Best Credit Monitoring Apps: Secure Your Financial Future

In today’s digital world, protecting your credit is essential. Credit monitoring apps offer a way to keep your financial information secure.

They help detect fraud, identity theft, and suspicious activity. Finding the best credit monitoring app can be overwhelming with so many options available. This guide will help you navigate through some of the top choices, so you can make an informed decision. One standout option is EverSafe®, a tool designed for seniors and caregivers. EverSafe® monitors financial activities, provides smart alerts, and offers comprehensive protection. It helps prevent financial exploitation and provides peace of mind. By choosing the right app, you can safeguard your financial future and enjoy greater security. Read on to discover the best credit monitoring apps available today. For more information on EverSafe®, visit EverSafe.

Introduction To Credit Monitoring Apps

Credit monitoring apps have become essential tools for managing and protecting your financial health. These apps help you stay informed about your credit status and detect any suspicious activity quickly. They offer a convenient way to monitor your credit reports from the comfort of your phone or computer.

Why Credit Monitoring Is Essential

Credit monitoring is crucial because it helps you spot identity theft early. If someone tries to open a new account in your name, you will be alerted immediately. This allows you to take action before significant damage occurs.

Monitoring your credit can also help you maintain a healthy credit score. It ensures that all the information on your credit report is accurate. Errors on your credit report can lower your score and affect your ability to get loans or credit cards.

How Credit Monitoring Apps Can Help

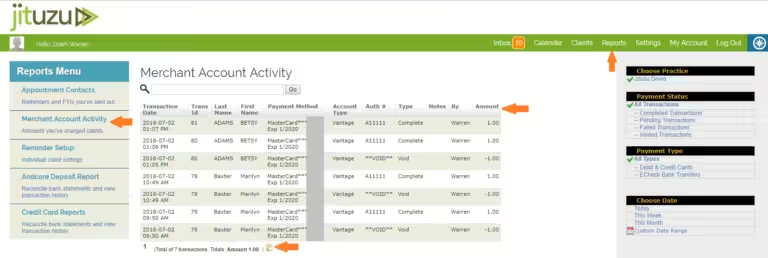

Credit monitoring apps provide several benefits. They offer real-time alerts for any unusual activities in your accounts. For example, EverSafe® sends notifications for changes in spending, dormant credit card use, and missing deposits.

These apps often provide comprehensive monitoring across various financial activities. EverSafe® monitors banking, credit card, investment, and retirement activities. It also tracks credit files from all three bureaus.

With personalized alerts, you can receive notifications via email, text, phone, or app, tailored to your preferences. EverSafe® also allows you to designate trusted individuals to receive alerts and assist in monitoring through the Trusted Advocate Feature.

Credit monitoring apps like EverSafe® offer specialized protection for seniors. They use enhanced algorithms to prevent financial exploitation and provide peace of mind for both seniors and their caregivers. The app is user-friendly and consolidates multiple accounts and institutions for easier monitoring.

Additionally, EverSafe® offers a 30-day free trial for new users. This allows you to experience the service and evaluate its effectiveness without any financial commitment.

| Main Features | Benefits |

|---|---|

| Smart Alerts | Prevents Financial Exploitation |

| Comprehensive Monitoring | Provides Peace of Mind |

| Personalized Alerts | 24/7 Support |

| Trusted Advocate Feature | User-Friendly |

| Fraud Remediation Support | Enhanced Protection for Seniors |

| Consolidated Family Dashboard |

For more information, you can contact EverSafe® at 1-888-575-3837 or visit their website at EverSafe.

Top Credit Monitoring Apps On The Market

In today’s digital age, monitoring your credit is crucial. Credit monitoring apps help protect against fraud and identity theft. Here, we will explore some of the best credit monitoring apps available.

Overview Of Leading Apps

Many apps on the market offer comprehensive credit monitoring. Let’s dive into a few of the top performers and what they bring to the table.

- EverSafe®: Designed for seniors, EverSafe® protects against fraud and identity theft. It also addresses age-related financial issues.

- Credit Karma: Offers free credit scores and reports from TransUnion and Equifax. It provides personalized recommendations.

- Experian: Provides daily credit report monitoring and alerts for any changes. It includes a free credit score.

- IdentityForce: Offers robust identity theft protection with credit monitoring. It includes alerts for suspicious activities.

Comparison Of Features And Benefits

| Feature | EverSafe® | Credit Karma | Experian | IdentityForce |

|---|---|---|---|---|

| Smart Alerts | Yes | No | Yes | Yes |

| Comprehensive Monitoring | Yes | Yes | Yes | Yes |

| Personalized Alerts | Yes | No | Yes | Yes |

| Trusted Advocate Feature | Yes | No | No | No |

| Fraud Remediation Support | Yes | No | No | Yes |

| Specialized Protection for Seniors | Yes | No | No | No |

EverSafe® stands out with features like Smart Alerts, Personalized Alerts, and specialized protection for seniors. It also offers comprehensive monitoring and a Trusted Advocate feature.

Credit Karma offers free credit scores and reports, but lacks some of the more personalized features like alerts and fraud support.

Experian provides daily monitoring and free credit scores, but it does not include a Trusted Advocate feature or specialized senior protection.

IdentityForce offers strong identity theft protection and comprehensive monitoring, but it lacks some senior-specific features available in EverSafe®.

For those seeking detailed protection and comprehensive monitoring, EverSafe® is a top choice, especially for seniors and their caregivers.

Key Features Of Credit Monitoring Apps

Credit monitoring apps provide essential tools to help you stay on top of your financial health. They offer various features to track and manage your credit, detect fraud, and provide financial insights. Let’s explore the key features of these apps:

Real-time Alerts And Notifications

One of the most crucial features of credit monitoring apps is real-time alerts and notifications. These alerts notify you about changes in your credit report, unusual spending patterns, or suspicious activities. For instance, EverSafe® offers smart alerts for changes in spending, dormant credit card use, missing deposits, and more. These alerts can be delivered via email, text, phone, or through the app, ensuring you stay informed at all times.

Credit Score Tracking And Reporting

Keeping track of your credit score is vital for maintaining financial health. Credit monitoring apps provide credit score tracking and reporting from major credit bureaus. EverSafe® offers comprehensive monitoring of credit files from all three bureaus. This feature helps you understand your credit score trends and make informed decisions to improve your creditworthiness.

Fraud Detection And Identity Theft Protection

Fraud detection and identity theft protection are essential in today’s digital age. Credit monitoring apps like EverSafe® are designed to protect against fraud and identity theft. They analyze financial activities across various accounts and institutions, providing fraud remediation support through access to former law enforcement professionals. The app also offers specialized protection for seniors, helping them avoid financial exploitation.

Financial Insights And Recommendations

Credit monitoring apps not only track your credit but also provide financial insights and recommendations. EverSafe® delivers personalized alerts and suggestions to help you manage your finances better. The app tracks upcoming and late bills, account balances, and more, offering a consolidated family dashboard for centralized monitoring of all family members’ accounts.

In summary, credit monitoring apps like EverSafe® provide a comprehensive suite of features to help you stay on top of your financial health. From real-time alerts and credit score tracking to fraud detection and financial insights, these apps are essential tools for managing your finances effectively.

| Feature | Description |

|---|---|

| Real-Time Alerts | Notifications for changes in spending, dormant credit card use, and more. |

| Credit Score Tracking | Comprehensive monitoring of credit files from all three bureaus. |

| Fraud Detection | Protection against fraud and identity theft, with fraud remediation support. |

| Financial Insights | Personalized alerts and suggestions for better financial management. |

Pricing And Affordability

When choosing the best credit monitoring apps, pricing and affordability are crucial factors. Some apps offer free plans, while others provide additional features at a cost. Understanding the pricing structure helps make an informed decision.

Free Vs. Paid Plans

EverSafe offers a 30-day free trial for new users. This allows users to experience its features without any financial commitment. Free plans often provide basic monitoring services but may lack advanced features.

Paid plans, on the other hand, typically offer comprehensive monitoring and enhanced protection. EverSafe’s paid plans include features like smart alerts, personalized notifications, and fraud remediation support.

Cost-benefit Analysis

When evaluating cost vs. benefits, consider the following:

- Smart Alerts: Notifications for suspicious activities and changes in spending.

- Comprehensive Monitoring: Tracks credit files from all three bureaus and monitors various accounts.

- Personalized Alerts: Alerts via email, text, phone, or the EverSafe App.

- Fraud Remediation Support: Access to former law enforcement professionals.

- Trusted Advocate Feature: Allows designating trusted individuals to assist in monitoring.

Weighing these features against the subscription cost helps determine the value of the investment.

Hidden Fees And Charges

EverSafe is transparent about its pricing. The 30-day free trial period means no hidden charges during the initial month. It’s important to review the terms and conditions of any service to ensure no unexpected fees.

For EverSafe, contacting customer support at 1-888-575-3837 can clarify any potential charges beyond the trial period.

Choosing the right credit monitoring app involves understanding the pricing and ensuring it aligns with your needs and budget. EverSafe’s offerings cater to different user requirements, providing both free and paid options with valuable features.

Pros And Cons Of Using Credit Monitoring Apps

Understanding the advantages and potential drawbacks of using credit monitoring apps can help you make an informed decision. These apps offer various benefits, but they also come with certain limitations.

Advantages Of Credit Monitoring Apps

Credit monitoring apps provide numerous benefits to users. Here are some of the key advantages:

- Real-Time Alerts: Apps like EverSafe® send notifications for changes in spending, dormant credit card use, and suspicious activities. This helps in quick identification and response to potential fraud.

- Comprehensive Monitoring: EverSafe® tracks account balances, bills, banking activities, credit card transactions, and credit files from all three bureaus. This ensures a holistic view of your financial health.

- Personalized Alerts: Users receive alerts via email, text, phone, or the app itself. This ensures that you are always informed, no matter where you are.

- Trusted Advocate Feature: EverSafe® allows members to designate trusted individuals to receive alerts. This is particularly helpful for seniors who may need assistance in monitoring their finances.

- Fraud Remediation Support: Access to former law enforcement professionals helps address and resolve any issues that arise.

- Consolidated Family Dashboard: EverSafe® provides centralized monitoring for all family members’ accounts. This feature simplifies the process of keeping track of multiple accounts and institutions.

- Specialized Protection for Seniors: Enhanced algorithms cater specifically to seniors, providing deeper protection and peace of mind.

Potential Drawbacks And Limitations

While credit monitoring apps offer many advantages, there are some potential drawbacks and limitations to consider:

- Cost: Although EverSafe® offers a 30-day free trial, there may be subscription fees involved after the trial period ends. This could be a concern for users on a tight budget.

- Privacy Concerns: Some users may be uncomfortable with the idea of sharing sensitive financial information with a third-party app. Ensuring the app has robust security measures is crucial.

- False Alarms: The app may sometimes flag legitimate transactions as suspicious, leading to unnecessary alerts and potential inconvenience.

- Reliance on Technology: Users need to be comfortable with using technology, as these apps require regular interaction and monitoring. For those not tech-savvy, this could be a barrier.

- Limited Scope: While comprehensive, these apps may not catch every fraudulent activity. Users should remain vigilant and not rely solely on the app for financial security.

Specific Recommendations For Ideal Users

Choosing the right credit monitoring app can be challenging. Different users have varying needs and preferences. Here are some specific recommendations based on common user requirements.

Best Apps For Budget-conscious Users

Budget-conscious users seek affordability without compromising essential features. Here are some top picks:

| App | Key Features | Price |

|---|---|---|

| Credit Karma | Free credit scores, reports, and monitoring | Free |

| Credit Sesame | Free credit score updates, identity theft insurance | Free |

| Mint | Budget tracking, credit score monitoring | Free |

Top Picks For Comprehensive Monitoring

Users needing comprehensive monitoring prefer apps that offer detailed insights and alerts. Here are the best options:

| App | Key Features | Price |

|---|---|---|

| EverSafe |

|

30-Day Free Trial |

| IdentityForce | Comprehensive credit monitoring, identity theft protection | $17.95/month |

| MyFICO | FICO score monitoring, identity theft insurance | $19.95/month |

Ideal Apps For Identity Theft Protection

Identity theft protection is crucial for many users. These apps offer robust features to safeguard your identity:

- EverSafe

- Specialized protection for seniors

- Smart Alerts for suspicious activities

- Personalized alerts and trusted advocate feature

- LifeLock

- Identity theft protection

- Credit monitoring

- Dark web monitoring

- IDShield

- Identity theft protection

- Credit monitoring

- Social security number monitoring

Frequently Asked Questions

What Are The Best Credit Monitoring Apps?

The best credit monitoring apps include Credit Karma, Mint, and Experian. These apps offer real-time alerts, credit score tracking, and identity theft protection. They are user-friendly and provide comprehensive credit reports.

How Do Credit Monitoring Apps Work?

Credit monitoring apps track changes in your credit report. They alert you to new accounts, inquiries, and potential fraud. This helps you stay informed about your credit status and take timely actions.

Are Credit Monitoring Apps Free?

Many credit monitoring apps offer free versions. Apps like Credit Karma and Mint provide free credit scores and reports. Some apps have premium features available for a fee.

Why Use A Credit Monitoring App?

Credit monitoring apps help you track your credit score and detect fraud. They provide alerts for suspicious activities, helping you protect your credit health.

Conclusion

Choosing the best credit monitoring app is crucial for financial security. Each app offers unique features for different needs. EverSafe® stands out for its comprehensive protection, especially for seniors. It monitors financial activity and offers personalized alerts. This helps prevent fraud and provides peace of mind. Check out EverSafe® here. Protect your finances today. Always stay informed and secure with the right app. Your financial wellness is worth the investment.