Trusted Credit Repair: Rebuild Your Financial Future Today

Are you tired of bad credit holding you back? Trusted credit repair can help.

Poor credit scores can affect your life in many ways. They can make it harder to get loans, rent an apartment, or even find a job. Fixing your credit might seem overwhelming, but it’s possible with the right help. Trusted credit repair services offer a way to improve your credit score. They guide you through the process, helping you remove errors and build a better financial future. This blog will explore how you can benefit from these services. So, let’s dive in and discover how trusted credit repair can change your life for the better. Check out Super.com for reliable credit repair services: Super.com – Super.

Introduction To Trusted Credit Repair

Credit scores influence many aspects of life. Trusted Credit Repair helps improve these scores. This service addresses negative items on your credit report. It also provides guidance for better financial habits.

Understanding Credit Repair

Credit repair involves fixing poor credit standings. This includes removing inaccurate information from your credit report. Sometimes, it means negotiating with creditors to remove negative items. The goal is to improve your credit score.

There are laws that govern credit repair. The Fair Credit Reporting Act (FCRA) is one such law. It allows you to dispute errors on your credit report. Trusted Credit Repair services help you navigate these laws.

Purpose And Importance Of Trusted Credit Repair

Trusted Credit Repair services have a clear purpose. They aim to improve your credit score. A good credit score is important for several reasons:

- Lower interest rates on loans and credit cards.

- Better chances of loan approval.

- Improved rental opportunities.

- Lower insurance premiums.

Having a good credit score can save you money. It can also provide peace of mind. Trusted Credit Repair services offer expert help. They can spot errors that you might miss. They can negotiate with creditors on your behalf.

In summary, Trusted Credit Repair is a valuable service. It helps improve credit scores. This can lead to better financial opportunities and savings. It is a smart investment in your financial future.

Key Features Of Trusted Credit Repair

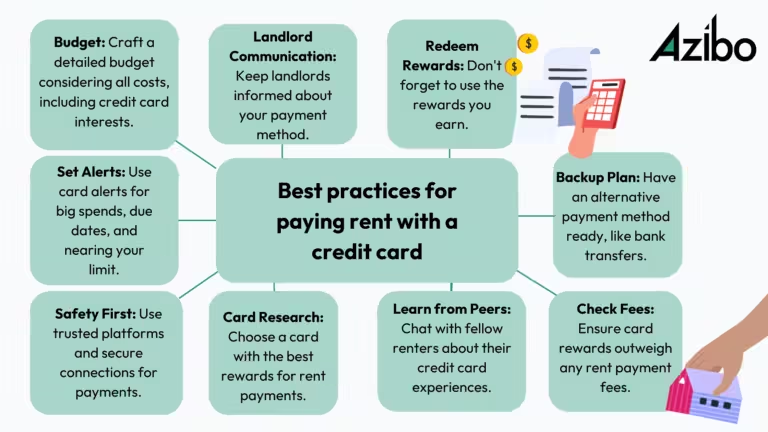

Trusted Credit Repair offers a variety of features to help improve your credit score. These features include personalized credit analysis, dispute resolution services, credit monitoring and alerts, and financial education resources. Each service is designed to address specific areas of your credit profile.

Trusted Credit Repair begins with a personalized credit analysis. Experts review your credit reports from major bureaus. They identify errors, inconsistencies, and areas for improvement. This step provides a tailored plan to increase your credit score.

The dispute resolution services handle errors on your credit report. Trusted Credit Repair contacts creditors and credit bureaus on your behalf. They provide evidence to support the removal of inaccurate information. This service ensures your credit report is accurate and fair.

Credit monitoring and alerts keep you informed of changes to your credit report. You receive notifications of new accounts, inquiries, or changes in your credit score. This service helps you stay on top of your credit health and quickly address any issues.

Trusted Credit Repair offers financial education resources to help you manage your finances. These resources include articles, guides, and tools to improve your financial literacy. They cover topics like budgeting, debt management, and saving strategies. This knowledge helps you make informed decisions and maintain good credit.

Personalized Credit Analysis

Personalized Credit Analysis is a key feature of Trusted Credit Repair. It helps you understand your unique credit profile. This analysis provides detailed insights tailored to your financial needs. Below, we delve into the various benefits of this feature.

Benefit: Tailored Insights For Individual Needs

Every individual’s credit situation is different. With Personalized Credit Analysis, you receive insights that are specific to your needs. This means you can focus on areas that will have the most impact on your credit score. Tailored insights help you understand the factors affecting your credit.

- Identify areas needing improvement.

- Understand your credit strengths.

- Receive customized recommendations.

Problem Solved: Identifying Specific Credit Issues

Many people struggle to identify the exact issues with their credit. Personalized Credit Analysis solves this problem. It highlights specific issues that are hurting your credit score. Knowing these issues is the first step to fixing them. This can include:

- Late payments.

- High credit utilization.

- Errors on your credit report.

By identifying these problems, you can take targeted actions to improve your credit.

Importance: Customized Action Plans

A generic plan won’t work for everyone. That’s why Customized Action Plans are essential. After identifying specific credit issues, you receive a plan tailored to your situation. These plans guide you through steps to improve your credit score. Key features include:

| Feature | Details |

|---|---|

| Action Steps | Specific actions you need to take. |

| Timeline | Estimated time to see improvements. |

| Resources | Tools and support to help you. |

Customized action plans ensure you have a clear path to better credit.

Dispute Resolution Services

Trusted Credit Repair offers exceptional dispute resolution services to help improve your credit score. These services ensure that your credit reports are accurate and free of errors. They address discrepancies that might be negatively impacting your financial health.

Benefit: Removing Inaccurate Information

One of the key benefits of dispute resolution services is the removal of inaccurate information. Errors on your credit report can lower your credit score. Trusted Credit Repair identifies and disputes these inaccuracies on your behalf.

- Incorrect personal information

- Erroneous account details

- Outdated credit entries

By removing these inaccuracies, you can see an improvement in your credit score. This can lead to better loan terms and lower interest rates.

Problem Solved: Addressing Errors On Credit Reports

Mistakes on credit reports are common. Incorrect entries can arise from clerical errors, identity theft, or outdated information. Trusted Credit Repair steps in to address these issues.

Their team meticulously reviews your credit reports. They identify errors and file disputes with the credit bureaus. This process ensures that your credit history reflects true and accurate information.

Importance: Ensuring Accurate Credit Scores

Ensuring accurate credit scores is crucial for financial stability. A high credit score opens doors to many opportunities.

- Better loan approval chances

- Lower interest rates

- Access to premium credit cards

Trusted Credit Repair helps you achieve an accurate credit score. They remove errors and inaccuracies, giving you a clear financial picture. This service is essential for anyone looking to maintain or improve their credit health.

| Service | Benefit |

|---|---|

| Dispute Resolution | Removes inaccurate information |

| Error Addressing | Corrects mistakes on credit reports |

| Accuracy Assurance | Ensures accurate credit scores |

Credit Monitoring And Alerts

Credit monitoring and alerts are essential tools for managing your credit health. Trusted Credit Repair provides these services to help you stay on top of your credit status. By understanding changes and detecting issues early, you can maintain a healthy credit score and prevent potential problems.

Benefit: Staying Informed About Credit Changes

With credit monitoring, you receive real-time updates on your credit report. This means you will know about any changes to your credit score, new accounts, or inquiries. Staying informed allows you to take immediate action if something unexpected happens.

Regular updates can help you understand what affects your credit score. You can then make informed decisions to improve or maintain your credit health.

Problem Solved: Early Detection Of Fraudulent Activities

Credit monitoring services help detect fraudulent activities early. If someone tries to open a new account in your name, you will receive an alert. This early warning system helps you stop identity theft before it causes significant damage.

By addressing suspicious activities quickly, you can protect your financial health and avoid potential legal issues. This proactive approach saves time and stress in the long run.

Importance: Proactive Credit Management

Proactive credit management is crucial for maintaining a good credit score. Credit monitoring and alerts help you stay ahead of potential problems. You can correct errors on your credit report before they impact your score.

By regularly checking your credit status, you can plan for major financial decisions. This includes applying for loans, credit cards, or mortgages. Staying proactive ensures you have the best possible credit profile when you need it most.

Financial Education Resources

At Super.com, we believe in providing comprehensive financial education resources to our users. These resources are designed to empower individuals, solve financial literacy problems, and ensure long-term financial health.

Benefit: Empowering Users With Knowledge

Our financial education resources aim to empower users with knowledge. Understanding credit and finance is crucial for making informed decisions. We offer:

- Interactive tutorials on credit management

- Detailed guides on improving credit scores

- Webinars with financial experts

- Accessible e-books and articles

These resources help users take control of their financial future with confidence.

Problem Solved: Lack Of Financial Literacy

Many people struggle with financial literacy. They find it hard to understand complex financial terms and concepts. This lack of knowledge can lead to poor financial decisions. Our resources address this problem by:

- Breaking down complex topics into simple, digestible parts

- Providing real-life examples to illustrate key points

- Offering step-by-step guides to practical financial tasks

These efforts ensure everyone can improve their financial literacy, regardless of their starting point.

Importance: Long-term Financial Health

Long-term financial health is vital for a stable and secure future. Our resources play a crucial role in achieving this goal. By educating users, we help them:

| Action | Benefit |

|---|---|

| Understand credit reports | Improve credit scores |

| Manage debts effectively | Reduce financial stress |

| Create realistic budgets | Ensure savings growth |

These benefits contribute to a financially secure future, reducing anxiety and promoting well-being.

Pricing And Affordability

Understanding the pricing and affordability of credit repair services is crucial. Trusted Credit Repair offers competitive rates. Let’s dive into the details of their cost structure and how they stack up against competitors.

Cost Structure Of Trusted Credit Repair

Trusted Credit Repair provides transparent pricing. Here is a breakdown of their cost structure:

- Initial Setup Fee: $99 (one-time charge)

- Monthly Fee: $79 (recurring charge)

The initial setup fee covers the cost of obtaining your credit reports and setting up your account. The monthly fee includes ongoing credit repair services. This includes disputing errors, providing credit advice, and offering continuous support.

Value For Money: Comparing With Competitors

When comparing Trusted Credit Repair with other services, their pricing stands out. Here is a comparison with two major competitors:

| Service | Initial Setup Fee | Monthly Fee |

|---|---|---|

| Trusted Credit Repair | $99 | $79 |

| Competitor A | $120 | $89 |

| Competitor B | $100 | $85 |

As seen in the table, Trusted Credit Repair offers lower setup and monthly fees compared to Competitors A and B. This makes their services more affordable for many customers.

Furthermore, Trusted Credit Repair provides a high level of service. They ensure that each customer gets personalized attention, which adds value to their pricing model.

In summary, Trusted Credit Repair’s pricing is competitive and offers great value. They provide quality services at an affordable price, making them a preferred choice for many seeking credit repair.

Pros And Cons Of Trusted Credit Repair

Understanding the pros and cons of trusted credit repair can help you make an informed decision. Each service has its strengths and weaknesses. Let’s explore the advantages and limitations of trusted credit repair based on real-world usage.

Advantages Based On Real-world Usage

- Improved Credit Score: Many users report a significant boost in their credit score.

- Professional Expertise: Experts handle complex credit issues, saving time and effort.

- Customized Strategies: Tailored plans fit individual financial situations and goals.

- Better Loan Terms: Higher credit scores often lead to lower interest rates on loans.

- Educational Resources: Users gain valuable knowledge about managing their credit.

Drawbacks And Limitations

- Cost: Credit repair services can be expensive for some users.

- Time-Consuming: Improvements may take several months to reflect.

- No Guarantees: Success rates vary, and some negative items may remain.

- Possible Scams: Not all credit repair services are reputable. Research is essential.

- Limited Scope: Some services may not address all credit issues.

Ideal Users And Scenarios

Understanding who benefits most from credit repair services can help you decide if it’s the right fit. Here, we will discuss the ideal users and best situations for using Trusted Credit Repair.

Who Should Use Trusted Credit Repair?

Trusted Credit Repair is designed for individuals who need to improve their credit scores. This service is ideal for:

- People with low credit scores: Those struggling with poor credit due to past financial issues.

- First-time credit users: New credit users who want to build a strong credit history.

- Individuals with inaccuracies on their credit reports: Those needing to dispute errors on their credit reports.

- Prospective homebuyers: People looking to secure better mortgage rates.

- People seeking better credit card offers: Those wanting to qualify for credit cards with lower interest rates and better rewards.

Best Situations For Utilizing The Service

Using Trusted Credit Repair is most effective in certain scenarios. Here are some of the best situations:

| Situation | Benefit |

|---|---|

| Job Applications | Improving credit can enhance job prospects where credit checks are required. |

| Loan Applications | Better credit scores can lead to lower interest rates and better loan terms. |

| Debt Management | Helps in consolidating debts and managing repayment plans more effectively. |

| Financial Recovery | Assists in recovering from financial setbacks such as bankruptcy or defaults. |

By knowing who should use Trusted Credit Repair and the best situations to utilize the service, you can make an informed decision. This helps in achieving your financial goals more efficiently.

Frequently Asked Questions

What Is Trusted Credit Repair?

Trusted credit repair involves improving your credit score through reliable methods. It includes disputing errors and negotiating with creditors.

How Long Does Credit Repair Take?

Credit repair typically takes three to six months. This duration can vary based on individual circumstances.

Can Credit Repair Improve My Credit Score?

Yes, credit repair can improve your credit score. It involves correcting errors and removing negative items.

Is Credit Repair Worth It?

Credit repair is worth it if you want to boost your credit score. It can help you secure better financial terms.

Conclusion

Repairing your credit can seem daunting. Trusted Credit Repair is a reliable solution. This service helps rebuild your financial health. Need a trusted partner? Consider Super.com. It offers excellent credit repair options. Visit Super.com for more information. Start your journey to better credit today. Make informed decisions and regain financial control.