Varo Pre-Qualification: Easy Steps to Get Started

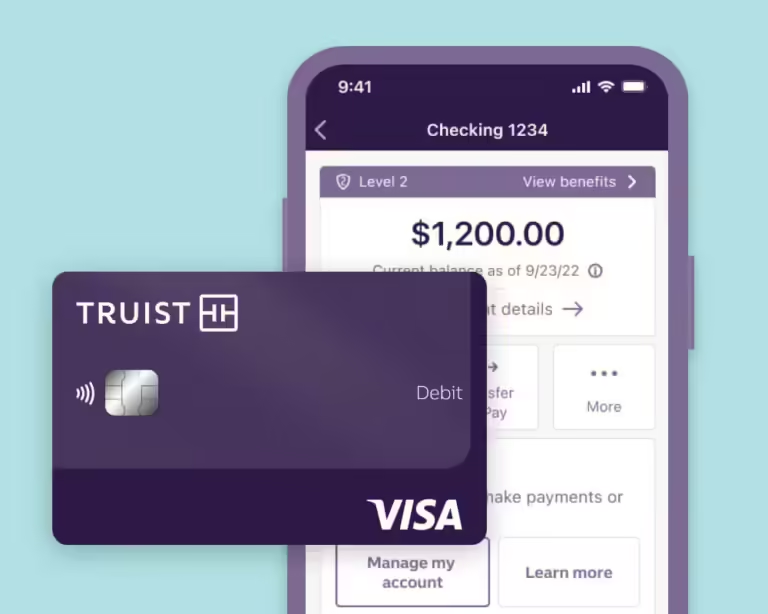

Thinking about trying Varo? Varo Bank offers a seamless mobile banking experience.

This blog will help you understand Varo Pre-Qualification. Varo Bank, known for its user-friendly app, brings convenience to your fingertips. The Varo app allows you to manage your accounts, send money, and track your budget all from your smartphone. No more waiting in line at the bank. With its enhanced security features, you can trust your information is safe. Plus, the app is free to download with no hidden fees. Learn how Varo Pre-Qualification can simplify your banking experience and help you take control of your finances. Discover more about Varo Bank by visiting their official website: Varo Bank.

Introduction To Varo Pre-qualification

The Varo Pre-Qualification process helps potential customers understand their eligibility for Varo’s financial products. This initial step ensures that users can navigate their financial journey smoothly. The following sections will delve deeper into understanding Varo and the importance of pre-qualification.

Understanding Varo And Its Purpose

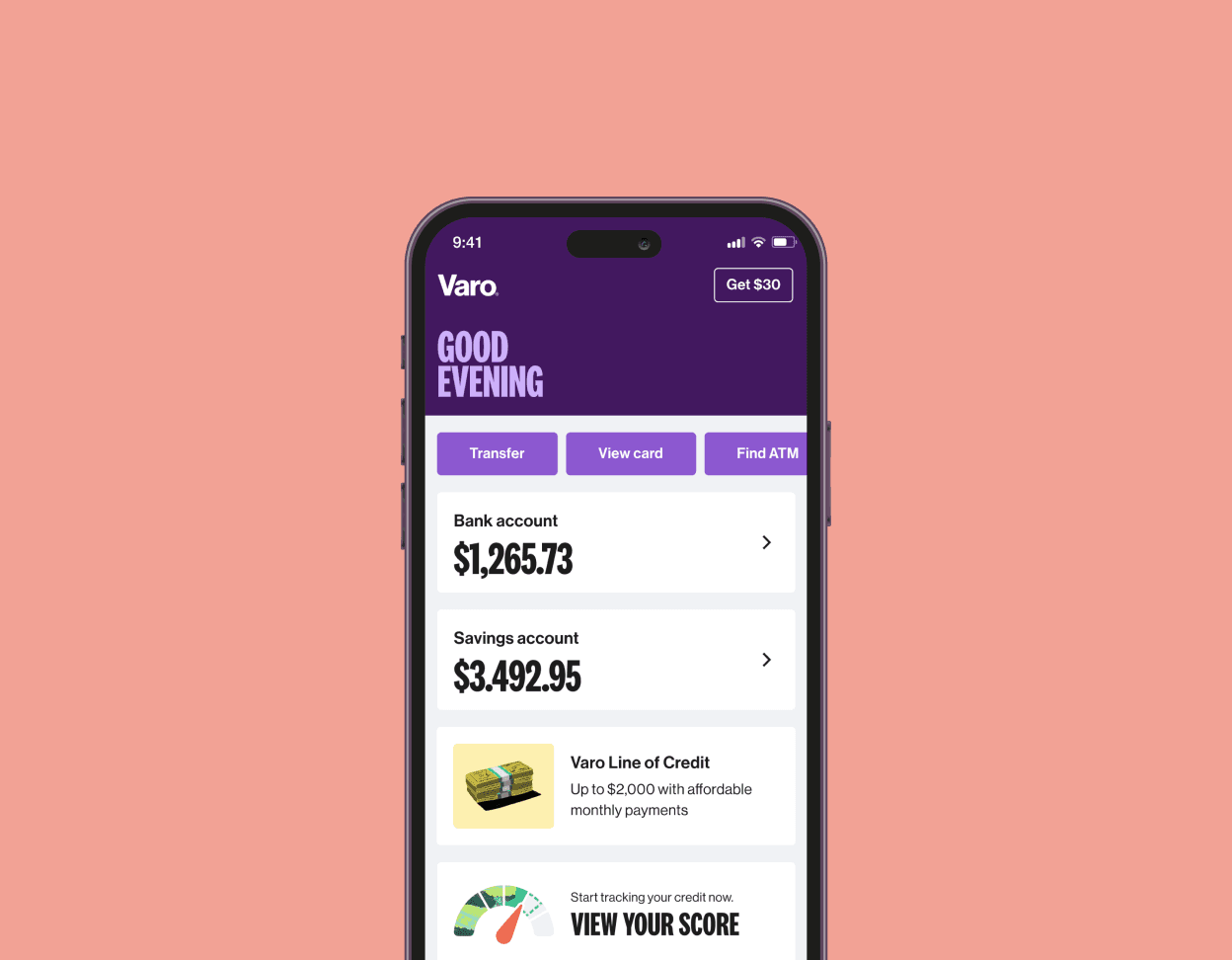

Varo is a mobile banking application designed to offer users an efficient way to manage their finances. The app provides a range of banking services directly from your smartphone, making it a convenient choice for modern banking.

Key features of the Varo app include:

- Mobile Banking: Access to banking services from your smartphone.

- Account Management: Check balances, view transactions, and manage funds.

- Money Transfers: Send and receive money easily.

- Budgeting Tools: Tools to help track spending and save money.

- Security: Enhanced security features to protect user data and transactions.

The Varo app is free to download and use. It has no monthly maintenance fees or minimum balance requirements, providing cost-effective banking solutions.

Importance Of Pre-qualification

Pre-qualification is a crucial step in the financial journey. It helps users understand their eligibility for Varo’s services before applying. This step saves time and ensures users meet the necessary criteria without affecting their credit score.

Benefits of pre-qualification include:

- Time-saving: Quickly determine eligibility without extensive paperwork.

- Credit Score Protection: Pre-qualification checks do not impact your credit score.

- Informed Decision-making: Know which products you qualify for before applying.

Understanding the pre-qualification process helps users make informed decisions about their financial products. It empowers them with the knowledge needed to manage their finances effectively using the Varo app.

Key Features Of Varo Pre-qualification

Varo Bank offers a unique pre-qualification process that stands out in the crowded financial services market. Understanding the key features of Varo Pre-Qualification can help you make an informed decision about using this service.

No Impact On Credit Score

One of the standout features of Varo Pre-Qualification is that it has no impact on your credit score. Unlike traditional credit checks, this process uses a soft inquiry. This means you can check your eligibility without worrying about a negative mark on your credit report.

Quick And Easy Application Process

The application process for Varo Pre-Qualification is designed to be quick and easy. You can complete the application directly from the Varo app on your smartphone. Here’s a quick look at the steps involved:

- Open the Varo app

- Navigate to the pre-qualification section

- Enter your basic information

- Submit your application

This streamlined process ensures you spend less time applying and more time managing your finances.

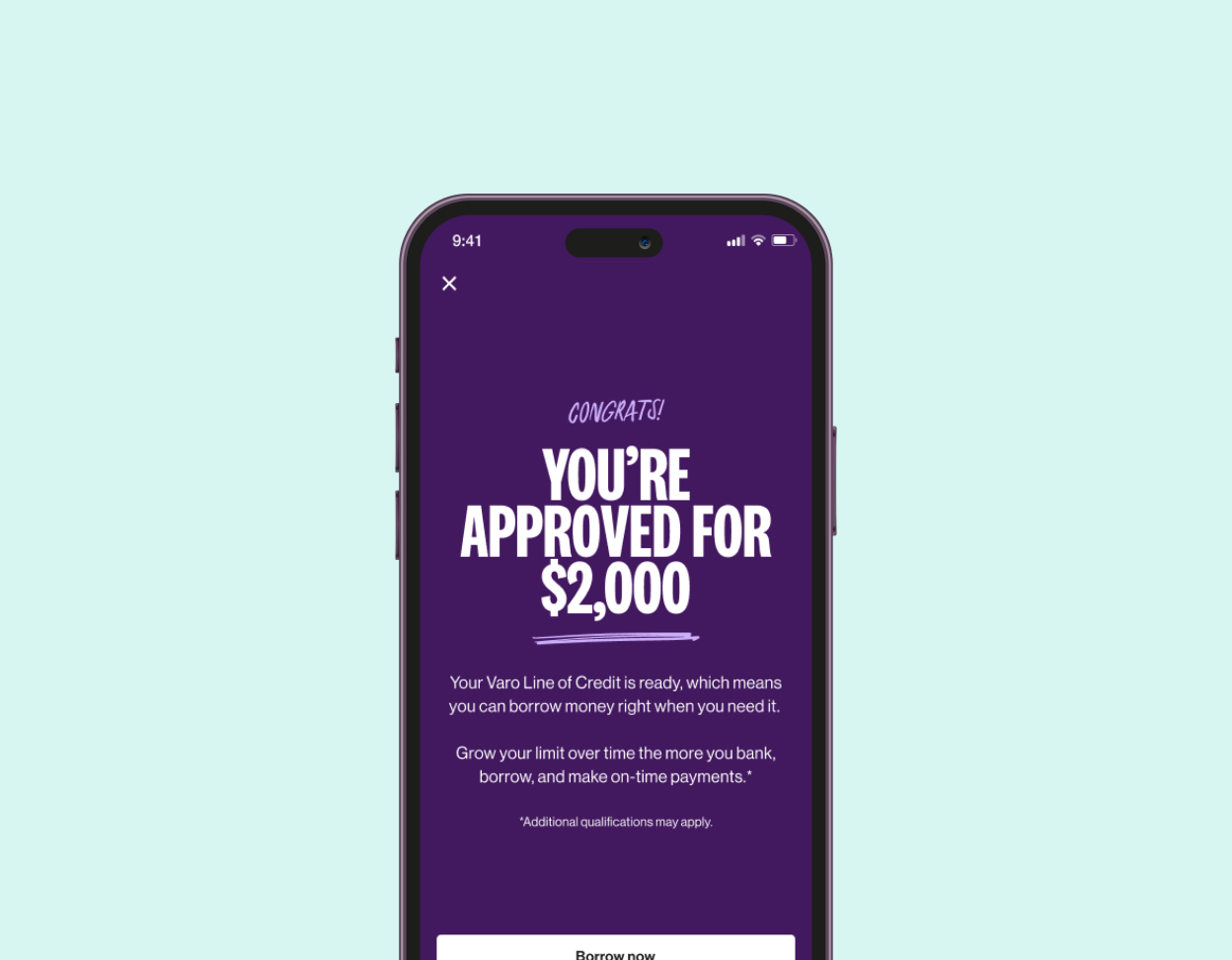

Instant Decision

With Varo Pre-Qualification, you receive an instant decision. There’s no need to wait days or even hours to know your status. The system provides immediate feedback, allowing you to proceed with your financial plans without delay.

These key features make Varo Pre-Qualification an attractive option for anyone seeking a hassle-free way to check their financial options. Explore the Varo app today and take control of your financial future.

Steps To Get Started With Varo Pre-qualification

Getting pre-qualified for Varo Bank services is a straightforward process. Follow these simple steps to get started with Varo pre-qualification. It helps you determine your eligibility for Varo products and services.

Step 1: Visit The Varo Website

Begin by visiting the official Varo website at https://www.varomoney.com/. Ensure you have a stable internet connection for a smooth experience. Avoid using VPNs or IP proxies as this might interfere with the process.

Step 2: Fill Out The Pre-qualification Form

Once on the website, navigate to the pre-qualification section. Here, you will find a form that requires basic personal and financial information. Provide accurate details such as:

- Full Name

- Email Address

- Phone Number

- Current Address

- Income Details

Double-check your entries to ensure there are no errors before proceeding to the next step.

Step 3: Submit Your Application

After filling out the form, click on the submit button to send your pre-qualification application. Varo will review your information and provide you with a response in real-time. You will receive instant notifications regarding your pre-qualification status.

Remember, the Varo app is free to download and use, with no monthly maintenance fees or minimum balance requirements. This makes managing your finances more accessible and efficient.

Pricing And Affordability

When it comes to banking, pricing and affordability are crucial. Varo Bank ensures you get the best value for your money. Here’s what you need to know about Varo’s pricing and affordability features.

No Fees For Pre-qualification

Varo Bank stands out with its no fees for pre-qualification policy. Unlike many financial institutions, Varo does not charge you for checking your pre-qualification status. This means you can explore your financial options without any upfront costs.

Here are some of the benefits of having no fees for pre-qualification:

- Cost-saving: No hidden charges or fees.

- Risk-free: Explore financial options without financial commitment.

- Convenience: Easy and quick pre-qualification process.

Comparison With Other Financial Institutions

Comparing Varo Bank with other financial institutions highlights its affordability. Let’s look at a quick comparison:

| Features | Varo Bank | Traditional Banks |

|---|---|---|

| No Fees for Pre-Qualification | Yes | No |

| Monthly Maintenance Fees | No | Varies (up to $15) |

| Minimum Balance Requirements | No | Yes |

| Mobile Banking | Yes | Yes, but with limited features |

With Varo Bank, you enjoy a hassle-free banking experience. There are no monthly maintenance fees or minimum balance requirements. Traditional banks often charge for these services, making Varo a cost-effective alternative.

Varo’s mobile banking features are comprehensive, providing more flexibility and control over your finances. This makes Varo not only affordable but also highly convenient.

In summary, Varo Bank offers a user-friendly, affordable banking solution. Explore your financial options without worrying about hidden fees. Enjoy complete control over your finances with the Varo app.

Pros And Cons Of Varo Pre-qualification

Varo Bank offers a pre-qualification process that can help users determine their eligibility for financial products without affecting their credit scores. This section explores the pros and cons of using Varo Pre-Qualification.

Benefits Of Using Varo For Pre-qualification

- Soft Credit Check: The pre-qualification process involves a soft credit check, which does not impact your credit score.

- Convenience: You can complete the process directly from the Varo mobile app at any time.

- Real-time Updates: Receive instant notifications about your pre-qualification status.

- Financial Control: Better understand your eligibility before formally applying for loans or credit cards.

- Cost-effective: The service is free, and there are no hidden fees.

Potential Drawbacks To Consider

- Limited Access: The app may not be accessible from certain countries due to restrictions.

- Internet Dependency: A stable internet connection is required to complete the pre-qualification process.

- Not a Guarantee: Pre-qualification does not guarantee approval for financial products.

- Limited Information: Users might receive limited details about why they did or did not pre-qualify.

Who Should Use Varo Pre-qualification?

Understanding who should use Varo Pre-Qualification can help you decide if it’s the right tool for you. Varo Pre-Qualification offers numerous benefits and specific scenarios where it excels. Let’s delve into the details to see who the ideal users are and the specific situations where Varo Pre-Qualification shines.

Ideal Users

Varo Pre-Qualification is ideal for:

- First-time credit card applicants who need to understand their eligibility.

- Individuals with limited credit history seeking to build their credit score.

- People aiming to manage their finances more efficiently with a mobile banking app.

- Anyone looking to avoid hard credit inquiries that could impact their credit score.

Specific Scenarios Where Varo Pre-qualification Excels

There are specific scenarios where Varo Pre-Qualification stands out:

- Applying for a new credit card: Helps you understand your eligibility without affecting your credit score.

- Managing finances on the go: Use the Varo app for real-time updates and efficient money management.

- Budgeting and saving: Leverage Varo’s budgeting tools to track your spending and save money.

- Sending and receiving money: Simplifies money transfers with just a few taps on your smartphone.

- Enhanced security: Protects your financial data with advanced security features.

Using Varo Pre-Qualification can provide you with better financial control and peace of mind.

Frequently Asked Questions

What Is Varo Pre-qualification?

Varo pre-qualification is a process to check eligibility for a Varo account. It involves a soft credit inquiry.

How Do I Pre-qualify For Varo?

To pre-qualify for Varo, you need to provide personal information online. It involves a soft credit check.

Does Varo Pre-qualification Affect Credit Score?

No, Varo pre-qualification does not affect your credit score. It uses a soft credit inquiry.

Is Varo Pre-qualification Free?

Yes, Varo pre-qualification is completely free. There are no charges involved in the process.

Conclusion

Varo Pre-Qualification offers an easy way to manage your finances. The Varo app provides convenient banking, money transfers, and budgeting tools. Enjoy real-time updates and enhanced security. No fees or minimum balance required. For more information, visit Varo Bank. Experience financial control and convenience with Varo. Start managing your money better today.