Truist Checking Account Flexibility: Maximize Your Financial Freedom

Truist One Checking offers a flexible and user-friendly experience. It’s designed for those who want simplicity and benefits.

In today’s fast-paced world, managing your finances should be easy and hassle-free. Truist One Checking provides you with the tools to do just that. With no overdraft fees, automatic upgrades, and easy online management, this account is perfect for anyone who values convenience. You can even earn a $400 bonus as a new customer by completing simple qualifying activities. Plus, the secure mobile app lets you monitor your finances anytime, anywhere. Ready to simplify your banking? Click here to learn more about Truist One Checking.

Introduction To Truist Checking Account

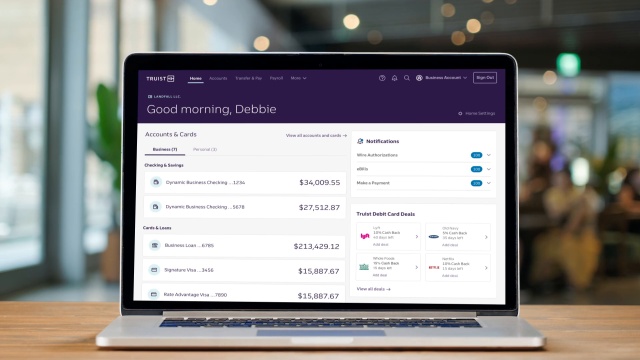

The Truist Checking Account offers flexibility and convenience for its customers. With various features and benefits, it aims to provide a seamless banking experience. Whether you are new to banking or looking for better options, Truist has a checking account that suits your needs.

Overview Of Truist Checking Accounts

Truist offers a variety of checking accounts designed to meet different financial needs. The Truist One Checking account stands out with no overdraft fees and automatic upgrades. This account is accessible online and through a secure mobile app, making it easy to manage your finances on the go.

| Feature | Details |

|---|---|

| No Overdraft Fees | Enjoy peace of mind with no charges for overdrafts. |

| Automatic Upgrades | Get automatic enhancements to your account features. |

| Online Management | Manage your account effortlessly online. |

| Mobile App Access | Monitor your account and get financial insights on the go. |

Purpose And Benefits Of Having A Checking Account With Truist

Having a Truist checking account offers numerous benefits:

- Earn a $400 bonus for new customers who meet qualifying activities.

- Fast and easy online account opening with a minimum deposit of just $50.

- Secure mobile app for convenient account access and management.

- No worry about overdraft fees and the hassle of manual upgrades.

The Truist One Checking account is suitable for anyone seeking a hassle-free banking experience with added financial perks. With an intuitive mobile app and user-friendly online platform, managing your finances has never been easier.

Key Features Of Truist Checking Accounts

Truist Checking Accounts offer a range of features designed to meet your financial needs. From saving on banking costs to managing your account on the go, Truist provides convenient and flexible options. Explore the key features below to see how Truist can benefit you.

No Monthly Maintenance Fees: Save On Banking Costs

With Truist Checking Accounts, you can enjoy no monthly maintenance fees. This means you save on banking costs and keep more of your money. It’s an ideal choice for those who seek a cost-effective banking solution.

Overdraft Protection Options: Avoid Unexpected Fees

Truist offers overdraft protection options to help you avoid unexpected fees. You can link your checking account to a savings account or line of credit. This ensures your transactions are covered and you stay in control of your finances.

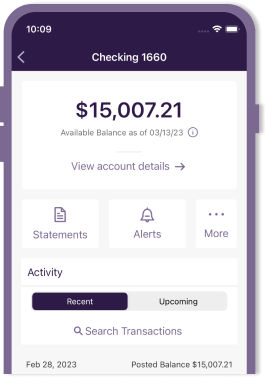

Mobile And Online Banking: Manage Your Finances On The Go

Truist provides robust mobile and online banking capabilities. You can monitor your account, transfer funds, and pay bills from anywhere. The secure mobile app gives you financial insights and helps you manage your money conveniently.

Cash Back Rewards: Earn While You Spend

With Truist Checking Accounts, you can earn cash back rewards on your purchases. This feature allows you to benefit from your everyday spending. It’s a simple way to make your money work harder for you.

Extensive Atm Network: Access Your Money Anywhere

Truist has an extensive ATM network that gives you access to your funds wherever you are. You can withdraw cash, check your balance, and perform other transactions without hassle. This network ensures you have convenient access to your money at all times.

Pricing And Affordability

The Truist One Checking account is designed with customer affordability in mind. It offers a range of features that make managing finances easy and cost-effective. This section will delve into the pricing and associated fees, strategies to avoid common fees, and a comparison with competitors to determine if Truist offers the best value for your needs.

Breakdown Of Fees Associated With Truist Checking Accounts

The Truist One Checking account has a transparent fee structure. Here is a detailed breakdown:

| Fee Type | Amount |

|---|---|

| Minimum Opening Deposit | $50 |

| Monthly Maintenance Fee | $0 |

| Overdraft Fees | None |

| ATM Fees | Varies (depends on ATM network) |

One of the standout features is the absence of overdraft fees, making it a cost-effective option for many customers.

How To Avoid Common Fees

Avoiding common fees is straightforward with Truist One Checking. Follow these simple tips:

- Maintain a Positive Balance: Ensure your account balance stays positive to avoid potential issues.

- Use Truist ATMs: To minimize ATM fees, utilize Truist’s ATM network.

- Sign Up for Direct Deposits: Qualify for various incentives and bonuses by setting up direct deposits.

- Monitor Your Account: Regularly check your account through the mobile app to stay on top of your finances.

Comparison With Competitors: Is Truist The Best Value?

Comparing Truist One Checking with other banks helps determine its value. Here are some key comparisons:

| Feature | Truist One Checking | Competitor A | Competitor B |

|---|---|---|---|

| Minimum Opening Deposit | $50 | $100 | $25 |

| Monthly Maintenance Fee | $0 | $10 | $5 |

| Overdraft Fees | None | $35 | $30 |

| New Customer Bonus | $400 | $200 | $100 |

Truist One Checking stands out with no overdraft fees, a low minimum deposit, and a generous new customer bonus.

Pros And Cons Of Truist Checking Accounts

Truist Checking Accounts offer a blend of flexibility and convenience, making them a popular choice among customers. Below, we explore the advantages and disadvantages, as well as real-world customer experiences.

Advantages: Flexibility And Convenience

Truist One Checking comes with several notable benefits:

- No overdraft fees: Helps you avoid unexpected charges.

- Automatic account upgrades: Keeps your account features up-to-date.

- Online account management: Provides easy access and control over your finances.

- Mobile app access: Offers real-time account monitoring and financial insights.

- $400 bonus: Available for new checking customers who meet qualifying criteria.

These features make Truist One Checking ideal for those seeking a hassle-free banking experience with added financial benefits.

Disadvantages: Potential Limitations To Consider

Despite the advantages, there are some limitations:

- Minimum opening deposit: Requires an initial deposit of $50.

- Reward eligibility: Only new customers qualify for the $400 bonus.

- Account maintenance: The account must remain open and have a positive balance for rewards.

- Offer restrictions: Cannot combine with other checking offers.

These limitations may affect your decision depending on your banking needs.

Real-world Usage: Customer Experiences And Feedback

Customer feedback provides valuable insights:

| Feature | Positive Feedback | Negative Feedback |

|---|---|---|

| No overdraft fees | Customers appreciate avoiding extra charges. | Some miss traditional overdraft protection. |

| Mobile app | Users find it easy to navigate and use. | Occasional technical glitches reported. |

| Account upgrades | Automatic upgrades keep accounts current. | Some prefer manual upgrade options. |

| $400 bonus | New customers find the bonus attractive. | Existing customers cannot avail this offer. |

Most customers find Truist One Checking beneficial but note some areas for improvement. Overall, the account provides a convenient, fee-free banking option.

Ideal Users And Scenarios

The Truist One Checking account offers unique features and benefits. It is designed to meet various financial needs. Understanding who can benefit most from this account and the best scenarios for its use is crucial.

Who Can Benefit Most From A Truist Checking Account?

Individuals seeking a hassle-free checking account will find Truist One Checking ideal. The account has no overdraft fees and offers automatic upgrades. This means fewer worries about extra charges and continuous improvement of account features.

New customers can benefit greatly. They can earn a $400 bonus for completing qualifying activities. This incentive makes it attractive for those looking to open a new checking account.

Truist One Checking is also suitable for tech-savvy users. The account includes online account management and a mobile app. These tools provide easy access and insights into financial activities.

Best Scenarios For Using Truist Checking Accounts

The account is perfect for those who need a quick and easy account opening. The process is fast and can be done online. This is convenient for people with busy schedules.

It is also great for users who make frequent deposits. To qualify for the $400 bonus, new customers must complete two direct deposits totaling $1,000 or more. This requirement makes it suitable for individuals with regular income.

Mobile banking enthusiasts will appreciate the secure and convenient mobile app. It allows users to monitor their accounts and gain financial insights on the go.

Recommendations For Specific Financial Needs

| Financial Need | Recommendation |

|---|---|

| No Overdraft Fees | Truist One Checking eliminates overdraft fees, making it suitable for individuals who want to avoid unexpected charges. |

| Incentive Offers | New customers can benefit from a $400 bonus by completing qualifying activities, ideal for those seeking extra financial perks. |

| Online and Mobile Access | For those who prefer managing their finances digitally, the online account management and mobile app provide secure and convenient access. |

Students and young adults will find this account especially beneficial. The minimum opening deposit is only $50, making it accessible for those with limited funds.

Individuals who require account stability will appreciate the reward forfeiture policy. It ensures the account must remain open and in good standing until the reward is deposited. This encourages consistent account management.

Conclusion: Maximizing Your Financial Freedom With Truist

Choosing the right checking account is crucial for achieving financial freedom. Truist One Checking offers flexibility, convenience, and valuable benefits, making it an excellent choice for managing your finances effectively.

Summary Of Key Points

Here are the main features and benefits of the Truist One Checking account:

| Features | Benefits |

|---|---|

| No overdraft fees | Avoid costly fees and manage your account with peace of mind. |

| Automatic account upgrades | Enjoy improved account features automatically as you meet certain criteria. |

| Online account management | Access and manage your account conveniently from anywhere. |

| Mobile app access | Monitor your account and gain financial insights on the go. |

Additional benefits include:

- $400 bonus for new checking customers

- Fast and easy online account opening

- Secure and convenient mobile app

Final Thoughts On Choosing Truist For Your Checking Account

Truist One Checking is ideal for individuals who seek a hassle-free and benefit-rich checking account. With no overdraft fees and automatic upgrades, managing your money becomes simpler. The $400 bonus is an attractive incentive for new customers, and the online and mobile account management tools make it easy to stay on top of your finances.

To maximize your financial freedom, consider opening a Truist One Checking account. Ensure you meet the eligibility criteria and use the promo code DC2425TR1400 during account opening to qualify for the offer.

Frequently Asked Questions

What Are The Benefits Of A Truist Checking Account?

A Truist checking account offers flexibility, convenience, and various features. It includes mobile banking, overdraft protection, and no monthly fees with a qualifying balance.

How To Open A Truist Checking Account?

You can open a Truist checking account online or at a branch. Provide personal information, identification, and initial deposit.

Does Truist Offer Mobile Banking?

Yes, Truist offers a robust mobile banking app. It allows you to manage your account, deposit checks, and pay bills.

Are There Fees For Truist Checking Accounts?

Truist checking accounts may have monthly fees. However, these can be waived with a qualifying balance or direct deposit.

Conclusion

Truist One Checking offers a flexible, hassle-free banking experience. With no overdraft fees and automatic upgrades, managing finances is easier. New customers can also earn a $400 bonus. Online account management and mobile app access provide convenience at your fingertips. Ready for a straightforward checking account? Explore more about Truist One Checking here.