Varo Financial Wellness: Transform Your Financial Future Today

Financial wellness is crucial for a stable and secure future. Varo Financial Wellness aims to simplify banking and improve financial health.

Varo Bank provides a mobile banking app designed for easy access to banking services. With Varo, users can manage their finances directly from their smartphones. The app offers features such as account monitoring, transaction tracking, and enhanced security. Its user-friendly interface ensures that even those with limited banking experience can navigate effortlessly. Varo Bank is committed to providing a seamless banking experience with regular updates for optimal performance. The best part? The Varo app is free to download and use. Learn more about Varo’s offerings and start your journey to financial wellness today with Varo.

Introduction To Varo Financial Wellness

Varo Financial Wellness is a comprehensive solution designed to help users manage their finances effectively. It combines the ease of mobile banking with personalized financial tools. This service aims to empower users to make better financial decisions and achieve their financial goals.

What Is Varo Financial Wellness?

Varo Financial Wellness is part of the Varo Bank ecosystem. It offers users a suite of tools to monitor their spending, save money, and access their accounts in real-time. The mobile app provides a seamless banking experience, ensuring users can manage their finances from anywhere.

Purpose And Benefits Of Varo Financial Wellness

The primary purpose of Varo Financial Wellness is to offer a user-friendly and secure platform for managing personal finances. Here are some key benefits:

- Convenient Access: Users can access their banking services on the go.

- Enhanced Security: The app has top-notch security features to protect user data.

- User-Friendly Interface: The interface is designed for easy navigation.

- Regular Updates: The app receives frequent updates to maintain optimal performance.

With Varo Financial Wellness, users can stay on top of their financial health effortlessly. The app’s intuitive design and robust features make it an excellent choice for anyone looking to manage their money better.

Key Features Of Varo Financial Wellness

Varo Financial Wellness offers a range of features designed to help users manage their finances effectively. From savings accounts to credit cards and insights into cash flow, Varo provides tools that make banking easier and more efficient. Here are the key features of Varo Financial Wellness:

Varo Savings Account

The Varo Savings Account offers a high-interest rate, helping users grow their savings faster. With no minimum balance requirements and no monthly fees, it’s a great option for anyone looking to save money. Users can easily transfer funds between their Varo Bank account and their Varo Savings Account, making it simple to manage their money.

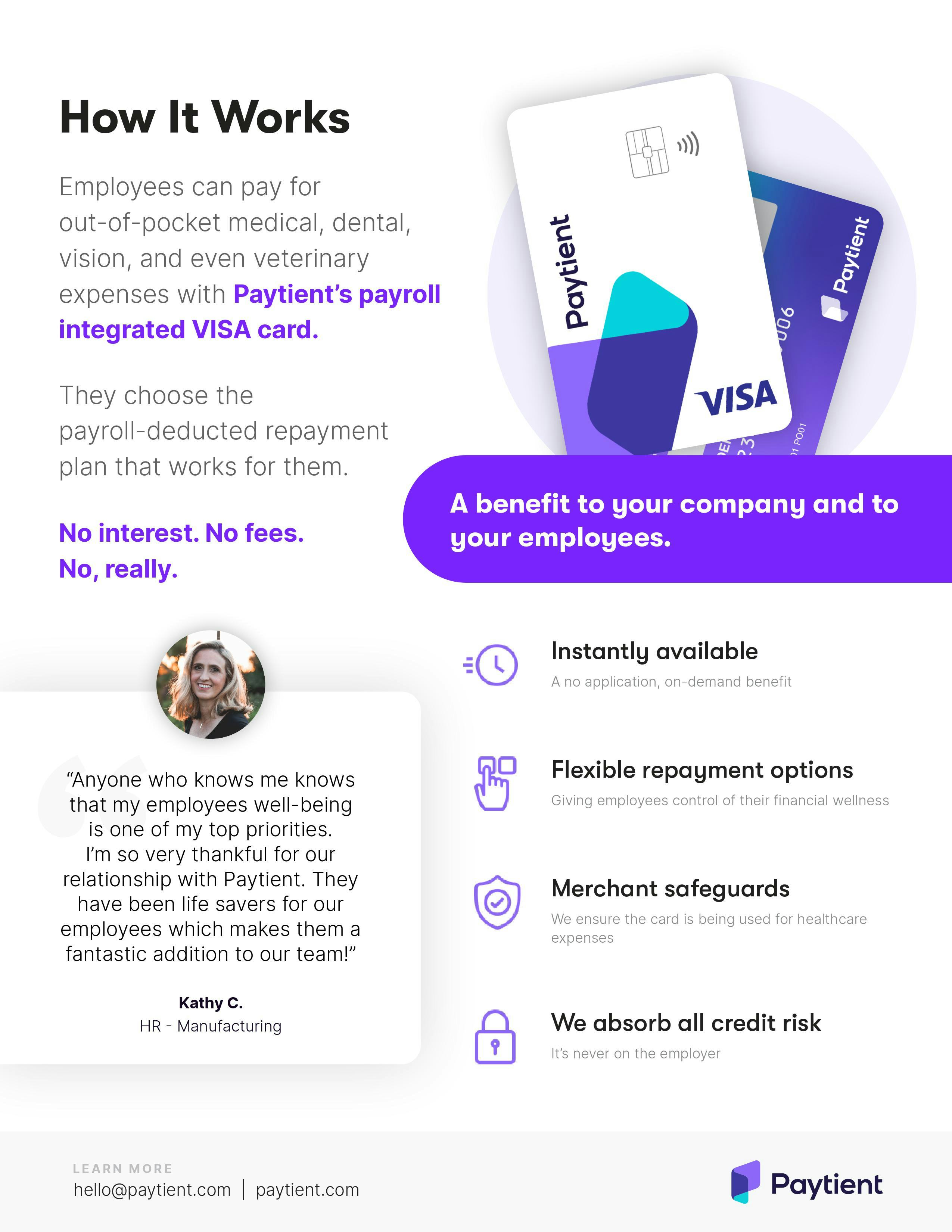

Varo Advance

Varo Advance allows users to access small cash advances when they need it most. Eligible customers can borrow up to $100 with no interest and repay it on their next payday. This feature provides a safety net for unexpected expenses and helps avoid costly overdraft fees.

Varo Cash Flow Insights

Varo Cash Flow Insights gives users a clear view of their financial health. It tracks income, expenses, and upcoming bills, helping users understand their spending patterns and make informed financial decisions. By providing personalized insights, Varo helps users stay on top of their finances and plan for the future.

Varo Believe Credit Card

The Varo Believe Credit Card is designed to help users build or rebuild their credit. It offers a secured credit card with no annual fee and reports to all three major credit bureaus. Users can set their own credit limit based on the amount they deposit, giving them control over their credit-building journey.

Automatic Savings Tools

Varo provides Automatic Savings Tools that help users save effortlessly. With features like Save Your Pay and Save Your Change, users can automatically transfer a portion of their paycheck or round up purchases to the nearest dollar and save the difference. These tools make it easy to build savings without even thinking about it.

No Fee Overdraft Protection

Varo offers No Fee Overdraft Protection for eligible users. This feature allows users to overdraft up to $50 without incurring any fees. It provides peace of mind by covering small, unexpected expenses and ensuring users avoid costly overdraft charges.

| Feature | Details |

|---|---|

| Varo Savings Account | High-interest rate, no minimum balance, no monthly fees |

| Varo Advance | Borrow up to $100, no interest, repay on payday |

| Varo Cash Flow Insights | Tracks income, expenses, and bills, provides insights |

| Varo Believe Credit Card | Secured credit card, no annual fee, reports to credit bureaus |

| Automatic Savings Tools | Save Your Pay, Save Your Change, automatic transfers |

| No Fee Overdraft Protection | Overdraft up to $50, no fees |

Pricing And Affordability

Understanding the costs associated with banking services is crucial. Varo offers a range of features designed to keep banking affordable and accessible. Let’s delve into the specifics of Varo’s pricing, and see how it stacks up against competitors and what value it provides for the money.

Varo Account Fees

Varo stands out in the banking industry with its minimal fee structure. Here are some of the key points:

- No monthly maintenance fees: Varo does not charge a monthly fee to maintain your account.

- No overdraft fees: Avoiding overdraft fees can save you a significant amount annually.

- No foreign transaction fees: You can travel and use your Varo account without worrying about extra charges.

- Free ATMs: Access to over 55,000 Allpoint® ATMs without surcharge fees.

Cost Comparison With Competitors

How does Varo compare with other banking options? Here’s a quick look:

| Bank | Monthly Fees | Overdraft Fees | Foreign Transaction Fees |

|---|---|---|---|

| Varo | None | None | None |

| Traditional Bank A | $10 | $35 per instance | 3% per transaction |

| Traditional Bank B | $12 | $33 per instance | 3% per transaction |

Value For Money

Varo’s fee structure makes it a competitive option in the banking sector. Consider these points:

- Cost Savings: With no monthly fees or hidden charges, Varo saves you money.

- Convenience: Access to free ATMs and no foreign transaction fees provides added value.

- Security: Enhanced security measures protect your data without extra costs.

Choosing Varo means more savings and fewer worries about hidden fees. This makes it a smart choice for those seeking affordable and accessible banking solutions.

Pros And Cons Of Varo Financial Wellness

Varo Financial Wellness aims to offer a comprehensive mobile banking experience. Like any service, it has its strengths and weaknesses. Understanding the pros and cons can help users make informed decisions.

Advantages Of Using Varo

- Convenient Access: Varo allows users to access banking services anywhere through their smartphones. This feature offers unprecedented convenience.

- Enhanced Security: Varo includes robust security measures to protect user data. These measures ensure that users’ personal information remains safe.

- User-Friendly Interface: The app has an intuitive design that makes navigation simple. Users can easily manage their accounts and transactions.

- Free to Use: The Varo app is free to download and use. There are no hidden charges or fees for accessing basic services.

- Regular Updates: Varo provides regular updates to ensure optimal performance. These updates keep the app running smoothly and efficiently.

Potential Drawbacks

- Limited Features: While Varo covers basic banking needs, it may lack advanced features that some users require.

- Dependency on Mobile Devices: Varo is primarily a mobile app, which may not suit users who prefer desktop access.

- No Refund Policies: As a free service, Varo does not offer refund or return policies. Users might face challenges if they encounter issues with the service.

Ideal Users For Varo Financial Wellness

The Varo Financial Wellness app is designed for people who want convenient and secure mobile banking. Whether you need to check your account balance, transfer funds, or monitor transactions, Varo has you covered. This app is perfect for anyone who seeks easy access to their banking services right from their smartphone.

Best Scenarios For Using Varo

Varo is ideal for various scenarios:

- Busy Professionals: Those with tight schedules can manage their finances quickly.

- Travelers: Access banking services while traveling without visiting a branch.

- Students: College students can easily manage their funds on the go.

- Security-Conscious Users: People looking for enhanced security features.

Who Should Consider Varo?

Several groups of people should consider using Varo:

- Tech-Savvy Users: Those who prefer a user-friendly and updated mobile interface.

- Individuals Seeking Convenience: People who want banking services at their fingertips.

- Cost-Conscious Users: Users who appreciate the app’s free download and use.

Varo fits well into the lives of people who want modern, secure, and efficient banking services. The app’s features and benefits make it a strong choice for anyone seeking to manage their finances effortlessly.

Frequently Asked Questions

What Is Varo Financial Wellness?

Varo Financial Wellness is a program that helps users improve financial health. It offers tools for budgeting, saving, and managing money effectively.

How Does Varo Financial Wellness Work?

Varo Financial Wellness provides personalized financial insights and recommendations. It uses your financial data to suggest improvements and track progress.

Is Varo Financial Wellness Free?

Yes, Varo Financial Wellness is free for Varo Bank account holders. It offers valuable financial tools without additional costs.

Can Varo Help With Budgeting?

Yes, Varo Financial Wellness includes budgeting tools. It helps you create, manage, and stick to a budget.

Conclusion

Varo Bank offers a seamless mobile banking experience. Its user-friendly app provides convenient access to your finances. Varo ensures your data is secure and private. Regular updates keep the app running smoothly. Best of all, the Varo app is free. Explore the benefits and download the Varo app today. Start managing your finances with ease.