Instant Credit Decision Services: Quick Approval in Minutes

In today’s fast-paced world, getting quick financial decisions is crucial. Instant Credit Decision Services offer a solution for those needing swift credit approvals.

Instant credit decision services are transforming the way we access credit. These services use advanced technology to provide immediate responses to credit applications. With just a few clicks, you can know if you’re approved for a credit card or loan. This convenience saves time and reduces the stress of waiting. Whether you’re planning a big purchase or need emergency funds, instant credit decision services can be a game changer. Stay tuned as we delve into the benefits, features, and how to make the most of these services to simplify your financial life. For more information, check out TorFX UK.

Introduction To Instant Credit Decision Services

In today’s fast-paced world, Instant Credit Decision Services are becoming essential. These services allow individuals to get quick credit approvals, making financial transactions smoother and faster. This blog post will introduce you to the concept of Instant Credit Decision Services and explain why they are increasingly important.

What Are Instant Credit Decision Services?

Instant Credit Decision Services provide quick credit approvals. These services use advanced algorithms to assess creditworthiness in real-time. This process eliminates the traditional waiting period associated with credit approvals.

For example, a service like TorFX UK can offer instant decisions on credit card applications. The key features include verifying browser security settings, ensuring Cookies and JavaScript are enabled, and providing a unique ray ID for troubleshooting.

| Features | Benefits |

|---|---|

| Verifies browser security settings | Enhances security of the site connection |

| Ensures Cookies and JavaScript are enabled | Helps in diagnosing connection issues quickly |

| Provides a unique ray ID for troubleshooting | Offers a straightforward way to contact customer service for support |

The Growing Need For Quick Credit Approvals

The demand for quick credit approvals is growing. Many people need fast access to credit for various reasons. Whether it’s for personal finance management or emergency expenses, quick credit approvals can be a lifesaver.

Instant Credit Decision Services meet this need by providing a fast and secure way to assess creditworthiness. This is especially useful for online transactions where time is of the essence.

In summary, Instant Credit Decision Services like those offered by TorFX UK are becoming more crucial. They provide a secure and efficient way to get quick credit approvals, making financial transactions seamless and hassle-free.

Key Features Of Instant Credit Decision Services

Instant Credit Decision Services offer a seamless and efficient way to get credit decisions quickly. These services come with several key features that enhance the user experience and security. Let’s explore the main features that make these services stand out.

Automated Application Processing

Automated application processing speeds up the credit decision process. It eliminates the need for manual reviews, making the process faster and more accurate.

- Reduces human error

- Saves time for both the user and the provider

- Enables 24/7 application submissions

Real-time Credit Scoring

Real-time credit scoring provides instant feedback on credit applications. This feature uses advanced algorithms to evaluate creditworthiness.

- Provides immediate results

- Increases approval rates

- Improves customer satisfaction

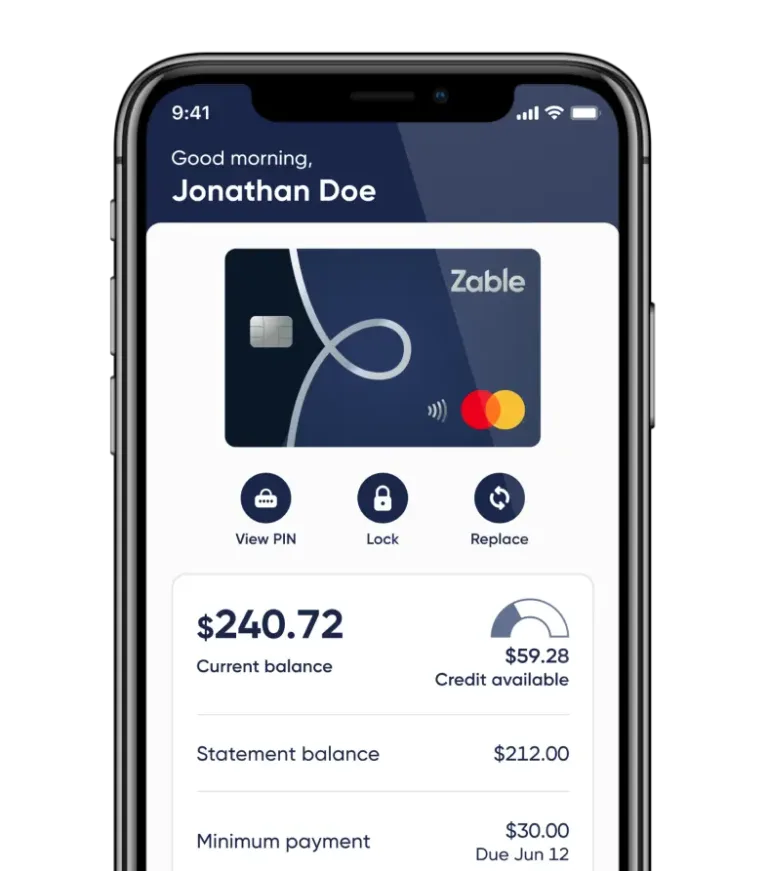

User-friendly Interfaces

User-friendly interfaces make the application process simple and straightforward. These interfaces are designed to be intuitive and easy to navigate.

- Enhances user experience

- Reduces application errors

- Encourages more users to apply

Secure Data Handling

Secure data handling ensures that all personal information is protected. This feature is crucial for maintaining trust and compliance with data protection regulations.

- Encrypts sensitive information

- Prevents data breaches

- Adheres to privacy laws

Instant Credit Decision Services like TorFX UK offer a reliable way to get quick credit decisions. These key features ensure a fast, secure, and user-friendly experience for all applicants.

How Instant Credit Decision Services Benefit Consumers

Instant credit decision services offer many benefits to consumers. These services make the process of obtaining credit faster, easier, and less stressful. Below are the key benefits:

Speed And Convenience

Consumers receive credit decisions in minutes. This speed saves time and reduces waiting periods.

- No need for long application forms

- Quick responses help with urgent financial needs

- Simplifies the process of applying for multiple credit cards

The convenience is unparalleled. Consumers can apply from home or on the go, using their smartphones or computers.

Increased Accessibility To Credit

Instant credit decision services make credit accessible to a wider audience. More people can apply and get approved quickly.

- People with varying credit scores have better chances

- Greater inclusion for those with limited financial history

- Helps consumers build or improve their credit scores

Improved accessibility means more opportunities for financial growth.

Reduced Application Anxiety

Instant decisions reduce the anxiety associated with waiting for credit approval. Knowing the outcome quickly eases stress.

- No more days of uncertainty

- Fewer worries about financial planning

- Peace of mind with immediate feedback

This reduction in anxiety is beneficial for mental well-being.

Overall, instant credit decision services offer significant advantages. They provide speed, convenience, and reduce stress. Consumers experience a streamlined process that enhances their financial experience.

How Instant Credit Decision Services Benefit Lenders

Lenders seek efficient and secure ways to process credit applications. Instant Credit Decision Services offer numerous benefits. These services streamline operations, enhance risk management, and improve customer satisfaction.

Operational Efficiency

Instant Credit Decision Services automate credit assessment. This reduces manual workload and speeds up the application process. Automation minimizes errors and allows lenders to handle higher volumes.

| Manual Process | Instant Decision Services |

|---|---|

| Time-consuming | Fast and efficient |

| High error rate | Minimal errors |

| Limited capacity | High volume handling |

Enhanced Risk Management

These services use advanced algorithms to assess credit risk. They consider various factors like credit history and income. This leads to more accurate risk evaluation.

- Advanced algorithms for risk assessment

- Consider multiple data points

- Improve accuracy in credit decisions

This reduces the chance of approving high-risk applicants. Lenders can make informed decisions and reduce defaults.

Improved Customer Satisfaction

Customers appreciate quick decisions. Instant services provide immediate feedback on applications. This reduces wait times and enhances the customer experience.

- Quick feedback on applications

- Reduced waiting times

- Better customer experience

Satisfied customers are more likely to return. They also recommend the service to others. This helps lenders build a loyal customer base.

Pricing And Affordability Of Instant Credit Decision Services

Understanding the pricing and affordability of instant credit decision services is crucial for both lenders and consumers. These services streamline the credit approval process, making it faster and more efficient. Let’s dive into the cost structures for lenders and the affordability for consumers.

Cost Structures For Lenders

Lenders often face various cost structures when implementing instant credit decision services. Here are some common models:

- Subscription-based: Lenders pay a monthly or annual fee for access to the service.

- Per-transaction: Costs are incurred each time a credit decision is processed.

- Tiered pricing: Costs vary based on the volume of transactions processed.

These cost structures allow lenders to choose a model that best fits their business needs. A clear understanding of these options helps in budgeting and financial planning.

Affordability For Consumers

For consumers, the affordability of instant credit decision services can be influenced by several factors:

- No extra fees: Many services do not charge consumers directly, making them affordable.

- Reduced wait times: Faster decisions mean consumers can access credit when they need it most.

- Improved credit access: Quick decisions can help consumers who need urgent financial assistance.

These benefits ensure that consumers find instant credit decision services both accessible and valuable.

Pros And Cons Of Instant Credit Decision Services

Instant Credit Decision Services offer quick and efficient ways to determine creditworthiness. They come with both advantages and disadvantages. Below, we explore the pros and cons under specific headings.

Pros: Speed, Accessibility, And Efficiency

One of the most significant benefits is the speed at which decisions are made. Traditional credit approvals can take days or even weeks. Instant credit decisions, however, provide outcomes within minutes. This rapid response is invaluable during urgent situations.

Instant Credit Decision Services are highly accessible. Many people can apply online from the comfort of their home. It eliminates the need to visit a bank or financial institution. This convenience is especially useful for those with tight schedules.

These services are designed for efficiency. Automated systems process applications quickly and accurately. This minimizes human error and speeds up the approval process. Efficiency helps both the lender and the borrower save time and resources.

Cons: Potential For Overborrowing, Data Privacy Concerns

One major downside is the risk of overborrowing. The ease and speed of obtaining credit can lead some to take on more debt than they can manage. This can result in financial strain and long-term debt issues.

Another concern is data privacy. Instant credit decisions require personal and financial information. This data can be vulnerable to breaches and misuse. Ensuring the security of this information is crucial.

Ideal Users And Scenarios For Instant Credit Decision Services

Instant Credit Decision Services, like those provided by TorFX UK, offer a quick and secure way to determine creditworthiness. These services are beneficial for both consumers and businesses. By verifying browser security settings and ensuring Cookies and JavaScript are enabled, these services enhance the user experience. Below, we explore the best use cases for consumers, businesses, and lenders.

Best Use Cases For Consumers

Instant Credit Decision Services are ideal for consumers in various scenarios:

- Applying for Credit Cards: Consumers can receive instant decisions on their credit card applications, saving time and reducing stress.

- Personal Loans: Quick credit decisions help consumers secure personal loans efficiently, whether for emergencies or planned expenses.

- Online Shopping: Instant credit decisions enable consumers to make large purchases online with financing options.

These services enhance the shopping and borrowing experience by providing immediate feedback. This minimizes waiting times and uncertainty.

Best Use Cases For Businesses And Lenders

Businesses and lenders also benefit significantly from Instant Credit Decision Services:

- Credit Card Issuers: These services streamline the application process, allowing issuers to approve or deny applications swiftly.

- Loan Providers: Instant decisions on loan applications improve customer satisfaction and operational efficiency.

- Retailers: Offering instant credit at the point of sale encourages customers to make purchases, boosting sales and customer loyalty.

For businesses and lenders, these services provide a competitive edge. They improve customer service and operational efficiency.

Frequently Asked Questions

What Is An Instant Credit Decision?

An instant credit decision is a quick evaluation of your creditworthiness. It provides immediate approval or denial. This process is often automated.

How Does Instant Credit Decision Work?

Instant credit decisions use automated systems to evaluate your credit information. They analyze your credit score, history, and other factors. The decision is made in seconds.

Are Instant Credit Decisions Reliable?

Yes, instant credit decisions are generally reliable. They use advanced algorithms and data analysis. However, they may not consider unique circumstances.

Can I Improve My Chances For Instant Approval?

Yes, you can improve your chances for instant approval. Maintain a good credit score and a clean credit history. Pay off outstanding debts.

Conclusion

Instant credit decision services simplify the application process. They save time and reduce stress. With quick approvals, you can access funds faster. This is essential in today’s fast-paced world. For secure and fast transactions, consider using TorFX UK. Their service enhances security and helps diagnose issues quickly. Visit their website for more details: TorFX UK. Choose smart, secure options for your financial needs. Your peace of mind matters.