Quick Account Access: Simplify Your Online Security Today

Quick Account Access is essential in today’s fast-paced world. With so many financial tasks to manage, having easy and swift access to your accounts is crucial.

The Truist One Checking Account offers a seamless solution for those seeking quick account access with added benefits. This account stands out with its automatic upgrades and no overdraft fees, making banking hassle-free. By opening a new Truist One Checking Account online, you can earn $400 by completing qualifying activities. With a minimum opening deposit of just $50, the account ensures simplicity and convenience. Plus, it’s available to residents in specific states across the US. Discover more about the Truist One Checking Account and how it can simplify your financial management by visiting Truist Retail Checking.

Introduction To Quick Account Access

In today’s fast-paced world, having quick access to your bank account is crucial. Quick Account Access ensures you can manage your finances easily and efficiently. Let’s explore what it entails and its purpose.

What Is Quick Account Access?

Quick Account Access refers to the ability to swiftly access your bank account. This feature allows you to check balances, transfer money, and perform other banking activities without delays. The Truist One Checking Account is designed with this convenience in mind.

With Quick Account Access, you can manage your Truist One Checking Account seamlessly. This feature supports your banking needs, providing real-time updates and easy navigation.

The Purpose Of Quick Account Access

The main purpose of Quick Account Access is to simplify your banking experience. Here are some key benefits:

- Automatic upgrades: Enjoy enhanced features without manual intervention.

- No overdraft fees: Avoid unexpected charges and maintain a healthy balance.

- Earn rewards: Gain $400 by opening a new Truist One Checking account online and meeting the qualifying activities.

Quick Account Access is designed to offer hassle-free banking. It ensures you can handle your finances effortlessly. With the Truist One Checking Account, you benefit from features that enhance your banking experience.

| Main Features | Benefits |

|---|---|

| Automatic upgrades | No manual updates needed |

| No overdraft fees | Avoid unexpected charges |

| Earn rewards | Gain $400 with qualifying activities |

In summary, Quick Account Access is a must-have feature for modern banking. The Truist One Checking Account offers this, along with other benefits, ensuring a seamless banking experience.

Key Features Of Quick Account Access

The Quick Account Access feature of the Truist One Checking Account simplifies banking. It offers a seamless experience with several convenient and secure options. Let’s explore the key features that make this possible.

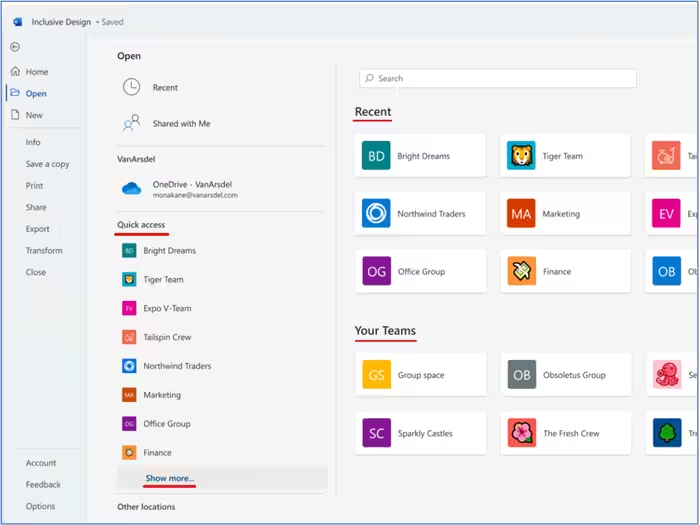

One-click Login

With One-Click Login, you can access your account instantly. No need to remember multiple passwords. This feature saves time and reduces the hassle of logging in.

Biometric Authentication

Biometric Authentication uses your fingerprint or facial recognition. This adds an extra layer of security. It’s fast, reliable, and ensures that only you can access your account.

Two-factor Authentication Integration

Two-Factor Authentication Integration (2FA) provides additional security. After entering your password, you’ll receive a code on your phone. Enter this code to complete the login process. This way, even if someone knows your password, they can’t access your account without the second factor.

Password Manager Compatibility

The system is compatible with popular Password Managers. These tools store and auto-fill your login details. This enhances security and convenience, ensuring you never forget your credentials.

In summary, the Quick Account Access feature of the Truist One Checking Account offers a secure and efficient banking experience. With One-Click Login, Biometric Authentication, Two-Factor Authentication Integration, and Password Manager Compatibility, managing your account has never been easier.

Pricing And Affordability

The Truist One Checking Account offers a variety of features with affordable pricing. This section breaks down the costs and benefits, helping you understand the value for your money.

Free Vs. Paid Versions

The Truist One Checking Account does not have separate free and paid versions. Instead, it offers a standard account with comprehensive features:

- Automatic upgrades

- No overdraft fees

These features are included in the account without additional fees, ensuring you get the most out of your banking experience without hidden costs.

Subscription Plans

Unlike subscription-based banking services, the Truist One Checking Account requires a minimum opening deposit of just $50. There are no ongoing subscription fees. Instead, you maintain your account with the following requirements:

- Open the account online.

- Enroll in the promotion with promo code DC2425TR1400.

- Receive at least two qualifying direct deposits totaling $1,000 or more within 120 days.

These simple steps qualify you for a $400 reward, making it a cost-effective choice for new customers.

Value For Money

The Truist One Checking Account offers exceptional value for money. Here are the key benefits:

| Feature | Benefit |

|---|---|

| Automatic Upgrades | Enjoy enhanced features without additional costs. |

| No Overdraft Fees | Avoid unexpected charges and manage your finances better. |

| $400 Reward | Earn a significant reward by meeting simple requirements. |

With these features, the Truist One Checking Account provides substantial benefits with minimal financial commitment. The combination of automatic upgrades, no overdraft fees, and the potential to earn a $400 reward makes it a wise choice for value-conscious customers.

Pros And Cons Of Quick Account Access

Quick Account Access has become a vital feature in banking. It simplifies managing finances and enhances user experience. Yet, like any feature, it has its benefits and drawbacks. This section explores both aspects of Quick Account Access.

Benefits Based On Real-world Usage

Truist One Checking Account offers several benefits that enhance Quick Account Access:

- Automatic upgrades: Users enjoy seamless account improvements without manual interventions.

- No overdraft fees: Financial peace of mind as unexpected charges are avoided.

- $400 reward: Earn this by opening a new account and completing qualifying activities.

These features provide a hassle-free banking experience. Users can manage their accounts with ease. Automatic upgrades ensure the account evolves with user needs. No overdraft fees prevent financial stress. The $400 reward is a significant incentive for new users.

Potential Drawbacks

Despite its advantages, Quick Account Access has some potential drawbacks:

- Eligibility requirements: The $400 reward requires meeting specific criteria. This includes making qualifying direct deposits totaling $1,000 or more within 120 days.

- Geographic limitations: The offer is available only in specific states. Users outside these areas cannot benefit.

- Account maintenance: The account must remain open and in good standing. Users must maintain a balance of at least $0.01 until the reward is deposited.

These conditions may limit the accessibility and attractiveness of Quick Account Access. Users must be aware of the eligibility requirements. Geographic restrictions can exclude potential users. Maintaining the account in good standing requires diligence.

By weighing the pros and cons, users can make informed decisions. Quick Account Access offers convenience but demands attention to detail.

Ideal Users And Scenarios

The Truist One Checking Account is designed to meet various banking needs. Ideal users benefit from its unique features. Different scenarios make this account especially valuable. Let’s explore who should use Quick Account Access and the best scenarios for usage.

Who Should Use Quick Account Access?

The Truist One Checking Account is ideal for:

- Individuals seeking hassle-free banking with no overdraft fees.

- New customers looking to earn a $400 reward.

- Residents of the eligible states: AL, AR, FL, GA, IN, KY, MD, MS, NC, NJ, OH, PA, SC, TN, TX, VA, WV, and DC.

- People who prefer automatic account upgrades.

- Those who can meet the direct deposit requirements.

Best Scenarios For Usage

Quick Account Access is best used in scenarios such as:

- Opening a new account online to earn a $400 reward.

- Managing finances without worrying about overdraft fees.

- Automatically upgrading to better account features.

- Receiving direct deposits of at least $1,000 within 120 days.

- Maintaining an account balance to stay eligible for rewards.

The table below summarizes the key features and benefits:

| Feature | Description |

|---|---|

| Automatic Upgrades | Account upgrades occur without user intervention. |

| No Overdraft Fees | Users enjoy banking without the worry of overdraft charges. |

| $400 Reward | Earn $400 by meeting specific direct deposit requirements. |

| Minimum Opening Deposit | A minimum deposit of $50 is required to open an account. |

Truist One Checking Account offers a blend of convenience and rewards. Quick Account Access makes it a practical choice for many users and scenarios.

Frequently Asked Questions

How Can I Quickly Access My Account?

To quickly access your account, use saved passwords or autofill features. Enable two-factor authentication for added security.

What Is The Easiest Way To Log In?

The easiest way to log in is by using biometric options like fingerprint or facial recognition, if available.

Can I Save My Login Details Safely?

Yes, use a reputable password manager to store and encrypt your login details safely. Avoid saving passwords in browsers.

Are Quick Access Methods Secure?

Quick access methods, like biometric authentication, are generally secure. Ensure your device is protected with a strong password or PIN.

Conclusion

Accessing your accounts quickly can transform your banking experience. The Truist One Checking Account offers hassle-free banking with no overdraft fees. Enjoy automatic upgrades and the chance to earn $400 by opening an account online. Manage your finances effortlessly with this reliable checking account. For more details, visit Truist Retail Checking today. Simplify your banking and enjoy peace of mind.