Truist Banking Insights: Unlocking Financial Success Today

Looking to better understand your banking options? Truist Banking Insights offers valuable information about modern banking solutions.

Managing your finances can be challenging. Truist One Checking provides a seamless banking experience with automatic upgrades and no overdraft fees. Enjoy features like online account opening and the opportunity to earn $400. This account is designed to grow with you, ensuring your financial needs are met with ease and convenience. Discover how Truist One Checking can simplify your banking life. Visit Truist for more details and start your journey towards hassle-free banking today.

Introduction To Truist Banking

Truist Banking offers modern, convenient, and personalized financial solutions. The bank aims to provide an exceptional banking experience with a range of products and services, including Truist One Checking. This introductory section will explore Truist’s purpose, vision, and what makes it unique in the banking world.

Who Is Truist?

Truist is a leading financial institution formed by the merger of BB&T and SunTrust. With headquarters in Charlotte, North Carolina, Truist is one of the largest banks in the United States. The bank serves millions of customers across a wide range of financial services, including personal banking, wealth management, and commercial banking.

Purpose And Vision

Truist’s purpose is to inspire and build better lives and communities. The bank believes in creating a positive impact on its customers, employees, and the communities it serves. Truist’s vision is to become the most trusted and preferred financial partner. They aim to achieve this by delivering innovative solutions and exceptional customer experiences.

Truist One Checking

Truist One Checking is a checking account designed to meet your financial needs with ease and convenience. It offers several attractive features:

- Automatic upgrades: Enhanced banking features over time.

- No overdraft fees: Enjoy a hassle-free banking experience.

- Online account opening: Open an account quickly and conveniently.

- Qualifying direct deposit requirement: Meet requirements to earn rewards.

Benefits:

- Earn $400 by opening a new Truist One Checking account online and completing qualifying activities.

- Automatic upgrades for enhanced banking features over time.

Pricing Details:

| Minimum opening deposit | $50 |

|---|---|

| Promotion eligibility | At least two qualifying direct deposits totaling $1,000 or more within 120 days of account opening |

Refund or Return Policies:

- Reward forfeiture if the account is changed to a non-qualifying type, closed before reward deposit, or has a $0.00 or negative balance at verification.

- Reward will be deposited within 4 weeks after qualification requirements are met.

- Account must be in good standing with at least $0.01 balance at the time of verification.

Additional Terms:

- Offer valid for accounts opened online between 10/31/24 and 4/30/25.

- Promo code DC2425TR1400 must be used during account opening.

- Offer non-transferable and cannot be combined with other checking offers.

- Available to US residents with a valid taxpayer identification number in specified states.

How to Enroll:

- Open a new Truist One Checking account online.

- Enter promo code DC2425TR1400 during the account opening process.

- Complete the qualifying direct deposit requirements within 120 days.

For more details or assistance, visit the Truist website or call 800.709.8700.

Key Features Of Truist Banking

Truist Banking offers a range of features designed to provide a seamless and secure banking experience. Below, we explore the key features that set Truist Banking apart, ensuring you have all the information you need to make an informed decision.

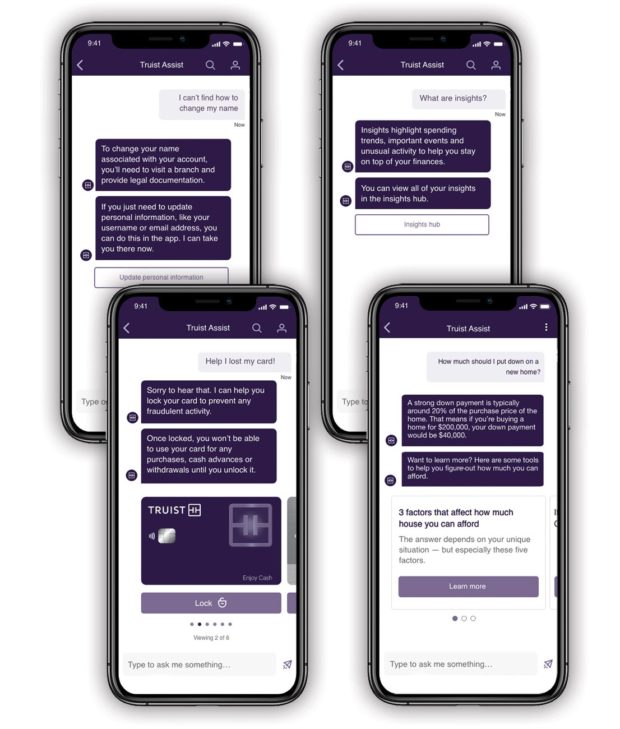

Truist Banking boasts a user-friendly digital platform that simplifies your banking experience. The platform allows you to manage your accounts online with ease. Here are some key highlights:

- Online account opening

- Mobile banking app with intuitive navigation

- Real-time account updates

- Easy bill pay and fund transfers

With these features, you can handle all your banking needs from the comfort of your home.

Truist Banking provides comprehensive financial services to cater to various needs. Whether you’re looking for a checking account or financial advice, Truist has you covered.

| Service | Description |

|---|---|

| Truist One Checking | No overdraft fees and automatic upgrades |

| Credit Cards | Various credit card options with rewards |

| Loans | Personal, auto, and home loans |

| Investment Services | Financial planning and investment management |

Truist’s range of financial services ensures that all your financial needs are met in one place.

Security is a top priority at Truist Banking. The bank employs robust security measures to protect your financial information. Key security features include:

- Two-factor authentication

- Encryption of sensitive data

- Real-time fraud monitoring

- Secure login processes

These measures ensure that your personal and financial information remains safe and secure.

For more information about Truist Banking and its features, visit the Truist website or contact their support team at 800.709.8700.

User-friendly Digital Platform

Truist offers a user-friendly digital platform designed to make banking easy and efficient. The platform includes various features to meet your financial needs, ensuring a seamless experience. Let’s explore its components.

Mobile And Online Banking

Truist’s mobile and online banking services provide easy access to your accounts. You can manage your finances anytime, anywhere. Features include:

- Account balance checks

- Transaction history

- Bill payments

- Money transfers

These services are designed to be intuitive and easy to use. The mobile app is available on both iOS and Android platforms, ensuring accessibility for all users.

Personalized Financial Tools

Truist offers personalized financial tools to help you manage your money effectively. These tools include:

- Budget tracking

- Spending insights

- Financial goal setting

- Customized alerts

These tools are designed to provide valuable insights into your spending habits and help you achieve your financial goals.

Truist’s digital platform is built to support your financial well-being. Whether you’re checking balances or setting budgets, it offers the tools you need.

Comprehensive Financial Services

Truist offers a range of comprehensive financial services. They are designed to meet various financial needs. Truist ensures convenience and ease of use. Explore their offerings below:

Checking And Savings Accounts

Truist One Checking is a standout option. It offers automatic upgrades and no overdraft fees. This account is tailored to make banking easier.

| Feature | Details |

|---|---|

| Automatic Upgrades | Enhance your banking features over time. |

| No Overdraft Fees | Enjoy a hassle-free banking experience. |

| Online Account Opening | Open your account from the comfort of your home. |

| Qualifying Direct Deposit | Meet deposit requirements to earn rewards. |

With Truist One Checking, you can earn $400. Complete qualifying activities to get this reward. The minimum opening deposit is $50. Ensure two qualifying direct deposits totaling $1,000 or more within 120 days. This account offers great value and convenience.

Loan And Credit Options

Truist provides various loan and credit options. These cater to different financial needs. They offer personal loans, home loans, and credit cards. Their terms are competitive and flexible.

- Personal Loans: Suitable for various personal financial needs.

- Home Loans: Options for buying or refinancing a home.

- Credit Cards: Range of credit cards with different benefits and rewards.

Each option comes with unique advantages. Truist aims to support your financial goals.

Investment Services

Truist offers investment services to grow your wealth. They provide personalized investment advice. Their services include retirement planning, wealth management, and more.

- Retirement Planning: Prepare for a secure future.

- Wealth Management: Manage and grow your assets.

- Personalized Advice: Tailored investment strategies.

Truist’s investment services help you achieve financial stability. Their expert advisors guide you every step of the way.

For more details or assistance, visit the Truist website or call 800.709.8700.

Robust Security Measures

Truist Banking offers a secure and reliable banking experience. Protecting your financial information is a top priority. The comprehensive security measures ensure your data remains safe.

Advanced Fraud Detection

Truist uses advanced fraud detection systems to monitor transactions. These systems identify unusual activities. They provide real-time alerts for suspicious behavior.

- 24/7 transaction monitoring

- Real-time alerts for suspicious activities

- AI-based anomaly detection

These features help prevent unauthorized access. They keep your account secure. Rest assured, your money is safe with Truist.

Secure Login Options

Truist offers multiple secure login options. These ensure only authorized users can access your account. Choose the method that suits you best.

- Two-factor authentication (2FA)

- Biometric authentication (fingerprint, facial recognition)

- Strong password requirements

Two-factor authentication adds an extra layer of security. Biometric options provide quick and safe access. Strong passwords ensure your account remains protected.

Combining these methods creates a robust defense. Truist ensures your banking experience is secure and hassle-free.

Pricing And Affordability

Understanding the pricing and affordability of Truist One Checking is crucial for making informed financial decisions. This section breaks down the various costs associated with Truist Banking, including account fees, loan and credit rates, and investment service costs. Let’s dive in!

Account Fees Breakdown

Truist One Checking offers a minimum opening deposit of $50. One significant advantage is the absence of overdraft fees, which can save you money over time. Here’s a summary of the main account fees:

- Minimum opening deposit: $50

- Overdraft fees: None

- Monthly maintenance fee: Varies based on account type

To avoid monthly maintenance fees, make sure to meet the qualifying direct deposit requirements. This includes at least two qualifying direct deposits totaling $1,000 or more within 120 days of account opening.

Loan And Credit Rates

Truist offers competitive loan and credit rates to help you manage your finances effectively. Here’s a quick overview:

| Type | Rate |

|---|---|

| Personal Loans | Starting at 5.99% APR |

| Credit Cards | Variable APR based on creditworthiness |

Rates for personal loans start at 5.99% APR, making borrowing affordable. Credit card rates are variable and depend on your creditworthiness.

Investment Service Costs

Investing with Truist comes with its own set of costs. Here’s what you can expect:

- Account management fees: Based on portfolio value

- Transaction fees: May apply to certain trades

- Advisory fees: Percentage of assets under management

Investing in Truist services can provide great value, especially with automatic upgrades and no overdraft fees. The costs are tailored to ensure you get the most out of your investments.

Pros And Cons Of Truist Banking

Truist Banking offers a range of services designed to meet diverse financial needs. Understanding the pros and cons helps you decide if Truist is the right choice for you.

Advantages Of Truist Banking

- No Overdraft Fees: Truist One Checking ensures you never pay overdraft fees, providing a worry-free banking experience.

- Automatic Upgrades: Enjoy enhanced banking features over time with automatic upgrades.

- Online Account Opening: Open your account online with ease and convenience.

- Promotional Offers: Earn $400 by opening a new Truist One Checking account and completing qualifying activities.

Potential Drawbacks

- Minimum Opening Deposit: A $50 minimum deposit is required to open a Truist One Checking account.

- Qualifying Direct Deposit Requirement: To earn the $400 bonus, you must complete at least two qualifying direct deposits totaling $1,000 or more within 120 days.

- Geographical Restrictions: The offer is only available to US residents in specified states.

For more details or assistance, visit the Truist website or call 800.709.8700.

Ideal Users For Truist Banking

Truist One Checking is a versatile banking option. It caters to diverse financial needs. The account offers automatic upgrades and no overdraft fees, making it user-friendly. Here, we explore the ideal users and best scenarios for using Truist Banking.

Best Scenarios For Usage

Truist One Checking fits well in several financial scenarios:

- Individuals seeking a hassle-free banking experience: The absence of overdraft fees ensures peace of mind.

- People looking for easy online account management: Open accounts online with ease.

- Users who prefer automatic upgrades: Enjoy enhanced features over time without extra effort.

- Those wanting to earn rewards: Gain $400 by completing qualifying activities.

Who Benefits Most

This account is designed to benefit specific groups:

- New banking customers: First-time users can manage their money effortlessly.

- Frequent direct deposit users: Ensure at least two qualifying deposits totaling $1,000 within 120 days.

- Residents of specified states: US residents with valid taxpayer identification in selected states.

- People avoiding overdraft fees: No more worrying about overdraft charges.

Here’s a quick overview:

| Feature | Benefit |

|---|---|

| Automatic Upgrades | Enhanced banking features over time |

| No Overdraft Fees | Hassle-free banking experience |

| Online Account Opening | Convenient and easy to manage |

| $400 Reward | Incentive for meeting qualifying activities |

Truist One Checking is accessible and beneficial for many. It’s a practical choice for modern banking needs.

Frequently Asked Questions

What Services Does Truist Bank Offer?

Truist Bank offers checking and savings accounts, loans, mortgages, and investment services. They also provide online and mobile banking.

How Can I Open An Account With Truist Bank?

You can open an account online or visit a Truist Bank branch. Required documents include ID and proof of address.

Is Truist Bank Secure?

Yes, Truist Bank employs advanced security measures. They use encryption and fraud monitoring to protect your data and finances.

What Are Truist Bank’s Customer Support Options?

Truist Bank offers phone, email, and chat support. They also provide a comprehensive help center on their website.

Conclusion

Discover the ease of Truist One Checking today. This account offers automatic upgrades and no overdraft fees. Enjoy a seamless banking experience. Earn $400 by completing qualifying activities. Ready to simplify your banking? Open your account now and experience the benefits firsthand. Visit Truist for more details and get started on your financial journey.