Credit Repair Services Near Me: Boost Your Credit Score Today

Are you searching for reliable credit repair services near you? Look no further.

Credit repair services can help you improve your credit score and financial health. Finding the right credit repair service can be challenging, but it’s worth the effort. These services analyze your credit reports, dispute inaccuracies, and guide you on improving your credit score. Whether you have errors on your credit report or need advice on managing your credit, professional help can make a significant difference. Your financial well-being is important, and having a good credit score opens doors to better loan rates and financial opportunities. Ready to take control of your credit? Explore the best credit repair services near you and start your journey to a healthier financial future. For business owners, consider opening a VIALET Business Account. This account offers instant money transfers, multiple IBANs, and virtual corporate cards. With VIALET, managing multi-currency payments and automating mass payouts become seamless and efficient. Visit VIALET to learn more about their tailored business solutions.

Introduction To Credit Repair Services

Struggling with a low credit score can be frustrating. It can affect your ability to get loans, credit cards, and even housing. That’s where credit repair services come in. They help improve your credit score by addressing inaccuracies and offering guidance on financial management. Let’s dive into what these services entail.

What Are Credit Repair Services?

Credit repair services identify and dispute errors on your credit report. They communicate with credit bureaus on your behalf. These services can remove incorrect information and help manage your debts. Many offer personalized advice to improve your financial habits.

Why Your Credit Score Matters

Your credit score reflects your creditworthiness. Lenders use it to decide if you qualify for loans or credit cards. A higher score means better interest rates and terms. It can also impact your ability to rent an apartment or get a job. Maintaining a good credit score is crucial for your financial health.

| Feature | Description |

|---|---|

| Identification of Errors | Spotting inaccuracies on credit reports |

| Dispute Handling | Communicating with credit bureaus to fix errors |

| Debt Management Advice | Providing tips to manage and reduce debts |

| Improvement Strategies | Offering personalized plans to boost credit scores |

These key features show how credit repair services can help you regain financial control. By addressing inaccuracies and offering practical advice, you can see significant improvements in your credit score.

Key Features Of Credit Repair Services

Credit repair services are essential for improving your credit score. These services offer several key features to help you manage and repair your credit effectively. Understanding these features can help you choose the best service for your needs.

Personalized Credit Analysis

One of the most important features of credit repair services is Personalized Credit Analysis. Experts analyze your credit report to identify areas of improvement. They look for errors, inaccuracies, and negative items that impact your credit score.

This analysis helps create a customized plan tailored to your financial situation. It ensures that the strategies used are specific to your needs. This personalized approach is crucial for effective credit repair.

Dispute Resolution With Credit Bureaus

Another key feature is Dispute Resolution with Credit Bureaus. Credit repair services work on your behalf to dispute incorrect or outdated information on your credit report. They communicate directly with credit bureaus to challenge these inaccuracies.

They follow a systematic process to ensure that disputed items are investigated and removed if found to be incorrect. This can significantly improve your credit score over time.

Credit Counseling And Education

Credit Counseling and Education is also a vital part of credit repair services. These services provide valuable resources and guidance to help you understand credit management better. They offer tips on budgeting, debt management, and responsible credit usage.

Education empowers you to make informed financial decisions, preventing future credit issues. Continuous support and counseling ensure you stay on track with your credit repair goals.

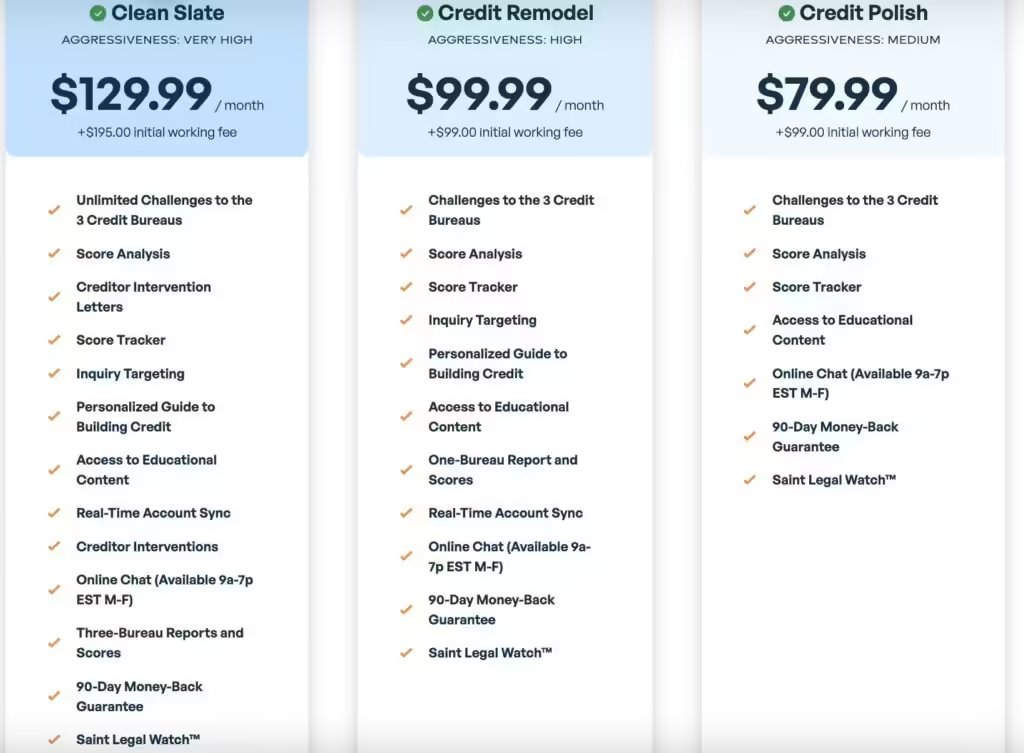

Pricing And Affordability Of Credit Repair Services

Understanding the costs associated with credit repair services is essential. These services can help improve your credit score, but they come at a price. Let’s dive into the details to see what you might expect when seeking credit repair services near you.

Cost Breakdown Of Different Service Levels

Credit repair services offer various levels of assistance, each with its own pricing. Here’s a breakdown of common service levels:

| Service Level | Features | Cost |

|---|---|---|

| Basic Plan | Credit report analysis, dispute letters for errors | $50 – $100 per month |

| Standard Plan | Everything in Basic plus score monitoring | $100 – $150 per month |

| Premium Plan | Everything in Standard plus personalized advice | $150 – $200 per month |

Are Credit Repair Services Worth The Investment?

Deciding if credit repair services are worth the investment depends on your specific needs. Here are some points to consider:

- Time-Saving: Credit repair can be time-consuming. Professionals handle the process efficiently.

- Expertise: They understand credit laws and can effectively dispute errors.

- Improved Credit Score: A better credit score can lead to lower interest rates on loans.

- Peace of Mind: Knowing your credit is being handled by experts can reduce stress.

While the costs may seem high, the potential benefits often outweigh the investment. Improved credit can save you money in the long run.

Pros And Cons Of Using Credit Repair Services

Credit repair services can be a valuable resource for improving your credit score. However, it’s essential to weigh both the advantages and potential drawbacks before deciding if they are right for you.

Advantages Of Professional Credit Repair

Professional credit repair services offer several benefits that can help you manage and improve your credit score more effectively:

- Expertise: Credit repair professionals have a deep understanding of credit laws and regulations. They know how to challenge errors and negotiate with creditors.

- Time-Saving: Handling credit disputes and negotiations can be time-consuming. Professionals manage these tasks, saving you valuable time.

- Resources: Credit repair services have access to tools and resources that may not be available to the average consumer.

- Customized Plans: These services often provide personalized credit improvement plans tailored to your specific situation.

- Support: Continuous support and guidance throughout the credit repair process can help you stay on track and avoid further credit issues.

Potential Drawbacks To Consider

While there are clear advantages, potential drawbacks should also be considered:

- Cost: Credit repair services can be expensive. Fees vary, and some services may charge monthly subscriptions or per-item fees.

- No Guarantees: There are no guarantees that credit repair services will achieve the desired results. Success depends on various factors.

- Scams: The credit repair industry has its share of fraudulent companies. It’s crucial to research and choose a reputable service.

- DIY Alternatives: Many credit repair tasks can be handled independently. With research and effort, you can dispute errors and negotiate with creditors on your own.

- Legal Risks: Engaging with a disreputable service could lead to legal issues, especially if they employ unethical practices.

Recommendations For Ideal Users

Credit repair services can be a valuable resource for many individuals. Whether you need to improve your credit score, resolve inaccuracies, or manage debt, these services can provide essential support. This section highlights who can benefit the most and the scenarios where credit repair services are most effective.

Who Can Benefit The Most From Credit Repair Services?

Credit repair services are not for everyone, but they offer significant benefits for specific groups:

- Individuals with Poor Credit Scores: Those with a credit score below 600 can see significant improvements.

- People Facing Loan Rejections: If you’ve been denied loans or credit cards, repair services can help.

- Consumers with Credit Report Errors: Errors on credit reports are common and can be corrected with professional help.

- Debt Management Seekers: Those struggling with debt can get guidance on managing and reducing what they owe.

Scenarios Where Credit Repair Services Are Most Effective

There are specific situations where credit repair services can be particularly effective:

- Home Buying: Improving credit scores can lead to better mortgage rates.

- Car Financing: A higher credit score can lower interest rates on auto loans.

- Starting a Business: Business owners need good credit to secure funding and favorable terms.

- After Bankruptcy: Recovering from bankruptcy is challenging, but repair services can expedite the process.

In these scenarios, credit repair services offer tailored solutions to enhance financial stability and access to credit.

For businesses seeking reliable financial solutions, the VIALET Business Account offers numerous benefits:

| Feature | Description |

|---|---|

| Tailored Business Account | Seamless e-commerce transactions with multi-functional EUR business account and online payment platform. |

| Multi-Currency Payments | Manage multiple currencies with transparent charges and honest rates. |

| Virtual Corporate Cards | Use virtual Visa or Mastercard for various business expenses. |

| Mass Payouts via API | Automate regular payments to numerous recipients quickly with a tailored mass-payout solution. |

| B2B API Connections | Integrate preferred apps, automate payments, and manage supplier deadlines. |

| Acquiring for E-commerce | Optimize checkout with preferred payment methods and benefit from top e-commerce platform plugins. |

Businesses can enjoy quick account setup, fast transactions, personalized support, robust security, and transparent fees with VIALET.

Frequently Asked Questions

What Are Credit Repair Services?

Credit repair services help improve your credit score by addressing errors on your credit report. They negotiate with creditors to remove negative items.

How Do Credit Repair Services Work?

Credit repair services review your credit report, identify inaccuracies, and dispute them with credit bureaus. They also offer guidance on improving your credit score.

Are Credit Repair Services Worth It?

Credit repair services can be worth it if you have significant errors on your credit report. They save you time and effort.

Can Credit Repair Services Remove Negative Items?

Credit repair services can remove negative items if they are inaccurate or unverifiable. They negotiate with creditors and credit bureaus.

Conclusion

Finding reliable credit repair services near you can be transformative. These services help improve your credit score and financial health. If you’re a business looking for robust financial solutions, consider the VIALET Business Account. It offers seamless transactions, multi-currency payments, and personalized support. Investing in such services can lead to better financial management and growth. Make informed choices for a brighter financial future.