Financial Planning With Credit: Unlock Your Financial Potential

Financial planning with credit is crucial for business growth. It ensures financial stability and opens doors to new opportunities.

In the dynamic world of business, leveraging credit smartly can be a game-changer. It helps in managing cash flow, optimizing expenses, and expanding operations. One effective way to achieve this is through a robust business account like the VIALET Business Account. This all-in-one growth engine offers flexible business accounts, instant money transfers, and open banking solutions. With the ability to manage multiple IBANs from a single account and add team members with different access levels, VIALET provides a comprehensive solution for modern businesses. Whether you need to handle multi-currency payments, use virtual corporate cards, or automate payouts, VIALET offers the tools to streamline your financial planning. Explore more about VIALET here.

Introduction To Financial Planning With Credit

Financial planning is crucial for achieving stability and growth. Using credit effectively can be a significant part of this planning. Credit can offer flexibility and opportunities if managed wisely. This section will explore the basics of credit, the importance of financial planning, and how credit plays a role in it.

Understanding The Basics Of Credit

Credit allows you to borrow money with the promise to repay it later. Understanding the types of credit is essential. They include:

- Revolving Credit: This type includes credit cards, where you can borrow up to a limit.

- Installment Credit: This includes loans that you repay in fixed amounts over time.

Each type of credit has its own terms and conditions. Knowing these helps you make informed decisions.

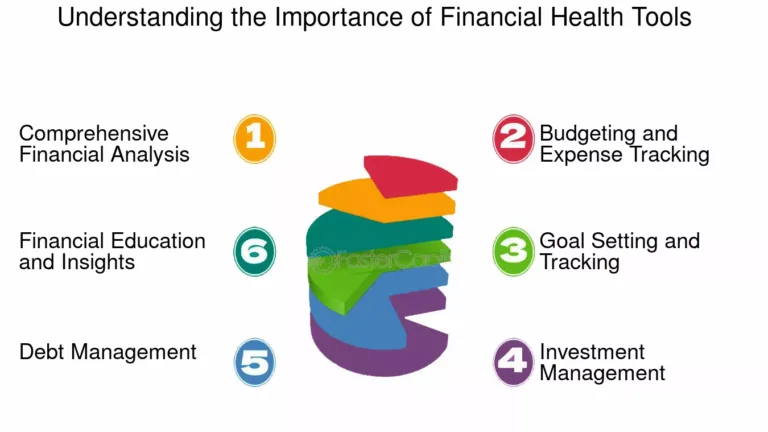

The Importance Of Financial Planning

Financial planning involves setting goals and creating a roadmap to achieve them. It includes budgeting, saving, and investing. Here are key reasons why financial planning is important:

- Goal Setting: Helps you define short-term and long-term goals.

- Budgeting: Ensures you manage your income and expenses effectively.

- Risk Management: Prepares you for unexpected financial challenges.

- Wealth Building: Helps you accumulate assets over time.

Effective financial planning leads to better financial health and peace of mind.

How Credit Plays A Role In Financial Planning

Credit can be a powerful tool in financial planning. Here’s how:

- Financing Large Purchases: You can use credit for buying assets like homes and cars.

- Cash Flow Management: Credit helps manage cash flow during lean periods.

- Building Credit History: Responsible use of credit improves your credit score.

- Business Growth: Business credit can fund expansion and operations.

For businesses, solutions like the VIALET Business Account offer flexible options. You can manage multiple IBANs, make multi-currency payments, and use virtual corporate cards. These features streamline financial management and support business growth.

Using credit wisely within your financial plan ensures you leverage its benefits while minimizing risks. Always stay informed about your credit terms and monitor your credit usage regularly.

Key Features Of Financial Planning With Credit

Financial planning with credit involves using credit responsibly to achieve financial goals. Understanding key features can help you make informed decisions and maximize benefits. Below are some crucial aspects to consider.

Building A Strong Credit Score

Your credit score is vital for financial planning. A strong credit score can lead to better interest rates and loan approvals. Here’s how to build it:

- Pay bills on time.

- Keep credit card balances low.

- Avoid opening many new credit accounts at once.

- Check your credit report regularly for errors.

Utilizing Credit For Investments

Credit can be a powerful tool for investments. Using credit wisely can provide funds for opportunities that generate returns. Consider the following:

- Use low-interest loans for high-return investments.

- Invest in assets like real estate or stocks.

- Maintain a balance between credit use and investment risks.

Managing Credit Card Debt Effectively

Credit card debt can be overwhelming. Effective management is essential to avoid financial strain. Here are some tips:

| Strategy | Description |

|---|---|

| Pay More Than Minimum | Reduce principal faster and save on interest. |

| Consolidate Debt | Combine multiple debts into one with lower interest. |

| Balance Transfers | Transfer high-interest debt to a lower-interest card. |

Leveraging Credit For Large Purchases

Using credit for large purchases can be beneficial if done correctly. It allows you to spread payments and manage cash flow. Some considerations include:

- Choose low-interest or zero-interest financing options.

- Plan for repayment within the promotional period.

- Ensure the purchase fits within your budget.

Effective use of credit can enhance your financial planning. It offers flexibility and opportunities when managed wisely.

Pricing And Affordability

When considering financial planning with credit, understanding the pricing and affordability of different credit options is crucial. This section will explore the costs associated with credit, affordable credit products for various needs, and how to balance costs and benefits.

Cost Of Credit: Interest Rates And Fees

The cost of credit primarily includes interest rates and fees. These can vary based on the type of credit product and the lender’s terms. For instance, credit cards and business accounts like the VIALET Business Account often come with transparent charges, making it easier to manage expenses.

| Credit Product | Interest Rate | Fees |

|---|---|---|

| Credit Cards | 15% – 25% APR | Annual Fees, Late Payment Fees |

| VIALET Business Account | Varies | Transparent account charges, Multi-currency payment fees |

Affordable Credit Products For Different Needs

Different credit products cater to various needs. Finding affordable options depends on understanding your financial goals and requirements. Products like the VIALET Business Account offer several features:

- Flexible Business Accounts: Manage multiple IBANs and team access.

- Multi-Currency Payments: Supports EUR, USD, GBP, PLN, SEK, DKK, CZK, CHF.

- Virtual Corporate Cards: Use for business expenses.

- Mass Payouts via API: Automate payments to numerous recipients.

These features provide flexibility and affordability for businesses, helping them manage their finances more effectively.

Balancing Costs And Benefits

Balancing the costs and benefits of credit involves evaluating the overall value a product offers. For instance, the VIALET Business Account not only offers transparent fees but also provides:

- Speed & Ease of Use: Open an account in minutes with fast transactions.

- Personalized Support: Direct communication with an account manager.

- Robust Security: 24/7 protection of financial data.

- Transparent Fees: Clear and honest pricing for multi-currency payments.

By weighing these factors, businesses can make informed decisions about their credit options, ensuring they choose products that align with their financial planning goals.

Pros And Cons Of Financial Planning With Credit

Financial planning with credit can be a double-edged sword. It offers flexibility and opportunities but also carries risks. Understanding these pros and cons can help you make better decisions. Let’s delve into the advantages and drawbacks of using credit for financial planning.

Advantages: Flexibility And Opportunity

Using credit can provide significant flexibility and opportunity for individuals and businesses. Here are some key advantages:

- Access to funds for immediate needs without waiting for savings.

- Ability to seize investment opportunities that may arise unexpectedly.

- Improved cash flow management by spreading costs over time.

- Enhanced business growth by investing in new projects or expansions.

For instance, the VIALET Business Account offers flexible accounts, instant money transfers, and the ability to manage multiple IBANs. This can be highly beneficial for businesses looking to streamline their financial operations.

Drawbacks: Risk Of Debt And Mismanagement

Despite the advantages, financial planning with credit has its drawbacks. Here are some potential risks:

- Risk of debt accumulation if not managed properly.

- High-interest rates on borrowed funds can lead to increased costs.

- Credit score impact due to missed or late payments.

- Mismanagement of funds leading to financial instability.

It’s crucial to use credit wisely and ensure you have a solid plan to repay any borrowed amounts. Failure to do so can lead to financial stress and long-term consequences.

Balancing Benefits And Risks

Balancing the benefits and risks of financial planning with credit involves strategic planning and careful management. Here are some tips:

| Benefits | Risks |

|---|---|

| Immediate access to funds | Potential for debt accumulation |

| Enhanced cash flow | High-interest rates |

| Business growth opportunities | Credit score impact |

By understanding the potential pitfalls and planning accordingly, you can leverage credit to your advantage. Use tools like the VIALET Business Account for better financial management and growth.

Specific Recommendations For Ideal Users

Financial planning with credit involves tailoring strategies to fit the unique needs of different users. Below are specific recommendations for various user groups, ensuring they leverage credit effectively and responsibly.

Young Professionals: Building Credit Early

Young professionals should focus on building their credit early to secure their financial future. Here are some tips:

- Open a credit card: Start with a secured credit card if needed.

- Pay bills on time: Timely payments boost your credit score.

- Keep balances low: Maintain a low credit utilization ratio.

Using a service like VIALET can simplify managing multiple accounts and ensuring timely payments, which is crucial for building credit.

Families: Using Credit For Major Expenses

Families often need credit for significant expenses like home renovations or education. Here’s how to manage it:

- Plan your expenses: Create a budget for big purchases.

- Use low-interest credit options: Look for credit cards with favorable terms.

- Monitor your credit: Keep an eye on your credit score.

VIALET’s flexible business account and transparent fees make it easier for families to manage large expenses without hidden costs.

Entrepreneurs: Financing Business Ventures

Entrepreneurs need reliable credit options to finance their ventures. Consider these strategies:

- Separate personal and business finances: Use a business account like VIALET’s.

- Leverage virtual corporate cards: Simplify business expenses and tracking.

- Automate payments: Use mass payouts via API to streamline operations.

VIALET’s robust security and personalized support ensure entrepreneurs can focus on growing their business without financial worries.

Retirees: Managing Credit In Later Years

Retirees should manage credit wisely to avoid unnecessary debt. Here are some tips:

- Consolidate debts: Simplify payments by consolidating multiple debts.

- Use credit sparingly: Avoid new credit unless necessary.

- Monitor financial accounts: Keep track of all transactions and balances.

VIALET’s easy-to-use platform and direct communication with an account manager can help retirees manage their finances effectively.

| User Group | Recommendations |

|---|---|

| Young Professionals | Open a credit card, pay bills on time, keep balances low |

| Families | Plan expenses, use low-interest credit, monitor credit |

| Entrepreneurs | Separate finances, use virtual cards, automate payments |

| Retirees | Consolidate debts, use credit sparingly, monitor accounts |

Frequently Asked Questions

What Is Financial Planning With Credit?

Financial planning with credit involves managing your credit usage strategically. It aims to enhance your financial stability and future prospects.

How Can Credit Affect Financial Planning?

Credit impacts your financial planning by influencing interest rates. It also affects loan approvals and overall financial health.

Why Is Credit Management Important?

Credit management is crucial for maintaining a good credit score. It helps in securing better loan terms and financial opportunities.

What Are The Benefits Of Good Credit?

Good credit offers lower interest rates. It also provides better loan terms and increased financial flexibility.

Conclusion

Effective financial planning with credit can enhance business growth. Leveraging tools like the VIALET Business Account simplifies this process. A flexible account with multiple IBANs offers great control. Fast transactions and multi-currency support add convenience. For more details, check out VIALET. Start optimizing your financial strategy today.