Best Rewards Credit Cards: Maximize Your Benefits Today

Finding the best rewards credit cards can be a game-changer for your finances. They offer perks that can save you money and enhance your lifestyle.

In this blog post, we’ll dive into some of the top rewards credit cards available today. From cashback to travel points, rewards cards can offer significant benefits if used wisely. Understanding the options and selecting the right card can make a big difference in maximizing rewards and achieving financial goals. Whether you are looking for a card with no annual fee, one that offers the best travel perks, or a card with high cashback rates, this guide will help you navigate through the best choices. Let’s get started on finding the perfect rewards credit card for your needs. To know more about business accounts, check out the VIALET Business Account.

Introduction To Rewards Credit Cards

Rewards credit cards offer a unique way to earn benefits on everyday spending. From travel miles to cashback, these cards provide diverse rewards for cardholders. Understanding how they work can help you maximize their potential.

What Are Rewards Credit Cards?

Rewards credit cards give points, miles, or cashback for every purchase. These rewards can be used for various benefits:

- Travel rewards like flights and hotel stays

- Cashback on everyday purchases

- Gift cards and merchandise

Each card has different earning rates and reward structures. Some may offer bonus points for specific categories like dining or groceries.

Why You Should Consider A Rewards Credit Card

There are several reasons to consider using a rewards credit card:

- Earn rewards on purchases: Get points, miles, or cashback on every transaction.

- Special bonuses: Many cards offer sign-up bonuses for new users.

- Flexibility: Use rewards for travel, cashback, or other perks.

VIALET Business Account offers a tailored business account and payment platform. It supports multi-currency payments and virtual corporate cards.

| Feature | Description |

|---|---|

| Multi-Currency Payments | Manage multiple currencies with transparent charges and rates. |

| Virtual Corporate Cards | Issue virtual Visa or Mastercard for business expenses. |

| Mass Payouts via API | Automate regular payments with one-click mass-payout solutions. |

VIALET also provides robust security, personalized support, and transparent fees. This makes it a valuable choice for businesses seeking efficient financial management.

Key Features Of Top Rewards Credit Cards

Rewards credit cards offer great benefits for cardholders. Understanding the key features can help you maximize your rewards. Here, we explore the essential elements of top rewards credit cards.

Earning Points And Cashback

Rewards credit cards let you earn points or cashback on purchases. Typically, you earn a percentage back on every dollar spent. For example, a card might offer 1% cashback on all purchases. Some cards provide higher rates for specific spending categories.

Bonus Categories And Rotating Rewards

Some rewards credit cards have bonus categories. These categories offer higher rewards rates for specific types of purchases. Examples include groceries, gas, or dining out. Rotating rewards change categories every few months. Keeping track of these can enhance your rewards.

Sign-up Bonuses And Welcome Offers

Many rewards credit cards feature sign-up bonuses. These offers provide extra points or cashback for meeting a spending threshold. For instance, you might earn 50,000 points after spending $3,000 in the first three months. Welcome offers can significantly boost your rewards.

Redemption Options And Flexibility

Top rewards credit cards offer flexible redemption options. Points or cashback can be redeemed for travel, gift cards, or statement credits. Some cards provide better value for specific redemptions, like travel. Flexibility in how you use rewards adds to the card’s value.

Additional Perks And Benefits

Beyond earning rewards, these credit cards come with additional perks. Examples include travel insurance, purchase protection, and extended warranties. Many cards offer access to airport lounges or concierge services. These benefits enhance the overall cardholder experience.

| Feature | Description |

|---|---|

| Earning Points and Cashback | Earn rewards on every purchase, with higher rates for specific categories. |

| Bonus Categories and Rotating Rewards | Gain extra rewards in designated categories, which may change periodically. |

| Sign-Up Bonuses and Welcome Offers | Receive large bonuses for meeting initial spending requirements. |

| Redemption Options and Flexibility | Redeem rewards in various ways, including travel, gift cards, and more. |

| Additional Perks and Benefits | Enjoy extra features like travel insurance, purchase protection, and lounge access. |

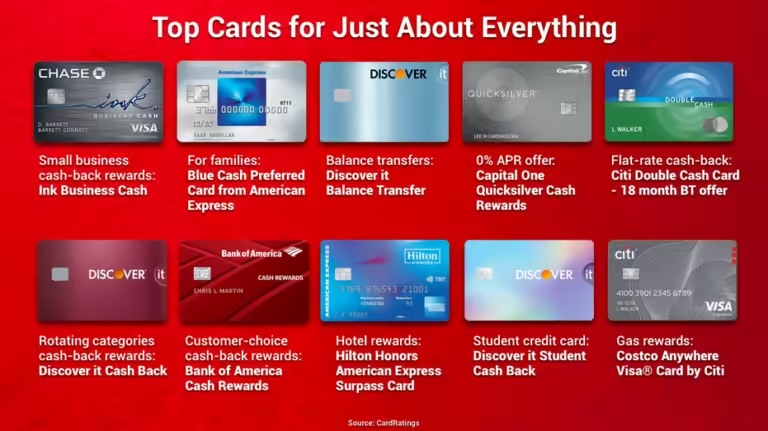

Best Rewards Credit Cards For 2023

Finding the best rewards credit card can be overwhelming. We have simplified the process by identifying the top cards in 2023. Whether you want cashback, travel points, or dining perks, there’s a card for you.

Best Overall Rewards Credit Card

The best overall rewards credit card provides a perfect balance of benefits. It offers strong rewards in multiple categories, including travel, dining, and everyday purchases.

- High rewards rate on all purchases

- Flexible redemption options for cash, travel, or gift cards

- Low annual fee compared to its benefits

Best Cashback Rewards Credit Card

If you prefer cash back, this credit card is ideal. It offers high cash back percentages on specific categories like groceries and gas.

- 5% cash back on rotating categories

- 1% cash back on all other purchases

- Sign-up bonus for new cardholders

Best Travel Rewards Credit Card

Travel enthusiasts will love this card. It provides generous travel rewards and perks, making it perfect for frequent flyers.

- 3x points on travel and dining

- Travel insurance included

- No foreign transaction fees

Best For Dining And Entertainment

This card is perfect for those who enjoy dining out and entertainment. It offers high rewards rates at restaurants and entertainment venues.

- 4x points on dining and entertainment

- Exclusive access to events and concerts

- Annual dining credit benefit

Best For Groceries And Gas

Ideal for families, this card rewards you for everyday spending on groceries and gas. It helps maximize your savings on essential purchases.

- 3% cash back at grocery stores

- 2% cash back at gas stations

- 1% cash back on all other purchases

Pricing And Affordability

Exploring the best rewards credit cards involves understanding their pricing and affordability. Key factors include annual fees, interest rates, foreign transaction fees, and balance transfer fees. Let’s break these down for clarity.

Annual Fees And Interest Rates

Annual fees vary among credit cards. Some cards offer no annual fees, making them attractive for budget-conscious users. Others charge fees but offer significant rewards in return.

| Card | Annual Fee | Interest Rate |

|---|---|---|

| VIALET Business Account | Transparent and competitive fees | Not specified |

| Card B | $95 | 14.99% – 22.99% |

| Card C | No annual fee | 15.99% – 24.99% |

Foreign Transaction Fees

Foreign transaction fees can add up for frequent travelers. Many credit cards charge 1% to 3% on each transaction made abroad.

- VIALET Business Account: Transparent charges and rates for multi-currency payments.

- Card B: 3% foreign transaction fee.

- Card C: No foreign transaction fee.

Balance Transfer Fees

Balance transfer fees are important for those looking to consolidate debt. These fees usually range from 3% to 5% of the transferred amount.

- VIALET Business Account: Not specified.

- Card B: 5% balance transfer fee.

- Card C: 3% balance transfer fee.

Understanding these fees and charges can help you choose the best rewards credit card for your needs. Always read the terms and conditions to avoid surprises.

Pros And Cons Based On Real-world Usage

Rewards credit cards offer numerous benefits, but they also come with potential downsides. Understanding these pros and cons can help you make informed decisions. Let’s explore the advantages and common drawbacks of using rewards credit cards based on real-world usage.

Advantages Of Using Rewards Credit Cards

- Earn Rewards: Get points, miles, or cash back for every purchase.

- Sign-Up Bonuses: Many cards offer lucrative bonuses for new users.

- Travel Perks: Enjoy free checked bags, priority boarding, and more.

- Purchase Protection: Safeguard your purchases against damage or theft.

- Extended Warranties: Extend the manufacturer’s warranty on purchased items.

- Flexible Redemption Options: Redeem rewards for travel, gift cards, or statement credits.

Common Drawbacks And How To Mitigate Them

While rewards credit cards have many advantages, they also present some challenges. Here are common drawbacks and strategies to mitigate them:

| Drawback | Mitigation Strategy |

|---|---|

| High Interest Rates | Pay off your balance in full each month to avoid interest charges. |

| Annual Fees | Choose a card with benefits that outweigh the annual fee. |

| Complex Rewards Programs | Read the terms and conditions to understand how to maximize rewards. |

| Potential for Overspending | Set a budget and monitor your spending regularly. |

By recognizing these drawbacks and taking steps to mitigate them, you can enjoy the benefits of rewards credit cards while minimizing the risks.

Specific Recommendations For Ideal Users

Choosing the right rewards credit card can be a game-changer. Different cards cater to different needs. Below are specific recommendations for ideal users.

Frequent Travelers

For those who travel often, a card with travel rewards is essential. Look for cards offering:

- Airline Miles: Earn miles for every dollar spent.

- Hotel Points: Redeem points for free nights at hotels.

- Travel Insurance: Coverage for trip cancellations and lost luggage.

Examples include:

- Chase Sapphire Preferred

- American Express Platinum

- Capital One Venture Rewards

Everyday Spenders

For those who use their card for daily expenses, a card with cash back rewards is ideal. Look for cards that offer:

- High Cash Back Rates: Earn a higher percentage on groceries and gas.

- No Annual Fee: Avoid fees that eat into your rewards.

- Flexible Redemption Options: Redeem cash back as statement credits or direct deposits.

Examples include:

- Blue Cash Everyday from American Express

- Discover it Cash Back

- Citi Double Cash Card

Business Owners

Business owners need cards that offer both rewards and flexibility. The VIALET Business Account is a top choice, offering:

- Multi-Currency Payments: Manage multiple currencies with transparent charges.

- Virtual Corporate Cards: Issue virtual cards for business expenses.

- Mass Payouts via API: Automate payments to numerous recipients.

Other options include:

- Chase Ink Business Preferred

- American Express Business Gold

- Capital One Spark Cash for Business

Students And Young Adults

Students and young adults need a card that helps build credit. Look for cards offering:

- No Annual Fee: Ideal for those on a tight budget.

- Credit Education Tools: Learn how to manage and build credit.

- Rewards for Good Grades: Some cards offer bonuses for maintaining good grades.

Examples include:

- Discover it Student Cash Back

- Journey Student Rewards from Capital One

- Bank of America Travel Rewards for Students

Frequently Asked Questions

What Are The Best Rewards Credit Cards?

The best rewards credit cards offer high cashback, travel points, and exclusive perks. They cater to various spending habits and preferences. Consider cards from Chase, American Express, and Citi for top-notch rewards.

Which Credit Card Offers The Highest Cashback?

The Citi Double Cash Card offers one of the highest cashback rates. You earn 2% on every purchase: 1% when you buy and another 1% when you pay.

Are Travel Rewards Credit Cards Worth It?

Yes, travel rewards credit cards are worth it if you travel frequently. They offer points, miles, and travel-related perks. These can save you money on flights and hotels.

How Can I Maximize Credit Card Rewards?

To maximize credit card rewards, use your card for everyday purchases. Pay your balance in full each month. Take advantage of bonus categories and sign-up bonuses.

Conclusion

Finding the best rewards credit card can feel overwhelming. Each card offers unique benefits suited to different needs. Assess your spending habits and priorities. Choose a card that maximizes your rewards. For businesses, consider the VIALET Business Account. It offers flexible account management, instant transfers, and robust security. Learn more about VIALET’s features here. Make an informed decision and enjoy the rewards that best align with your lifestyle. Happy card hunting!