Truist Digital Banking Experience: Simplifying Your Financial Life

In today’s fast-paced world, managing finances efficiently is crucial. The Truist Digital Banking Experience offers a seamless way to handle your money online.

Truist’s digital platform is designed to make your banking life easier. From opening a Truist One Checking Account online to managing funds through their mobile app, Truist provides convenience at your fingertips. New customers can benefit from features like automatic account upgrades and no overdraft fees, making it a smart choice for hassle-free banking. Plus, with the chance to earn a $400 bonus by simply setting up direct deposits, the Truist Digital Banking Experience stands out as both user-friendly and rewarding. For more details, check out Truist’s offerings here.

Introduction To Truist Digital Banking

Truist Digital Banking offers a modern, secure, and convenient way to manage finances online. With a user-friendly interface and powerful features, it simplifies banking tasks and provides access to various services directly from a smartphone or computer.

Overview Of Truist Digital Banking

Truist Digital Banking includes several features designed to make banking easier:

- Mobile App: Manage accounts, pay bills, and transfer money on the go.

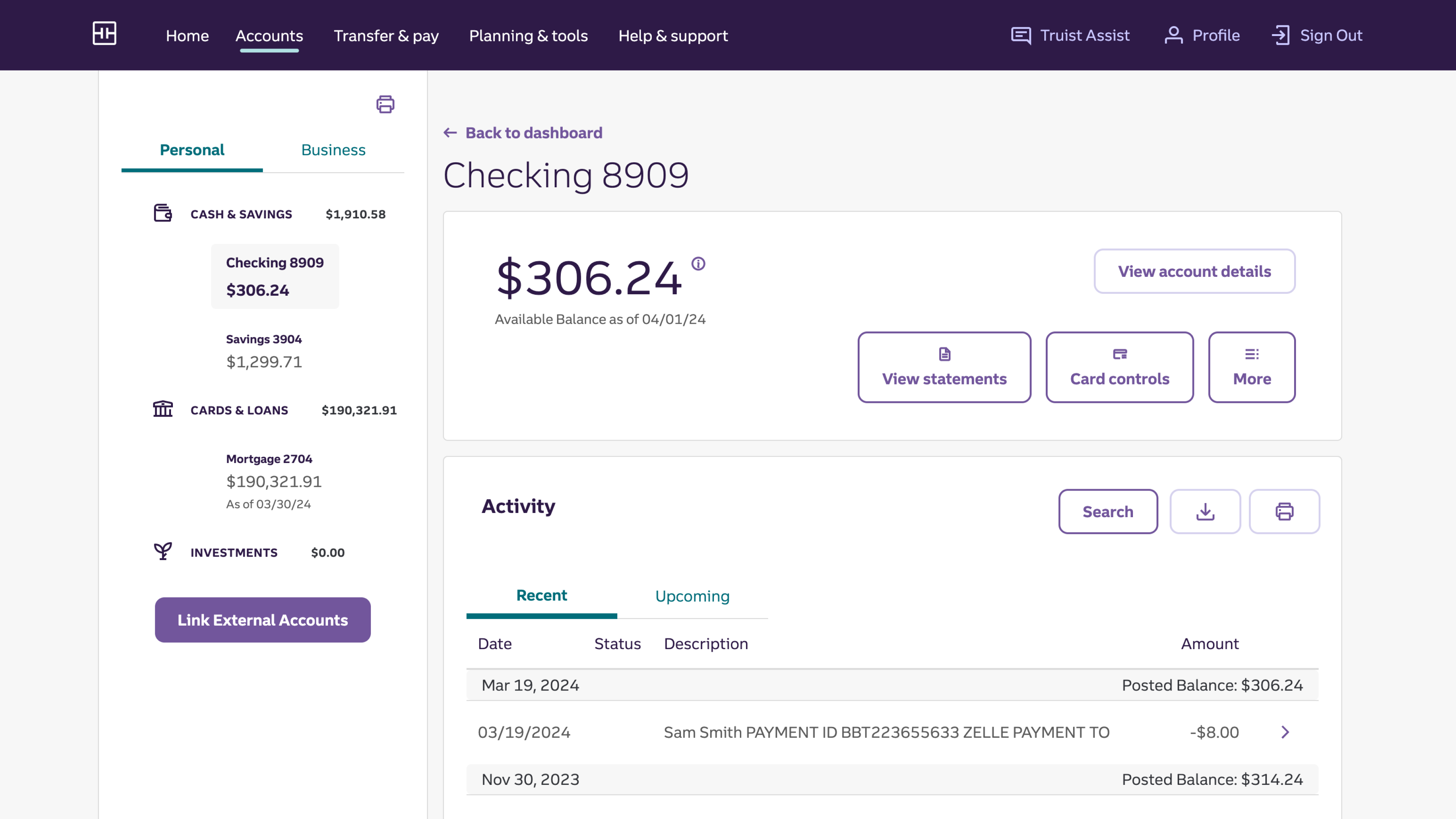

- Online Banking: Access account information, view transaction history, and perform banking tasks from any web browser.

- Security: Advanced security measures like two-factor authentication to protect user information.

- Customer Support: 24/7 support available through phone or chat to assist with any issues.

Purpose And Target Audience

The Truist Digital Banking platform aims to provide a seamless banking experience for all customers. It is especially beneficial for:

- Individuals who prefer managing their finances online.

- Customers looking for convenience and quick access to banking services.

- People who want to avoid overdraft fees and take advantage of automatic upgrades.

With features like the Truist One Checking Account, users can benefit from:

| Feature | Benefit |

|---|---|

| Automatic Upgrades | Account upgrades automatically based on usage and balance. |

| No Overdraft Fees | Helps customers avoid unexpected fees. |

| $400 Bonus Offer | New customers can earn $400 by opening an account online and completing qualifying direct deposits. |

The platform suits those who want to manage finances effortlessly and enjoy the benefits of modern banking.

Key Features Of Truist Digital Banking

Truist Digital Banking offers a modern, efficient, and secure way to manage your finances. Whether you’re checking your balance, transferring money, or paying bills, Truist has designed its digital banking experience to be simple and user-friendly.

Truist’s digital banking platform boasts a user-friendly interface that makes navigating your account easy. With intuitive menus and clear instructions, you can quickly find the features you need. The streamlined design ensures you can manage your finances efficiently without getting lost in complicated menus.

The Truist Mobile Banking App allows you to handle your banking needs on the go. Available for both Android and iOS devices, the app offers features like:

- Account balance checking

- Transaction history review

- Bill payments

- Mobile check deposits

With the app, you can manage your finances anytime and anywhere, making banking more convenient than ever.

Your security is a top priority with Truist. The platform uses advanced security measures to protect your personal information and transactions. Key security features include:

- Two-factor authentication

- Encryption technology

- Real-time fraud monitoring

These measures ensure that your data remains safe and secure, giving you peace of mind.

Truist offers a range of personal financial management tools to help you stay on top of your finances. These tools include:

- Budget tracking

- Spending analysis

- Financial goal setting

These features provide valuable insights into your spending habits and help you manage your money more effectively.

With Truist, money transfers and payments are seamless and straightforward. The platform supports:

- Internal transfers between Truist accounts

- External transfers to other banks

- Bill payments

- Peer-to-peer payments

Whether you need to pay a bill or send money to a friend, Truist makes it easy and fast.

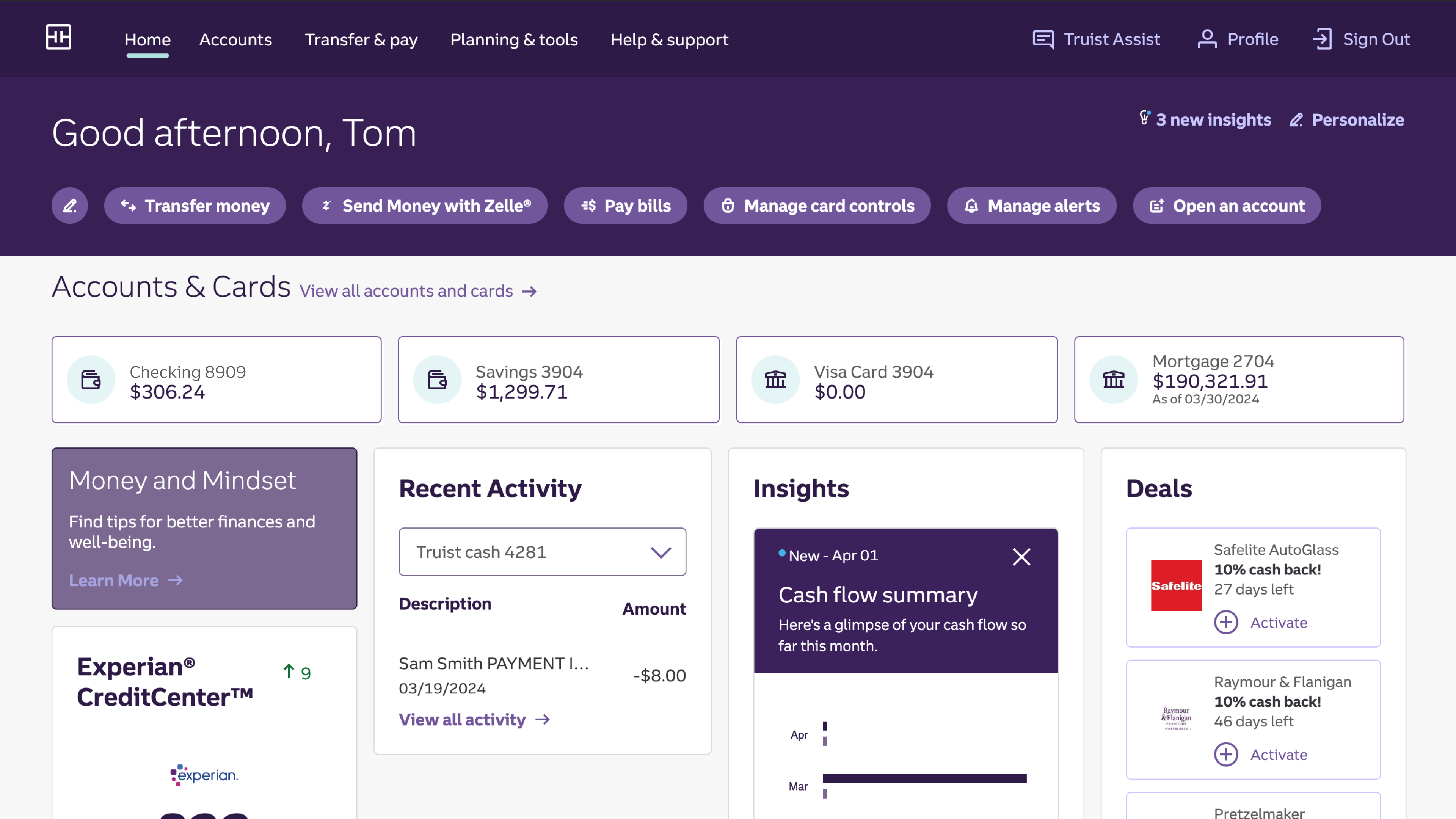

User-friendly Interface

The Truist Digital Banking Experience offers a user-friendly interface. This makes managing your finances simple and enjoyable. Let’s explore the key features of this interface.

Intuitive Navigation

The Truist platform features intuitive navigation. Users can easily find what they need without confusion. The main menu is clear and well-organized. Key functions like account overview, transfers, and bill pay are accessible with a single click.

| Feature | Benefit |

|---|---|

| Clear Menu | Find essential functions quickly |

| Quick Access | One-click access to key functions |

| Well-Organized Layout | Reduces confusion and saves time |

Customizable Dashboard

The customizable dashboard is another standout feature. Users can personalize their dashboard to suit their preferences. This includes rearranging widgets and selecting which information is displayed.

- Rearrange widgets for a tailored view

- Select which accounts and transactions are shown

- Track your spending and savings goals easily

This customization makes the Truist digital banking experience unique. It ensures that each user has a dashboard that meets their specific needs.

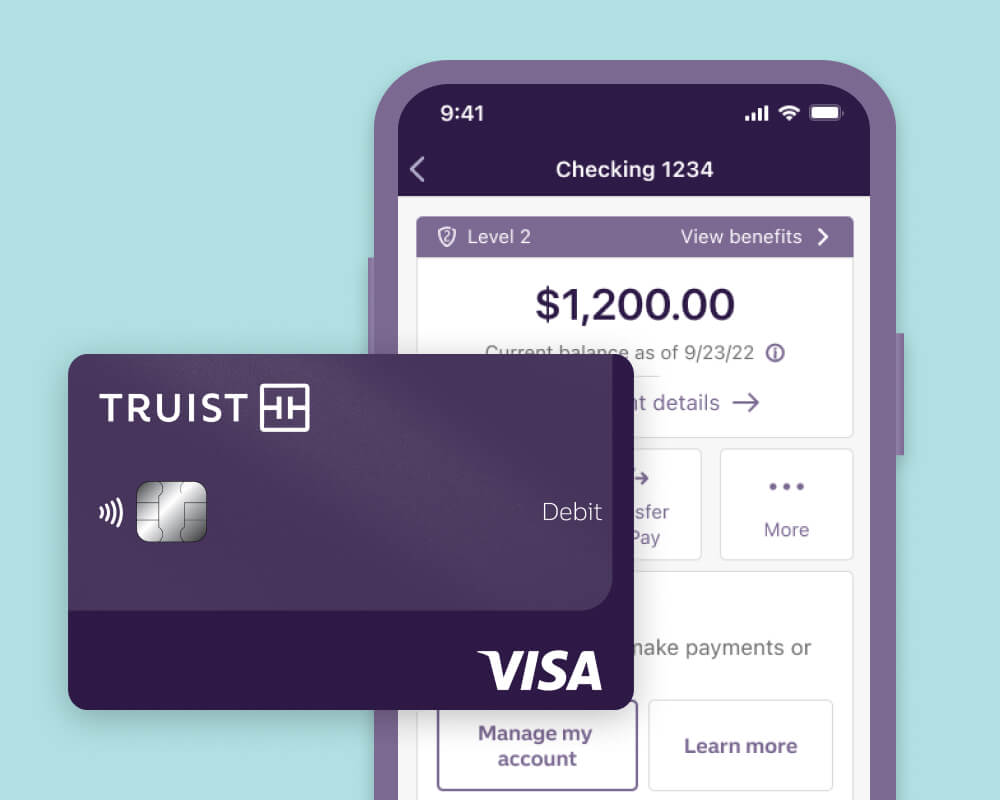

Mobile Banking App

The Truist Mobile Banking App offers a seamless and user-friendly experience. This app allows users to manage their finances on the go. Below, explore the features that make this app an essential tool for modern banking.

Access Anytime, Anywhere

With the Truist Mobile Banking App, you can access your accounts anytime, anywhere. Whether at home, work, or traveling, your banking needs are just a tap away. This flexibility ensures you stay on top of your finances effortlessly.

| Feature | Benefits |

|---|---|

| 24/7 Availability | Manage your accounts anytime |

| Global Access | Access your accounts from anywhere |

Mobile Check Deposit

Deposit checks quickly using your smartphone. The Truist app’s mobile check deposit feature saves time and trips to the bank. Simply take a photo of the check, enter the amount, and submit. It’s that easy.

- Quick and Convenient: Deposit checks in minutes

- Secure: Your data is protected

- Confirmation: Receive instant confirmation of your deposit

Real-time Alerts

Stay informed with real-time alerts. The Truist Mobile Banking App notifies you of important account activity. You can set up alerts for balance updates, transactions, and more. This helps you monitor your account and avoid surprises.

- Balance Alerts: Know your account balance instantly

- Transaction Alerts: Get notified of account activity

- Security Alerts: Stay aware of any unusual activity

Advanced Security Measures

Truist Digital Banking Experience offers robust security to ensure your financial data remains safe. With advanced security measures, you can bank online with confidence. Let’s explore the key features that safeguard your information.

Multi-factor Authentication

Multi-Factor Authentication (MFA) adds an extra layer of security to your account. It requires users to provide two or more verification methods. This could be something you know (password), something you have (security token), or something you are (fingerprint).

- Password: The first line of defense.

- Security Token: A unique code sent to your device.

- Biometric: Fingerprint or facial recognition.

With MFA, unauthorized access is significantly reduced, making your account safer.

Fraud Detection And Alerts

Truist employs advanced fraud detection systems. These systems monitor your account for suspicious activity.

Real-Time Monitoring: Transactions are analyzed instantly. If a transaction seems unusual, it gets flagged.

Alerts: You receive immediate notifications via SMS or email. This allows you to take action quickly to secure your account.

| Alert Type | Description |

|---|---|

| Login Alerts | Notifies you of any login attempts. |

| Transaction Alerts | Informs you of large or unusual transactions. |

These measures help prevent fraud and protect your funds.

Data Encryption

Data encryption ensures your information is secure during transmission and storage. Truist uses advanced encryption protocols to protect your data.

- SSL Encryption: Secures data during online transactions.

- Database Encryption: Protects stored data from unauthorized access.

These encryption methods make it nearly impossible for hackers to intercept your data.

With these advanced security measures, Truist Digital Banking Experience offers a secure and trustworthy platform for managing your finances.

Personal Financial Management Tools

Managing personal finances can be challenging. Truist Digital Banking offers intuitive tools to help you keep track of your money. These tools are designed to simplify budgeting, saving, and overall financial management, giving you greater control and peace of mind.

Budgeting And Expense Tracking

Truist’s budgeting tools help you plan and monitor your spending. You can categorize your expenses, set monthly budgets, and track your spending habits. This feature ensures you stay on top of your finances and avoid overspending.

- Set Categories: Create specific categories for various expenses like groceries, entertainment, and bills.

- Track Spending: Monitor your daily, weekly, and monthly spending in real-time.

- Visual Insights: Use graphs and charts to understand your spending patterns better.

Savings Goals And Progress Monitoring

Truist helps you set and achieve your savings goals. Whether you are saving for a vacation, a new gadget, or an emergency fund, the platform makes it easy to track your progress.

- Set Goals: Define your savings goals and target amounts.

- Monitor Progress: Regularly check your progress with visual tools and reminders.

- Automate Savings: Set up automatic transfers to your savings account to stay on track.

With these personal financial management tools, Truist Digital Banking simplifies managing your money. These features are especially useful for users of the Truist One Checking Account, who can benefit from automatic upgrades and no overdraft fees.

Seamless Money Transfers And Payments

The Truist digital banking experience offers seamless money transfers and payments. With Truist, you can manage your finances effortlessly. The platform ensures quick and secure transactions, making your life easier.

Instant Transfers Between Accounts

Truist allows instant transfers between your accounts. You can move money with just a few clicks. Whether it’s between your checking and savings accounts, the process is fast and efficient.

- Easy to use interface

- Secure and reliable

- Immediate fund availability

Bill Payment Services

Paying bills is a breeze with Truist’s bill payment services. You can schedule payments and set up automatic payments. This ensures you never miss a due date.

| Feature | Benefit |

|---|---|

| Automatic Payments | No missed due dates |

| Scheduling | Plan payments ahead |

| Reminders | Stay on top of your bills |

Peer-to-peer Payments

Truist offers peer-to-peer payments for splitting bills or sending money to friends. The process is simple and quick. You can use the Truist app to send money directly to another person’s account.

- Log in to your Truist account

- Select ‘Send Money’

- Enter the recipient’s details

- Confirm the amount and send

With these features, Truist ensures a smooth and hassle-free banking experience. Whether you need to transfer money, pay bills, or send funds to friends, Truist makes it easy and convenient.

For more information, visit the Truist website.

Pricing And Affordability

Understanding the pricing and affordability of Truist Digital Banking is essential. It helps you make informed decisions about your banking needs. Below, we break down the account fees and charges, and compare costs with competitors.

Account Fees And Charges

The Truist One Checking Account is designed to be cost-effective. Key features include:

- No Overdraft Fees: Customers avoid unexpected charges.

- Minimum Opening Deposit: Only $50 is required to open an account.

- Direct Deposit Requirement: At least two direct deposits to qualify for the promotional offer.

For new customers, there’s a $400 Bonus Offer. Open an account online and complete qualifying direct deposits to earn the bonus. Use the promotional code DC2425TR1400 during account opening. Note that this offer is valid from 10/31/2024 to 4/30/2025.

Cost Comparisons With Competitors

| Bank | Minimum Deposit | Overdraft Fees | Bonus Offer |

|---|---|---|---|

| Truist | $50 | None | $400 |

| Bank of America | $100 | $35 | $200 |

| Chase | $25 | $34 | $225 |

| Wells Fargo | $25 | $35 | $300 |

The table shows that Truist offers competitive pricing. The minimum deposit is lower than some competitors. No overdraft fees and a significant bonus offer make Truist an attractive option.

Pros And Cons Of Truist Digital Banking

Truist Digital Banking offers many features that make managing your finances easier. It is important to understand both the strengths and areas for improvement. Here, we explore the pros and cons of using Truist Digital Banking.

Strengths Of Truist Digital Banking

Truist Digital Banking provides numerous benefits that enhance the user experience.

- Automatic Upgrades: The Truist One Checking Account automatically upgrades based on usage and balance. This ensures you benefit from the best features as your financial situation improves.

- No Overdraft Fees: Avoid unexpected fees with no overdraft charges, giving you peace of mind.

- Convenience: Open an account easily online and manage it through the Truist mobile app. This makes accessing your finances simple and quick.

- $400 Bonus Offer: New customers can earn a $400 bonus by opening an account and completing qualifying direct deposits.

- Financial Management: The Truist mobile app provides insights and tools for better financial management.

- Multilingual Support: Assistance is available in multiple languages, including Spanish and Korean, ensuring broad accessibility.

Areas For Improvement

While Truist Digital Banking has many strengths, there are areas where it could improve.

- Direct Deposit Requirement: Customers must receive at least two direct deposits to qualify for promotional offers. This might be a hurdle for some users.

- Account Type Change: Changing your account type before receiving the bonus can result in reward forfeiture. This limits flexibility.

- Offer Validity: The promotional offer is only valid for a limited time, from 10/31/2024 to 4/30/2025. Customers must act within this period.

- Non-Transferable Offers: The promotional offer cannot be combined with other checking offers. This may limit the overall value you can receive.

- Tax Reporting: The value of the reward may be reported to the IRS, and any taxes are the responsibility of the recipient. This could reduce the net benefit of the bonus.

Understanding these pros and cons can help you decide if Truist Digital Banking is right for you.

Recommendations For Ideal Users

The Truist Digital Banking Experience offers a range of features tailored to meet the needs of various users. Below are recommendations for individuals and small businesses who can benefit the most from Truist One Checking Account.

Best Fit For Individuals

Individuals seeking a hassle-free checking account will find Truist One Checking Account ideal. The automatic upgrades based on usage and balance ensure that your account evolves with you. No overdraft fees protect you from unexpected charges, making it easier to manage your finances.

During the holiday season, the $400 bonus offer is a significant advantage for new customers. To qualify, open an account online and complete the qualifying direct deposits. The convenience of an easy online account opening process and access to the Truist mobile app for financial management make it a top choice for those prioritizing ease and efficiency.

| Feature | Benefit |

|---|---|

| Automatic Upgrades | Account adapts to your financial habits |

| No Overdraft Fees | Avoid unexpected charges |

| $400 Bonus Offer | Earn extra money during the holidays |

| Easy Online Account Opening | Quick and convenient setup |

| Truist Mobile App | Manage your account on the go |

Best Fit For Small Businesses

Small businesses looking for a reliable checking account will benefit from Truist One Checking Account. The automatic upgrades ensure that your account grows with your business. With no overdraft fees, small businesses can manage their cash flow without the worry of additional charges.

The $400 bonus offer can be an added incentive during the holiday season. Simply open an account online and complete the qualifying direct deposits. Small businesses will also appreciate the ease of online account opening and the Truist mobile app for managing finances and gaining insights on the go.

- Automatic Upgrades: Account evolves with your business needs.

- No Overdraft Fees: Helps manage cash flow efficiently.

- $400 Bonus Offer: Extra funds for your business.

- Easy Online Account Opening: Quick setup for busy entrepreneurs.

- Truist Mobile App: Financial management and insights.

For more details, visit the Truist website and refer to the full Terms and Conditions of the promotion.

Frequently Asked Questions

What Features Does Truist Digital Banking Offer?

Truist Digital Banking offers online bill pay, mobile check deposit, account alerts, and money transfers. It also includes budgeting tools and financial insights.

How Secure Is Truist Digital Banking?

Truist Digital Banking uses advanced encryption and multi-factor authentication. It ensures your financial information remains safe and secure.

Can I Deposit Checks Using Truist’s Mobile App?

Yes, Truist’s mobile app allows you to deposit checks easily. Simply take a photo of the check and follow the prompts.

Does Truist Digital Banking Support Budgeting Tools?

Yes, Truist Digital Banking includes budgeting tools. They help you track spending, set goals, and manage your finances effectively.

Conclusion

Experience banking with ease and reliability through Truist Digital Banking. The Truist One Checking Account offers automatic upgrades and no overdraft fees. This account makes managing money simple. New customers can earn a $400 bonus with qualifying direct deposits. Open an account online and start enjoying these benefits today. Visit the Truist website for more details and get started. Enjoy a hassle-free banking experience with Truist.