Best Credit Card For Renters: Maximize Rewards & Benefits

Finding the best credit card for renters can be a daunting task. There are many options, each offering unique benefits and rewards.

Renters often struggle to find a credit card that rewards them for their largest monthly expense—rent. The Bilt World Elite Mastercard® is designed specifically for this purpose. It allows renters to earn points on their rent payments without any transaction fees. Issued by Wells Fargo Bank N.A. And part of the Mastercard network, this card also offers travel and lifestyle rewards, making it a versatile choice for anyone looking to maximize their spending. With exclusive access to events and special offers, the Bilt World Elite Mastercard® offers more than just rent rewards. Interested in learning more? Check out the Bilt Rewards for detailed information.

Introduction To Credit Cards For Renters

Finding the best credit card for renters can be a challenging task. Renters have unique financial needs, and the right credit card can help manage rent payments while offering valuable rewards. In this blog post, we will explore how credit cards like the Bilt World Elite Mastercard® can benefit renters.

Understanding The Needs Of Renters

Renters often look for ways to make their monthly payments more manageable. They need a credit card that allows them to earn rewards without incurring extra fees. Renters also benefit from flexible rewards programs that offer travel and lifestyle benefits.

How Credit Cards Can Help Renters

Credit cards can be a valuable tool for renters. They can help in several ways:

- Earn Rewards: The Bilt World Elite Mastercard® allows renters to earn points on rent payments without transaction fees.

- Flexible Redemption Options: Points can be redeemed for travel, lifestyle rewards, and exclusive access to events.

- Manage Expenses: Renters can track and manage their rent payments easily through their credit card statements.

Using a credit card designed for renters can turn everyday expenses into valuable rewards.

Benefits Of The Bilt World Elite Mastercard®

The Bilt World Elite Mastercard® offers several benefits tailored for renters:

| Feature | Description |

|---|---|

| Issuer | Wells Fargo Bank N.A. |

| Network | Mastercard |

| Rewards Program | Bilt Rewards |

| Usage | Can be used for paying rent and other purchases |

| Rewards on Rent | Earn points on rent payments without any transaction fees |

| Travel Rewards | Points can be redeemed for travel rewards |

| Lifestyle Rewards | Access to various lifestyle rewards and benefits |

| Exclusive Access | Special offers and access to events for cardholders |

These benefits make the Bilt World Elite Mastercard® an excellent choice for renters looking to maximize their spending.

Key Features Of The Best Credit Cards For Renters

Finding the right credit card as a renter can save you money and offer valuable rewards. Here, we explore the key features you should look for in the best credit cards for renters. From rewards programs to security features, these elements can make a significant difference in your financial journey.

Rewards Programs: Maximizing Points And Cashback

The best credit cards for renters often have robust rewards programs. For instance, the Bilt World Elite Mastercard® offers points on rent payments without transaction fees. You can redeem these points for travel and lifestyle rewards, adding value to your everyday spending.

Introductory Offers And Sign-up Bonuses

Introductory offers and sign-up bonuses can provide immediate value. Look for cards that offer significant bonuses upon meeting a spending threshold within the first few months. This can jumpstart your rewards accumulation and make the card more enticing.

Low Or No Annual Fees

A card with low or no annual fees can be particularly appealing. While the annual fee for the Bilt World Elite Mastercard® is not specified, cards with no annual fees allow you to maximize your rewards without additional costs.

Flexible Payment Options

Flexible payment options can ease the stress of monthly budgeting. The ability to pay rent and other expenses through a credit card like the Bilt World Elite Mastercard® can provide convenience and financial flexibility.

Security Features And Fraud Protection

Security is paramount. Look for cards that offer robust security features and fraud protection. Mastercard networks, for example, are known for their comprehensive security measures, which can give you peace of mind when using your card for rent payments and other transactions.

Pricing And Affordability Breakdown

The Bilt World Elite Mastercard® offers unique benefits for renters. Understanding its pricing structure is essential. This section provides a detailed breakdown of the card’s affordability.

Annual Fees And Interest Rates

Annual Fees: The annual fee for the Bilt World Elite Mastercard® is not specified. Check the card issuer’s terms for exact details.

Interest Rates: Interest rates and fees are also not specified. It is crucial to refer to Wells Fargo’s terms and conditions for detailed information.

Hidden Fees To Watch Out For

Hidden Fees: Always be vigilant about potential hidden fees. While specific fees are not mentioned, typical hidden fees may include:

- Late payment fees

- Over-limit fees

- Foreign transaction fees

Review the card’s terms to avoid unexpected charges.

Balance Transfer Options

Balance Transfer Options: Balance transfer details are not provided. It is advisable to check with the card issuer for any balance transfer offers or fees.

Transferring balances can help manage debt, but always consider the transfer fee and interest rate before proceeding.

For more information, visit the official Bilt Rewards website or consult the card issuer’s terms and conditions.

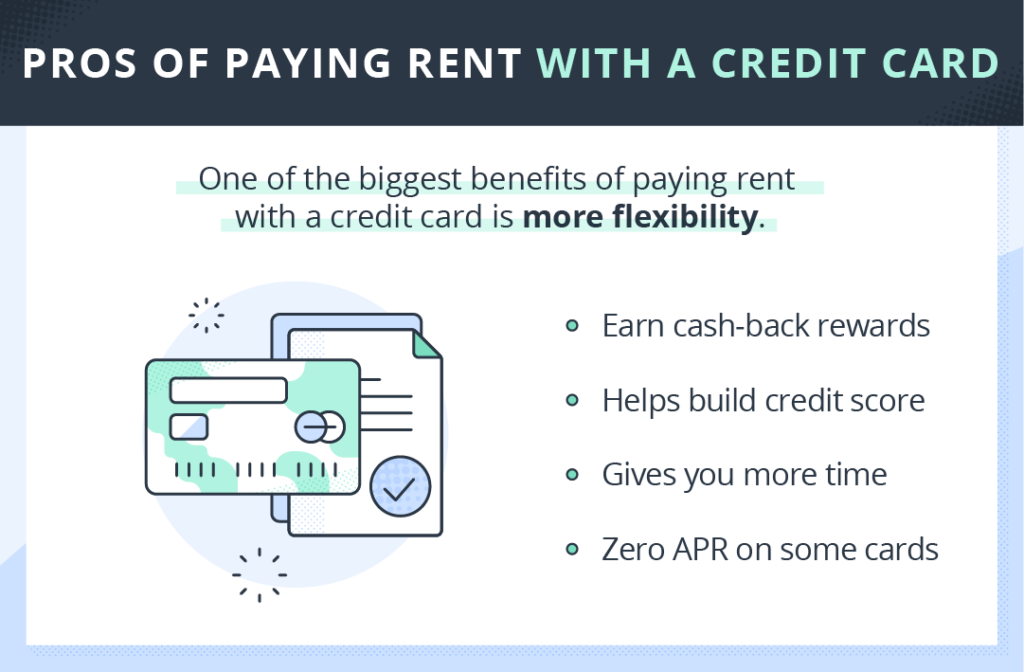

Pros And Cons Of Using Credit Cards For Rent Payments

Paying rent with a credit card can be convenient. It also comes with its own set of advantages and disadvantages. It’s essential to weigh these factors before making a decision.

Advantages: Building Credit And Earning Rewards

Using a credit card like the Bilt World Elite Mastercard® for rent payments can help in building credit. Timely payments are reported to credit bureaus. This can improve your credit score.

Another benefit is earning rewards. The Bilt Rewards program allows you to earn points on rent payments without any transaction fees. These points can be redeemed for travel or lifestyle rewards.

- No transaction fees on rent payments

- Earn points for every dollar spent on rent

- Points can be redeemed for travel rewards

- Access to exclusive events and offers

Disadvantages: Potential For Debt Accumulation

While using a credit card for rent payments has its perks, it also has downsides. One significant disadvantage is the potential for debt accumulation. If the balance is not paid off in full each month, interest charges can add up quickly.

Credit cards often come with high-interest rates. This can lead to increased financial burden. It’s crucial to manage your spending and ensure that you can pay off the balance monthly.

| Disadvantages | Description |

|---|---|

| Debt Accumulation | Possible to accumulate debt if not paid off monthly |

| Interest Rates | High-interest rates can increase financial burden |

It’s important to be mindful of your financial situation. This helps in making informed decisions about using credit cards for rent payments.

Specific Recommendations For Ideal Users Or Scenarios

Choosing the right credit card can be overwhelming, especially with so many options available. The ideal card depends on your specific needs and spending habits. Let’s explore some of the best credit cards for renters based on different scenarios and user profiles.

Best Credit Cards For Frequent Renters

If you rent frequently, the Bilt World Elite Mastercard® is an excellent choice. This card allows you to earn points on rent payments without any transaction fees, which is a unique benefit. The Bilt Rewards program offers various lifestyle and travel rewards, making it perfect for those who rent often and want to maximize their benefits.

- Issuer: Wells Fargo Bank N.A.

- Network: Mastercard

- Rewards Program: Bilt Rewards

- Key Benefit: Earn points on rent payments without transaction fees

Best Credit Cards For Those Looking To Build Credit

For individuals aiming to build or improve their credit score, a secured credit card might be the best option. Secured cards require a deposit, which acts as your credit limit. These cards report to major credit bureaus, helping you establish a positive credit history. While the Bilt World Elite Mastercard® is not a secured card, it can still be beneficial for building credit due to its responsible use and rewards.

| Card | Key Benefit | Annual Fee |

|---|---|---|

| Bilt World Elite Mastercard® | Earn points on rent payments | Not specified |

| Secured Credit Card | Helps build credit | Varies |

Best Credit Cards For Maximizing Rewards

If your goal is to maximize rewards, the Bilt World Elite Mastercard® stands out. This card offers points on everyday purchases and travel rewards. You can redeem points for travel, lifestyle rewards, and exclusive experiences. This makes it a versatile option for those who want to get the most out of their spending.

- Travel Rewards: Points can be redeemed for flights, hotels, and more.

- Lifestyle Rewards: Access various benefits and exclusive events.

- Exclusive Offers: Special deals and promotions for cardholders.

For more details, visit the Bilt Rewards website.

Frequently Asked Questions

What Is The Best Credit Card For Paying Rent?

The best credit card for paying rent offers rewards and low fees. Look for cards with high cashback or points on rent payments.

Can I Earn Rewards By Paying Rent With A Credit Card?

Yes, many credit cards offer rewards on rent payments. Ensure the card provides good rewards for large expenses.

Are There Fees For Using Credit Cards To Pay Rent?

Some landlords charge fees for credit card payments. Always check with your landlord to avoid unexpected costs.

How Do I Choose A Credit Card For Rent Payments?

Select a card with high rewards, low fees, and suitable credit limits. Compare options to find the best fit.

Conclusion

Selecting the right credit card for renters can be a game-changer. The Bilt World Elite Mastercard® offers valuable rewards on rent payments. No transaction fees make it an attractive choice. You can also earn travel and lifestyle rewards. Learn more about the benefits of the Bilt World Elite Mastercard® here. Choose wisely and enjoy the rewards.