Financial Security Solutions: Unlocking Your Path to Stability

Financial security is essential for a stable and stress-free life. With numerous threats like fraud and identity theft, protecting your finances can feel overwhelming.

EverSafe® offers comprehensive financial security solutions tailored for seniors and caregivers. This tool acts as a vigilant guardian, monitoring your financial activities across multiple accounts. With features like smart alerts, comprehensive monitoring, and fraud detection, EverSafe® ensures you stay informed about any suspicious activities. Personalized alerts notify you and your trusted contacts about unusual financial behavior, helping to prevent significant financial damage. The platform also provides a consolidated family dashboard, making it easy to manage finances for multiple family members. EverSafe® offers peace of mind and round-the-clock support from fraud remediation experts, ensuring your finances are always secure. To learn more, visit EverSafe®.

Introduction To Financial Security Solutions

In today’s world, financial security is crucial. It’s important to safeguard your financial well-being from potential threats. Financial security solutions like EverSafe® offer tools to help you protect your finances. Let’s dive into what financial security is and the purpose behind these solutions.

Understanding Financial Security

Financial security means having a stable and secure financial status. It ensures that you can meet your financial needs and protect yourself from unexpected financial issues. Financial security includes having a good credit score, savings, and a secure way to manage your money.

EverSafe® provides tools to help users monitor their financial activities. This includes tracking credit card usage, savings, and preventing fraud.

Purpose Of Financial Security Solutions

Financial security solutions aim to protect individuals from financial threats. These threats can include fraud, identity theft, and financial exploitation. The purpose is to provide peace of mind and ensure users’ financial stability.

EverSafe® offers several features to achieve this purpose:

- Smart Alerts: Notifies users about changes in spending, cash usage, and suspicious activities.

- Comprehensive Monitoring: Tracks bills, account balances, and banking activities.

- Fraud Detection and Remediation: Identifies unusual activities and provides tools for resolution.

- Personalized Alerts: Customizes alerts based on the user’s financial history.

- Trusted Advocate Feature: Allows trusted individuals to receive alerts and assist in monitoring.

- Consolidated Family Dashboard: Manages all family finances from a single platform.

- Specialized Protection for Seniors: Offers enhanced algorithms for senior protection.

These features help users prevent financial exploitation and provide a sense of security. EverSafe® is designed to be easy to use and offers round-the-clock support.

For more information, visit EverSafe’s website.

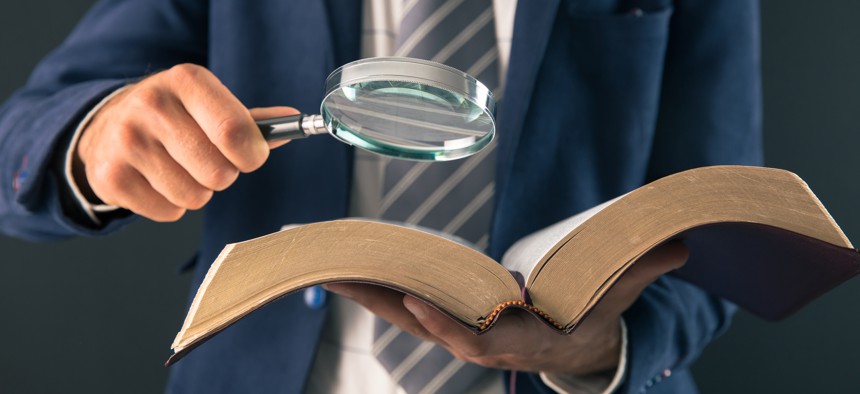

Key Features Of Financial Security Solutions

Financial security solutions like EverSafe® offer a range of tools to protect and manage your finances. These solutions are designed to provide peace of mind and ensure your financial well-being. Here are some key features that make EverSafe® a valuable financial wellness tool:

Comprehensive Financial Planning

EverSafe® provides comprehensive monitoring across multiple accounts and institutions. It tracks account balances, banking activities, credit files, and home values. This holistic view helps users make informed decisions and plan their finances effectively.

Risk Management And Insurance

EverSafe® is equipped with fraud detection and remediation features. It identifies unusual withdrawals, irregular investment activity, and late bill payments. The tool also offers round-the-clock support with access to fraud remediation experts, including former law enforcement professionals.

Investment Strategies

EverSafe® monitors investment activity and alerts users to any irregularities. The personalized alerts are based on the user’s financial history and can be delivered via email, text, phone, or the EverSafe App. This ensures that users are always aware of their investment performance and can take action if needed.

Debt Management

EverSafe® helps track upcoming and late bills, providing smart alerts for missing deposits and suspicious vendors. This proactive approach prevents financial exploitation and helps users manage their debts effectively. The tool’s user-friendly interface makes it easy to stay on top of financial obligations.

For more details on how EverSafe® can enhance your financial security, visit their website.

Pricing And Affordability Of Financial Security Solutions

Financial security solutions, such as EverSafe®, help protect your finances from fraud and identity theft. Understanding the cost of these services is crucial to determine their value and affordability. This section will cover the pricing details and compare costs with benefits, ensuring you find the right solution within your budget.

Cost Breakdown Of Different Services

EverSafe® offers a range of services designed to safeguard financial activities:

- Smart Alerts: Notifies about changes in spending, cash usage, and suspicious activities.

- Comprehensive Monitoring: Tracks bills, account balances, banking activities, and credit files.

- Fraud Detection and Remediation: Identifies anomalies and provides tools for resolution and recovery.

- Personalized Alerts: Customized alerts based on financial history, delivered via email, text, phone, or the app.

- Trusted Advocate Feature: Allows trusted individuals to receive alerts and assist in monitoring.

- Consolidated Family Dashboard: A single platform to manage all family finances and accounts.

- Specialized Protection for Seniors: Enhanced algorithms for deeper protection.

Pricing Details:

- 30-Day Free Trial: Users can try EverSafe® for 30 days at no cost.

Comparing Costs With Benefits

When evaluating financial security solutions, it’s essential to compare costs with the benefits they provide:

| Service | Benefit | Cost |

|---|---|---|

| Smart Alerts | Immediate notification of suspicious activities | Included |

| Comprehensive Monitoring | Tracks all financial activities | Included |

| Fraud Detection | Identifies and resolves fraud issues | Included |

The peace of mind and security provided by these features often outweigh the costs.

Affordable Options For Different Budgets

EverSafe® offers various options to fit different budgets:

- 30-Day Free Trial: Allows users to experience the service without any initial investment.

For more information, visit EverSafe’s website or contact their support team.

Pros And Cons Of Financial Security Solutions

Financial security solutions provide a way to protect your financial assets. Understanding their advantages and potential drawbacks can help you make an informed decision. Let’s explore the benefits and considerations of using such tools.

Advantages Of Implementing Financial Security Solutions

Financial security solutions offer several benefits, making them a valuable tool for many users. Here are some key advantages:

- Fraud Prevention: Tools like EverSafe® help to prevent financial exploitation by monitoring transactions and alerting you of suspicious activities.

- Comprehensive Monitoring: These solutions provide extensive tracking of bills, account balances, and credit files, ensuring you stay informed about your finances.

- Smart Alerts: EverSafe® offers personalized alerts to notify you and your trusted contacts about changes in financial activities, which can help in early detection of potential issues.

- Consolidated Family Dashboard: Manage all family finances from a single platform, making it easier to oversee multiple accounts and institutions.

- Peace of Mind: With round-the-clock support and access to fraud remediation experts, users can feel secure knowing their finances are protected.

Potential Drawbacks And Considerations

While financial security solutions offer many benefits, there are some potential drawbacks to consider:

- Cost: Although EverSafe® offers a 30-day free trial, ongoing use may require a subscription fee, which might be a consideration for some users.

- Complexity: Some users may find the initial setup and integration with multiple accounts a bit complex, especially if they are not tech-savvy.

- Privacy Concerns: Sharing financial information with a third-party service can raise privacy concerns for some individuals.

- Dependence on Technology: Relying heavily on technology for financial monitoring might be a drawback if there are technical issues or service disruptions.

Evaluating these pros and cons can help you decide if financial security solutions like EverSafe® are the right fit for your needs.

Recommendations For Ideal Users

EverSafe® offers a comprehensive solution for financial security. It is designed to protect against fraud, identity theft, and age-related financial issues. This tool is particularly beneficial for specific user groups. Below, we outline the best scenarios for utilizing financial security solutions and identify the target audience.

Best Scenarios For Utilizing Financial Security Solutions

EverSafe® is best suited for the following scenarios:

- Monitoring Multiple Accounts: Users with several bank accounts and credit cards.

- Protecting Seniors: Seniors and their caregivers needing enhanced protection.

- Family Financial Management: Families looking for a consolidated platform for financial oversight.

- Fraud Detection: Individuals concerned about unusual account activities and identity theft.

- Custom Alerts: Users requiring personalized financial alerts based on their history.

Target Audience: Who Can Benefit The Most

The following groups can benefit the most from EverSafe®:

| Target Audience | Benefits |

|---|---|

| Seniors | Enhanced protection against financial exploitation and fraud. |

| Caregivers | Ability to monitor and manage finances for seniors. |

| Families | Single platform for managing all family finances and accounts. |

| Individuals with Multiple Accounts | Comprehensive monitoring across various financial institutions. |

| Fraud-Conscious Users | Smart alerts and real-time notifications of suspicious activities. |

EverSafe® provides 24/7 support and an easy-to-use interface, ensuring peace of mind for all users. The 30-day free trial allows potential users to experience the benefits without upfront costs.

Conclusion: Achieving Stability Through Financial Security Solutions

Attaining financial stability is crucial for a stress-free life. Implementing comprehensive financial security solutions, like EverSafe®, can significantly contribute to this goal. By leveraging advanced features and smart alerts, individuals can safeguard their finances efficiently and effectively.

Summarizing The Benefits

EverSafe® offers numerous benefits that enhance financial security:

- Prevents Financial Exploitation: Stops exploiters before significant financial damage occurs.

- Peace of Mind: Provides a sense of security and helps users sleep better knowing their finances are monitored.

- Round-the-Clock Support: Access to fraud remediation experts, including former law enforcement professionals.

- Easy to Use: User-friendly interface and comprehensive support for users and their families.

Encouraging Action Towards Financial Stability

To achieve financial stability, take proactive steps:

- Utilize tools like EverSafe® to monitor and analyze financial activities.

- Set up smart alerts to stay informed about any unusual activity.

- Designate trusted individuals to assist in monitoring your finances.

- Take advantage of the 30-day free trial to experience the benefits firsthand.

Start your journey towards financial security today. Visit EverSafe for more information.

Frequently Asked Questions

What Is Financial Security?

Financial security means having enough resources to cover your expenses. It includes savings, investments, and insurance. It ensures a stable financial future.

Why Is Financial Security Important?

Financial security is crucial for peace of mind. It helps you handle emergencies and plan for the future. It ensures a comfortable lifestyle.

How Can I Achieve Financial Security?

To achieve financial security, start by budgeting. Save regularly, invest wisely, and get adequate insurance. Monitor and adjust your financial plan frequently.

What Are Financial Security Solutions?

Financial security solutions include savings accounts, investment plans, insurance policies, and retirement funds. These tools help you build and maintain financial stability.

Conclusion

EverSafe® offers comprehensive financial protection for seniors and their caregivers. Its smart alerts and monitoring provide peace of mind and security. The service tracks spending, detects fraud, and assists with resolution. With personalized alerts and round-the-clock support, users stay informed and safe. Try EverSafe for free for 30 days and experience its benefits firsthand. Learn more about EverSafe here.