Understanding Credit Utilization: Boost Your Credit Score Today

Credit utilization is a key factor in managing your credit score. Knowing how it works can boost your financial health.

Most people don’t realize how much credit utilization impacts their credit score. It’s not just about paying bills on time; it’s about how much credit you use compared to your total credit limit. This ratio can significantly affect your creditworthiness. Understanding credit utilization helps you make smarter financial decisions. It allows you to keep your credit score healthy, which can save you money on loans and mortgages. One way to manage credit utilization is by using a credit card that offers rewards and benefits, such as the Bilt World Elite Mastercard®. With this card, you can earn rewards on rent payments and enjoy exclusive lifestyle benefits. Learn more about this card by visiting the Bilt Rewards website.

Introduction To Credit Utilization

Understanding credit utilization is crucial for maintaining a healthy credit score. It impacts your financial health and your ability to secure loans and credit. In this section, we will explore what credit utilization is and why it is important for your credit score.

What Is Credit Utilization?

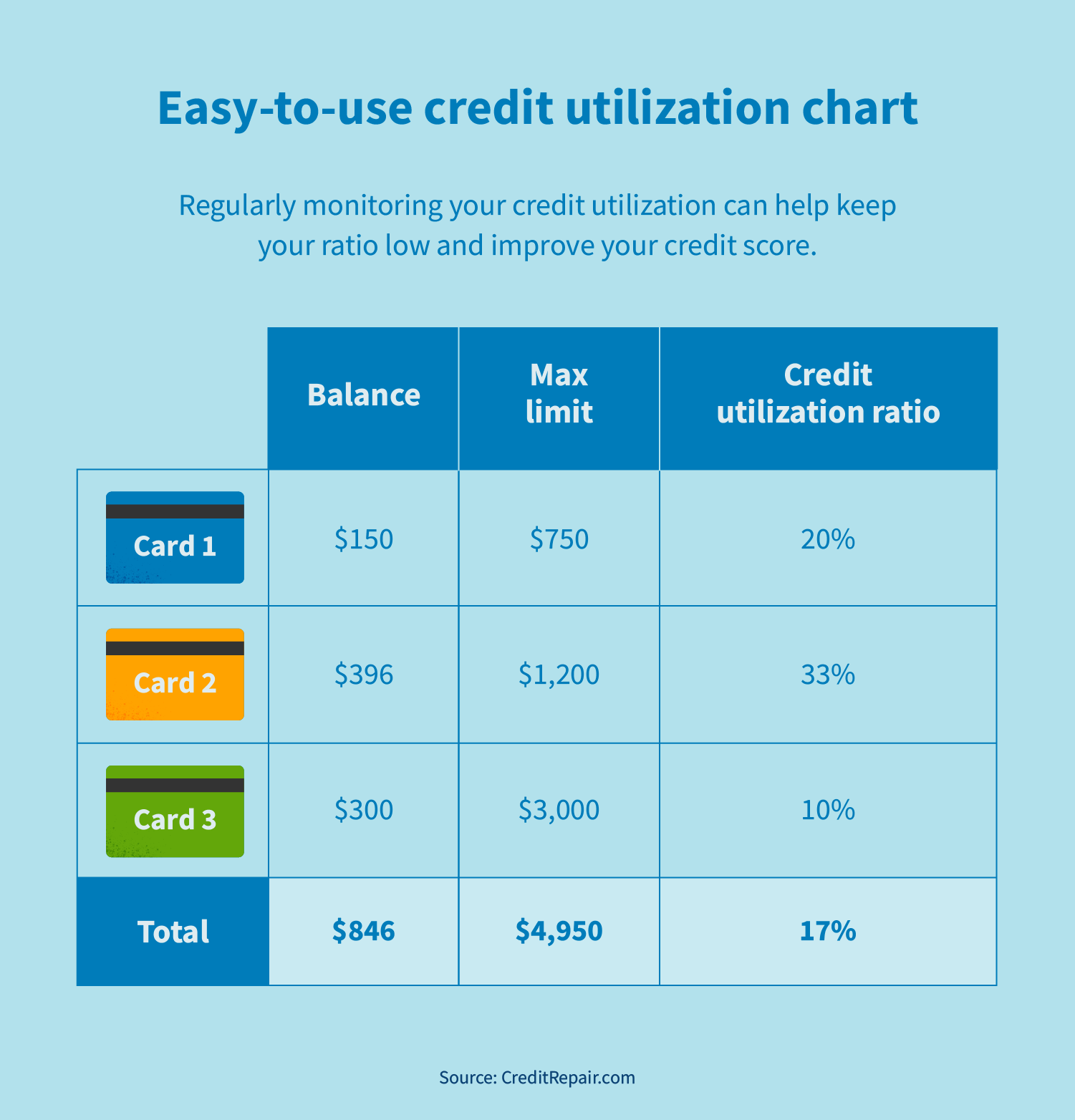

Credit utilization refers to the percentage of your available credit that you are using. It is calculated by dividing your total credit card balances by your total credit limits. For instance, if you have a credit card with a $5,000 limit and you have charged $1,000 to it, your credit utilization rate is 20%.

Most experts recommend keeping your credit utilization below 30%. This means if your total credit limit across all cards is $10,000, you should aim to use no more than $3,000 at any given time. High credit utilization can signal to lenders that you are over-relying on credit, which may affect your ability to get new loans or credit cards.

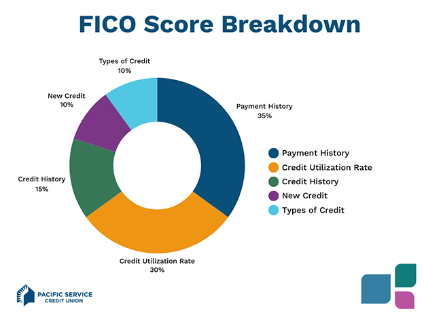

Importance Of Credit Utilization In Credit Scores

Credit utilization significantly impacts your credit score. It is one of the major factors that credit bureaus consider when calculating your score. A lower utilization rate indicates responsible credit usage and can positively affect your score. Conversely, a high utilization rate can lower your score, making it harder to obtain loans or new credit cards.

Here are some key points to understand the importance:

- Impact on Credit Score: Lower utilization rates can boost your credit score.

- Loan Approval: Lenders view low utilization as a sign of responsible credit management.

- Interest Rates: Better credit scores can lead to lower interest rates on loans.

Monitoring your credit utilization is essential for maintaining a good credit score. It helps you understand your spending habits and manage your debt more effectively.

Key Features Of Credit Utilization

Understanding credit utilization is essential for managing your credit health. By knowing its key features, you can better handle your credit and improve your credit score. Let’s explore some critical aspects of credit utilization.

How Credit Utilization Is Calculated

Credit utilization is the ratio of your credit card balances to your total credit limits. It is calculated by dividing the total credit card balances by the total credit limits and then multiplying the result by 100 to get a percentage.

For example, if you have two credit cards with limits of $5,000 each, and your total balance is $2,000, your credit utilization would be:

(2000 / 10000) x 100 = 20%A lower credit utilization ratio indicates that you are using less of your available credit, which is favorable for your credit score.

Optimal Credit Utilization Rate

The optimal credit utilization rate is typically below 30%. Most credit experts suggest keeping your utilization between 1% and 30% to maintain a healthy credit score.

Aiming for this range shows that you are using credit responsibly without relying too heavily on it. Consistently maintaining a low utilization rate can positively influence your credit profile.

Impact Of High Credit Utilization On Credit Scores

High credit utilization can negatively affect your credit score. When your utilization rate exceeds 30%, it may signal to lenders that you are overextended and potentially at risk of defaulting on payments.

This high ratio can lead to a decrease in your credit score, making it harder to qualify for new credit or loans. It is crucial to monitor your credit card balances and keep your utilization rate in check to avoid these negative impacts.

For example, consider the Bilt World Elite Mastercard® by Wells Fargo Bank N.A. This card offers rewards for rent payments and other lifestyle benefits. By managing your credit utilization effectively, you can maximize these rewards without risking your credit health.

To learn more about the Bilt World Elite Mastercard®, visit the Bilt Rewards website.

Strategies To Improve Credit Utilization

Improving your credit utilization is crucial for maintaining a healthy credit score. This section will explore effective strategies to help you manage and enhance your credit utilization rate.

Pay Down Balances Regularly

One of the most effective strategies is to pay down balances regularly. This means making payments more frequently than the standard monthly due date. Consider bi-weekly payments to reduce your credit card balances faster. This approach helps in keeping your credit utilization rate low, positively impacting your credit score.

| Payment Frequency | Impact |

|---|---|

| Monthly | Standard reduction in balance |

| Bi-Weekly | Faster reduction in balance |

Increase Your Credit Limit

Another strategy is to increase your credit limit. Contact your credit card issuer to request a limit increase. A higher credit limit can reduce your credit utilization ratio, provided your spending remains the same. Be mindful to not increase your spending with the higher limit.

- Request a credit limit increase online or via phone.

- Ensure your credit score and payment history are in good standing.

Avoid Closing Old Credit Accounts

It’s essential to avoid closing old credit accounts. Old accounts with a long history can positively impact your credit score. They contribute to the length of your credit history, which is a key factor in calculating your credit score. Keeping these accounts open, even if unused, helps maintain a favorable credit utilization rate.

- Keep old accounts open and active.

- Use them occasionally to prevent inactivity closure.

By implementing these strategies, you can effectively manage and improve your credit utilization, leading to a healthier credit score.

Tools And Resources For Managing Credit Utilization

Effectively managing credit utilization is essential for maintaining a healthy credit score. Various tools and resources can assist in keeping track of your credit usage, ensuring you stay within recommended limits. Below are some valuable resources to help you manage your credit utilization better.

Credit Monitoring Services

Credit monitoring services provide real-time updates on your credit report and score. These services help you track your credit utilization and alert you to any unusual activity. Some popular credit monitoring services include:

- Credit Karma: Offers free credit score monitoring and personalized recommendations.

- Experian: Provides daily credit report updates and identity theft protection.

- TransUnion: Features credit score tracking and credit lock services.

Financial Planning Apps

Financial planning apps can help you manage your finances and keep track of your credit utilization. These apps offer features such as budgeting tools, expense tracking, and bill reminders. Some useful financial planning apps include:

- Mint: Offers budget tracking, bill reminders, and credit score monitoring.

- YNAB (You Need a Budget): Focuses on budgeting and helping you gain control of your finances.

- Personal Capital: Combines budgeting tools with investment tracking and retirement planning.

Consulting With Credit Counselors

Credit counselors are professionals who can provide personalized advice on managing credit utilization. They help you create a budget, develop a debt repayment plan, and offer guidance on improving your credit score. Consulting with a credit counselor can be particularly beneficial if you are struggling with high credit utilization. Some reputable credit counseling agencies include:

- National Foundation for Credit Counseling (NFCC): Offers financial counseling and debt management plans.

- Money Management International (MMI): Provides credit counseling, debt management, and financial education.

- GreenPath Financial Wellness: Focuses on debt counseling, credit report reviews, and budgeting assistance.

Utilizing these tools and resources can help you effectively manage your credit utilization and maintain a healthy credit score.

Pros And Cons Of Managing Credit Utilization

Understanding the pros and cons of managing credit utilization can help you make better financial decisions. Credit utilization refers to the ratio of your current credit card balances to your credit limits. It is an essential factor in determining your credit score. Let’s explore the benefits and challenges of managing credit utilization effectively.

Benefits Of Maintaining Low Credit Utilization

Maintaining a low credit utilization has several advantages. It can positively impact your credit score. A low credit utilization ratio indicates that you are using a small portion of your available credit. This suggests to lenders that you are financially responsible.

- Improves Credit Score: A low credit utilization ratio can boost your credit score.

- Better Loan Approval Chances: Lenders are more likely to approve loans if your credit utilization is low.

- Lower Interest Rates: With a good credit score, you may qualify for lower interest rates on loans and credit cards.

- Financial Flexibility: Low credit utilization provides more available credit for emergencies.

Challenges In Managing Credit Utilization

Managing credit utilization can present challenges. It requires discipline and careful planning. Here are some common challenges:

- Budgeting Constraints: Keeping spending within limits can be tough, especially with unexpected expenses.

- Tracking Balances: Regularly monitoring credit card balances to ensure they remain low can be time-consuming.

- Multiple Cards Management: Managing credit utilization across multiple cards can be complex.

- Limited Credit History: New credit card users may find it challenging to build a credit history while maintaining low utilization.

Using tools like the Bilt World Elite Mastercard® can help manage credit utilization effectively. This card, issued by Wells Fargo Bank N.A. in partnership with Mastercard, is designed to provide unique rewards and benefits. It focuses on rent payments and other lifestyle rewards. Users can earn rewards on rent payments and access exclusive lifestyle benefits and rewards. For more details, visit the Bilt Rewards website.

Recommendations For Ideal Users

Understanding credit utilization is key to managing your finances and improving your credit score. Here are recommendations for ideal users who should focus on credit utilization.

Who Should Focus On Credit Utilization?

Anyone aiming to maintain or improve their credit score should focus on credit utilization. This includes:

- Individuals planning to apply for a mortgage

- People looking to refinance existing loans

- Those interested in securing better interest rates on credit cards

- Consumers aiming to enhance their financial health

By keeping your credit utilization in check, you can achieve these goals more efficiently.

Scenarios Where Credit Utilization Management Is Crucial

Managing credit utilization is crucial in several scenarios. Here are some key situations where it matters most:

| Scenario | Importance |

|---|---|

| Applying for a new credit card | Helps secure better terms and lower interest rates |

| Preparing for a major purchase | Improves chances of loan approval |

| Paying off existing debt | Reduces overall debt burden and improves credit score |

| Rent payments with Bilt World Elite Mastercard® | Earn rewards while managing credit utilization |

Each scenario highlights the importance of keeping your credit utilization low for better financial opportunities.

Frequently Asked Questions

What Is Credit Utilization?

Credit utilization is the ratio of your credit card balance to your credit limit. It’s expressed as a percentage.

Why Is Credit Utilization Important?

Credit utilization is important because it affects your credit score. High utilization can lower your credit score.

How To Calculate Credit Utilization?

To calculate credit utilization, divide your credit card balance by your credit limit. Multiply the result by 100.

What Is A Good Credit Utilization Ratio?

A good credit utilization ratio is below 30%. Keeping it lower can positively impact your credit score.

Conclusion

Credit utilization impacts your credit score significantly. Keep it low. Manage it wisely. Understand how it works to improve financial health. Consider tools like Bilt World Elite Mastercard® for better rewards. Earn points on rent payments and other perks. Visit Bilt Rewards for more details. Make informed choices to maintain good credit. Stay on top of your finances. Small steps can lead to big improvements. Thank you for reading.