Banking Apps For Budgeting: Master Your Finances Effortlessly

Managing your finances can be tough. Banking apps make it easier.

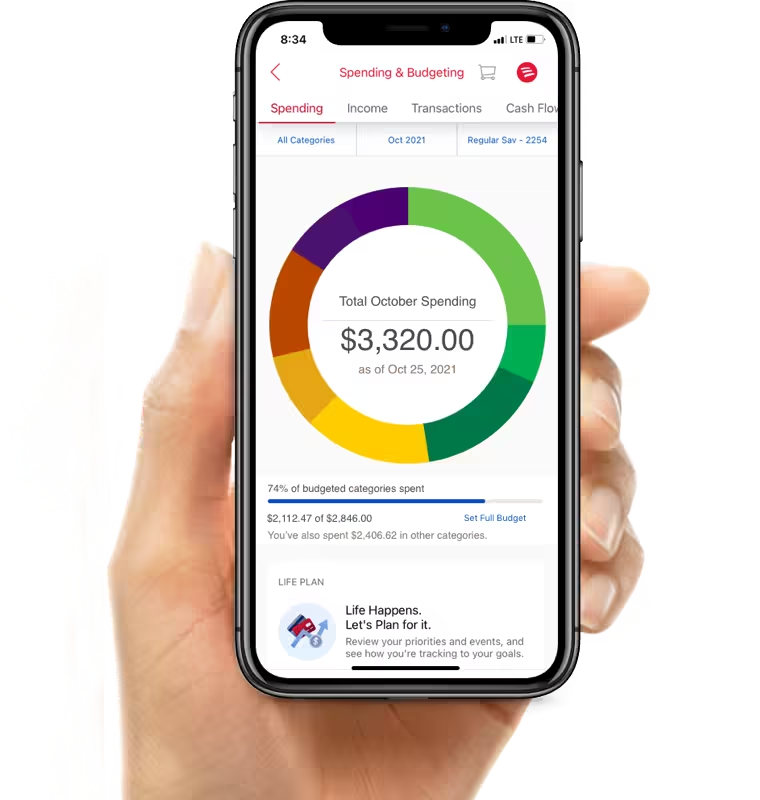

They help you keep track of your spending and savings. Budgeting is crucial for financial health. Banking apps offer a convenient way to manage your money. They provide real-time updates, spending insights, and budgeting tools. With these features, you can easily monitor your expenses and plan for the future. Whether you want to save for a big purchase or avoid overspending, banking apps can help. They simplify financial management and offer peace of mind. One great option is Truist One Checking. It offers no overdraft fees and automatic upgrades. Plus, you can earn a $400 reward as a new customer. Learn more about it here.

Introduction To Banking Apps For Budgeting

Budgeting is a crucial part of financial management. It helps you keep track of income and expenses. Banking apps for budgeting make this process easier. They offer tools to monitor spending, set goals, and manage your money effectively.

What Are Banking Apps For Budgeting?

Banking apps for budgeting are digital tools provided by financial institutions. These apps help users manage their finances. They allow you to track your spending, set financial goals, and monitor your savings. Many banking apps also offer features like automatic categorization of expenses, bill reminders, and alerts for unusual activity.

Some apps, like the Truist One Checking app, offer unique features. These include automatic upgrades and no overdraft fees. Users can earn a $400 reward by meeting specific criteria. For example, new customers must complete direct deposits totaling $1,000 within 120 days.

Why Budgeting Apps Are Essential For Financial Management

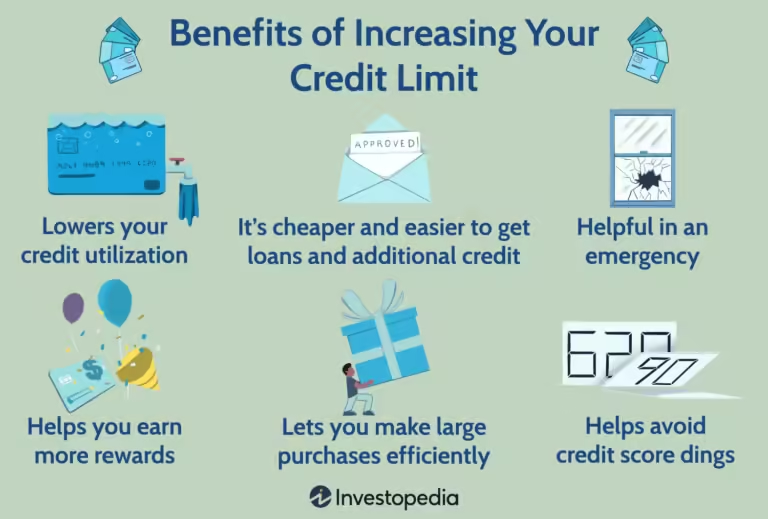

Budgeting apps are essential for several reasons. Firstly, they help you keep track of your spending. This can prevent overspending and help you stay within your budget. Secondly, these apps provide a clear picture of your financial health. They show your income, expenses, and savings in one place.

Moreover, budgeting apps can help you set and achieve financial goals. For instance, you can set a savings goal for a vacation or a new car. The app will track your progress and provide reminders. Additionally, apps like Truist One Checking simplify account management with automatic upgrades. They also save you money by eliminating overdraft fees.

| Feature | Description |

|---|---|

| Automatic Upgrades | Accounts are automatically upgraded to better plans as you grow financially. |

| No Overdraft Fees | Save money by not incurring overdraft charges. |

| $400 New Customer Reward | Earn a reward by meeting specific deposit criteria. |

In summary, banking apps for budgeting are indispensable tools. They help you manage your finances better and achieve your financial goals. Apps like Truist One Checking offer additional benefits, making financial management simpler and more rewarding.

Key Features Of Top Banking Apps For Budgeting

Banking apps have revolutionized the way we manage our finances. They offer a range of features that help users keep track of their spending and stay within budget. Here are some key features to look for in top banking apps for budgeting.

Automated Expense Tracking

Automated expense tracking allows users to categorize their spending automatically. This feature helps in easily identifying where the money goes. It reduces manual entry and saves time. Users can view their expenses in real-time.

Customizable Budget Categories

Top banking apps offer customizable budget categories. Users can create categories that fit their lifestyle. This feature allows for a personalized budgeting experience. It helps in tracking spending in specific areas like groceries, entertainment, and utilities.

Real-time Financial Insights

Real-time financial insights provide up-to-date information on account balances and spending patterns. This feature helps users make informed financial decisions. It offers insights into spending habits and financial health.

Integration With Multiple Accounts

Integration with multiple accounts is a crucial feature. It allows users to manage all their financial accounts in one place. This includes checking, savings, credit cards, and investment accounts. It offers a comprehensive view of one’s financial situation.

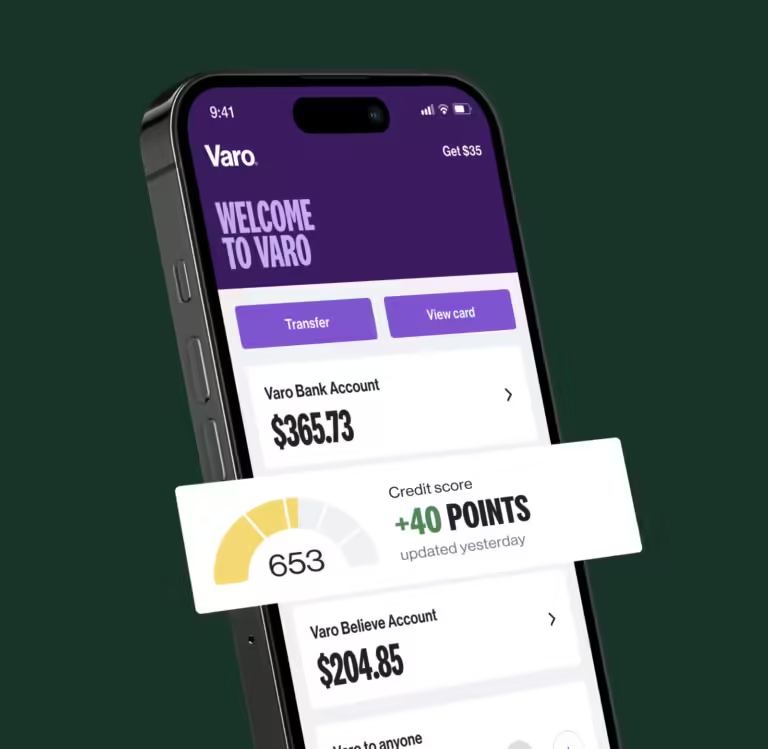

Goal Setting And Savings Plans

Goal setting and savings plans help users save for specific objectives. Users can set financial goals like saving for a vacation or an emergency fund. The app tracks progress and offers tips to reach these goals. It motivates users to save more effectively.

Pricing And Affordability Breakdown

Budgeting apps offer various pricing models to suit different needs. Understanding the cost and value of these apps helps make an informed decision. This section covers the pricing details and benefits of both free and premium versions of popular budgeting apps.

Free Vs. Premium Versions

Most budgeting apps provide both free and premium versions. Free versions often include essential features like:

- Expense tracking

- Basic budgeting tools

- Reports and summaries

Premium versions offer advanced features such as:

- Customizable categories

- Advanced analytics

- Priority customer support

- Integration with other financial tools

Choosing between free and premium depends on your financial goals and needs.

Cost Comparison Of Popular Budgeting Apps

| App Name | Free Version | Premium Version |

|---|---|---|

| App A | $0 | $5/month |

| App B | $0 | $10/month |

| App C | $0 | $7/month |

As seen, premium versions vary in price. Assessing what each app offers helps determine the best fit.

Value For Money: What You Get At Different Price Points

Free versions provide essential tools for tracking and budgeting. Premium versions, while more costly, offer significant benefits such as:

- Personalization: Customizable budgeting categories.

- Comprehensive Reports: Detailed financial analytics.

- Advanced Features: Integration with other financial tools.

Paying for a premium version can save time and provide deeper insights into your finances. Assessing your needs and budget helps decide whether the additional features are worth the cost.

For instance, if you need basic expense tracking, a free version suffices. If you require detailed financial analysis, a premium version is more suitable.

Pros And Cons Based On Real-world Usage

Banking apps for budgeting have both advantages and disadvantages. Real-world user experiences highlight these aspects. Understanding these can help you decide if a budgeting app fits your needs.

Ease Of Use

Many users appreciate the user-friendly interfaces of budgeting apps. They often feature simple navigation and clear instructions. This makes them accessible even for those less tech-savvy. Some apps offer tutorials and tips to help new users get started. However, a few users report that certain features can be confusing. The learning curve varies depending on the app’s complexity and design.

Security And Privacy Concerns

Security is a major concern for users. Banking apps handle sensitive financial data. Most apps use advanced encryption to protect information. They also require multi-factor authentication for added security. Despite these measures, some users remain wary. Concerns about data breaches and unauthorized access persist. It’s crucial to choose apps with strong security protocols and transparent privacy policies.

Customer Support And User Community

Good customer support is essential for resolving issues. Users value responsive and helpful support teams. Many apps offer live chat, email, and phone support. A strong user community can also be beneficial. Forums and social media groups provide a platform for users to share tips and solutions. Yet, some users experience delays in response times. Others find community forums less helpful for specific problems.

Accuracy And Reliability Of Financial Data

Accuracy in financial data is critical for effective budgeting. Most apps provide reliable data synchronization with bank accounts. This ensures up-to-date information on transactions and balances. Yet, some users report occasional discrepancies. Issues like delayed updates or missing transactions can occur. Regularly reviewing and verifying data can help mitigate these problems.

Specific Recommendations For Ideal Users Or Scenarios

When choosing the right banking app for budgeting, consider your unique needs. Different users have different requirements. Whether you’re a beginner, an advanced user, part of a family, or a small business owner, there’s an app tailored for you. Below are specific recommendations based on your scenario.

Best Apps For Beginners

Starting with budgeting can be overwhelming. Here are some apps that make it easy:

- Mint: This app offers an intuitive interface with simple budgeting tools. It helps track spending and offers personalized tips.

- YNAB (You Need A Budget): Ideal for beginners, YNAB provides step-by-step guidance on managing budgets and building savings.

Top Choices For Advanced Users

Advanced users require more detailed analytics and customization. Consider these options:

- Personal Capital: This app offers investment tracking and detailed financial reports. It’s perfect for users who want to manage both budgeting and investments.

- Quicken: Known for its comprehensive financial tools, Quicken provides robust features for advanced budgeting and financial planning.

Ideal Apps For Families And Shared Budgets

Managing a family budget requires collaboration. Here are the best apps for shared budgeting:

- Goodbudget: This app uses the envelope budgeting system, making it easy to allocate funds for different family expenses.

- Honeydue: Designed for couples, Honeydue allows sharing of expenses and budgets, fostering financial transparency.

Budgeting Apps For Small Business Owners

Small business owners need apps that handle both personal and business finances efficiently. These apps fit the bill:

- QuickBooks: Ideal for small businesses, QuickBooks offers invoicing, expense tracking, and financial reporting.

- Wave: This free app provides comprehensive tools for accounting, invoicing, and receipt scanning.

Choosing the right app ensures efficient budgeting and financial management. Whether you’re a beginner, advanced user, part of a family, or a small business owner, there’s an app that fits your needs.

| App Name | Best For | Key Features |

|---|---|---|

| Mint | Beginners | Intuitive interface, spending tracking |

| YNAB | Beginners | Step-by-step guidance, savings building |

| Personal Capital | Advanced Users | Investment tracking, financial reports |

| Quicken | Advanced Users | Comprehensive financial tools |

| Goodbudget | Families | Envelope budgeting, expense allocation |

| Honeydue | Families | Shared expenses, financial transparency |

| QuickBooks | Small Business Owners | Invoicing, expense tracking |

| Wave | Small Business Owners | Accounting tools, receipt scanning |

Frequently Asked Questions

What Are The Best Banking Apps For Budgeting?

Some top banking apps for budgeting include Mint, YNAB (You Need A Budget), and PocketGuard. These apps help users track expenses, set financial goals, and manage money efficiently.

How Do Banking Apps Help In Budgeting?

Banking apps assist in budgeting by categorizing expenses, tracking spending habits, and offering insights. They help users create budgets, set goals, and monitor financial health.

Are Banking Apps For Budgeting Secure?

Yes, most banking apps for budgeting use encryption and security protocols. They ensure user data is protected and transactions are secure.

Can Banking Apps Replace Traditional Budgeting Methods?

Yes, banking apps can replace traditional budgeting methods. They provide real-time tracking, automated categorization, and easy access to financial information, making budgeting more efficient.

Conclusion

Banking apps for budgeting can make financial management easier. They help track expenses. They also assist in setting and achieving savings goals. A reliable choice is Truist One Checking. It offers no overdraft fees and automatic upgrades. New customers can earn a $400 reward. Open an account online and meet the deposit criteria. Managing money has never been simpler. To learn more, visit the Truist website here. Start budgeting smartly with the right banking app today.