tools provide a modern approach to handling personal finance. These tools offer both advantages and disadvantages that users should consider. Let’s explore the pros and cons to help you make an informed decision.

Advantages: Convenience And Efficiency

Possible Finance offers a seamless way to manage your credit. The Possible Card gives quick access to funds without a credit check. Here are some key benefits:

- Instant Access: Borrow up to $500 instantly with Possible Loan.

- No Hidden Fees: No late or penalty fees with either the loan or card.

- Easy Application: Apply for the Possible Card with no credit check or deposit.

- Flexible Repayment: Pay over time in four installments.

- Credit Building: Helps build your credit history with on-time payments.

These features make online credit card management tools like Possible Finance highly convenient and efficient for users.

Disadvantages: Security Concerns And Dependence On Technology

While online tools offer many benefits, they also come with potential drawbacks. Here are some concerns:

- Security Risks: Storing financial information online can be risky. Cybersecurity threats are ever-present.

- Tech Dependency: Dependence on technology can be problematic. Internet outages or technical issues may limit access to your account.

- Eligibility Limits: Not all states offer the same services. Eligibility for products like the Possible Card varies by state.

- Approval Times: Fund disbursement can take up to five days, which may not be ideal for urgent needs.

These disadvantages highlight the importance of considering security and technology reliability when using online credit card management tools.

Who Should Use Online Credit Card Management Tools?

Online credit card management tools are designed to simplify and streamline the process of handling credit cards. These tools are not just for tech-savvy individuals but are ideal for a wide range of users. Let’s explore who can benefit the most from these tools.

Ideal Users: Busy Professionals And Frequent Travelers

Busy professionals often juggle multiple tasks and responsibilities. Time is precious. Online credit card management tools help them stay on top of their finances without the need to manually track every transaction. Features like automated alerts and spending summaries ensure that they never miss a payment or overspend.

Frequent travelers benefit greatly from these tools. Traveling can lead to varied spending patterns, making it hard to keep track. Online tools offer real-time notifications and currency conversion insights, ensuring that travelers can manage their finances seamlessly, no matter where they are.

Scenarios: Managing Multiple Credit Cards And Large Transactions

Managing multiple credit cards can be a daunting task. Online credit card management tools provide a consolidated view of all credit cards in one place. This helps users monitor due dates, credit limits, and reward points efficiently. The ability to set up automatic payments for each card ensures that users maintain a good credit score without stress.

Large transactions require careful monitoring. Online tools offer detailed insights into spending patterns. This is especially useful for those who make frequent high-value purchases. Users can set spending limits and receive instant notifications for any large transactions, ensuring they stay within their budget.

For those using products like Possible Loan and Possible Card, these tools are invaluable. They allow users to manage their credit limits, track repayments, and monitor their credit-building progress with ease.

Frequently Asked Questions

What Is Online Credit Card Management?

Online credit card management allows you to track and control your credit card usage. It offers features like viewing statements, setting spending limits, and making payments online.

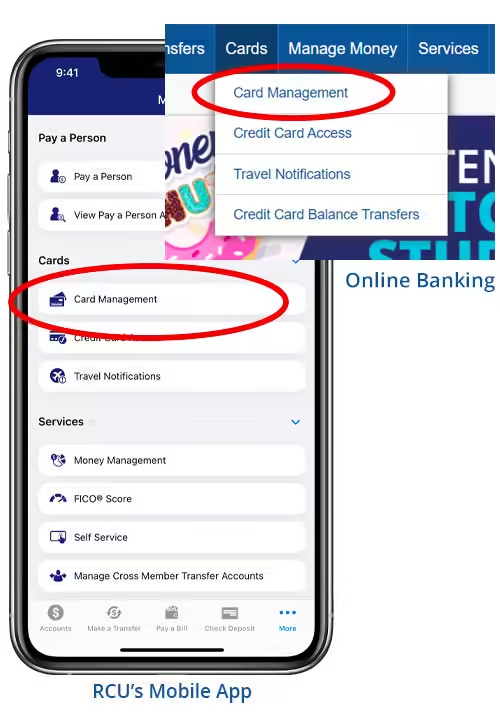

How Do I Manage My Credit Card Online?

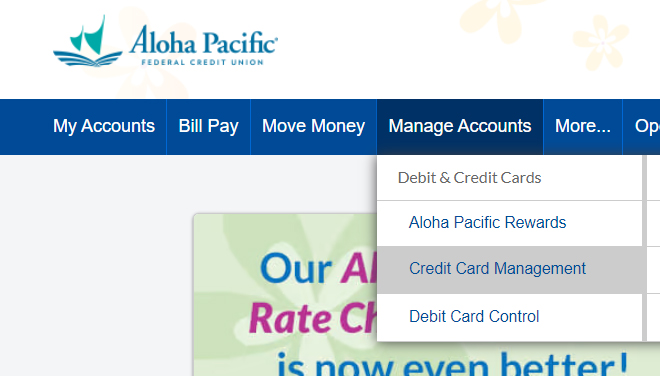

To manage your credit card online, log into your bank’s online portal or mobile app. You can view transactions, pay bills, and set alerts.

Are Online Credit Card Services Secure?

Yes, online credit card services are generally secure. Banks use encryption and two-factor authentication to protect your information.

Can I Set Spending Limits Online?

Yes, many credit card issuers allow you to set spending limits through their online management tools. This helps in budgeting and avoiding overspending.

Conclusion

Online credit card management can simplify your financial life. Tools like Possible Finance offer flexible solutions. Borrow up to $500 or access a Possible Card with no late fees. Improve your credit score by paying on time. Manage your finances easily and transparently. Check out Possible Finance for more information. Easy access to funds and no hidden fees. Take control of your credit journey today.