Varo Account Fees: Everything You Need to Know

Banking can sometimes be costly with hidden fees and surprise charges. Varo Bank aims to change that with its transparent fee structure.

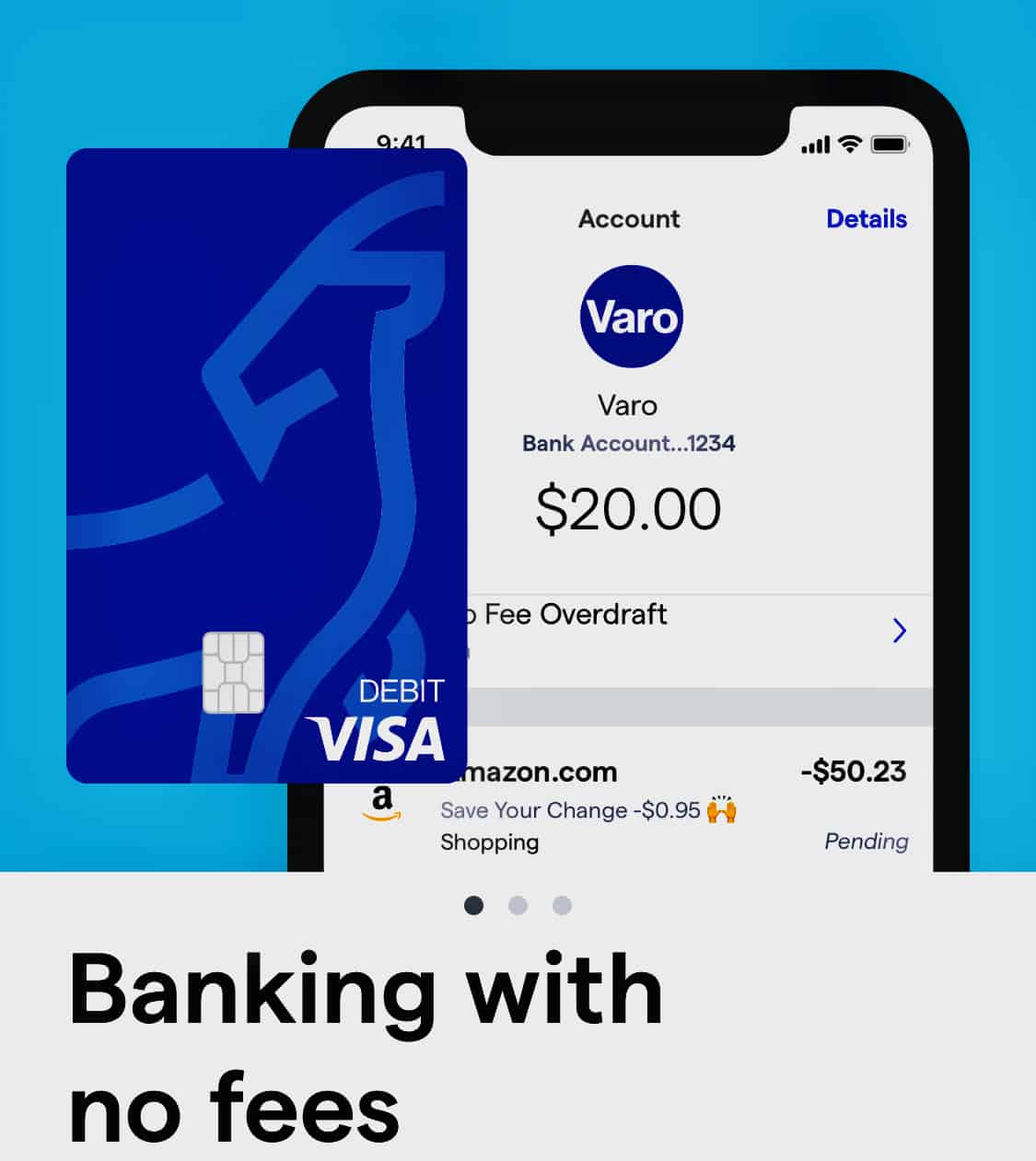

Understanding the fees associated with your bank account is crucial. Varo Bank, known for its user-friendly app, offers a straightforward and economical approach to banking. With a focus on transparency, Varo ensures you know exactly what you’re getting into. This blog post will dive into the details of Varo account fees, so you can make an informed decision. Whether you’re curious about transaction fees or just want to avoid unexpected costs, keep reading to discover how Varo keeps banking simple and affordable. For more information on Varo Bank, visit Varo Bank.

Introduction To Varo Account Fees

Understanding Varo account fees is crucial for any user. Varo Bank aims to offer a seamless, fee-free banking experience. Knowing the fees helps manage your finances better.

What Is Varo?

Varo is a mobile banking app. It offers secure and easy access to various banking services. The app supports multiple financial transactions and has a user-friendly interface. Varo is compatible with the latest mobile operating systems.

Purpose Of The Article

This article aims to inform users about Varo account fees. It explains the benefits of using Varo and how it ensures transparency in banking transactions. The goal is to help users manage their finances efficiently.

| Feature | Description |

|---|---|

| Account Fees | No hidden fees for basic banking transactions. |

| App Pricing | Free to download and use. |

| Security | Enhanced security measures to protect user data and transactions. |

| Support | Users can contact customer support for assistance. |

- Convenient management of banking needs from a mobile device.

- Regular updates for optimal performance and security.

- No hidden fees for basic transactions.

Understanding Varo’s No-fee Structure

Varo Bank stands out with its unique no-fee structure. This approach helps users save money and simplifies their banking experience. Below, we explore the key aspects of Varo’s no-fee policy.

No Monthly Maintenance Fees

Varo does not charge monthly maintenance fees. This means users do not pay a fee just to keep their account open. Many traditional banks charge monthly fees that can add up over time. With Varo, you can save money and avoid unnecessary costs.

No Overdraft Fees

Overdraft fees can be a burden for many bank customers. Varo eliminates this problem by not charging overdraft fees. If you spend more than what is in your account, Varo does not penalize you. This feature helps users manage their finances without fear of extra charges.

No Foreign Transaction Fees

Traveling abroad often comes with hidden costs, such as foreign transaction fees. Varo does not charge foreign transaction fees. This means you can use your Varo account for purchases abroad without worrying about extra fees. This feature is particularly beneficial for frequent travelers.

Key Features Of Varo Accounts

Varo Bank offers a range of features designed to make banking simple and accessible. Below are some of the key features that make Varo accounts stand out.

Early Direct Deposit

With Varo, you can receive your paycheck up to two days early. This feature helps users manage their finances better and ensures timely access to funds.

High-yield Savings

Varo offers a high-yield savings account with competitive interest rates. This helps users grow their savings faster compared to traditional banks.

- No minimum balance required

- No monthly fees

- Automatic savings tools

Varo Advance

Varo Advance allows users to get a cash advance when they need it most. This feature provides short-term liquidity without high fees.

- Borrow up to $100

- Low fees compared to payday loans

- Quick and easy access to funds

| Feature | Benefit |

|---|---|

| Early Direct Deposit | Receive paychecks up to two days early |

| High-Yield Savings | Grow savings faster with competitive interest rates |

| Varo Advance | Access cash advances quickly and affordably |

Visit the Varo website for more information and to sign up.

Breaking Down The Costs: When Fees Apply

Varo Bank offers a range of banking services with minimal fees. However, there are certain instances where fees may apply. Understanding these fees is crucial for managing your finances effectively. Let’s break down the costs associated with Varo Bank services.

Cash Deposits

Depositing cash into your Varo account is straightforward. Yet, it’s important to know where and how you can do it to avoid fees. Cash deposits at in-network locations, such as certain retailers, incur no charges. However, using out-of-network locations may lead to fees. Always check for the nearest in-network locations to save on costs.

Out-of-network Atm Fees

Accessing your money through ATMs can sometimes attract fees. Varo Bank provides a wide network of fee-free ATMs. But, using an out-of-network ATM will incur a fee of $2.50 per transaction. This fee is in addition to any charges imposed by the ATM operator. Stick to in-network ATMs to avoid these costs.

Wire Transfers

While Varo Bank supports various financial transactions, wire transfers are an exception. Currently, Varo does not offer wire transfer services. Therefore, no fees apply for this service through Varo. For transferring funds, users can utilize other available options within the app, such as ACH transfers, which are fee-free.

Understanding these fees ensures you can manage your Varo account effectively and avoid unnecessary costs. Always stay informed about where fees might apply, so you can make the most of your banking experience with Varo Bank.

Pros And Cons Of Varo’s Fee Structure

The Varo banking app offers a unique fee structure that appeals to many users. Understanding the advantages and limitations of their fee model can help you decide if Varo is the right choice for your financial needs.

Advantages Of No-fee Banking

Varo’s no-fee banking model provides several benefits:

- No monthly maintenance fees: Users can save money without worrying about monthly charges.

- Free ATM withdrawals: With thousands of ATMs in their network, you can access cash without paying extra.

- No overdraft fees: Varo does not charge for overdrafts, which can help you avoid unexpected expenses.

- No foreign transaction fees: You can make purchases abroad without extra costs.

These advantages make Varo a cost-effective option for users who want to avoid traditional banking fees.

Potential Drawbacks And Limitations

While Varo’s fee structure has many benefits, there are some limitations:

- ATM fees outside the network: Using out-of-network ATMs can incur fees.

- Limited physical branches: Varo is mainly an online bank, which might be inconvenient for those who prefer in-person services.

- Cash deposits: Depositing cash can be difficult since it requires third-party services that may charge fees.

- Account limitations: Some users may miss features offered by traditional banks, like certain types of loans or credit cards.

Considering these points can help you weigh the benefits against the potential drawbacks of Varo’s fee structure.

Who Should Consider A Varo Account?

A Varo account suits different types of users. It provides a range of features and benefits that make it an attractive option for many.

Ideal Users And Scenarios

Varo is perfect for:

- Tech-savvy individuals: Those who prefer managing their finances via a mobile app.

- Frequent travelers: Users who need easy access to banking services anywhere.

- Young adults: Ideal for those starting to manage their finances independently.

- Cost-conscious users: Those looking for an account with no hidden fees.

These users will find Varo’s user-friendly interface and secure access beneficial.

Comparing Varo To Traditional Banks

Let’s see how Varo compares to traditional banks:

| Feature | Varo | Traditional Banks |

|---|---|---|

| Account Fees | No hidden fees | Monthly maintenance fees |

| Accessibility | 24/7 via mobile app | Limited to branch hours |

| Security | Enhanced security measures | Standard security protocols |

Varo offers significant advantages in accessibility and cost. Traditional banks often come with higher fees and less flexibility.

Frequently Asked Questions

What Are Varo Account Fees?

Varo Bank offers fee-free banking. There are no monthly maintenance or overdraft fees. ATM withdrawals are free at Allpoint® ATMs.

Does Varo Charge Overdraft Fees?

Varo does not charge overdraft fees. It offers No Fee Overdraft up to $50 if you qualify and opt-in.

Are There Atm Fees With Varo?

Varo does not charge ATM fees at Allpoint® ATMs. Using out-of-network ATMs may incur fees from the ATM operator.

Is There A Monthly Fee For Varo Accounts?

Varo Bank does not have any monthly maintenance fees. You can enjoy fee-free banking with Varo.

Conclusion

To sum up, Varo Bank offers a seamless mobile banking experience. It provides easy access to various financial services with no hidden fees. Users can manage their banking needs conveniently and securely from their mobile devices. The app is user-friendly and regularly updated for optimal performance. If you need a reliable banking app, consider Varo. Learn more about Varo Bank here.