Checking Account With Overdraft Protection: Avoid Fees and Stress

Managing your finances can be stressful, especially if you worry about overdraft fees. A checking account with overdraft protection can help ease these worries.

Truist One Checking Account offers a solution with no overdraft fees and automatic upgrades. This account provides several benefits, including easy online management and a $400 promotional offer for new customers. With a minimum opening deposit of just $50, it’s accessible and user-friendly. Plus, you can enjoy the peace of mind that comes with avoiding unexpected fees. Interested in a hassle-free banking experience? Learn more about the Truist One Checking Account and its benefits by visiting their website.

Introduction To Checking Accounts With Overdraft Protection

Managing your finances can sometimes be challenging, especially when unexpected expenses arise. A checking account with overdraft protection can help you avoid costly fees and provide peace of mind. One such product is the Truist One Checking account, which offers various features and benefits to make financial management simpler and more efficient.

What Is Overdraft Protection?

Overdraft protection is a service that links your checking account to another account, such as a savings account or a line of credit. This service covers transactions when your checking account has insufficient funds, preventing declined payments and overdraft fees.

With the Truist One Checking account, you get the added benefit of no overdraft fees. This means you won’t incur additional charges if you accidentally spend more than what’s available in your account.

Purpose And Benefits Of Overdraft Protection

The primary purpose of overdraft protection is to ensure your transactions are covered, even if your account balance is low. This can be particularly useful for avoiding the embarrassment and inconvenience of declined transactions.

Some key benefits of overdraft protection with the Truist One Checking account include:

- Automatic upgrades – Enjoy enhanced account features as your financial needs grow.

- Easy online account management – Manage your account effortlessly through Truist’s online and mobile banking services.

- Enhanced financial control – Avoid overdraft fees and maintain better control over your finances.

Additionally, the Truist One Checking account offers a promotional reward of $400 for new account holders who meet specific requirements. To qualify, open a new account online, complete at least two qualifying direct deposits totaling $1,000 or more within 120 days, and use promo code DC2425TR1400 during account opening.

Overdraft protection can make a significant difference in managing your finances, offering peace of mind and added convenience. With the Truist One Checking account, you can take advantage of these benefits and more.

Key Features Of Checking Accounts With Overdraft Protection

Checking accounts with overdraft protection offer essential features to help you avoid costly fees and manage your finances better. Here are the key features you should know about.

Automatic Transfer From Linked Accounts

With this feature, funds are automatically transferred from a linked savings or another account to cover transactions that exceed your checking account balance. This helps in avoiding overdraft fees and ensures your payments go through smoothly.

Overdraft Line Of Credit

An overdraft line of credit is like having a safety net. When your account balance is insufficient, the bank covers the deficit up to a certain limit. You can repay this amount with interest, similar to a credit card. This feature provides financial flexibility when you need it most.

Overdraft Fees Protection

Truist One Checking account offers no overdraft fees. This means you won’t be penalized for occasional overdrafts, making it easier to manage your finances without worrying about extra charges. It also includes automatic upgrades to keep your account in good standing.

Customizable Overdraft Limits

Some banks allow you to set custom overdraft limits based on your financial habits and needs. This feature helps you stay within a budget and avoid excessive borrowing. You can adjust these limits as your financial situation changes, providing enhanced financial control.

For more information about the Truist One Checking account, visit the Truist website.

Pricing And Affordability Breakdown

Understanding the pricing and affordability of the Truist One Checking Account with Overdraft Protection is crucial. This section breaks down the costs associated with maintaining the account, comparing overdraft fees, and identifying any hidden fees. Let’s dive into the details.

Monthly Maintenance Fees

The Truist One Checking Account does not specify a monthly maintenance fee in the provided information. However, many banks typically charge a fee unless certain conditions are met, such as maintaining a minimum balance or having qualifying direct deposits.

- Minimum opening deposit: $50

- Qualifying Direct Deposits required: $1,000 within 120 days

For more details, visit the Truist website.

Overdraft Fees Comparison

One of the standout features of the Truist One Checking Account is no overdraft fees. This can be a significant saving compared to other banks, which may charge up to $35 per overdraft incident.

| Bank | Overdraft Fee |

|---|---|

| Truist | $0 |

| Bank of America | $35 |

| Chase | $34 |

| Wells Fargo | $35 |

No overdraft fees mean more financial control and less worry about unexpected charges.

Additional Costs And Hidden Fees

While the Truist One Checking Account boasts no overdraft fees, it’s essential to be aware of other potential costs. These could include:

- ATM fees for using non-Truist ATMs

- Wire transfer fees

- Stop payment fees

- Foreign transaction fees

Always review the bank’s fee schedule for a complete understanding of all potential charges.

Value For Money Analysis

The Truist One Checking Account offers good value, especially with the promotional offer. By meeting the qualifying direct deposit requirements, you can earn $400. Additionally, the lack of overdraft fees provides enhanced financial control.

- Open an account between 10/31/24 and 4/30/25

- Complete 2 qualifying Direct Deposits totaling $1,000 within 120 days

- Use promo code: DC2425TR1400

- Receive $400 within 4 weeks after meeting requirements

The promotional offer, combined with no overdraft fees, makes this account an attractive choice for many users.

:max_bytes(150000):strip_icc()/what-does-overdraft-protection-mean-for-your-credit-960738-final-b393f72c0de549e89fd867ee40b1a46c.jpg)

Pros And Cons Of Checking Accounts With Overdraft Protection

Checking accounts with overdraft protection can be a lifesaver when funds are low. Yet, they also come with their own set of drawbacks. Understanding the advantages and limitations helps you decide if it’s right for you.

Advantages Of Overdraft Protection

- Avoid Overdraft Fees: Overdraft protection helps you avoid costly overdraft fees. This can save you money and stress.

- Automatic Coverage: Your transactions are covered automatically, preventing declined payments.

- Financial Flexibility: It offers peace of mind, providing a cushion when your balance is low.

- Convenience: Truist One Checking account offers no overdraft fees, enhancing your financial control.

- Online Management: Manage your account easily with Truist’s online and mobile banking services.

Potential Drawbacks And Limitations

- Interest Charges: Overdrafts might incur interest, increasing your debt.

- False Security: Relying too much on overdraft protection might lead to poor financial habits.

- Qualifying Conditions: To enjoy benefits, you must meet specific requirements, such as qualifying direct deposits.

Comparing With Standard Checking Accounts

| Features | Truist One Checking | Standard Checking |

|---|---|---|

| Overdraft Fees | None | Yes |

| Automatic Upgrades | Yes | No |

| Promotional Offer | Earn $400 | Varies |

| Minimum Deposit | $50 | $100 |

Truist One Checking account stands out with its no overdraft fees and promotional offers. It’s crucial to understand the benefits and limitations before making a choice.

Specific Recommendations For Ideal Users

The Truist One Checking Account offers a variety of features that can benefit different types of users. Overdraft protection is one of these features, helping you avoid unnecessary fees and manage your finances better.

Best Scenarios For Using Overdraft Protection

Overdraft protection can be particularly useful in several scenarios:

- Irregular Income: If you have a variable income, overdraft protection can provide a cushion during lean months.

- Unexpected Expenses: It can help cover unforeseen costs, like medical bills or car repairs, without incurring hefty fees.

- Frequent Transactions: If you make many transactions, overdraft protection ensures none are declined due to insufficient funds.

Who Should Avoid Overdraft Protection?

While overdraft protection offers many benefits, it may not be suitable for everyone:

- Consistent Budgeters: If you meticulously track your spending, you might not need this feature.

- Low Balance Users: Those who frequently maintain a low balance could find the protection more of a crutch than a benefit.

- Fee Avoiders: If you are averse to any potential fees, it may be best to avoid this option.

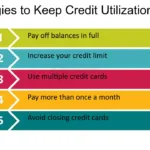

Tips For Maximizing Benefits

Maximize the benefits of overdraft protection with these tips:

- Monitor Your Balance: Regularly check your account to stay aware of your financial status.

- Set Up Alerts: Use account alerts to notify you when your balance is low.

- Link Accounts: Connect a savings account to cover any overdrafts, reducing the risk of fees.

Utilize the Truist One Checking Account to its full potential by taking advantage of these features and tips. For more details, visit the Truist website.

:max_bytes(150000):strip_icc()/overdraft-4191679-899410ea0c854304b930597f7126d1e0.jpg)

Frequently Asked Questions

What Is Overdraft Protection?

Overdraft protection is a banking service. It prevents transactions from being declined due to insufficient funds. It covers shortfalls by linking to another account or credit line.

How Does Overdraft Protection Work?

Overdraft protection links your checking account to another account or credit line. It covers insufficient funds, avoiding declined transactions and additional fees.

Are There Fees For Overdraft Protection?

Yes, banks may charge fees for overdraft protection. Fees vary by bank and account type. Check your bank’s fee schedule.

Can Overdraft Protection Impact Credit Score?

Overdraft protection itself doesn’t impact your credit score. However, unpaid overdraft fees or linked credit lines can affect your credit.

Conclusion

Choosing a checking account with overdraft protection can provide peace of mind. The Truist One Checking Account offers no overdraft fees and automatic upgrades. This account helps manage finances with ease, enhancing your financial control. With simple online management and the chance to earn $400, it’s a valuable choice. Open your account today and enjoy the benefits. For more details, visit Truist One Checking Account.