Varo Credit Card Application: Simplify Your Financial Journey

Applying for a Varo Credit Card is simple and efficient. This card offers excellent features for managing finances.

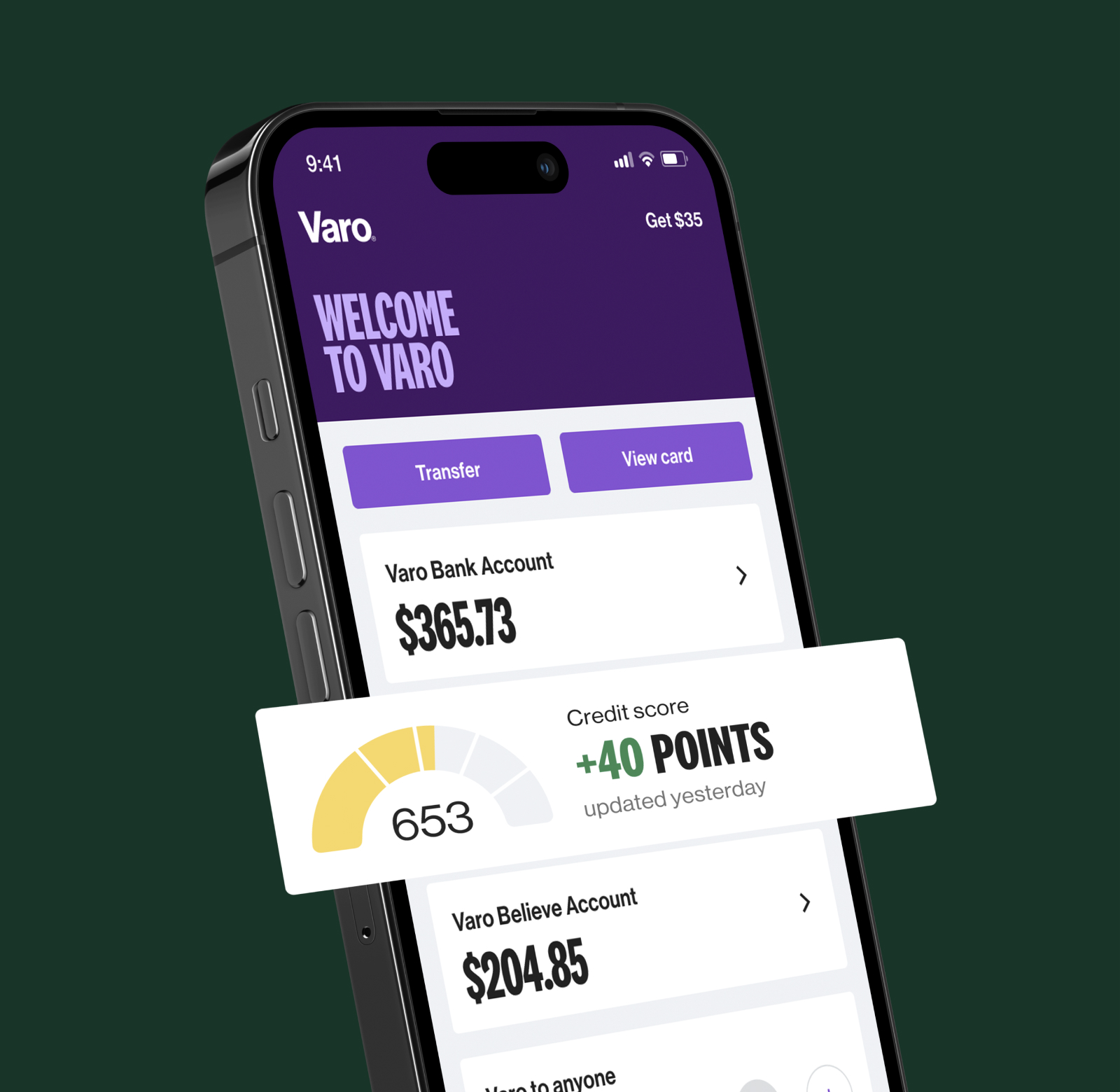

With the Varo Mobile Banking App, you can handle your finances securely from your smartphone. The app provides mobile banking access, account management, and real-time transaction tracking, ensuring you stay updated on your financial activities. Its secure login and user-friendly interface make it an ideal choice for anyone looking to manage their money effortlessly. The best part? It’s free to download and use. Ready to explore more about Varo’s credit card? Click here to get started.

Introduction To Varo Credit Card

Varo Bank offers a convenient and secure credit card option through its mobile banking app. This card provides users with numerous benefits, making it an attractive choice for many.

Overview Of Varo Credit Card

The Varo Credit Card is designed to help users manage their finances effectively. It integrates seamlessly with the Varo Mobile Banking App, allowing users to handle all their banking needs in one place. The card comes with features that enhance financial management and security.

Main features of the Varo Credit Card include:

- Mobile banking access

- Account management

- Transaction tracking

- Secure login

Purpose And Benefits Of Using Varo Credit Card

The Varo Credit Card serves several purposes. It aims to provide users with easy access to their financial accounts, real-time transaction updates, and a user-friendly interface. The card also includes enhanced security features to protect users’ personal information.

Key benefits of the Varo Credit Card:

- Easy access to financial accounts

- Real-time transaction updates

- Enhanced security features

- User-friendly interface

The Varo Credit Card is free to download and use, making it a cost-effective option for managing your finances. Users can enjoy the convenience and security of a modern banking experience without any additional costs.

| Feature | Details |

|---|---|

| Mobile Banking Access | Manage finances through the Varo Mobile Banking App |

| Account Management | Handle all your banking needs in one place |

| Transaction Tracking | Get real-time updates on your transactions |

| Secure Login | Enhanced security to protect personal information |

Key Features Of Varo Credit Card

The Varo Credit Card offers a range of features designed to make your financial life easier and more rewarding. From saving on fees to earning cashback, this card has a lot to offer. Let’s dive into the key features that make the Varo Credit Card a standout choice.

No Annual Fees: Save On Unnecessary Costs

Many credit cards come with annual fees that can add up over time. With the Varo Credit Card, you don’t have to worry about these charges. Enjoy the benefits of your credit card without the burden of extra costs.

High Credit Limit: More Purchasing Power

Having a high credit limit can give you more purchasing power and financial flexibility. The Varo Credit Card offers a generous credit limit, allowing you to make larger purchases when needed.

Cashback Rewards: Earn While You Spend

Who doesn’t love earning rewards while spending? The Varo Credit Card provides cashback rewards on your purchases. This means you get a percentage of your money back on every transaction, making your spending more rewarding.

User-friendly Mobile App: Manage Your Finances On The Go

The Varo Mobile Banking App makes managing your credit card and other finances easy and convenient. With this app, you can:

- Track transactions in real-time

- Access account details instantly

- Ensure secure logins

Fraud Protection: Secure Your Transactions

Security is a top priority with the Varo Credit Card. The card includes robust fraud protection features. This ensures your transactions are secure and gives you peace of mind.

Here’s a quick overview of the key features:

| Feature | Details |

|---|---|

| No Annual Fees | Save on unnecessary costs |

| High Credit Limit | Enjoy more purchasing power |

| Cashback Rewards | Earn while you spend |

| User-Friendly Mobile App | Manage finances on the go |

| Fraud Protection | Secure your transactions |

These features make the Varo Credit Card a great choice for anyone looking to simplify their finances and enjoy added benefits. For more information, visit the Varo Bank website.

Pricing And Affordability

Understanding the pricing and affordability of the Varo Credit Card is crucial. By knowing the fees and charges, you can decide if this card fits your budget. Let’s dive into the specifics.

Breakdown Of Fees And Charges

The Varo Credit Card offers a straightforward fee structure. Here is a detailed breakdown:

| Fee Type | Amount |

|---|---|

| Annual Fee | $0 |

| Foreign Transaction Fee | $0 |

| Late Payment Fee | $0 |

| Balance Transfer Fee | $0 |

| Cash Advance Fee | $0 |

As you can see, the Varo Credit Card has no hidden fees. This makes it an affordable option for many users.

Comparison With Other Credit Cards

Comparing the Varo Credit Card with other credit cards helps highlight its affordability:

- Annual Fee: Many credit cards charge an annual fee, ranging from $25 to $500. The Varo Credit Card charges $0.

- Foreign Transaction Fee: Some cards charge up to 3% for foreign transactions. The Varo Credit Card charges $0.

- Late Payment Fee: Late payment fees can be as high as $40. The Varo Credit Card charges $0.

These comparisons show the Varo Credit Card is more affordable than many other cards. With no fees, it can save you money.

Pros And Cons Of Varo Credit Card

The Varo Credit Card is gaining attention for its user-friendly features and ease of access. Like any credit card, it has its own set of advantages and disadvantages. Understanding these can help you decide if it’s the right choice for you.

Advantages: What Users Love About Varo

- Mobile Banking Access: The Varo Mobile Banking App allows you to manage your credit card from your phone.

- Account Management: Easily monitor your spending, check balances, and make payments.

- Transaction Tracking: Get real-time updates on your transactions, helping you stay on top of your finances.

- Secure Login: Enhanced security features protect your personal information.

- User-Friendly Interface: The app is designed to be intuitive and easy to use, even for beginners.

- No Annual Fees: The Varo Credit Card does not charge any annual fees, making it a cost-effective option.

- Free to Download: The Varo Mobile Banking App is free to download and use, adding to its appeal.

Disadvantages: Areas For Improvement

- Limited Physical Branches: Varo operates mainly online, which may be inconvenient for those who prefer in-person banking.

- No Specific Refund Policies: The lack of clear refund or return policies might be a concern for some users.

- Dependence on Mobile App: Heavy reliance on the mobile app can be a drawback if you experience technical issues.

- Limited Features: Some users might find the features limited compared to other credit cards on the market.

Ideal Users And Scenarios

The Varo Credit Card stands out for its simplicity and ease of use. It’s an excellent choice for many users, especially those seeking a straightforward way to manage their finances. Understanding who should apply and the best scenarios for using the Varo Credit Card can help you decide if it meets your needs.

Who Should Apply For Varo Credit Card

Varo Credit Card is perfect for individuals wanting a hassle-free banking experience. Here are some ideal users:

- Those who prefer mobile banking.

- People needing real-time transaction updates.

- Users who value enhanced security features.

- Individuals seeking a user-friendly interface.

If you fit any of these categories, the Varo Credit Card might be a great fit for you.

Best Scenarios For Using Varo Credit Card

The Varo Credit Card shines in many scenarios. Here are some of the best situations where using the Varo Credit Card can be beneficial:

- For everyday purchases due to its ease of use.

- When you need to track transactions in real-time.

- If you require secure login for your financial activities.

- When managing your finances on the go.

In each of these scenarios, the Varo Credit Card offers valuable features that enhance your financial management experience.

Conclusion: Simplify Your Financial Journey With Varo

Managing your finances can be easy with the Varo Credit Card. The card offers a range of benefits tailored to your needs. This card, part of the Varo Mobile Banking App, simplifies your financial tasks. Stay on top of your spending and enjoy enhanced security features. Read on to learn how this credit card can make your life easier.

Final Thoughts On Varo Credit Card

The Varo Credit Card is a reliable choice for many. It offers easy access to your financial accounts and real-time transaction updates. You can manage your finances from anywhere, anytime. The user-friendly interface ensures you can navigate the app with ease. Secure login protects your personal information. It’s free to download and use, making it accessible for everyone.

Steps To Apply For Varo Credit Card

- Visit the Varo Bank website.

- Download the Varo Mobile Banking App from your app store.

- Open the app and create a new account.

- Follow the prompts to complete your account setup.

- Navigate to the credit card application section.

- Fill out the required personal information.

- Submit your application and wait for approval.

Applying for the Varo Credit Card is straightforward and quick. Once approved, you can start enjoying the benefits right away.

Frequently Asked Questions

What Is The Varo Credit Card?

The Varo Credit Card is a credit-building card. It offers no annual fees and helps improve your credit score.

How Do I Apply For A Varo Credit Card?

To apply, visit Varo’s website or use the mobile app. Follow the prompts to complete your application.

What Are The Benefits Of Varo Credit Card?

The Varo Credit Card offers no annual fees, flexible payment options, and credit-building features. It helps improve your credit score.

Can I Get Approved With Bad Credit?

Yes, Varo Credit Card is designed for those with poor or no credit. It helps build or rebuild credit.

Conclusion

Applying for a Varo Credit Card is simple and straightforward. The Varo Mobile Banking App enhances your banking experience with secure, real-time access. Manage your finances effortlessly. Enjoy the benefits of user-friendly features and enhanced security. Ready to get started? Apply now through the Varo Bank website. Your financial journey begins here.