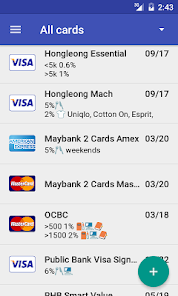

Credit Card Management App: Simplify Your Finances Today

Managing credit cards can be a headache. A credit card management app can help.

In today’s fast-paced world, keeping track of multiple credit cards is challenging. This is where a credit card management app becomes indispensable. It simplifies tracking expenses, managing due dates, and optimizing card benefits. One such tool is the VIALET Business Account. Designed for businesses, it offers flexible financial solutions, including virtual corporate cards and multi-currency payments. With VIALET, you can manage multiple IBANs and automate mass payouts efficiently. It’s tailored to support SEPA, SWIFT, and local payments, ensuring smooth financial operations. Explore how VIALET can streamline your business finances by visiting their website.

Introduction To Credit Card Management Apps

Managing credit cards can be complex without the right tools. Credit card management apps simplify this process, making it easier to track and control your finances. This section introduces these apps and their benefits.

What Is A Credit Card Management App?

A credit card management app is a software application designed to help users manage their credit cards efficiently. These apps provide features like tracking expenses, monitoring due dates, and alerting users to suspicious activities.

Purpose And Benefits Of Using A Credit Card Management App

The primary purpose of a credit card management app is to streamline credit card usage. It aims to make financial management more accessible and more transparent.

| Feature | Benefit |

|---|---|

| Expense Tracking | Helps keep track of all your purchases and spending patterns. |

| Payment Reminders | Ensures you never miss a payment due date, avoiding late fees. |

| Fraud Alerts | Notifies you of any suspicious activities, protecting your finances. |

| Budgeting Tools | Assists in creating and sticking to a budget, promoting financial discipline. |

- Expense Tracking: Keep track of all your purchases.

- Payment Reminders: Avoid late fees with timely alerts.

- Fraud Alerts: Get notified of suspicious activities.

- Budgeting Tools: Create and maintain a budget.

Using a credit card management app like VIALET Business Account can offer tailored solutions for businesses. VIALET provides unique features such as managing multiple IBANs, supporting various payment methods, and offering virtual corporate cards.

VIALET‘s features include:

- Opening multiple IBANs.

- Adding team members with different access levels.

- Managing accounts in various currencies (EUR, USD, GBP, etc.).

- Automating regular payments through mass payouts via API.

- Integrating apps with VIALET’s payment platform for streamlined payments.

- Optimizing checkout processes for e-commerce with preferred payment methods.

Benefits of using VIALET include:

- Quick account setup and fast transactions.

- Direct communication with an account manager for personalized support.

- 24/7 protection with advanced security features.

- No hidden charges, allowing businesses to invest in growth.

In conclusion, a credit card management app is essential for better financial management. VIALET offers a comprehensive solution for businesses to handle their finances efficiently.

Key Features Of Credit Card Management Apps

Credit card management apps, like VIALET, offer a range of features that help users manage their credit cards efficiently. These features ensure better financial control and security. Let’s explore the key functionalities that make these apps indispensable.

Real-time Expense Tracking

One of the most crucial features is real-time expense tracking. This feature allows users to monitor their transactions instantly. You can see where your money goes and adjust your spending habits accordingly. It helps in avoiding unnecessary expenses and staying within your budget.

Automated Bill Reminders

Automated bill reminders are essential to avoid late fees and maintain a good credit score. These reminders notify you when a payment is due. They can be set up to alert you via email or push notifications, ensuring you never miss a payment.

Budgeting Tools And Spending Analytics

Effective budgeting tools and spending analytics are vital for financial planning. These tools help categorize your expenses and provide insights into your spending patterns. You can set budget limits for different categories and track your progress. This helps in making informed financial decisions and achieving your financial goals.

Security Features

Security is a top priority. Advanced security features include encryption, two-factor authentication, and real-time fraud alerts. These measures protect your financial information and prevent unauthorized access. VIALET offers 24/7 protection, ensuring your data is always secure.

Integration With Other Financial Accounts

Integration with other financial accounts simplifies managing multiple accounts from a single platform. You can link your credit card to your business account, like the VIALET Business Account. This integration enables seamless money transfers, automated payments, and consolidated financial management. It is ideal for businesses managing multiple IBANs and currencies.

| Feature | Description |

|---|---|

| Real-Time Expense Tracking | Monitor transactions instantly and adjust spending habits. |

| Automated Bill Reminders | Get notified of due payments to avoid late fees. |

| Budgeting Tools and Spending Analytics | Set budget limits, categorize expenses, and track spending. |

| Security Features | Protect financial data with encryption and fraud alerts. |

| Integration with Other Financial Accounts | Link multiple accounts for seamless financial management. |

These features of credit card management apps, like VIALET, ensure better control over your finances. They help avoid unnecessary expenses, make timely payments, and keep your data secure.

Pricing And Affordability

Understanding the pricing and affordability of the VIALET Business Account is crucial for businesses. It helps in making informed decisions. This section will provide detailed insights into the available options and their costs.

Free Vs. Paid Versions

VIALET offers both free and paid versions of its business account. The free version provides basic features to get started, such as:

- Opening multiple IBANs

- Adding team members

- Assigning different access levels

The paid version, on the other hand, unlocks advanced functionalities, including:

- Mass payouts via API

- B2B API connections

- Acquiring for e-commerce

Subscription Plans And Costs

VIALET has a transparent fee structure but does not provide specific pricing details on their website. To get a precise quote, businesses are encouraged to contact their support team at support@vialet.eu.

Here is a general overview of the pricing components:

| Plan | Features | Cost |

|---|---|---|

| Free Version | Basic Account Management | Free |

| Paid Version | Advanced Features | Contact Support |

Value For Money Analysis

The VIALET Business Account offers significant value for money. It provides a range of features that streamline business financial operations. Key benefits include:

- Speed and ease of use with quick account setup.

- Personalized support via direct communication with an account manager.

- Robust security with 24/7 protection.

- Transparent fees with no hidden charges.

Businesses have praised VIALET for its efficiency, reliability, and excellent customer support. Positive testimonials highlight the quick resolution of issues and the seamless integration of SEPA & SWIFT payments.

Pros And Cons Of Credit Card Management Apps

Credit card management apps like VIALET offer businesses the ability to handle financial operations with ease. These apps come with a range of features designed to streamline processes, but they also have some potential drawbacks. In this section, we will explore the advantages and potential limitations of using credit card management apps.

Advantages Of Using Credit Card Management Apps

Using credit card management apps can offer several benefits:

- Ease of Use: These apps are user-friendly and easy to navigate.

- Instant Transfers: Allows for quick money transfers, saving time.

- Open Banking Solutions: Integrate various banking services in one platform.

- Multiple IBANs: Manage multiple accounts from a single interface.

- Multi-Currency Payments: Handle payments in different currencies with ease.

- Virtual Cards: Use virtual cards for business expenses, enhancing security.

- Mass Payouts: Automate payments to multiple recipients via API.

- B2B API Connections: Streamline payments by integrating apps with the payment platform.

- Acquiring for E-commerce: Optimize checkout processes for online stores.

- Transparent Fees: No hidden charges, promoting cost-effective growth.

- Robust Security: 24/7 protection with advanced security features.

- Personalized Support: Direct communication with an account manager for tailored assistance.

Potential Drawbacks And Limitations

While credit card management apps have numerous benefits, there are also some potential drawbacks to consider:

- Learning Curve: New users may need time to understand all features.

- Dependence on Technology: Requires reliable internet access and up-to-date devices.

- Security Concerns: Despite robust security, there is always a risk of cyber threats.

- Fees: Transparent fees are beneficial, but specific pricing details may not be clear initially.

- Limited Refund/Return Policies: Refund and return policies are not always specified.

- Reliability: Some businesses may experience occasional technical issues.

- Support Availability: While support is usually good, response times can vary.

Understanding the pros and cons of credit card management apps helps businesses make informed decisions. Evaluating these factors ensures that they choose the right tool to meet their financial management needs.

Recommendations For Ideal Users

VIALET Business Account is a robust tool designed to streamline business financial operations. Understanding who can benefit the most from this service will help potential users maximize its features.

Best Scenarios For Using Credit Card Management Apps

Credit card management apps like VIALET are invaluable for businesses that need to manage multiple financial tasks efficiently. Here are some scenarios where they shine:

- Managing Multiple Accounts: Businesses with various IBANs can streamline operations from a single platform.

- Multi-Currency Transactions: Companies dealing in multiple currencies (EUR, USD, GBP, etc.) can benefit from transparent charges.

- Automating Payments: VIALET allows mass payouts via API, which is ideal for regular vendor payments or employee salaries.

- Secure Online Transactions: The robust security features ensure safe and secure transactions 24/7.

Who Can Benefit The Most?

Several types of businesses and professionals can gain significant advantages from using VIALET:

| Type of User | Benefits |

|---|---|

| Small to Medium Enterprises (SMEs) | Quick account setup, fast transactions, and no hidden charges. |

| International Businesses | Support for SEPA, SEPA Instant, and SWIFT payments. |

| Online Retailers | Optimized checkout processes with preferred payment methods. |

| High-Risk Companies | Reliable support and efficient issue resolution. |

| Freelancers and Contractors | Easy management of multiple currencies and transparent fees. |

Whether you are a small business owner or a freelancer, VIALET offers personalized support and robust security, making it an ideal choice for managing your financial operations efficiently.

Frequently Asked Questions

What Is A Credit Card Management App?

A credit card management app helps you track and manage your credit card expenses. It provides insights into your spending patterns and helps you stay within budget.

How Can I Benefit From Using A Credit Card Management App?

Using a credit card management app can help you avoid overspending and late fees. It keeps you informed about your credit card usage and helps you maintain a good credit score.

Are Credit Card Management Apps Secure?

Yes, most credit card management apps use encryption to protect your data. They often require multi-factor authentication to ensure your account’s safety.

Can I Link Multiple Credit Cards In One App?

Yes, many credit card management apps allow you to link multiple credit cards. This feature helps you track all your expenses in one place.

Conclusion

Managing your business finances just got easier with VIALET. The app simplifies transactions, offers robust security, and supports multiple currencies. Enjoy seamless financial operations and transparent fees. Ready to streamline your business finances? Try VIALET today. Learn more about VIALET.