Varo Interest-Free Period: Maximize Your Savings Strategy

Managing finances can be a challenge. Varo Bank aims to simplify this.

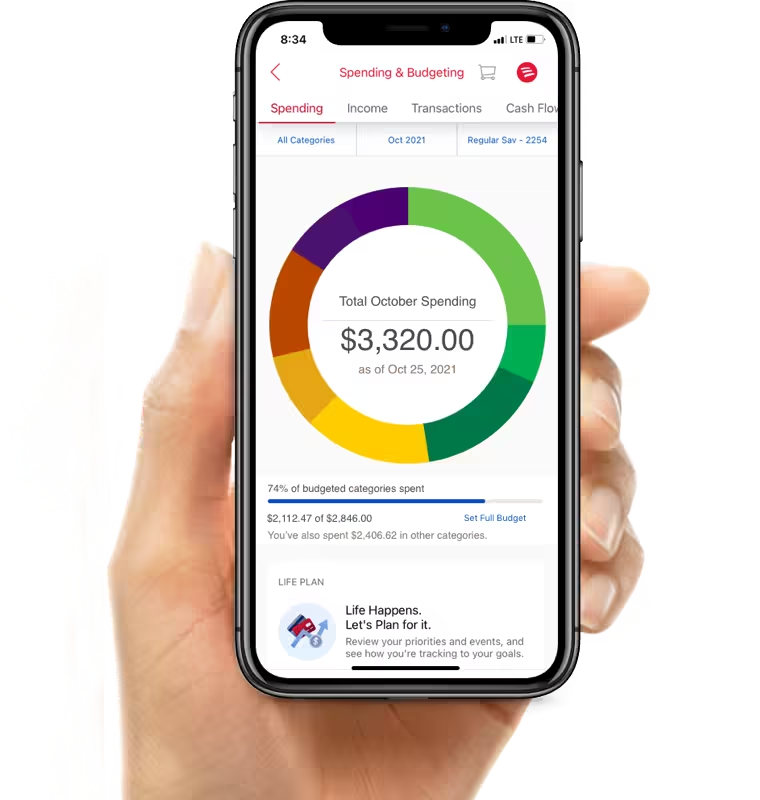

Varo Bank offers a range of services, including checking and savings accounts, through its user-friendly mobile app. One of the standout features is the Varo Interest-Free Period. This period allows you to manage your finances without the burden of interest charges, making it easier to stay on top of your money. Imagine having the freedom to handle your daily transactions with peace of mind, knowing you won’t incur extra costs. The Varo app provides secure and convenient access to all your banking needs, right from your smartphone. Ready to explore the benefits of Varo? Discover more here.

Introduction To Varo’s Interest-free Period

Varo Bank offers an interest-free period for its users, making it easier to manage finances without worrying about interest charges. This feature is designed to help customers optimize their financial planning and reduce the burden of interest payments. Let’s delve into the details of Varo’s interest-free period.

What Is Varo’s Interest-free Period?

The interest-free period provided by Varo Bank is a specific duration during which customers can make transactions without incurring any interest charges. This period typically applies to certain transactions, allowing users to enjoy the benefits of interest-free credit. Understanding this period can help customers make informed financial decisions and manage their expenses more efficiently.

Purpose And Benefits Of Utilizing Interest-free Period

The main purpose of Varo’s interest-free period is to offer financial flexibility to its customers. By taking advantage of this period, users can:

- Save Money: Avoid interest charges on transactions made within the interest-free period.

- Manage Finances: Plan and budget more effectively without the immediate pressure of interest costs.

- Improve Credit Score: Timely payments within the interest-free period can positively impact credit scores.

Utilizing the interest-free period can lead to significant financial benefits, making it a valuable feature for Varo Bank customers.

Key Features Of Varo’s Interest-free Period

The Varo Interest-Free Period offers a unique advantage for users seeking to manage their finances effectively. This feature allows users to make transactions without accruing interest, providing a hassle-free banking experience. Below are the key aspects of this feature.

How It Works: Understanding The Mechanics

Varo provides an interest-free period for specific transactions. During this period, users can make purchases without any interest charges. This helps in managing expenses and reducing the overall cost of borrowing.

The interest-free period is automatically applied to eligible transactions. Users do not need to take any additional steps to activate it. This makes it convenient and straightforward to use.

Eligibility Criteria: Who Can Avail It?

Not everyone qualifies for the interest-free period. To be eligible:

- Users must have an active Varo account.

- The account should be in good standing with no overdue payments.

- Only specific transactions qualify for the interest-free period.

Meeting these criteria ensures that users can benefit from the interest-free period seamlessly.

Duration And Limitations: Key Timeframes To Know

The interest-free period is not indefinite. Here are the key timeframes:

- The interest-free period typically lasts for 30 days from the transaction date.

- Users must settle the outstanding amount within this period to avoid interest charges.

It’s crucial to keep track of these timeframes to fully benefit from the interest-free period. Failure to do so may result in interest charges, negating the benefits.

Maximizing Savings With Varo’s Interest-free Period

Varo Bank offers an interest-free period to help you manage your finances better. Understanding how to maximize savings during this period can significantly enhance your financial well-being. Below are some effective strategies to make the most of Varo’s interest-free period.

Effective Budgeting Strategies

Creating a budget is crucial for managing your finances. Use Varo’s tools to track your income and expenses. This can help you identify areas where you can cut costs.

- Set clear financial goals: Define what you want to achieve.

- Track your spending: Use Varo’s app to monitor your expenses.

- Adjust your budget: Make changes as needed to stay on track.

Smart Spending During The Interest-free Period

Spending wisely during the interest-free period can help you save more. Prioritize essential expenses and avoid unnecessary purchases.

- Focus on needs: Spend on what you truly need.

- Avoid impulse buys: Think twice before making purchases.

- Take advantage of deals: Look for discounts and offers.

Utilizing Varo’s Tools For Better Financial Management

Varo offers various tools to help you manage your finances effectively. These tools can provide insights into your spending habits and help you save more.

| Tool | Benefit |

|---|---|

| Expense Tracking | Helps you monitor your spending and stay within budget. |

| Savings Goals | Allows you to set and track your savings targets. |

| Alerts and Notifications | Keeps you informed about your account activities. |

By using these tools, you can gain better control over your finances and make the most of Varo’s interest-free period.

For more information, visit the Varo Bank website.

Pricing And Affordability Breakdown

Understanding the cost implications of using Varo can help you make an informed decision. This section will break down the pricing and affordability of Varo services, comparing traditional banking costs, identifying hidden fees, and exploring long-term savings potential.

Comparing Costs: Traditional Banking Vs. Varo

Traditional banks often come with various fees for account maintenance, overdrafts, and minimum balance requirements. These can add up quickly and make banking expensive.

Varo, on the other hand, offers a simpler and more cost-effective solution:

- No monthly maintenance fees

- No minimum balance requirements

- No overdraft fees

With Varo, you can save on these common fees, making it a more affordable choice for everyday banking needs.

Hidden Fees To Watch Out For

Traditional banks may have hidden fees that are not immediately obvious:

- ATM fees

- Foreign transaction fees

- Paper statement fees

Varo aims to be transparent with their fees. They provide clear information on any charges, helping you avoid unexpected costs. Always review the fee schedule to stay informed.

Long-term Savings Potential

Using Varo can lead to significant long-term savings. Here’s how:

- No monthly fees mean savings of $10-$15 per month.

- No overdraft fees can save you $35 per occurrence.

- Higher interest rates on savings accounts increase your earnings.

Over time, these savings add up, making Varo a financially smart choice. By eliminating common banking fees, Varo helps you keep more of your money, contributing to your long-term financial health.

Pros And Cons Of Varo’s Interest-free Period

Varo Bank offers an interest-free period for its customers. This feature can significantly benefit users, but it also has some limitations. Let’s explore the advantages and drawbacks in detail.

Advantages: How It Benefits Users

The interest-free period offers several notable advantages:

- Cost Savings: Users can save money on interest charges during this period.

- Debt Management: It helps in better managing debts without the burden of accruing interest.

- Financial Flexibility: Provides more flexibility in repaying borrowed amounts.

- Encourages Spending: Users may feel more comfortable making purchases knowing they won’t incur immediate interest.

Drawbacks: Potential Limitations And Risks

Despite the benefits, there are some potential drawbacks:

- Limited Duration: The interest-free period is temporary and may lead to unexpected interest charges if balances are not paid off in time.

- Behavioral Risk: Users might overspend, assuming they can always pay off the balance later.

- Complex Terms: Understanding the terms and conditions can be challenging for some users.

- Eligibility Criteria: Not all users may qualify for the interest-free period, depending on their credit score and financial behavior.

By weighing these pros and cons, users can make informed decisions about utilizing Varo’s interest-free period effectively.

Ideal Users And Scenarios For Varo’s Interest-free Period

Varo’s interest-free period is a valuable feature for many users. It allows you to manage finances without the burden of interest. Understanding who benefits most and in what scenarios can help you make the most of this feature.

Who Will Benefit The Most?

Different users find Varo’s interest-free period useful:

- Students: Students often face tight budgets. The interest-free period helps manage expenses without accruing interest.

- Freelancers: Freelancers with inconsistent income benefit from paying off balances during higher-income months.

- New Credit Users: Those new to credit cards can learn financial responsibility without the stress of interest.

Specific Scenarios Where Varo’s Interest-free Period Shines

There are specific situations where Varo’s interest-free period proves advantageous:

- Unexpected Expenses: Sudden medical bills or car repairs can be managed without immediate interest concerns.

- Large Purchases: Buying expensive items, like electronics or appliances, becomes manageable when paying off over the interest-free period.

- Seasonal Work: Workers with seasonal jobs can make purchases during off-seasons and pay off when their income increases.

Case Studies: Real-world Examples Of Successful Usage

Here are some real-world examples of how people have successfully used Varo’s interest-free period:

| User Type | Scenario | Outcome |

|---|---|---|

| College Student | Needed a laptop for studies | Bought a laptop and paid it off over three months |

| Freelance Designer | Faced a medical emergency | Used Varo card to cover bills, paid off in four months |

| Seasonal Worker | Purchased winter gear during summer | Cleared balance with winter job income |

By taking advantage of Varo’s interest-free period, users can manage their finances better. This feature provides flexibility and relief in various financial situations.

Conclusion And Final Recommendations

Varo Bank offers an interest-free period that can benefit users significantly. Here’s a detailed look at the key points, final thoughts, and actionable steps to get started with Varo’s interest-free period.

Summary Of Key Points

- Varo Bank provides mobile banking services.

- Services include checking and savings accounts.

- The app allows easy management of financial transactions.

- Access to banking services via the secure Varo app.

- No specific pricing details available.

- No information on refund or return policies.

Final Thoughts On Varo’s Interest-free Period

Varo Bank’s interest-free period is a valuable feature for users managing their finances. It allows users to avoid interest charges on their accounts, making it easier to save money. The convenience of mobile banking services ensures users can manage their accounts anytime, anywhere. The secure access provided by the Varo app adds an extra layer of confidence for users. Overall, Varo Bank offers a practical solution for those looking for efficient and reliable banking services.

Actionable Steps To Get Started

- Visit the Varo Bank website to learn more.

- Download the Varo app from the App Store or Google Play.

- Create an account and complete the registration process.

- Link your existing bank accounts to the Varo app.

- Explore the app’s features and start managing your finances interest-free.

By following these steps, you can begin to enjoy the benefits of Varo Bank’s interest-free period. Experience convenient and secure mobile banking with Varo today.

Frequently Asked Questions

What Is Varo’s Interest-free Period?

Varo offers a period where no interest is charged on purchases. This period helps users manage short-term expenses without incurring additional costs.

How Long Is Varo’s Interest-free Period?

Varo typically offers an interest-free period of up to 30 days. This period allows users to pay off balances without interest.

Can I Extend Varo’s Interest-free Period?

Varo does not currently allow extensions on the interest-free period. Users should aim to pay off balances within the given time frame.

Does Varo Charge Interest After The Period?

Yes, once the interest-free period ends, Varo charges interest on the remaining balance. Make sure to pay off your balance timely.

Conclusion

Enjoy the benefits of the Varo interest-free period. Manage your finances with ease. The Varo app offers convenient mobile banking. It simplifies your financial transactions. Secure and reliable, Varo is your trustworthy banking companion. For more details, visit Varo Bank today.