Credit Card For Emergencies: Your Lifeline in Unexpected Situations

In times of crisis, having a reliable financial safety net is crucial. A credit card for emergencies can provide peace of mind and quick access to funds when you need them most.

Imagine facing a sudden medical expense, car repair, or other unexpected cost. Without a plan, these situations can be stressful. A credit card dedicated to emergencies offers a solution. It allows you to cover urgent expenses without disrupting your budget. By having this financial tool ready, you can handle unforeseen events with confidence. In this blog post, we will explore why an emergency credit card is essential and how it can benefit you in critical moments. For a versatile and efficient option, consider the VIALET Business Account. Learn more about its features and benefits here.

Introduction To Credit Cards For Emergencies

In times of crisis, having a reliable financial backup can make all the difference. This is where credit cards for emergencies come into play. They offer a lifeline during unexpected situations. This section will introduce you to the concept of emergency credit cards and why they are essential.

What Are Emergency Credit Cards?

Emergency credit cards are designed for use during unforeseen financial needs. They provide immediate access to funds when you need them most. These cards often come with features such as low-interest rates, high credit limits, and flexible repayment options.

Here are some key characteristics of emergency credit cards:

- Low-Interest Rates: Helps in managing repayment without excessive charges.

- High Credit Limits: Offers more significant financial support during emergencies.

- Flexible Repayment Options: Allows you to repay the borrowed amount comfortably.

Importance Of Having A Credit Card For Emergencies

Having a credit card for emergencies is crucial for several reasons:

- Instant Access to Funds: Provides immediate financial support when needed.

- Peace of Mind: Reduces stress knowing you have a backup plan.

- Flexibility: Allows you to cover various expenses, from medical bills to unexpected repairs.

- Building Credit: Using and repaying the card responsibly can improve your credit score.

Emergency credit cards are a vital tool in managing unexpected financial situations. They offer immediate access to funds, reduce stress, and provide flexibility in covering various expenses. Additionally, responsible use can help build and improve your credit score.

Key Features Of Emergency Credit Cards

Emergency credit cards offer a range of features that make them an essential financial tool. They provide quick access to funds, higher credit limits, and flexible repayment options. Here’s a look at the key features that make these cards stand out.

Instant Access To Funds

Emergency credit cards are designed for quick access to cash when needed most. With these cards, you can withdraw money from ATMs or make purchases immediately. This feature ensures you can handle unexpected expenses without delay.

High Credit Limits

Many emergency credit cards come with high credit limits. This allows you to cover substantial expenses that arise suddenly. Whether it’s medical bills or urgent home repairs, a higher credit limit provides the financial flexibility you need.

Low Or No Annual Fees

To make emergency credit cards more accessible, many issuers offer low or no annual fees. This helps you maintain the card without worrying about high maintenance costs, making it a cost-effective option for emergencies.

Emergency Assistance Services

Some emergency credit cards offer additional benefits like emergency assistance services. These services can include roadside assistance, travel insurance, and even emergency medical help. Such features add extra value to your card, ensuring you are prepared for various situations.

Flexible Repayment Options

Flexible repayment options are a crucial feature of emergency credit cards. These cards often come with customizable repayment plans that fit your financial situation. You can choose to pay off your balance in full or make minimum payments, providing you with the flexibility to manage your finances effectively.

How Emergency Credit Cards Benefit You

In times of crisis, having an emergency credit card can be a lifesaver. It offers immediate financial support and keeps you prepared for unexpected expenses. Below, we explore the key benefits of emergency credit cards.

Peace Of Mind In Crisis Situations

Peace of mind is crucial during emergencies. An emergency credit card provides a financial cushion. This ensures you can handle unforeseen costs without stress. Knowing you have a backup plan helps you stay calm.

Quick Resolution Of Unexpected Expenses

Emergencies often require quick financial solutions. An emergency credit card ensures you can pay for urgent needs instantly. Whether it’s a medical bill or car repair, you can resolve issues fast.

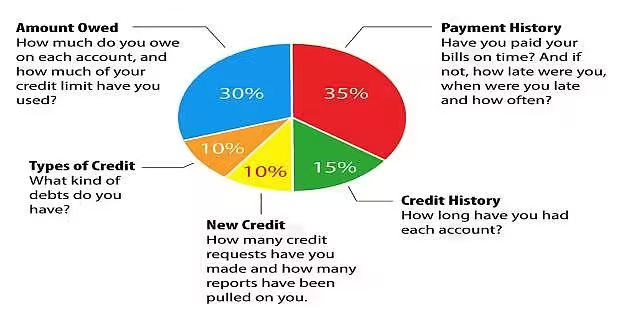

Building And Maintaining Credit Score

Using an emergency credit card responsibly helps in building and maintaining your credit score. Paying off balances on time positively affects your credit report. A good credit score is essential for future financial opportunities.

In summary, having an emergency credit card offers peace of mind, quick financial resolutions, and helps in maintaining a good credit score. These benefits make it an essential tool in your financial arsenal.

Pricing And Affordability Of Emergency Credit Cards

Emergency credit cards are essential for unforeseen expenses. Understanding their pricing is crucial. This section covers interest rates, annual fees, and balance transfer fees. Knowing these can help you choose the right card.

Interest Rates And Apr

Interest rates and Annual Percentage Rates (APR) are key factors. They determine the cost of borrowing. High-interest rates can lead to significant debt. Look for cards with low APR for emergencies.

| Interest Rate | APR |

|---|---|

| 10%-15% | 12%-18% |

| 16%-20% | 19%-25% |

Annual Fees And Other Charges

Annual fees can add to the cost of a credit card. Some cards offer no annual fees but have higher interest rates. Consider the total cost, not just the annual fee.

- No annual fee: Higher interest rates

- Low annual fee: Moderate interest rates

- High annual fee: Lower interest rates

Other charges include late payment fees, over-limit fees, and foreign transaction fees. Check the card’s terms to avoid unexpected costs.

Balance Transfer Fees

Balance transfer fees apply when moving debt from one card to another. These fees are usually a percentage of the transferred amount. They can range from 3% to 5%.

- 3% fee: $3 for every $100 transferred

- 4% fee: $4 for every $100 transferred

- 5% fee: $5 for every $100 transferred

Evaluate if the savings on interest outweigh the balance transfer fee. This is important for managing debt effectively.

For business needs, consider VIALET Business Account. It offers multiple IBANs, team access, and virtual corporate cards. VIALET ensures transparent fees and personalized support. Learn more about VIALET Business Account.

Pros And Cons Of Using Credit Cards In Emergencies

Credit cards can be a lifesaver in times of financial emergencies. They provide a quick solution when you need immediate funds. However, using credit cards during emergencies comes with its own set of pros and cons. Understanding these can help you make informed decisions.

Advantages: Convenience And Security

One of the main advantages of using credit cards in emergencies is their convenience. You can access funds instantly without the need for lengthy approval processes. This can be crucial when time is of the essence.

Credit cards also offer a high level of security. They come with fraud protection features that safeguard your transactions. If your card is stolen, you can report it and avoid being liable for unauthorized charges. This adds peace of mind in stressful situations.

Drawbacks: Potential For Debt Accumulation

On the downside, using credit cards for emergencies can lead to debt accumulation. If you cannot pay off the balance quickly, interest charges will start to add up. This can make it difficult to get out of debt.

Another drawback is the temptation to spend beyond your means. In an emergency, it can be easy to swipe your card without considering the long-term financial impact. This can lead to a cycle of debt that is hard to break.

| Advantages | Drawbacks |

|---|---|

| Convenience | Debt Accumulation |

| Security | Temptation to Overspend |

Using credit cards in emergencies has its benefits and risks. Weighing these can help you make better financial choices. Always plan ahead and use credit responsibly to avoid potential pitfalls.

Recommendations For Ideal Users

Credit cards are invaluable in emergencies. They provide quick access to funds during unexpected situations. However, not every card suits everyone. Here are some recommendations for ideal users based on different needs.

Best For Individuals Without Emergency Savings

Individuals without emergency savings benefit greatly from a credit card. A card with a low-interest rate is ideal. It helps manage sudden expenses without high costs. Look for cards offering an introductory 0% APR period. This feature allows users to pay off balances without interest for a set time.

Consider the VIALET Business Account for its robust features. It offers quick account setup and swift transactions. Users can manage payments in multiple currencies. This flexibility aids in diverse financial situations.

Ideal For Frequent Travelers

Frequent travelers need a card with travel perks. Look for cards offering travel insurance, airport lounge access, and no foreign transaction fees. These features make traveling less stressful and more enjoyable.

The VIALET Business Account offers multi-currency payments. It supports EUR, USD, GBP, and more. This feature is perfect for managing expenses abroad. Additionally, it provides virtual corporate cards, ensuring secure transactions worldwide.

Suitable For Families With Dependents

Families with dependents need a card with high credit limits and reward programs. Cashback on groceries, gas, and other essentials is beneficial. Look for cards offering flexible payment options and robust security features.

The VIALET Business Account is a great option. It allows adding team members and assigning different access levels. This feature is perfect for managing family expenses. The account also offers advanced security features, ensuring financial data is protected.

For more details, visit VIALET.

Frequently Asked Questions

What Is A Credit Card For Emergencies?

A credit card for emergencies is a card used for unexpected expenses. It’s ideal for urgent situations like medical bills or car repairs.

Why Should You Have A Credit Card For Emergencies?

Having a credit card for emergencies provides financial security. It ensures you can cover unexpected costs without stress.

How To Choose An Emergency Credit Card?

Choose an emergency credit card with low interest rates. Look for cards with no annual fees and a reasonable credit limit.

Can You Use A Regular Credit Card For Emergencies?

Yes, you can use a regular credit card for emergencies. Ensure it has a sufficient limit and manageable interest rates.

Conclusion

Emergencies can strike at any time. Having a reliable credit card is essential. VIALET Business Account offers a smart solution. It provides multi-currency payments and robust security. Manage your business finances effortlessly. Quick setup and personalized support ensure smooth operations. For more details, visit VIALET. Stay prepared and keep your business running smoothly.