Varo Mobile Banking: Revolutionizing Your Financial Freedom

Mobile banking has transformed how we manage our finances. Varo Bank is at the forefront of this change.

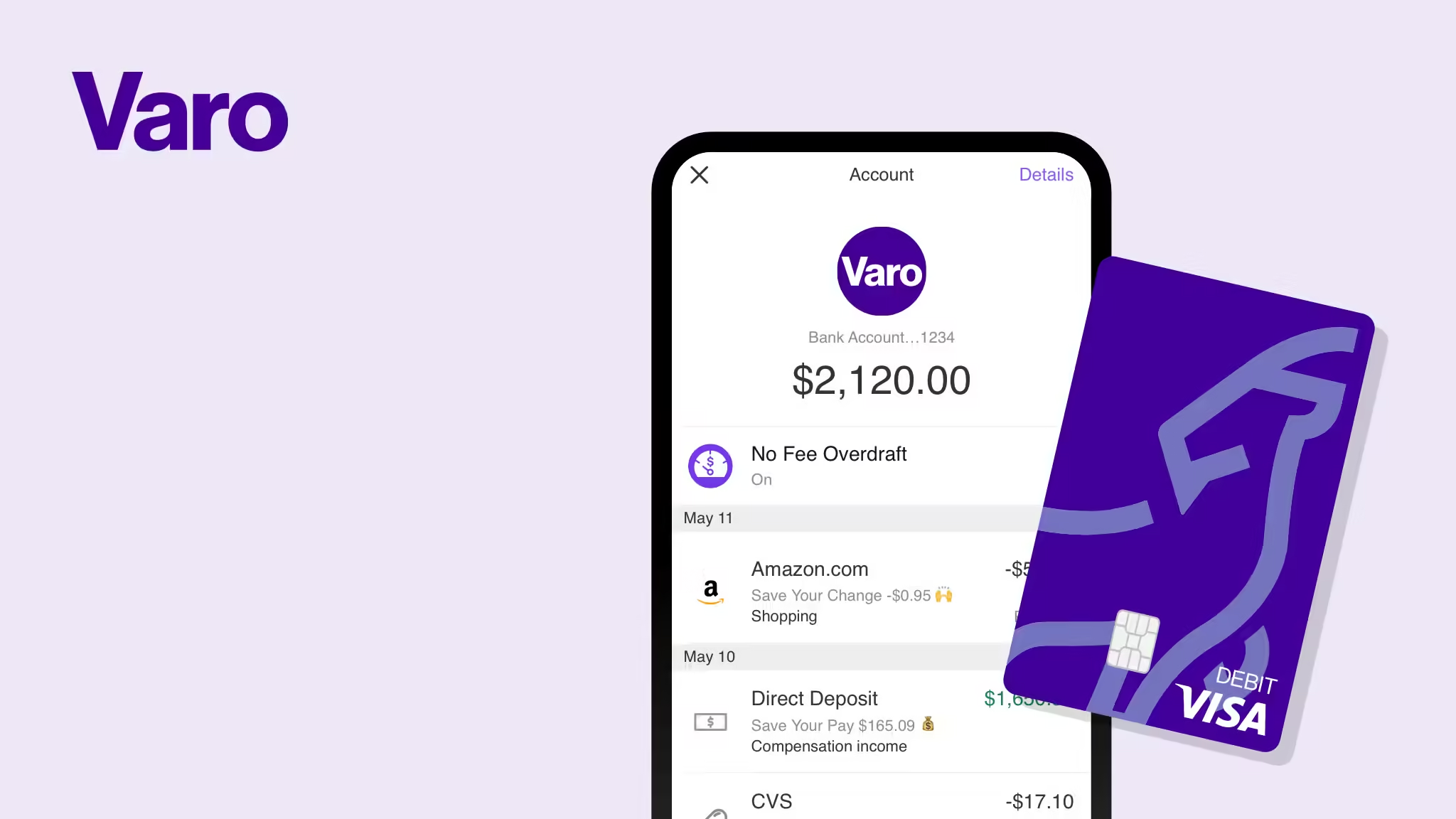

Varo Bank offers a seamless mobile banking experience through its Varo App. This app provides users with easy account management, secure transactions, and real-time notifications. Imagine managing your finances directly from your smartphone, anytime and anywhere. With Varo, you can keep track of your money effortlessly. The app is free to download and use, making it accessible to everyone. While the app is generally reliable, users might face login issues due to unstable internet connections or outdated app versions. Ready to simplify your banking? Discover more about Varo Bank here.

Introduction To Varo Mobile Banking

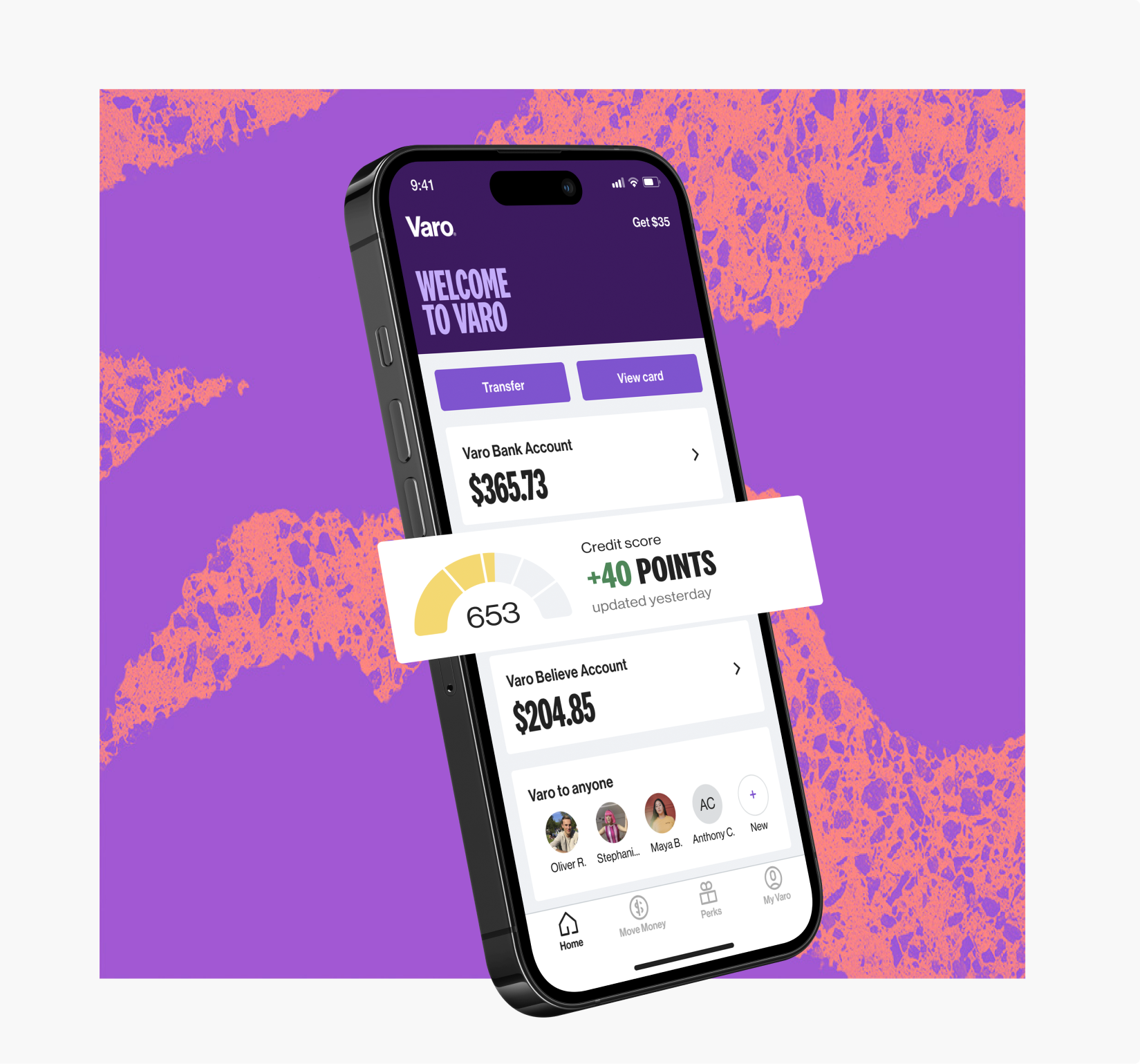

Varo Mobile Banking is a modern solution for managing your finances. It offers a seamless and convenient banking experience through your smartphone. Let’s delve into what makes Varo stand out and its core mission.

What Is Varo Mobile Banking?

The Varo App is a mobile banking application designed for easy and secure financial management. With Varo, you can handle your banking needs directly from your smartphone, providing flexibility and control at your fingertips.

Some of the main features include:

- Mobile banking services

- Easy account management

- Secure transactions

- Real-time notifications

These features ensure that users can perform banking tasks efficiently and with confidence in their security.

Purpose And Mission Of Varo

Varo aims to offer a banking experience that is both convenient and secure. The mission is to enable users to manage their finances effortlessly from their smartphones.

Varo provides:

- Convenience in managing finances from a smartphone

- Enhanced security for transactions

- Real-time updates and notifications for better financial control

The app is free to download and use, making it accessible to a wide range of users. While using Varo, ensure you have a stable internet connection and update the app regularly for the best experience.

Key Features Of Varo Mobile Banking

Varo Mobile Banking offers a range of features designed to make banking easy and convenient. This section highlights the key features that set Varo apart. From no-fee banking to automatic savings tools, Varo has something for everyone.

No-fee Banking: Save More, Spend Less

With Varo, there are no hidden fees. Enjoy no monthly maintenance fees, no overdraft fees, and no minimum balance requirements. This means you can save more of your hard-earned money and spend it on what matters most to you.

High-yield Savings Account: Maximize Your Savings

Varo offers a high-yield savings account with competitive interest rates. This allows your savings to grow faster. Earn more interest on your deposits and reach your financial goals sooner.

Early Direct Deposit: Get Paid Faster

With Varo, you can get your paycheck up to two days early. No more waiting for payday. This feature helps you manage your finances better and avoid last-minute stress.

Automatic Savings Tools: Effortless Financial Management

Varo provides automatic savings tools to help you save money effortlessly. Set up automatic transfers from your checking account to your savings account. Round up your transactions to the nearest dollar and save the difference. These tools make saving money simple and stress-free.

Varo Advance: Access Cash When You Need It

Sometimes you need a little extra cash before payday. Varo Advance lets you borrow up to $100 with no interest. Repay the amount with your next deposit. It’s a convenient way to handle unexpected expenses.

In summary, Varo Mobile Banking offers a range of features that make managing your finances simple and convenient. Whether you want to save more, get paid early, or access cash when you need it, Varo has you covered.

Pricing And Affordability

Varo Bank offers an exceptional mobile banking experience at no cost. This section breaks down Varo’s pricing and affordability, ensuring you understand their transparent and fair fee structure compared to traditional banks.

Fee Structure: Transparent And Fair

Varo Bank stands out for its transparent and fair fee structure. Here’s a detailed overview:

| Service | Fees |

|---|---|

| Account Maintenance | Free |

| ATM Withdrawals | Free at Allpoint ATMs |

| Overdraft | Free (up to $50 with Varo Advance) |

| Foreign Transactions | No fee |

Varo Bank charges no monthly maintenance fees. Additionally, customers can withdraw cash for free at over 55,000 Allpoint ATMs. Users also benefit from fee-free overdrafts up to $50 with Varo Advance, and there are no foreign transaction fees.

Comparing Varo To Traditional Banks

Varo Bank’s affordability shines when compared to traditional banks. Traditional banks often have various charges that can add up quickly. Here’s a comparison:

| Service | Varo Bank | Traditional Banks |

|---|---|---|

| Monthly Maintenance Fee | Free | Up to $15 |

| ATM Withdrawals | Free at Allpoint ATMs | $2.50 per withdrawal |

| Overdraft | Free (up to $50) | $35 per overdraft |

| Foreign Transactions | No fee | Up to 3% of transaction |

Traditional banks typically charge up to $15 monthly maintenance fees. ATM withdrawals can cost $2.50 per transaction, and overdraft fees can be as high as $35. In contrast, Varo Bank offers these services at no cost, making it an affordable choice for many.

Varo Bank’s pricing and affordability provide a cost-effective alternative to traditional banking. Enjoy free banking services and manage your finances seamlessly with the Varo App.

Pros And Cons Of Varo Mobile Banking

Varo Mobile Banking offers a modern way to manage finances using a smartphone. It has several benefits and a few drawbacks. Let’s explore the pros and cons of using Varo Mobile Banking.

Pros: The Benefits Of Choosing Varo

Varo Mobile Banking provides a range of benefits that appeal to its users:

- Convenience: Manage finances from your smartphone anytime, anywhere.

- Enhanced Security: Secure transactions ensure your money is safe.

- Real-Time Notifications: Get instant updates on account activities.

- Easy Account Management: Simple and intuitive interface for effortless banking.

- Free to Use: Download and use the app at no cost.

Cons: Potential Drawbacks To Consider

While Varo Mobile Banking has many benefits, there are some potential drawbacks:

- Login Issues: Users may face login problems due to unstable internet connections.

- VPN and Proxy Use: Access may be blocked if using a VPN or IP proxy.

- App Updates: Outdated app versions might cause functionality issues.

- Geographical Restrictions: Attempts to connect from blocked countries can be problematic.

Understanding these pros and cons helps in making an informed decision about using Varo Mobile Banking.

Ideal Users And Scenarios

Varo App is an excellent solution for various users and situations. Its user-friendly interface and comprehensive features make it ideal for individuals seeking efficient mobile banking services.

Who Can Benefit The Most From Varo?

Varo App is perfect for:

- Young professionals who need to manage their finances on the go.

- Students looking for an easy way to handle their banking needs.

- Freelancers who require real-time updates on their earnings and expenses.

- Anyone who prefers digital banking over traditional methods.

Varo App caters to a wide range of users by offering seamless and secure transactions.

Scenarios Where Varo Excels

Traveling: Varo App is ideal for frequent travelers. It helps you manage your money securely from anywhere in the world. You can avoid the hassle of traditional banking while moving between countries. Remember to ensure a stable internet connection to avoid login issues.

Budgeting: The app sends real-time notifications. This feature helps in tracking spending and maintaining a budget. You can easily monitor your transactions and make informed financial decisions.

Emergency Transfers: In urgent situations, Varo App allows quick money transfers. You can send or receive funds instantly, making it a reliable option during emergencies.

Freelancing: Freelancers can benefit from Varo’s easy account management. They can track their payments and manage their finances without any hassle.

Varo App’s convenience and security make it a top choice for these scenarios and more.

Frequently Asked Questions

What Is Varo Mobile Banking?

Varo Mobile Banking is a digital banking platform. It offers banking services via a mobile app. Users can manage finances on the go.

How Does Varo Mobile Banking Work?

Varo Mobile Banking works through an app. Users can open accounts, deposit checks, and transfer money. All banking services are online.

Is Varo Mobile Banking Safe?

Yes, Varo Mobile Banking is safe. It uses advanced encryption and security measures. Your financial information is protected.

Are There Fees With Varo Mobile Banking?

Varo Mobile Banking has no monthly fees. There are no overdraft fees either. Some services might have small fees.

Conclusion

Managing your finances has never been easier with the Varo App. Enjoy seamless banking, secure transactions, and real-time notifications, all from your smartphone. It’s free to download and use. Ready to simplify your banking experience? Start using the Varo App today by visiting Varo Bank.