Credit Card Offers For Bad Credit: Best Options To Rebuild Credit

Struggling with bad credit can be disheartening. But, there are credit card offers designed for people with bad credit.

If you have a low credit score, finding a suitable credit card can feel impossible. Many lenders hesitate to approve applications from individuals with poor credit history. However, some credit cards cater specifically to those needing to rebuild their credit. These cards can provide a pathway to improve your financial standing. They often come with unique benefits and features that help manage your finances better. This blog will explore some of the best credit card offers for those with bad credit, making it easier to find the right option for your needs. If you’re worried about financial security, consider using EverSafe®. It’s a comprehensive tool protecting against fraud and financial issues.

Introduction To Credit Card Offers For Bad Credit

Having bad credit can feel limiting, but it does not have to be the end of your financial journey. Credit card offers for bad credit can be a valuable tool to help rebuild your credit score and gain financial stability. This section will guide you through understanding bad credit, its implications, and how credit cards can assist in rebuilding credit.

Understanding Bad Credit And Its Implications

Bad credit typically means having a credit score below 580. This can result from various factors such as late payments, high credit card balances, or past bankruptcies. Bad credit has significant implications on your financial life, such as:

- Higher interest rates on loans and credit cards.

- Difficulty in getting approved for new credit.

- Higher insurance premiums.

- Challenges in renting an apartment.

Understanding these implications is crucial as it highlights the importance of taking steps to improve your credit score. Addressing bad credit can open doors to better financial opportunities and lower costs over time.

The Purpose Of Credit Cards For Rebuilding Credit

Credit cards for bad credit are specifically designed to help individuals rebuild their credit scores. These cards often come with higher interest rates and lower credit limits but offer a second chance to demonstrate responsible credit use. The main purposes of these credit cards include:

| Purpose | Description |

|---|---|

| Rebuilding Credit | Using the card responsibly and making timely payments can improve your credit score. |

| Financial Education | Helps users understand credit management and develop better financial habits. |

| Access to Credit | Provides access to credit which may not be available through traditional cards. |

By using credit cards for bad credit wisely, you can start to see improvements in your credit score. This can lead to better financial opportunities and lower interest rates in the future. Responsible credit use is key to this rebuilding process.

Key Features Of Credit Cards For Bad Credit

Credit cards for bad credit are designed to help individuals rebuild their credit scores. These cards come with unique features that make them accessible for those with less-than-perfect credit histories. Understanding these features can help you choose the right card for your financial situation.

Secured Vs. Unsecured Credit Cards: What’s The Difference?

Credit cards for bad credit can be either secured or unsecured.

| Secured Credit Cards | Unsecured Credit Cards |

|---|---|

| Require a security deposit | No security deposit needed |

| Deposit acts as credit limit | Credit limit based on credit score |

| Easier approval | Approval may be more difficult |

Low Credit Limits And Their Impact On Credit Building

Many credit cards for bad credit come with low credit limits. This can help you manage spending and avoid debt.

A low limit means using the card responsibly can positively impact your credit score. Keeping balances low and paying on time are crucial steps.

High Approval Rates For Individuals With Bad Credit

Credit cards for bad credit often have high approval rates. These cards are designed specifically for individuals with poor credit histories.

This high approval rate offers a chance to rebuild credit. By making timely payments, you can improve your credit score over time.

Top Credit Card Offers For Bad Credit

Finding a credit card when you have bad credit can be a challenge. However, several options cater specifically to individuals with poor credit scores. Below are the top credit card offers designed to help you rebuild your credit.

Discover It® Secured: Cash Back Rewards And No Annual Fee

The Discover it® Secured credit card is a great option for those with bad credit. It offers cash back rewards and has no annual fee, which makes it a cost-effective choice.

- Cash Back Rewards: Earn 2% cash back at gas stations and restaurants on up to $1,000 in combined purchases each quarter. Plus, 1% on all other purchases.

- No Annual Fee: Enjoy the benefits of this card without any annual fees.

- Security Deposit: A refundable security deposit, starting at $200, is required to open your account.

This card also offers free access to your FICO® Credit Score, helping you track your credit progress over time.

Capital One® Secured Mastercard®: Flexible Security Deposit

The Capital One® Secured Mastercard® is known for its flexible security deposit options, making it accessible for many people.

- Flexible Security Deposit: Depending on your creditworthiness, you might be able to get a $200 credit line with a refundable deposit of $49, $99, or $200.

- Credit Line Increase: Be automatically considered for a higher credit line in as little as six months.

- No Annual Fee: This card also does not charge an annual fee.

The card offers fraud coverage if your card is lost or stolen, providing you with peace of mind.

Opensky® Secured Visa® Credit Card: No Credit Check Required

The OpenSky® Secured Visa® Credit Card is unique because it does not require a credit check to apply.

- No Credit Check: OpenSky® does not check your credit history, making it easier for those with bad credit to get approved.

- Refundable Security Deposit: Your credit limit is determined by the amount of your refundable security deposit, starting at $200.

- Reports to All Three Major Credit Bureaus: Helps you build or rebuild your credit score by reporting your activity to the major credit bureaus.

Additionally, OpenSky® offers educational resources to help you understand and improve your credit score.

These credit card options provide various benefits and features to help individuals with bad credit rebuild their financial standing. Choose the one that best fits your needs and start working towards a better credit score.

How These Credit Cards Help Rebuild Credit

Credit cards designed for bad credit can be a powerful tool to rebuild your credit score. These cards offer several features and benefits that can help improve your credit over time. Here’s how they can assist in rebuilding your credit effectively:

Regular Reporting To Credit Bureaus

One of the most important features of credit cards for bad credit is that they regularly report your payment activity to the three major credit bureaus: Experian, Equifax, and TransUnion. This reporting is crucial for credit rebuilding as it ensures that your responsible use is reflected in your credit report.

- On-time payments positively impact your credit score.

- Consistent reporting helps establish a positive credit history.

- Missed payments are also reported, so timely payments are essential.

Opportunities For Credit Limit Increases

Many credit cards for bad credit offer opportunities for credit limit increases after demonstrating responsible use. This feature can significantly improve your credit score by reducing your credit utilization ratio.

- Start with a low credit limit to manage spending effectively.

- After several months of on-time payments, request a credit limit increase.

- Higher credit limits can lower your credit utilization ratio, improving your score.

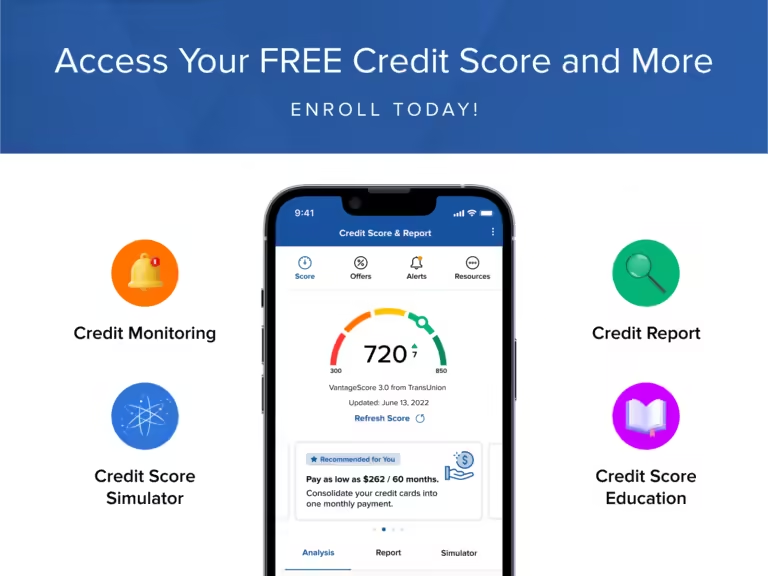

Access To Credit Education Tools And Resources

Credit cards for bad credit often come with access to credit education tools and resources. These tools can help you better understand and manage your credit.

| Tool/Resource | Benefit |

|---|---|

| Credit Score Monitoring | Track your credit score progress over time. |

| Financial Education Articles | Learn tips and strategies for improving your credit. |

| Budgeting Tools | Manage your finances and avoid overspending. |

Using these tools effectively can help you make informed decisions, avoid common pitfalls, and steadily improve your credit score.

Pricing And Affordability

Understanding the pricing and affordability of credit card offers for bad credit is crucial. This will help you make informed decisions. Below, we break down the key aspects that affect costs.

Annual Fees And Their Impact On Affordability

Annual fees are common with credit cards for bad credit. They can range from $0 to $99 or more. Higher fees can impact your budget. Choose a card with lower fees if possible.

| Card Type | Annual Fee Range |

|---|---|

| Secured Credit Cards | $0 – $50 |

| Unsecured Credit Cards | $30 – $99 |

Consider if the card offers benefits that justify the fee. For example, some cards provide credit monitoring services or cashback rewards. Weigh these benefits against the cost of the fee.

Interest Rates: What To Expect And How To Manage

Interest rates on credit cards for bad credit tend to be higher. Expect APRs between 20% and 30%. High interest can increase your debt quickly.

Here are some tips to manage high interest rates:

- Pay your balance in full each month.

- Make payments on time to avoid extra charges.

- Use the card only for essential purchases.

Monitoring your spending is vital. Tools like EverSafe® can help you track your credit card activity and alert you to unusual spending patterns.

Additional Fees To Be Aware Of

Credit cards for bad credit may have additional fees that add to the cost. These can include:

- Late payment fees

- Foreign transaction fees

- Balance transfer fees

- Cash advance fees

These fees can range from $35 to 5% of the transaction amount. Read the card’s terms carefully to understand all potential charges. Avoid unnecessary fees by using the card responsibly.

Pros And Cons Of Credit Cards For Bad Credit

Credit cards for bad credit come with their own set of benefits and drawbacks. Understanding these pros and cons can help you make informed decisions about whether these cards are right for you.

Pros: Building Credit History And Financial Discipline

One of the main advantages of credit cards for bad credit is the ability to build a credit history. By using the card responsibly, you can demonstrate your ability to manage credit, which can improve your credit score over time.

- Timely payments report to credit bureaus.

- Helps establish a positive payment history.

- Increases your credit score gradually.

Additionally, these cards can help you develop financial discipline. With lower credit limits, you are less likely to overspend, promoting better budgeting habits.

- Encourages regular monitoring of spending.

- Helps in managing a smaller credit line effectively.

- Teaches the importance of paying off balances.

Cons: High Fees And Interest Rates

On the downside, credit cards for bad credit often come with high fees and interest rates. These can include annual fees, maintenance fees, and higher-than-average interest rates, which can make these cards expensive to maintain.

| Fee Type | Average Cost |

|---|---|

| Annual Fee | $25 – $99 |

| Maintenance Fee | $5 – $12/month |

| Interest Rate | 20% – 30% APR |

These high costs can make it difficult to pay off balances, potentially leading to more debt. It’s essential to weigh these financial burdens before deciding on a card.

Real-world User Experiences

Many users have shared their experiences with credit cards for bad credit. Some find these cards helpful in rebuilding their credit scores. They appreciate the opportunity to show responsible credit use.

“After a few months of regular payments, my credit score started to improve. The card helped me get back on track.”

Others, however, highlight the downsides of high fees and interest rates. They express frustration over the cost of maintaining the card.

“The fees add up quickly. It feels like I’m always paying more than I’m using.”

These real-world experiences underscore the importance of understanding both the pros and cons before applying for a credit card for bad credit.

Specific Recommendations For Ideal Users

Finding the right credit card for bad credit can be challenging. We have specific recommendations for different types of users. These tailored options can help you build or rebuild your credit effectively.

Best Options For Those New To Credit

For individuals new to credit, a secured credit card is often the best choice. These cards require a refundable security deposit, which becomes your credit limit.

- Discover it® Secured: This card offers cashback rewards, no annual fee, and reports to all three credit bureaus.

- Capital One® Secured Mastercard®: A minimal deposit is required, and it provides access to a higher credit line after making your first five monthly payments on time.

Both options help you establish credit history while providing some perks.

Ideal Choices For Rebuilding After Financial Hardship

Rebuilding credit after financial hardship requires a card that reports to all three credit bureaus and offers tools to help manage your finances.

| Card Name | Features |

|---|---|

| Credit One Bank® Platinum Visa® for Rebuilding Credit | Offers 1% cashback rewards and monitors your credit score. |

| Indigo® Platinum Mastercard® | Provides pre-qualification with no impact on your credit score. |

These cards offer a pathway to recovery with benefits such as cashback rewards and credit monitoring.

Suggestions For Individuals With Limited Credit History

If you have limited credit history, consider a student credit card or an entry-level card with lenient approval criteria.

- Deserve® EDU Mastercard for Students: No annual fee and offers 1% cashback on all purchases.

- Petal® 2 “Cash Back, No Fees” Visa® Credit Card: No fees, cashback rewards, and reports to all three major credit bureaus.

These cards are excellent for building your credit history with ease.

For more detailed financial monitoring and protection, consider using EverSafe®. This tool offers a comprehensive financial wellness solution. It monitors multiple accounts, alerts suspicious activities, and provides round-the-clock support.

Learn more about EverSafe® here.

Frequently Asked Questions

What Are Credit Card Options For Bad Credit?

There are several credit card options for bad credit, including secured cards, subprime cards, and cards with higher interest rates.

How Can I Improve My Credit Score?

You can improve your credit score by paying bills on time, reducing debt, and regularly checking your credit report for errors.

Are Secured Credit Cards Good For Bad Credit?

Yes, secured credit cards are good for bad credit. They require a deposit, which acts as your credit limit.

Can I Get A Credit Card With No Credit Check?

Some credit cards for bad credit do not require a credit check, but they may have higher fees and interest rates.

Conclusion

Finding the right credit card for bad credit can be challenging. Remember to compare offers and read the fine print. Consider tools like EverSafe for added financial security. This service helps protect against fraud and identity theft. Stay informed and make wise choices to rebuild your credit.