Varo Bank Features: Unlocking Financial Freedom

Managing finances can be challenging, but Varo Bank makes it easier. This mobile banking app offers a range of features designed to simplify your financial life.

Varo Bank provides a seamless banking experience from your mobile device. With features like mobile banking access and easy account management, staying on top of your finances has never been more convenient. Varo Bank also offers various financial tools to help you better manage your money. Best of all, the app is free to download. Whether you need to check your balance, transfer funds, or monitor your spending, Varo Bank has you covered. Let’s explore the key features that make Varo Bank a popular choice for modern banking. For more information, visit Varo Bank.

Introduction To Varo Bank

Varo Bank is a modern financial institution offering innovative banking solutions through its mobile application. It aims to make banking seamless and accessible to everyone.

What Is Varo Bank?

Varo Bank is a digital bank that operates primarily through its mobile app, the Varo App. It provides users with a range of banking services directly from their smartphones. The Varo App allows for easy account management, financial planning, and monitoring.

With Varo Bank, customers can enjoy the convenience of mobile banking access, which includes features such as:

- Mobile banking access

- Account management

- Financial tools and resources

The app is available for free download, making it accessible for everyone.

Purpose And Mission

The primary purpose of Varo Bank is to provide convenient banking from your mobile device. It aims to simplify financial management with easy-to-use tools and resources.

Varo Bank’s mission is to offer an inclusive banking experience that caters to all users. The bank focuses on offering financial tools to help users manage their finances effectively.

By using Varo Bank, customers can handle their banking needs anytime, anywhere, without the need for traditional banking methods.

| Feature | Description |

|---|---|

| Mobile banking access | Access banking services directly from your mobile device |

| Account management | Manage your accounts easily through the app |

| Financial tools | Utilize various tools to manage your finances |

Varo Bank is dedicated to providing its users with a seamless and efficient banking experience through its app.

Key Features Of Varo Bank

Varo Bank offers a range of features designed to make banking simple and accessible. Here are the key features that set Varo Bank apart:

Varo Bank is committed to no-fee banking. This means no monthly maintenance fees, no overdraft fees, and no foreign transaction fees. This approach helps you save more of your money.

Varo Bank offers a high-yield savings account. Enjoy competitive interest rates that help your savings grow faster. This account is perfect for achieving your financial goals.

With Varo Bank, you can get your paycheck up to two days early. Early direct deposit ensures you have access to your money when you need it most.

Varo Bank provides automatic savings tools. These tools help you save money effortlessly. Set up automatic transfers to your savings account or round up your purchases to save the change.

Need a little extra cash? Varo Advance allows you to borrow up to $100 with no interest. This feature provides a safety net for unexpected expenses.

Varo Bank offers a credit building program. This program helps you improve your credit score with responsible use. It’s a great way to build a strong financial foundation.

Explore these features and more with the Varo App. Convenient banking at your fingertips.

No-fee Banking

Varo Bank offers a remarkable no-fee banking experience, making it a top choice for users seeking cost-effective banking solutions. With zero monthly fees, no overdraft fees, and access to a fee-free ATM network, Varo Bank ensures your money stays where it belongs – in your account.

Zero Monthly Fees

One of Varo Bank’s standout features is the absence of monthly fees. Unlike many traditional banks that charge maintenance fees, Varo Bank allows you to keep your account without any hidden costs. This means you won’t see unexpected charges on your statement each month.

No Overdraft Fees

Varo Bank understands the frustration of overdraft fees. That’s why they have eliminated them entirely. If your account balance goes negative, you won’t be hit with a fee. This policy helps users avoid financial stress and keeps their funds intact.

Fee-free Atm Network

Accessing your money should be convenient and fee-free. Varo Bank provides a vast network of fee-free ATMs, allowing you to withdraw cash without incurring additional charges. This network includes over 55,000 Allpoint® ATMs worldwide, ensuring you can find one near you.

| Feature | Details |

|---|---|

| Zero Monthly Fees | No charges for maintaining your account monthly. |

| No Overdraft Fees | No fees if your balance goes negative. |

| Fee-Free ATM Network | Access to over 55,000 Allpoint® ATMs without fees. |

These features make Varo Bank an attractive option for anyone seeking a straightforward and cost-effective banking experience. Enjoy hassle-free banking with Varo Bank and keep more of your money for what matters most.

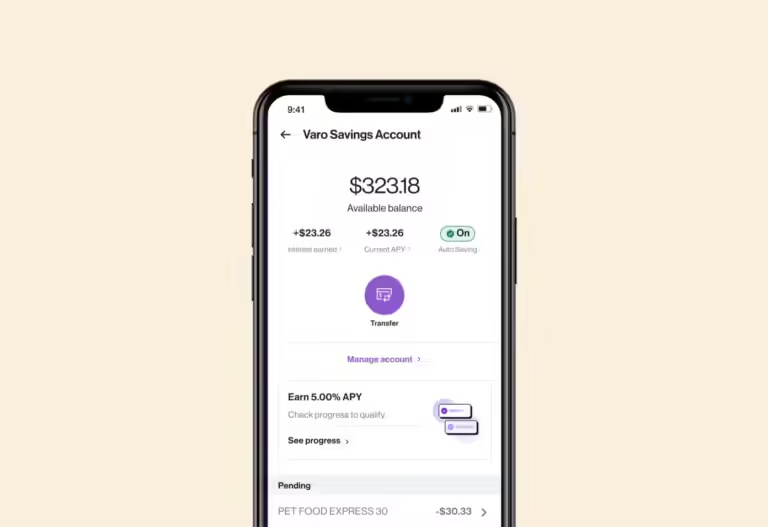

High-yield Savings Account

The Varo Bank High-Yield Savings Account is an excellent choice for those looking to grow their savings. This account offers several features that make saving money easier and more rewarding.

Competitive Interest Rates

One of the standout features of the Varo High-Yield Savings Account is its competitive interest rates. Varo offers some of the highest rates in the industry, ensuring your money grows faster than with traditional savings accounts. This means more earnings on your deposits.

No Minimum Balance Requirements

Another advantage of the Varo High-Yield Savings Account is that there are no minimum balance requirements. Whether you deposit a small or large amount, you can still benefit from the high interest rates. This makes it accessible for everyone, regardless of their financial situation.

Fdic Insurance

Your funds in the Varo High-Yield Savings Account are protected with FDIC insurance. This means that your money is insured up to $250,000 per depositor, providing peace of mind and security. You can trust that your savings are safe with Varo Bank.

Here’s a quick summary of the key features:

| Feature | Description |

|---|---|

| Competitive Interest Rates | High rates to maximize your earnings |

| No Minimum Balance Requirements | Accessible to everyone, no matter the deposit amount |

| FDIC Insurance | Protection for your funds up to $250,000 |

With these features, the Varo High-Yield Savings Account is a great option to consider for your savings needs. Start saving smarter and growing your money with Varo Bank.

Early Direct Deposit

Experience the convenience of getting your paycheck faster with Varo Bank’s Early Direct Deposit feature. This service allows you to receive your funds up to two days earlier than traditional banks. Enjoy quicker access to your hard-earned money without the wait.

Get Paid Up To Two Days Early

With Varo Bank, you can get paid up to two days early. Imagine having your paycheck available before others. This feature ensures you have your money when you need it most.

How It Works

Setting up Early Direct Deposit with Varo is simple. Here’s a quick guide:

- Open the Varo App on your mobile device.

- Navigate to the Direct Deposit section.

- Provide your employer with your Varo account and routing numbers.

- Your paychecks will be deposited directly into your Varo account.

With this setup, your funds are processed faster, giving you earlier access.

Benefits For Users

Early Direct Deposit comes with several benefits:

- Quick Access: Get your money up to two days before payday.

- Financial Planning: Manage your finances better with early access to funds.

- Convenience: No need to wait for your paycheck to clear.

Enjoy the peace of mind that comes with having your funds available sooner. Early Direct Deposit with Varo Bank is designed to make your financial life easier.

Automatic Savings Tools

The Varo Bank offers an impressive range of automatic savings tools. These features make saving money effortless and stress-free. With Varo’s innovative programs, you can watch your savings grow steadily over time. Let’s delve into three of these standout tools: the Round-Up Program, the Save Your Pay Program, and Customizable Savings Goals.

Round-up Program

The Round-Up Program is a simple yet effective way to save money. Each time you make a purchase with your Varo debit card, the transaction amount is rounded up to the nearest dollar. The difference is automatically transferred to your savings account. For example, if you spend $3.50, the app rounds it up to $4.00 and moves $0.50 to your savings.

Save Your Pay Program

The Save Your Pay Program is another smart feature of the Varo App. This program allows you to automatically save a portion of your paycheck. You can set a specific percentage or a fixed amount to be transferred to your savings account each payday. This ensures that you consistently save money without even thinking about it.

Customizable Savings Goals

With Varo’s Customizable Savings Goals, you can set specific targets for your savings. Whether it’s for a vacation, an emergency fund, or a new gadget, you can create a goal and track your progress. The app allows you to allocate money towards these goals automatically, making it easier to stay on track and achieve your financial objectives.

| Feature | Description |

|---|---|

| Round-Up Program | Rounds up purchases to the nearest dollar and saves the difference. |

| Save Your Pay Program | Automatically saves a portion of your paycheck each payday. |

| Customizable Savings Goals | Allows you to set and track specific savings goals. |

Varo Advance

Varo Advance is a key feature of the Varo Bank app. It provides quick and easy access to small cash advances. This service is designed to help you manage unexpected expenses without hassle. Let’s explore the main aspects of Varo Advance.

Small Cash Advances

With Varo Advance, you can get small cash advances ranging from $20 to $100. These advances can be requested directly through the Varo app. The process is simple and quick, ensuring you get the funds you need when you need them.

Flexible Repayment Options

Varo Advance offers flexible repayment options. You can repay the advance within 30 days without any additional fees. This flexibility makes it easier to manage your finances and avoid late fees or penalties.

Eligibility And Limitations

To be eligible for Varo Advance, you need to meet certain criteria:

- Your Varo Bank account must be at least 30 days old.

- You must have at least $1,000 in direct deposits within the last 31 days.

- There should be no negative balances on your account in the last 30 days.

These requirements ensure that the service is used responsibly and remains sustainable for all users.

Credit Building Program

Varo Bank’s Credit Building Program offers a practical way to enhance your credit score. This program is designed to help users build and maintain good credit health. With features like a secured credit card and credit monitoring services, it provides the tools you need to improve your credit score effectively.

Secured Credit Card

One of the key features of the Varo Bank Credit Building Program is the secured credit card. This card requires a deposit that acts as your credit limit. By using this card responsibly, you can build a positive credit history. It’s ideal for those new to credit or looking to rebuild their credit score.

Benefits of the secured credit card include:

- No annual fees

- Reports to major credit bureaus

- Helps establish or rebuild credit

Credit Monitoring Services

Varo Bank also offers credit monitoring services as part of their Credit Building Program. These services allow you to keep track of your credit score and report. Regular updates and alerts help you stay informed about any changes or issues that may affect your credit.

Features of credit monitoring services include:

- Monthly credit score updates

- Alerts for significant changes

- Detailed credit report analysis

Tips For Improving Credit Score

Building and maintaining a good credit score requires consistent effort and smart financial habits. Here are some tips to help you improve your credit score:

- Pay your bills on time. Late payments can significantly impact your score.

- Keep your credit card balances low. High balances can lower your score.

- Regularly check your credit report for errors. Dispute any inaccuracies.

- Avoid opening too many new accounts at once. Each application can affect your score.

- Maintain a mix of credit types. A diverse credit portfolio can be beneficial.

By following these tips and utilizing the features of Varo Bank’s Credit Building Program, you can take control of your credit health and work towards a better financial future.

Pricing And Affordability

Varo Bank offers a range of banking services through its mobile app. Understanding the pricing and affordability of Varo Bank’s services is crucial for potential users. Let’s break down the costs and see how Varo Bank compares with other competitors in the market.

Cost Breakdown

Varo Bank provides several services at no cost. Here is a detailed breakdown:

- Account Opening: Free

- Monthly Maintenance Fees: None

- Overdraft Fees: None

- ATM Fees: No fees at over 55,000 Allpoint® ATMs

- Foreign Transaction Fees: None

Varo Bank ensures that users face minimal charges, making banking accessible and affordable.

Comparative Analysis With Competitors

Comparing Varo Bank with traditional banks and other mobile banks can show its advantages.

| Feature | Varo Bank | Traditional Banks | Other Mobile Banks |

|---|---|---|---|

| Monthly Fees | None | $10 – $15 | $5 – $10 |

| Overdraft Fees | None | $35 – $40 | $15 – $25 |

| ATM Fees | None at Allpoint® ATMs | $2 – $5 | $1 – $3 |

Varo Bank stands out with zero fees for many services that other banks charge for.

Value For Money

Varo Bank offers great value for money with its free and low-cost services. Here’s why:

- Cost Efficiency: No hidden fees or surprise charges.

- Access to Tools: Users can manage finances easily with the app’s tools.

- Convenience: Bank from anywhere without worrying about fees.

Varo Bank ensures users save money while enjoying comprehensive banking services.

Pros And Cons Of Varo Bank

Varo Bank offers a variety of features that appeal to many users. This section delves into the benefits and potential drawbacks of using Varo Bank. We also include real-world user testimonials to provide a balanced view.

Real-world Usage Benefits

Varo Bank provides several advantages for its users. These benefits make it a popular choice for mobile banking.

- Convenient mobile banking: Manage your finances directly from your smartphone.

- Easy account management: Monitor your account activities with ease.

- Financial tools and resources: Access various tools to help manage your finances effectively.

- No monthly fees: Enjoy banking without worrying about monthly maintenance fees.

- Free ATM withdrawals: Withdraw cash from a network of ATMs without incurring fees.

Potential Drawbacks

Despite its numerous benefits, Varo Bank has some limitations that users should consider.

- No physical branches: Varo Bank operates entirely online, which may be inconvenient for some users.

- Limited customer service options: Customers may find it challenging to get support when needed.

- Potential fees for certain services: While there are no monthly fees, some services may incur charges.

User Testimonials

Here are some testimonials from real users of Varo Bank:

“I love how easy it is to manage my finances with Varo. The mobile app is intuitive and user-friendly.”

“Varo Bank’s lack of physical branches isn’t an issue for me. I appreciate the convenience of mobile banking.”

“Customer service could be better, but overall, I’m satisfied with Varo’s services.”

Recommendations For Ideal Users

The Varo App is a mobile banking application that offers seamless banking services. It is designed for users who prefer managing their finances on the go. With its many features, the app caters to a wide range of users. Below are some recommendations for who should use Varo Bank.

Who Should Use Varo Bank?

- Young Professionals: Ideal for those who need easy access to their accounts.

- Tech-Savvy Users: Perfect for individuals comfortable with mobile apps.

- Freelancers: Useful for managing irregular income and expenses.

- Students: Great for managing budgets and tracking spending.

- Travelers: Convenient for those frequently on the move.

Best Scenarios For Use

The Varo App shines in various scenarios, providing users with the flexibility they need:

- Daily Transactions: Effortlessly handle day-to-day banking tasks.

- Budgeting: Utilize financial tools to keep track of spending.

- Account Monitoring: Easily monitor account activity and balances.

- Financial Planning: Access resources to plan and manage your finances.

- Remote Banking: Conduct banking activities without visiting a branch.

Final Thoughts And Considerations

The Varo App offers numerous benefits for users. It provides convenient banking from your mobile device, easy account management, and access to financial tools. The app is free to download, making it an attractive option for many users.

Consider your banking needs and lifestyle to determine if Varo Bank is the right fit for you. The app is designed to make banking simple and accessible. Whether you are a young professional, freelancer, or student, Varo Bank can meet your financial management needs.

Frequently Asked Questions

What Are The Main Features Of Varo Bank?

Varo Bank offers no-fee banking, high-yield savings accounts, and cash advances. It also provides early direct deposit and budgeting tools. These features make managing finances easier and more efficient.

Does Varo Bank Offer Early Direct Deposit?

Yes, Varo Bank offers early direct deposit. Customers can access their funds up to two days early. This feature helps you manage your finances more effectively.

Is Varo Bank Fee-free?

Varo Bank is fee-free for most services. There are no monthly maintenance fees or overdraft fees. This makes banking with Varo affordable and straightforward.

Can I Get A Cash Advance With Varo Bank?

Yes, Varo Bank offers cash advances. Customers can borrow small amounts without high fees. This feature is helpful in emergencies.

Conclusion

Varo Bank makes managing finances easy and accessible. With the Varo App, users enjoy seamless mobile banking. Convenient account management and financial tools help keep your money in check. Download the app for free and start banking smarter today. Experience the benefits of modern banking. Visit Varo Bank to learn more.