Vialet Features: Unlocking the Best Banking Experience

In today’s fast-paced business world, managing finances efficiently is crucial. VIALET offers a comprehensive solution with its versatile business accounts.

VIALET Business Account stands out by providing flexible, multi-currency payment options and robust security features. It allows businesses to set up multiple IBANs, add team members, and manage access levels with ease. The platform supports various currencies like EUR, USD, GBP, and more, ensuring transparent charges and rates. Additionally, VIALET offers virtual corporate cards for seamless business expenses and mass payouts via API for efficient payment management. With B2B API connections, businesses can automate payments and streamline operations. VIALET also optimizes e-commerce transactions, making it easier for shoppers to pay directly from their bank. Explore more about VIALET and how it can benefit your business at VIALET.

Introduction To Vialet

Welcome to the world of VIALET. A comprehensive business account solution designed to streamline financial operations. VIALET offers a suite of features tailored to meet the needs of modern businesses. Whether you’re a small startup or a large enterprise, VIALET simplifies your financial management.

What Is Vialet?

VIALET is an all-in-one business account that provides flexible solutions for managing your company’s finances. It supports multi-currency payments, virtual corporate cards, and efficient mass payouts. Businesses can set up multiple IBANs, add team members, and assign different access levels with ease. The platform also integrates with preferred apps for automated payments and supplier deadline management.

Purpose And Mission Of Vialet

The purpose of VIALET is to offer a seamless and efficient financial management solution for businesses. The goal is to simplify complex financial operations and provide a robust platform for growth. VIALET aims to support businesses with quick account setup, swift transactions, and dedicated support.

VIALET’s mission is to empower businesses by providing a secure and easy-to-use financial platform. With a focus on transparency, speed, and personalized support, VIALET strives to be the trusted partner for businesses of all sizes.

| Main Features | Description |

|---|---|

| Flexible Business Account | Multiple IBANs, team member addition, and access level management. |

| Multi-Currency Payments | Supports various currencies with transparent charges and rates. |

| Virtual Corporate Cards | Virtual Visa or Mastercard for business expenses. |

| Mass Payouts via API | Automates regular payments to multiple recipients. |

| B2B API Connections | Integrates preferred apps for automated payments. |

| Acquiring for E-commerce | Optimizes checkout with preferred payment methods. |

VIALET provides a comprehensive solution for businesses seeking to manage their finances efficiently and securely. With transparent fees and robust security features, businesses can trust VIALET for their financial needs.

Key Features Of Vialet

Vialet offers a range of features designed to make managing business finances easier and more efficient. Let’s dive into some of the key features that set Vialet apart from the competition.

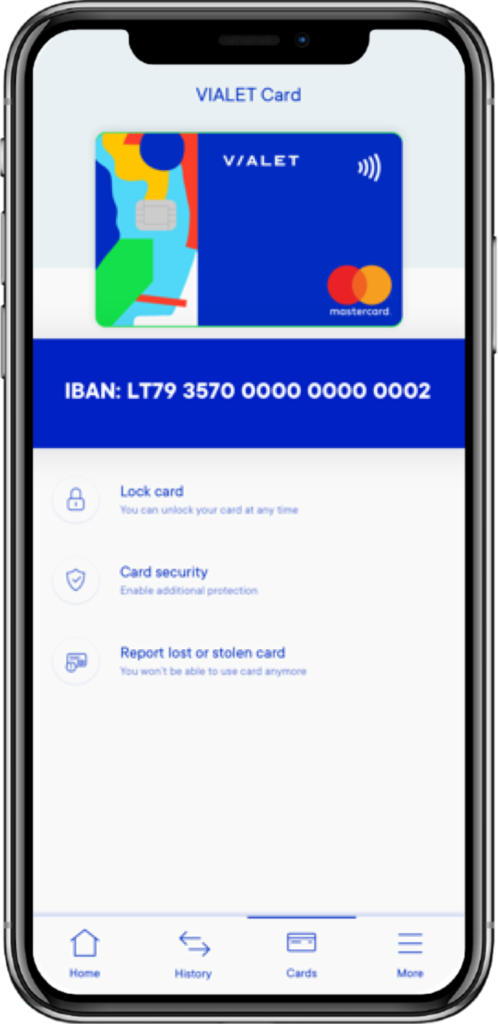

User-friendly Mobile App

The Vialet mobile app is intuitive and easy to navigate. Users can manage their accounts, monitor transactions, and perform various banking operations directly from their smartphones. The app is designed to save time and simplify financial management.

Innovative Security Measures

Vialet prioritizes security with advanced features to protect financial data. These include multi-factor authentication, end-to-end encryption, and regular security audits. Businesses can feel secure knowing their information is well protected.

Seamless International Transactions

With Vialet, businesses can make international payments in multiple currencies, including EUR, USD, GBP, PLN, SEK, DKK, CZK, and CHF. The platform offers transparent charges and competitive rates, making cross-border transactions straightforward and cost-effective.

Personalized Financial Insights

Vialet provides personalized financial insights to help businesses make informed decisions. Users can access detailed reports and analytics to better understand their financial health and plan for the future. This feature is invaluable for strategic planning and growth.

Flexible Spending Limits

Vialet allows businesses to set flexible spending limits on their virtual corporate cards. This ensures better control over expenses and helps manage budgets effectively. Businesses can set daily, weekly, or monthly limits according to their needs.

For more information, visit Vialet.

Pricing And Affordability

Understanding the cost and value of a business account is crucial. VIALET Business Account promises transparent and competitive pricing, making it a solid choice for businesses of all sizes. Let’s delve deeper into the specifics of their pricing and affordability.

Account Fees And Charges

VIALET Business Account stands out with its transparent fees. The pricing structure is designed to be clear, ensuring businesses know exactly what they are paying for. Here are some key points:

- Monthly Account Fee: Competitive and straightforward.

- Transaction Fees: Low fees for multi-currency payments including EUR, USD, GBP, and more.

- Virtual Corporate Cards: Affordable options for managing salaries and business expenses.

- Mass Payouts via API: Cost-effective automation of regular payments.

Comparison With Competitors

VIALET Business Account offers pricing that is competitive with other business accounts. Here’s a comparison to help you understand the value:

| Feature | VIALET | Competitor A | Competitor B |

|---|---|---|---|

| Monthly Fee | Competitive | Higher | Moderate |

| Transaction Fee | Low | Moderate | High |

| Virtual Cards | Affordable | High | Moderate |

| Mass Payouts | Cost-Effective | Moderate | High |

Value For Money

VIALET Business Account offers excellent value for money with its transparent pricing and robust features:

- Speed & Ease of Use: Quick setup and swift transactions save time.

- Personalized Support: Dedicated account managers provide tailored assistance.

- Robust Security: Advanced security ensures financial data protection.

- Transparent Fees: No hidden charges, just clear and competitive pricing.

Overall, the VIALET Business Account combines affordability with a comprehensive set of features, making it a valuable tool for business growth and financial management.

Pros And Cons Of Vialet

Vialet offers a comprehensive business account solution. It includes multiple features aimed at simplifying financial management for businesses. Below, we explore the advantages and potential drawbacks of using Vialet.

Advantages Of Using Vialet

- Flexible Business Account: Manage multiple IBANs from a single account. Add team members and assign access levels easily.

- Multi-Currency Payments: Supports various currencies including EUR, USD, GBP, and more. Transparent charges and competitive rates.

- Virtual Corporate Cards: Offers virtual Visa or Mastercard. Ideal for salaries, daily spending limits, and business expenses.

- Mass Payouts via API: Automates regular payments to multiple recipients efficiently.

- B2B API Connections: Integrate preferred apps for automated payments and supplier deadline management.

- Acquiring for E-commerce: Optimizes checkout with preferred payment methods. Enables shoppers to pay directly from their bank.

- Speed & Ease of Use: Quick account setup and swift transactions.

- Personalized Support: Direct communication with a dedicated account manager.

- Robust Security: Advanced security features protect financial data.

- Transparent Fees: Competitive pricing with no hidden charges.

Potential Drawbacks

- Refund/Return Policies: No specific refund or return policies mentioned.

- Limited Information: Detailed pricing structure not provided.

- Availability: Services might be limited to specific regions due to licensing.

Vialet is an all-in-one growth engine for businesses. It offers flexibility and robust features. However, potential users should consider the limited information on pricing and refund policies.

Ideal Users And Scenarios

VIALET Business Account offers a range of features that cater to various business needs. It is designed to be flexible and user-friendly, making it suitable for different types of users and scenarios.

Who Will Benefit Most From Vialet?

VIALET Business Account is perfect for:

- Small and Medium Enterprises (SMEs): Benefit from easy account setup, multiple IBANs, and transparent fees.

- Startups: Ideal for managing initial business expenses with virtual corporate cards and multi-currency payments.

- E-commerce Businesses: Enhance online payment processes with B2B API connections and acquiring for e-commerce.

- Freelancers and Contractors: Manage income and expenses efficiently with dedicated IBANs and mass payouts via API.

Best Use Cases For Vialet

Here are some scenarios where VIALET Business Account shines:

| Use Case | Description |

|---|---|

| Multiple Currency Management | Handle payments in EUR, USD, GBP, and more with transparent rates. |

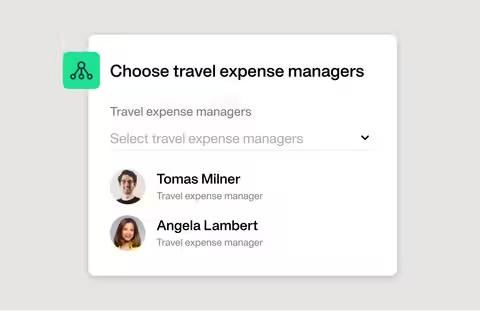

| Team Collaboration | Add team members, assign roles, and manage access levels easily. |

| Automated Payments | Use API for mass payouts and automate supplier payments. |

| Secure Transactions | Benefit from robust security features to protect financial data. |

| Quick Onboarding | Set up your account quickly and start managing finances with ease. |

VIALET Business Account offers a unique combination of flexibility, security, and user-friendliness. It is designed to meet the needs of modern businesses, whether they are small startups or established enterprises.

Frequently Asked Questions

What Are The Key Features Of Vialet?

Vialet offers a wide range of features including easy online banking, contactless payments, and instant money transfers. It also provides secure and user-friendly mobile banking apps.

How Secure Is Vialet For Transactions?

Vialet uses advanced encryption and security measures to ensure all transactions are safe and secure. Your data and money are protected at all times.

Can I Use Vialet Internationally?

Yes, Vialet can be used internationally. You can access your account and make transactions from anywhere in the world. It supports multiple currencies.

Does Vialet Offer Customer Support?

Yes, Vialet offers 24/7 customer support. You can contact them via phone, email, or live chat for any assistance.

Conclusion

Explore VIALET Business Account for your financial needs. It offers flexible business accounts, multi-currency payments, and virtual corporate cards. Manage your finances easily with transparent fees and robust security. For more information, visit the VIALET website and see how it can benefit your business.