Mobile Credit Card App: Revolutionizing Your Payment Experience

In today’s digital age, managing finances has never been easier. Mobile credit card apps have revolutionized how we handle our money.

If you’re seeking a reliable and user-friendly mobile credit card app, look no further than the Firstcard® Secured Credit Builder Card. Designed with both international students and immigrants in mind, this app offers a seamless way to build credit without an SSN. With no credit check required, 0% APR, and up to 15% cashback at over 29,000 partner merchants, it’s a smart choice for anyone looking to manage their finances effectively. Additionally, Firstcard® provides multilingual customer support and reports to all three major credit bureaus, ensuring a comprehensive financial solution. Discover more about this excellent financial tool and start building your credit today by visiting Firstcard.

Introduction To Mobile Credit Card Apps

Mobile credit card apps are transforming the way we manage our finances. They offer a convenient, secure, and efficient way to handle credit card transactions, track spending, and build credit history. One such app making waves is the Firstcard® Secured Credit Builder Card, designed to help individuals, including international students and immigrants without an SSN, build their credit history.

What Is A Mobile Credit Card App?

A mobile credit card app allows users to manage their credit card accounts directly from their smartphones. These apps offer a range of features such as tracking spending, making payments, viewing transaction history, and even earning rewards. The Firstcard app, for instance, provides features like no credit check, 0% APR, and up to 15% cashback at over 29,000 partner merchants.

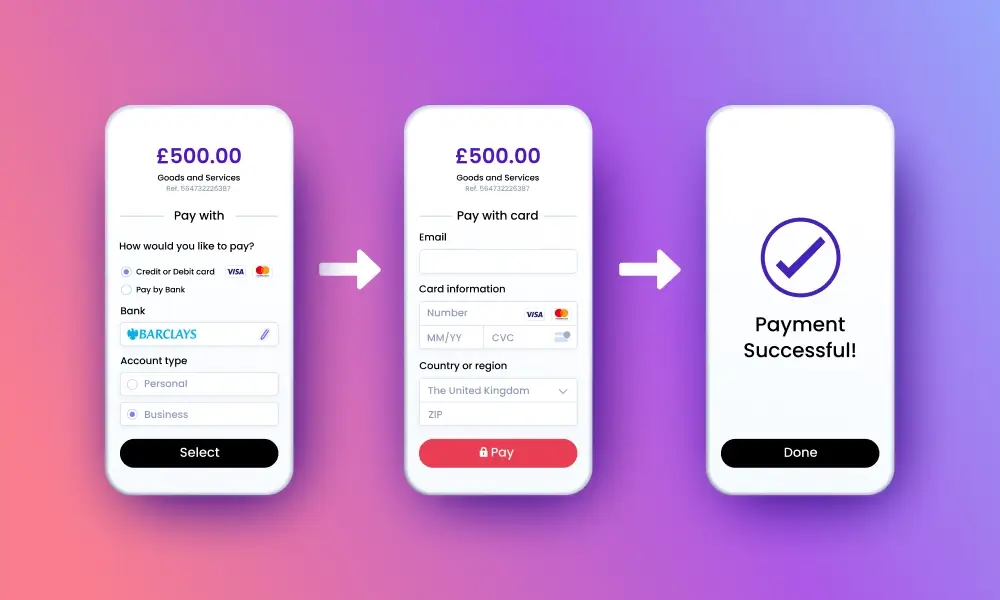

The Evolution Of Payment Methods

The way we make payments has evolved significantly over the years. From cash transactions to credit cards, and now mobile payment apps, each step has made the process more convenient and secure. Mobile credit card apps like Firstcard are the latest innovation, offering features like no late fees, overdraft fees, or setup fees, and FDIC-insured funds up to $250,000 through Regent Bank.

| Plan | Monthly Cost | APY | Foreign Transaction Fee | Merchant Cashback | Random Cashback |

|---|---|---|---|---|---|

| Standard | $4.99 | 0.75% | 3% | Up to 15% | Up to 10% |

| Build Your Credit | $8.99 | 2.00% | 1.5% | Up to 15% | Up to 10% |

| Premium | $12.99 | 4.00% | 0% | Up to 15% | Up to 10% |

Mobile credit card apps provide a seamless experience, making it easy to manage finances on the go. With features like multilingual customer support in English, Chinese, Japanese, Spanish, and Portuguese, apps like Firstcard cater to a diverse user base.

Key Features Of Mobile Credit Card Apps

Mobile credit card apps have transformed how individuals manage their finances. With a wide range of features, these apps offer convenience, security, and control. Let’s explore the key features that make mobile credit card apps, like Firstcard, indispensable tools for managing your credit.

Security And Fraud Protection

Security is a top concern for any financial tool. Firstcard ensures your funds are safe, being FDIC-insured up to $250,000 through Regent Bank. Powered by Mastercard, it comes with Zero Liability Fraud Protection. This means you are not responsible for unauthorized transactions. Industry-standard encryption technology further enhances security, protecting your sensitive information.

User-friendly Interface

A user-friendly interface makes managing credit seamless. Firstcard’s app is designed with simplicity in mind. Easy navigation and clear instructions help users track their spending, manage payments, and view transaction history effortlessly. The app supports multiple languages, including English, Chinese, Japanese, Spanish, and Portuguese, ensuring accessibility for a diverse user base.

Real-time Transaction Alerts

Real-time transaction alerts keep you informed about your spending. With Firstcard, you receive instant notifications for every transaction. This feature helps you monitor your spending, detect suspicious activities quickly, and manage your budget effectively.

Integration With Other Financial Tools

Integration with other financial tools enhances overall financial management. Firstcard can be linked with various budgeting apps, allowing you to consolidate your financial information. This integration helps in tracking expenses, setting financial goals, and analyzing spending patterns.

Rewards And Cash Back Programs

Rewards and cashback programs add value to your spending. Firstcard offers up to 15% cashback at over 29,000 partner merchants. You can also earn up to 10% random cashback, making every purchase rewarding. With different plans, users can choose the one that best suits their needs and earn up to 4.00% APY on deposits.

| Plan | Monthly Fee | APY | Foreign Transaction Fee | Merchant Cashback | Random Cashback |

|---|---|---|---|---|---|

| Standard Plan | $4.99 | 0.75% | 3% | Up to 15% | Up to 10% |

| Build Your Credit Plan | $8.99 | 2.00% | 1.5% | Up to 15% | Up to 10% |

| Premium Plan | $12.99 | 4.00% | 0% | Up to 15% | Up to 10% |

Pricing And Affordability

Firstcard® Secured Credit Builder Card offers various plans to suit different needs. Understanding the pricing and affordability of these plans can help you make an informed decision. Let’s explore the different subscription models, compare free vs. paid versions, and look into any hidden costs you should consider.

Subscription Models

| Plan | Monthly Fee | APY | Foreign Transaction Fee | Merchant Cashback | Random Cashback |

|---|---|---|---|---|---|

| Standard Plan | $4.99 | 0.75% | 3% | Up to 15% | Up to 10% |

| Build Your Credit Plan | $8.99 | 2.00% | 1.5% | Up to 15% | Up to 10% |

| Premium Plan | $12.99 | 4.00% | 0% | Up to 15% | Up to 10% |

Free Vs. Paid Versions

Firstcard® does not offer a free version. You must choose from the three paid subscription models. The Standard Plan, Build Your Credit Plan, and Premium Plan have different benefits. Each plan caters to different financial needs and goals.

The Standard Plan is the most affordable. It includes basic features like 0.75% APY and 3% foreign transaction fees. The Build Your Credit Plan offers better benefits at a higher cost. It includes 2.00% APY and a reduced foreign transaction fee of 1.5%. The Premium Plan offers the best benefits with 4.00% APY and no foreign transaction fees. This plan is ideal for those looking for maximum rewards and minimal fees.

Hidden Costs To Consider

While Firstcard® provides clear pricing, be aware of additional costs. Foreign transaction fees apply to the Standard and Build Your Credit Plans. These fees can add up if you make international purchases frequently.

Additionally, credit monitoring and APY features are not available for cardholders without an SSN. This limitation could impact your ability to fully utilize the card’s features. Late fees, overdraft fees, and setup fees are not part of Firstcard®’s pricing structure, which is a significant advantage.

Understanding these hidden costs can help you choose the best plan for your financial situation. Always review the terms and conditions carefully to avoid any surprises.

Pros And Cons Of Using Mobile Credit Card Apps

Mobile credit card apps like Firstcard® offer convenience and advanced features. However, they also have potential drawbacks. Let’s explore the pros and cons of using mobile credit card apps.

Benefits Of Going Mobile

Using mobile credit card apps provides several benefits. Here are some of the key advantages:

- Convenience: Access your credit card information anytime and anywhere.

- Security: Industry-standard encryption technology ensures your data is safe.

- Multilingual Support: Get help in multiple languages, including English, Chinese, Japanese, Spanish, and Portuguese.

- Cashback Rewards: Earn up to 15% cashback at over 29,000 partner merchants.

- Build Credit: Report to all three major credit bureaus to help build your credit history.

- No Fees: No late fees, overdraft fees, or setup fees with Firstcard.

- APY on Deposits: Earn up to 4.00% APY on deposits depending on your plan.

Potential Drawbacks And Limitations

Despite the advantages, there are some potential drawbacks to consider:

- Monthly Fees: Plans range from $4.99 to $12.99 per month.

- Foreign Transaction Fees: Standard and Build Your Credit plans have foreign transaction fees.

- Credit Monitoring Limitations: Credit monitoring unavailable for cardholders without an SSN.

- APY Limitations: APY features unavailable for cardholders without an SSN.

- Dependence on Mobile Access: Requires a smartphone and internet connection.

Understanding the benefits and potential drawbacks of mobile credit card apps like Firstcard® can help you make an informed decision.

Ideal Users And Scenarios

The Firstcard® Secured Credit Builder Card is a versatile tool designed for various users. Whether you are a frequent traveler, a small business owner, or someone on a tight budget, this card offers valuable benefits. Let’s explore who can benefit the most from this mobile credit card app.

Best For Frequent Travelers

Frequent travelers will find the Firstcard® particularly beneficial. The Premium Plan offers a 0% foreign transaction fee, ensuring you save money abroad. Additionally, the card’s Zero Liability Fraud Protection by Mastercard provides peace of mind while traveling.

Furthermore, the up to 15% cashback at over 29,000 partner merchants worldwide helps you earn rewards on your travel expenses. The multilingual customer support (English, Chinese, Japanese, Spanish, Portuguese) ensures you get help in your preferred language wherever you are.

Convenient For Small Business Owners

Small business owners can leverage the Firstcard® for efficient financial management. The Build Your Credit Plan and Premium Plan offer higher APY rates (up to 4.00%) on deposits, allowing you to maximize your business funds.

With no late fees, overdraft fees, or setup fees, you can manage your finances without worrying about hidden costs. The card also helps build credit through everyday business purchases, making it easier to secure loans and other financial products in the future.

Practical For Budget-conscious Individuals

For those on a budget, the Firstcard® offers a Standard Plan at $4.99/month, providing essential benefits at an affordable price. The 0.75% APY helps grow your savings, while the up to 15% merchant cashback rewards you for everyday spending.

With no risk of overspending and no late fees, this card is a practical choice for managing finances responsibly. The multilingual customer support ensures you have access to assistance in your preferred language, making financial management even easier.

Frequently Asked Questions

What Is A Mobile Credit Card App?

A mobile credit card app allows users to manage their credit cards. It offers features like tracking expenses, paying bills, and monitoring transactions.

How Secure Are Mobile Credit Card Apps?

Mobile credit card apps use advanced encryption and security measures. They ensure your personal and financial information is safe from unauthorized access.

Can I Pay Bills Using A Mobile Credit Card App?

Yes, mobile credit card apps let users pay bills. You can schedule automatic payments and avoid late fees.

Do Mobile Credit Card Apps Offer Rewards Tracking?

Most mobile credit card apps offer rewards tracking. Users can easily monitor and redeem their credit card rewards points.

Conclusion

Using a mobile credit card app like Firstcard can simplify your finances. Manage your credit, earn cashback, and enjoy multilingual support. It’s a smart way to build credit without the risk of overspending. Check out Firstcard today and start managing your finances better. For more information, visit Firstcard.