Varo Banking App: Revolutionizing Your Financial Management

In today’s fast-paced world, managing finances efficiently is essential. The Varo Banking App offers a modern solution for your banking needs.

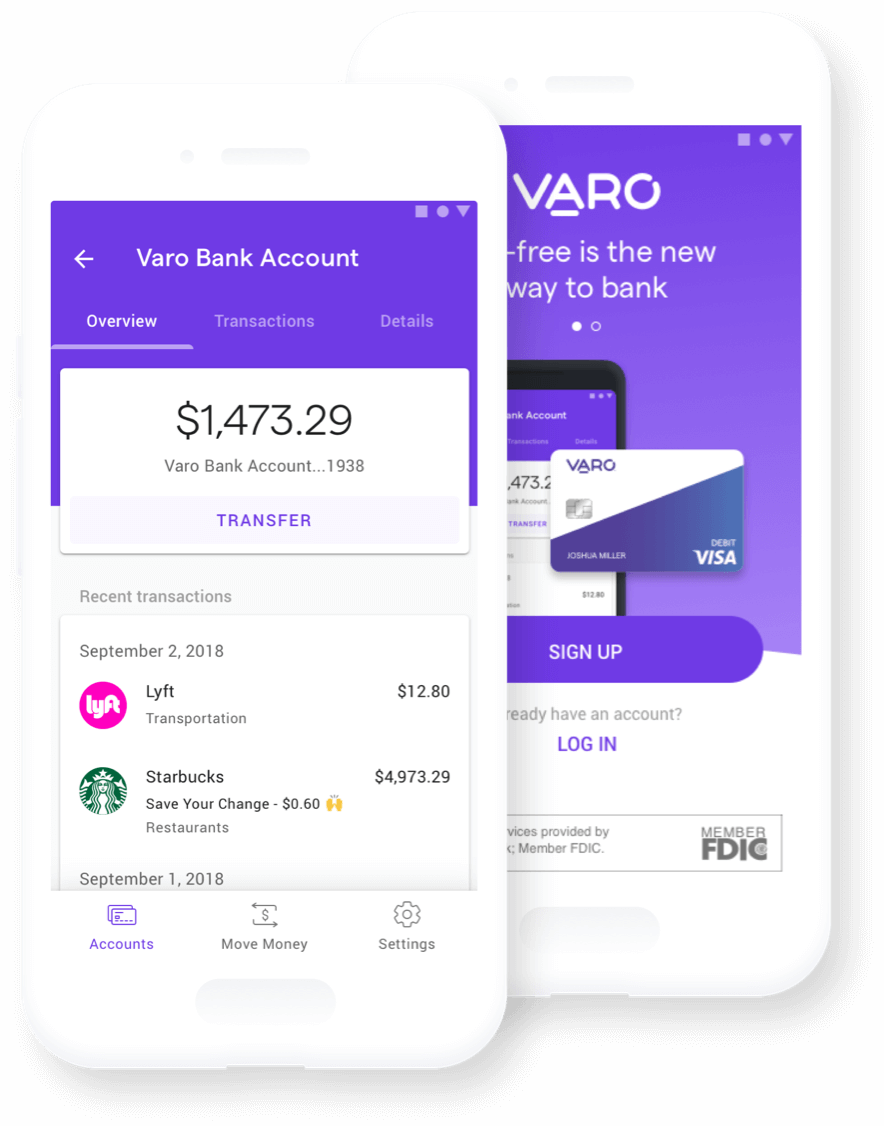

With the Varo App, you can handle your finances on-the-go with ease. This user-friendly app provides secure access to various banking services, making transactions simple and safe. You can download it for free and enjoy no monthly maintenance fees for standard accounts. Regular updates ensure the app runs smoothly and securely. Whether you need to check your balance, make transfers, or pay bills, Varo has you covered. Click here to explore more about Varo Banking App: Varo Bank. Stay tuned as we delve deeper into the features and benefits of the Varo Banking App in the upcoming sections.

Introduction To Varo Banking App

The Varo Banking App offers a modern way to manage your finances. With a user-friendly interface, it simplifies banking. The app provides secure and convenient access to various banking services.

What Is Varo Banking App?

The Varo Banking App is a mobile application designed for seamless financial management. It allows users to perform banking tasks quickly and securely from their mobile devices.

| Main Features | Benefits |

|---|---|

| User-friendly interface | Convenient banking on-the-go |

| Secure access | Enhanced security measures |

| Regular updates | Improved functionality |

| Device compatibility | Wide accessibility |

Purpose And Vision Of Varo

The purpose of the Varo Banking App is to offer a comprehensive banking solution. It aims to make financial management easier and more secure for everyone.

- Convenience: Access banking services from anywhere.

- Security: Ensure safe transactions with enhanced security measures.

- Accessibility: Use the app on various devices.

Varo envisions a world where banking is simple and accessible. The app is designed to meet the needs of modern users, providing a reliable and secure way to manage finances.

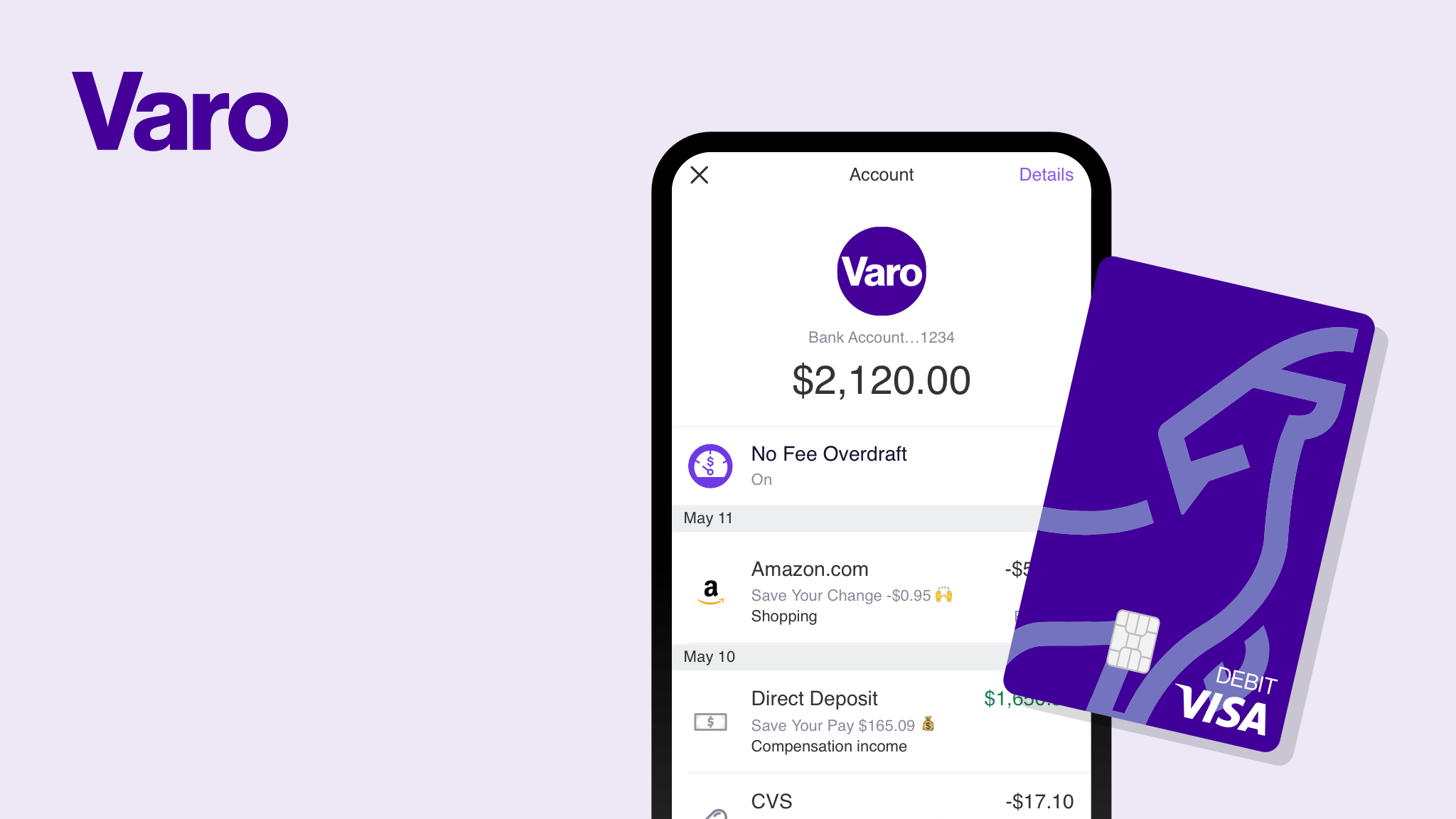

Key Features Of Varo Banking App

The Varo Banking App offers a variety of features to simplify financial management. From no-fee banking to 24/7 customer support, Varo ensures a seamless and secure banking experience. Let’s explore these key features in detail:

No-fee Banking: Say Goodbye To Hidden Charges

Varo Bank eliminates the hassle of hidden fees. There are no monthly maintenance fees, no overdraft fees, and no minimum balance requirements. Enjoy banking without worrying about unexpected charges. This helps you manage your finances more effectively.

Early Direct Deposit: Get Paid Faster

Varo allows you to access your paycheck up to two days early. This feature is especially useful for those who need funds quickly. With early direct deposit, you can handle your financial obligations sooner and avoid late fees.

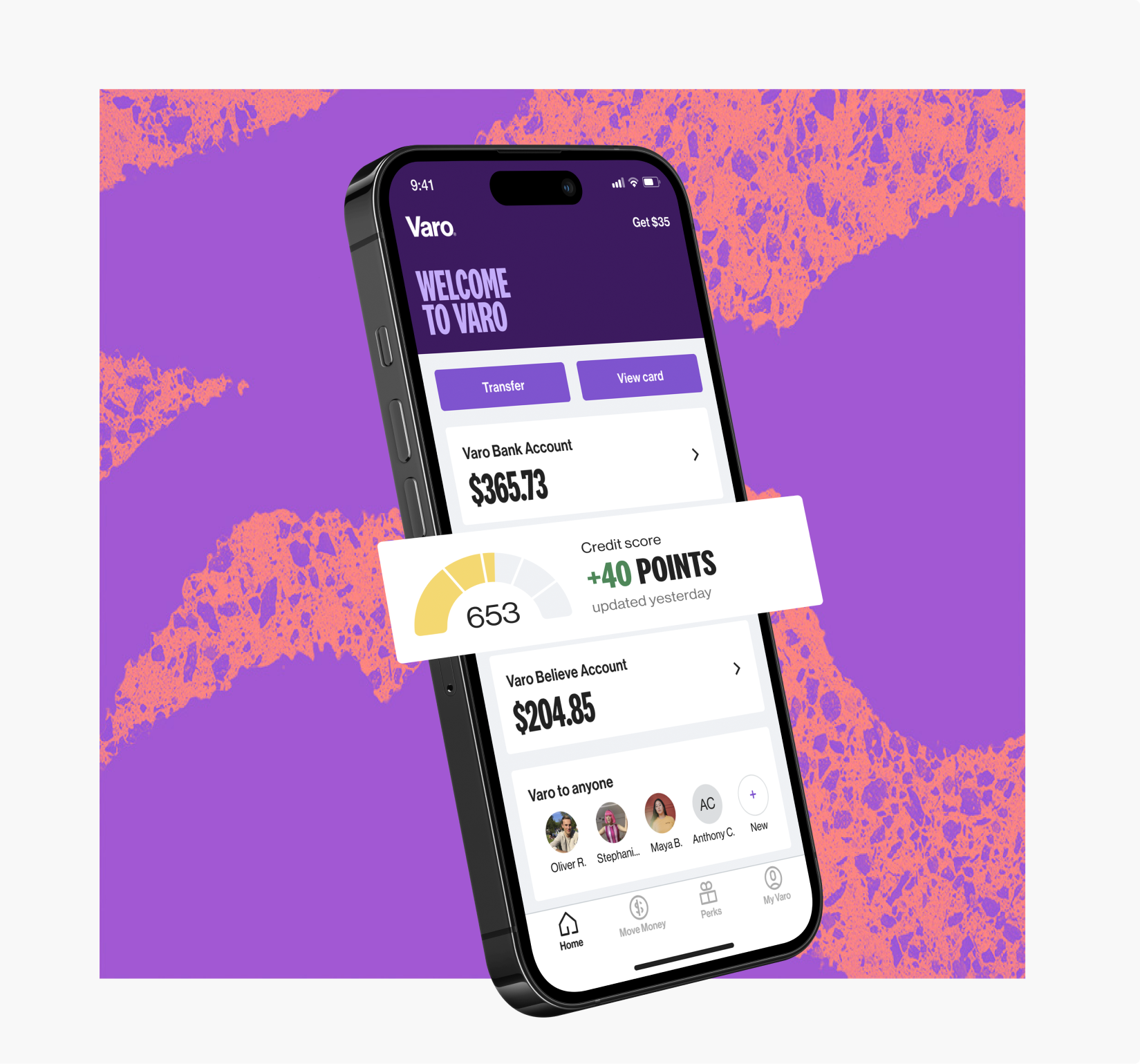

High-yield Savings Account: Grow Your Savings Effortlessly

Varo offers a high-yield savings account with competitive interest rates. This helps you grow your savings faster than a traditional savings account. The more you save, the more you earn.

Automated Savings Tools: Simplify Your Savings Strategy

Varo provides automated savings tools to help you save money easily. You can set up automatic transfers to your savings account. This ensures that you consistently put money aside without thinking about it.

Budgeting And Financial Insights: Stay On Top Of Your Finances

Varo offers budgeting tools and financial insights to help you manage your money. Track your spending, set budgets, and receive insights on your financial habits. This helps you make informed decisions and improve your financial health.

Mobile Check Deposit: Convenient Banking At Your Fingertips

With Varo’s mobile check deposit feature, you can deposit checks from your phone. Simply take a photo of the check, and deposit it into your account. This saves you time and trips to the bank.

24/7 Customer Support: Help When You Need It

Varo provides 24/7 customer support to assist you with any issues. Whether you have questions about your account or need help with a transaction, Varo’s support team is always available. Get the help you need, whenever you need it.

Pricing And Affordability

The Varo Banking App offers a range of services that are not only user-friendly but also highly affordable. Understanding the costs associated with using Varo can help you make an informed decision about whether this app is right for you. Below, we break down the fee structure and compare it with traditional banks.

Fee Structure: Understanding The Costs

One of the standout features of the Varo App is its transparent fee structure. Here’s what you need to know:

- Free Download: The Varo App can be downloaded for free from app stores.

- No Monthly Maintenance Fees: Standard account holders are not charged monthly maintenance fees, allowing you to save more.

- No Minimum Balance Requirements: Enjoy the freedom of not having to maintain a minimum balance.

These features make the Varo App a cost-effective solution for managing your finances. It eliminates common fees that traditional banks often charge.

Comparison With Traditional Banks

When comparing the Varo App to traditional banks, several key differences stand out:

| Feature | Varo App | Traditional Banks |

|---|---|---|

| Monthly Maintenance Fees | None | Typically $10-$15 |

| Minimum Balance | None | Often $500-$1500 |

| Account Opening Fees | None | Can be up to $50 |

The Varo App’s lack of fees and minimum balance requirements makes it an attractive option for those looking to avoid the high costs associated with traditional banks.

By choosing Varo, you can manage your finances more efficiently without worrying about hidden charges. This affordability is a major benefit for users wanting a hassle-free banking experience.

Pros And Cons Of Varo Banking App

The Varo Banking App offers a comprehensive mobile banking experience. Users enjoy many features, yet there are areas that need improvement. Let’s dive into the advantages and drawbacks of using the Varo Banking App.

Advantages: What Users Love About Varo

- Easy Navigation: The user-friendly interface makes banking simple.

- Free Download: The app is available for free without monthly fees for standard accounts.

- Enhanced Security: The app includes advanced security measures for safe transactions.

- Regular Updates: Frequent updates ensure the app runs smoothly and securely.

- Wide Accessibility: Compatible with various devices, making it accessible to many users.

Drawbacks: Areas For Improvement

- Internet Dependency: Requires a stable internet connection for optimal performance.

- Country Restrictions: Some regions may block access to the app.

- No VPN Support: Using VPNs or IP proxies can cause login issues.

- Limited Refund Policies: Specific refund policies are not clearly detailed.

The Varo Banking App stands out for its convenience and security. Users appreciate its ease of use and free access. But, it does have some limitations, such as internet dependency and country restrictions. Keeping these factors in mind can help users have a better experience with the Varo Banking App.

Who Should Use Varo Banking App?

The Varo Banking App offers a user-friendly interface, secure access, and a range of services. It is designed to make financial management simple and convenient. But who exactly stands to benefit the most from this app? Let’s delve into the ideal users and best scenarios for using Varo.

Ideal Users: Target Audience

The Varo Banking App is tailored for individuals seeking easy-to-use banking solutions. It is ideal for:

- Young adults who prefer managing finances on their mobile devices.

- Freelancers and gig workers who need flexible banking options.

- Tech-savvy users who value regular updates and security.

- People with busy schedules looking for on-the-go banking.

- Cost-conscious individuals who want a free app with no maintenance fees.

Best Scenarios For Using Varo

The Varo Banking App excels in various situations. Consider using Varo if you:

- Need instant access to your bank account without visiting a branch.

- Want to manage transactions and monitor your balance easily.

- Require a secure platform for online banking activities.

- Seek a seamless experience across different devices.

- Prefer a bank that frequently updates its app for better performance.

The Varo Banking App stands out for its convenience and user-friendly design. It meets the needs of modern users who demand reliable and secure banking at their fingertips.

Frequently Asked Questions

What Is Varo Banking App?

Varo Banking App is a mobile banking platform. It offers various banking services. These include checking and savings accounts, without traditional bank fees.

Is Varo Banking App Safe?

Yes, Varo Banking App is safe. It uses advanced encryption. Your funds are also insured by the FDIC.

How Do I Open A Varo Account?

To open a Varo account, download the app. Follow the on-screen instructions. Provide necessary personal information for verification.

What Fees Does Varo Bank Charge?

Varo Bank charges no monthly fees. There are no overdraft fees. No minimum balance is required.

Conclusion

Using the Varo App simplifies your banking experience. Its user-friendly interface and secure access make managing finances easy. Regular updates ensure the app performs well and stays secure. Download the Varo App today and enjoy convenient, fee-free banking. Check out the Varo App here for more details.