Small Business Credit Cards: Boost Your Business Efficiency

Small business credit cards can be a game changer for entrepreneurs. They provide essential financial flexibility and rewards.

Managing finances in a small business can be challenging. That’s where small business credit cards come in handy. These cards offer numerous benefits, including cash back, travel rewards, and the ability to separate personal and business expenses. But with so many options available, how do you choose the right one for your business? In this blog, we will explore the world of small business credit cards, discussing their advantages and how they can help streamline your business finances. Whether you are looking to manage cash flow, earn rewards, or build credit, finding the perfect card can be a crucial step for your business growth. Ready to get started on improving your business health? Check out the Hello Alice Business Health Score™ Assessment for a personalized growth plan and insightful analysis at Hello Alice.

Introduction To Small Business Credit Cards

Small business credit cards are essential tools for entrepreneurs. They help manage expenses, build credit, and streamline cash flow. Understanding their importance and functionality can significantly benefit your business.

What Are Small Business Credit Cards?

Small business credit cards are financial products designed for business-related expenses. They offer a line of credit that businesses can use to make purchases, pay for services, and handle other operational costs.

These cards often come with unique features tailored to business needs. This includes higher credit limits, rewards programs, and detailed expense tracking.

Purpose And Importance For Small Businesses

Small business credit cards serve several critical purposes. They help separate personal and business expenses, simplifying accounting and tax reporting. This separation is crucial for accurate financial management.

Using a business credit card also helps in building your business credit score. A good credit score opens doors to better financing options and lower interest rates.

Moreover, these cards often offer rewards such as cash back, travel points, or discounts on business-related purchases. These rewards can translate into significant savings over time.

Small business credit cards, like the Hello Alice Business Health Score™ Assessment, can also provide valuable insights. The assessment helps you understand your business’s financial health from various stakeholders’ perspectives. It offers personalized growth plans, step-by-step frameworks, and rewards for growth.

Main Features of Hello Alice Business Health Score™ Assessment:

- Personalized Growth Plan: Customized plans to position your business for success.

- Health Score Measurement: Assess how stakeholders view your business health.

- Step-by-Step Frameworks: Detailed frameworks to optimize business health.

- Rewards for Growth: Unlock grants, discounts, and other opportunities as you grow.

Benefits:

- Ensure your business is financially sound.

- Gain a comprehensive understanding of your business health.

- Follow personalized guidelines to enhance performance.

- Join a network of 1.4 million businesses focused on growth.

Getting Started:

- Measure your business health.

- Utilize personalized frameworks to improve your score.

- Take advantage of growth opportunities.

For more information and to get started, visit the Hello Alice website.

Key Features Of Small Business Credit Cards

Small business credit cards offer a range of features designed to support business growth and financial management. These cards provide tools that help track expenses, offer rewards, manage employee spending, and often come with low fees and special introductory offers.

Expense Tracking And Management Tools

Many small business credit cards come with expense tracking and management tools. These features allow businesses to monitor spending, categorize expenses, and generate detailed reports. Such tools help in budgeting and financial planning.

| Feature | Description |

|---|---|

| Expense Categorization | Automatically sorts expenses into categories for easy tracking. |

| Spending Reports | Generate monthly or quarterly reports for better financial oversight. |

Rewards And Cashback Programs

Small business credit cards often offer rewards and cashback programs. These programs provide points or cashback on eligible purchases, which can be redeemed for travel, office supplies, or other business needs.

- Earn points on every dollar spent.

- Redeem points for travel, merchandise, or statement credits.

- Receive cashback on common business expenses.

Employee Card Issuance And Control

Issuing cards to employees helps in managing business expenses. Small business credit cards offer employee card issuance and control features. Business owners can set spending limits, track transactions, and monitor usage in real-time.

- Set individual spending limits for each employee.

- Monitor employee spending and transactions.

- Generate separate reports for each card.

Low Or No Annual Fees

Many small business credit cards come with low or no annual fees. This makes them a cost-effective option for managing business expenses without the burden of high fees.

| Card Type | Annual Fee |

|---|---|

| Basic Business Card | $0 |

| Rewards Business Card | $95 |

Introductory Apr Offers

Small business credit cards often feature introductory APR offers. These offers include 0% APR on purchases or balance transfers for a limited time, helping businesses manage cash flow and reduce interest costs.

- 0% APR on purchases for the first 12 months.

- 0% APR on balance transfers for the first 12 months.

- Variable APR applies after the introductory period.

Pricing And Affordability Breakdown

Understanding the pricing and affordability of small business credit cards is crucial. This section will cover annual fees, interest rates, comparisons, and hidden costs. By the end, you will have a clear picture of what to expect financially from small business credit cards.

Annual Fees And Interest Rates

Most small business credit cards come with annual fees and varying interest rates. These fees can range from $0 to several hundred dollars annually. Interest rates typically depend on your credit score and financial health.

| Card Name | Annual Fee | Interest Rate |

|---|---|---|

| Card A | $95 | 15.99% – 22.99% |

| Card B | $0 | 13.99% – 20.99% |

| Card C | $199 | 14.99% – 23.99% |

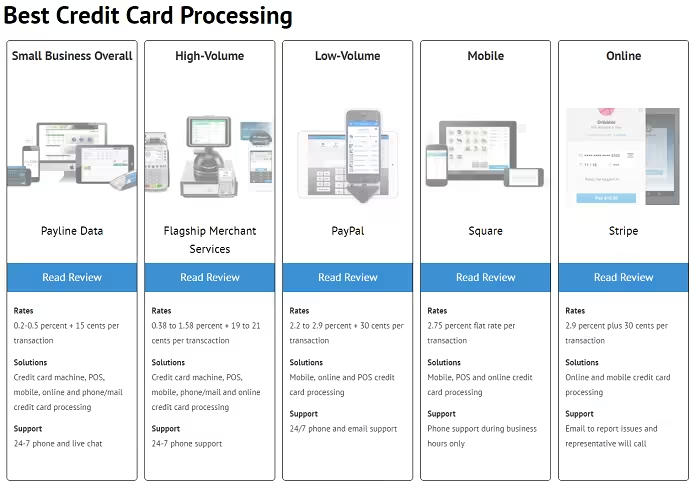

Comparison Of Popular Small Business Credit Cards

Comparing popular small business credit cards helps in making an informed decision. Below is a brief comparison of top cards available in the market:

- Card A: Best for cash back rewards, $95 annual fee, 15.99% – 22.99% interest rate.

- Card B: Best for no annual fee, 13.99% – 20.99% interest rate.

- Card C: Best for travel rewards, $199 annual fee, 14.99% – 23.99% interest rate.

Hidden Costs To Watch Out For

Hidden costs can significantly affect the total cost of owning a small business credit card. Be aware of the following:

- Foreign Transaction Fees: Charges for transactions made outside the country.

- Late Payment Fees: Fees for not paying your bill on time.

- Over-Limit Fees: Charges for exceeding your credit limit.

By understanding these hidden costs, you can better manage your finances and avoid unexpected expenses.

For more details on improving your business financial health, check out the Hello Alice Business Health Score™ Assessment. It offers a comprehensive evaluation and personalized growth plans to ensure your business is financially fit and ready for growth opportunities.

Pros And Cons Of Small Business Credit Cards

Small business credit cards offer both benefits and potential risks. Understanding these can help you make informed decisions for your business. Below, we explore the advantages and drawbacks of using small business credit cards.

Advantages Of Using A Small Business Credit Card

Small business credit cards come with various advantages that can benefit your business:

- Cash Flow Management: Credit cards help manage cash flow by covering expenses during low revenue periods.

- Expense Tracking: They offer detailed expense tracking, making financial management easier.

- Rewards and Incentives: Many cards provide rewards, cashback, and other incentives for spending.

- Build Business Credit: Responsible use can help build your business credit score.

- Separating Finances: Keeping business and personal expenses separate simplifies accounting.

Potential Drawbacks And Risks

While there are clear benefits, small business credit cards also come with some risks:

- High Interest Rates: Carrying a balance can result in high interest charges.

- Debt Accumulation: Easy access to credit can lead to significant debt if not managed properly.

- Personal Liability: Some cards may require a personal guarantee, putting personal assets at risk.

- Impact on Credit Score: Late payments or high balances can negatively impact your credit score.

- Fees: Annual fees, late payment fees, and other charges can add up.

Specific Recommendations For Ideal Users Or Scenarios

Choosing the right small business credit card can significantly impact your business’s financial health. Different businesses have different needs, and the ideal credit card can vary based on factors such as monthly expenses, the need for rewards, or managing employee spending. Below are specific recommendations for different business scenarios.

Best For Startups And New Businesses

Startups and new businesses often need a credit card that offers flexibility and support in the initial stages. Cards with low or zero annual fees and introductory 0% APR offers are ideal. These features help manage cash flow and avoid interest charges while the business is still growing.

Best For Businesses With High Monthly Expenses

Businesses with high monthly expenses should look for credit cards that offer higher credit limits and rewards on large purchases. Some cards provide extra points or cashback on categories like travel, office supplies, or advertising, which can add up quickly for businesses with substantial spending.

Best For Businesses Seeking Rewards And Cashback

If your business is focused on earning rewards and cashback, select a card that offers generous rewards programs. Look for cards that provide higher points or cashback on common business expenses like gas, travel, and dining. Some cards also offer sign-up bonuses, which can provide a significant boost to your rewards balance.

Best For Managing Employee Spending

For businesses that need to manage employee spending, a card that offers individual spending limits and real-time expense tracking is essential. These features allow you to control and monitor employee expenditures, ensuring that all spending aligns with company policies and budgets.

By choosing a credit card that fits your specific business scenario, you can optimize your financial management and support your business’s growth. For more tailored recommendations and to assess your business health, consider using the Hello Alice Business Health Score™ Assessment.

Frequently Asked Questions

What Are Small Business Credit Cards?

Small business credit cards are financial tools designed for business expenses. They help manage cash flow, track spending, and earn rewards.

How Do Small Business Credit Cards Work?

They work like personal credit cards. You make purchases, pay monthly bills, and can earn rewards. They also help build business credit.

Can I Get Rewards With Business Credit Cards?

Yes, many small business credit cards offer rewards. These can include cashback, travel points, or discounts on business purchases.

Are Small Business Credit Cards Tax-deductible?

Interest and fees on business credit cards can be tax-deductible. Always consult a tax professional for specific advice.

Conclusion

Small business credit cards can be a valuable tool. They help manage expenses and build credit. Choosing the right card is crucial. Evaluate your business needs and compare options. Consider rewards, fees, and interest rates. For a deeper financial understanding, consider using the Hello Alice Business Health Score™ Assessment. It offers personalized growth plans and insightful analysis. This tool helps improve your business health score and unlocks potential growth opportunities. Start today and position your business for success.