Cash Back Rewards: Maximize Your Savings Effortlessly

Cash Back Rewards can enhance your spending experience by providing financial perks. Imagine getting a percentage of your money back on purchases.

Intriguing, right? Cash Back Rewards programs are becoming increasingly popular. They offer a practical way to save money while spending. Whether you’re shopping for groceries, electronics, or dining out, these rewards can add up quickly. Understanding how these programs work and how to maximize their benefits is crucial. In this blog post, we will explore the ins and outs of Cash Back Rewards. We will guide you on how to make the most of these programs and boost your savings. Let’s dive in and discover the potential of Cash Back Rewards! Looking for ways to build your credit while enjoying rewards? Check out the Cheese Credit Builder Account here.

Introduction To Cash Back Rewards

Cash back rewards have become a popular feature in many credit card offers. These programs reward you for using your credit card, giving back a percentage of your purchases. Understanding how these rewards work can help you maximize your benefits and make informed decisions.

What Are Cash Back Rewards?

Cash back rewards are incentives offered by credit card companies. They give you a percentage of your spending back in cash. For example, if your card offers 1% cash back and you spend $100, you get $1 back. This reward can be redeemed in various ways, including statement credits, checks, or direct deposits to your bank account.

The Purpose Of Cash Back Rewards Programs

Cash back rewards programs aim to attract and retain customers. Credit card companies use these programs to encourage spending and build customer loyalty. By offering cash back, they provide a tangible benefit that appeals to many users. Furthermore, these programs often come with additional perks, such as no annual fees or bonus cash back on specific categories, enhancing their attractiveness.

| Feature | Description |

|---|---|

| Build with all 3 credit bureaus | Reports to Experian, Equifax, and TransUnion |

| No admin or membership fee | No hidden charges for maintaining the account |

| No credit check required | Opening an account does not impact your credit score |

| Autopay option | Automate payments to ensure on-time payments and credit building |

| Credit monitoring | Track your credit score and spot issues early |

| No hard pull | Does not affect your credit score |

One example of a product that leverages the idea of rewards and benefits is the Cheese Credit Builder Account. This account is designed to help users build their credit history without needing a credit card. It reports to all three major credit bureaus and does not require a credit check. There are no hidden fees, and it offers flexible deposit amounts and customizable term lengths.

How Cash Back Rewards Work

Cash back rewards programs allow you to earn a percentage of your spending back as cash. These rewards can be redeemed in various ways, providing a valuable incentive for using specific credit cards or services. Understanding how these programs work can help you maximize your benefits and make informed financial decisions.

Earning Cash Back On Purchases

When you use a cash back credit card, you earn a percentage of your purchase amount as cash back. This percentage varies based on the card and the type of purchase. For example, some cards offer higher cash back rates on groceries, gas, or dining.

- Standard Purchases: Earn a flat rate on all purchases.

- Category Bonuses: Higher rewards for specific categories like travel or groceries.

- Sign-Up Bonuses: Extra cash back for meeting spending thresholds within a set time.

Redeeming Cash Back Rewards

Redeeming your cash back rewards is simple and flexible. Most cards offer multiple redemption options.

- Statement Credits: Apply cash back directly to your credit card balance.

- Bank Deposits: Transfer cash back to your bank account.

- Gift Cards: Exchange cash back for gift cards from various retailers.

- Travel: Use rewards for travel expenses, including flights and hotels.

Check your card’s terms to understand the best redemption methods for you.

Different Types Of Cash Back Programs

Various cash back programs cater to different spending habits and preferences. Some common types include:

- Flat-Rate Cash Back: Earn a fixed percentage on every purchase.

- Tiered Cash Back: Different percentages for different spending categories.

- Rotating Categories: Quarterly changing categories with higher cash back rates.

Each type offers unique advantages. Choose one that aligns with your spending patterns.

By understanding how cash back rewards work, you can choose the best program for your needs. Whether you prefer flat-rate rewards or rotating categories, there’s a cash back card for you.

Key Features Of Top Cash Back Rewards Programs

Cash back rewards programs offer many benefits to consumers. By understanding key features, you can maximize your rewards. Below are some essential aspects to consider when evaluating top programs.

Percentage Of Cash Back Offered

The percentage of cash back offered is crucial. Many programs provide a base rate of 1% to 2%. Premium cards may offer higher rates, often 3% to 5% on specific categories.

Some cards even provide tiered rewards. For example, you might earn 1% on general purchases, 2% at grocery stores, and 3% on gas. Always check the terms and conditions.

Special Categories For Higher Rewards

Many cash back programs feature special categories. These categories offer higher rewards rates.

- Groceries

- Dining out

- Travel

- Gas stations

These categories often rotate. It’s important to keep track of these changes to maximize your rewards.

Introductory Offers And Bonuses

Introductory offers and bonuses can add significant value. Some cards offer sign-up bonuses. For example, you might earn $200 after spending $500 in the first three months.

Other cards offer higher cash back rates for an introductory period. This can be particularly useful for large purchases or planned expenses.

Partnerships With Retailers

Partnerships with retailers can enhance your rewards. Many cash back programs partner with specific retailers. This allows you to earn higher rewards on purchases from these stores.

For example, some cards offer 5% cash back at certain online retailers. Always review the list of partners to see where you can earn extra rewards.

Maximizing cash back rewards requires understanding these key features. By focusing on these aspects, you can choose the best program for your needs.

Credit: www.paymentsjournal.com

How To Maximize Your Cash Back Rewards

Maximizing your cash back rewards can significantly boost your savings. By using strategic methods, you can get the most out of your credit card benefits. Below are some effective ways to make the most of your cash back rewards.

Using Multiple Cards Strategically

Using multiple credit cards can increase your cash back rewards. Each card offers different benefits and cash back percentages. Here are some steps to follow:

- Identify the best cash back cards for different categories.

- Use a high cash back card for specific purchases like groceries or gas.

- Keep track of each card’s rewards and payment deadlines.

Taking Advantage Of Bonus Categories

Many credit cards offer higher cash back percentages in bonus categories. These categories often change every quarter. To maximize your rewards:

- Check your card’s bonus categories regularly.

- Plan your purchases according to these categories.

- Activate the bonus categories if required.

Shopping Through Cash Back Portals

Cash back portals can help you earn extra rewards on online purchases. These portals partner with various retailers to offer additional cash back. Here’s how to use them:

- Sign up for a cash back portal account.

- Shop through the portal to earn extra cash back.

- Combine portal rewards with your credit card rewards.

Tracking And Managing Your Rewards

To ensure you are maximizing your cash back rewards, it’s important to track and manage them effectively. Consider these tips:

- Use apps or spreadsheets to track rewards from different cards.

- Redeem rewards regularly to avoid expiration.

- Set reminders for bonus category activations and payment due dates.

By following these strategies, you can maximize your cash back rewards and save more money. Remember, consistent tracking and smart spending are key to getting the most out of your credit cards.

Pricing And Affordability

Understanding the pricing and affordability of cash back rewards cards is crucial. It can help you maximize value and make informed decisions. Let’s break down the costs and benefits.

Annual Fees And How They Affect Value

Many cash back cards charge an annual fee. While these fees can range from $0 to over $100, they can significantly impact the overall value.

Here’s a simple comparison:

| Card Type | Annual Fee | Cash Back Percentage | Break-Even Spend |

|---|---|---|---|

| Basic Cash Back Card | $0 | 1% | $0 |

| Mid-Tier Cash Back Card | $50 | 1.5% | $3,333 |

| Premium Cash Back Card | $100 | 2% | $5,000 |

Evaluate your spending habits to decide if the annual fee is worth the extra rewards.

No-fee Cash Back Cards

Some cards offer great rewards with no annual fee. These can be ideal for those who want to avoid extra costs.

Benefits include:

- No upfront costs

- Immediate value from rewards

- Lower risk for occasional users

These cards often have lower cash back rates but can still provide significant value.

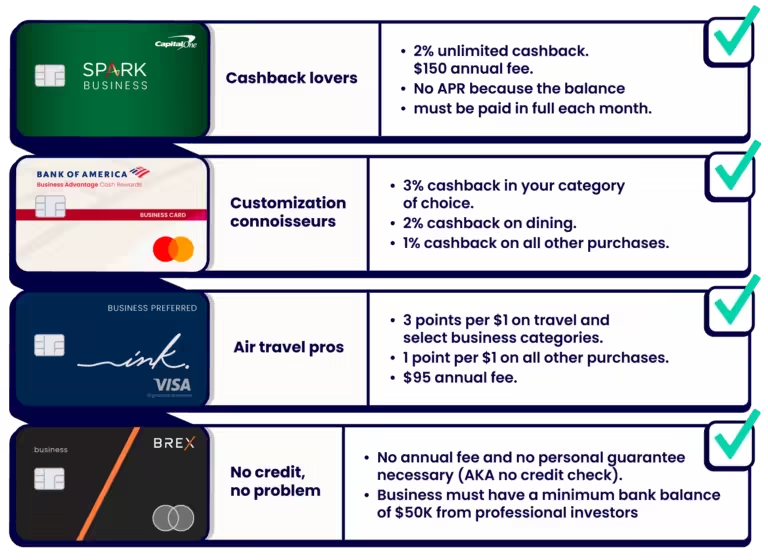

Comparing Different Cash Back Programs

Not all cash back programs are equal. Comparing them can help you find the best match for your needs.

Consider the following factors:

- Cash Back Rate: Higher rates mean more rewards.

- Spending Categories: Some cards offer higher rewards in specific categories like groceries or gas.

- Redemption Options: Flexibility in how you can use your rewards.

- Sign-Up Bonuses: Extra rewards for meeting initial spending requirements.

For instance, a card offering 5% cash back on groceries can be very valuable for a family. Comparing these factors will help you find the best card.

Pros And Cons Of Cash Back Rewards

Cash back rewards can be a great way to get something extra from your spending. But they also come with their own set of advantages and disadvantages. Knowing these can help you make a better decision.

Benefits Of Using Cash Back Rewards

Cash back rewards offer several benefits:

- Extra Savings: You earn money back on your purchases. This can add up over time.

- Simple and Easy: Many cash back cards automatically apply rewards to your account. No need for extra steps.

- Flexible Use: You can often use cash back rewards in multiple ways, such as statement credits, direct deposits, or gift cards.

- Low Maintenance: No need to track points or miles. Cash back is straightforward and easy to manage.

Using cash back rewards can also help you stay disciplined with your spending. As you see your rewards grow, you might be encouraged to spend wisely.

Potential Drawbacks And Pitfalls

Despite the benefits, there are some drawbacks:

- High Interest Rates: Many cash back cards have higher interest rates. If you carry a balance, interest charges can negate your rewards.

- Annual Fees: Some cards come with annual fees. Make sure your rewards outweigh the cost.

- Spending Requirements: You may need to spend a certain amount to earn the best rewards. This can lead to unnecessary spending.

- Limited Categories: Some cards only offer high rewards in specific categories. If your spending habits don’t match, you might not benefit as much.

Being aware of these potential pitfalls can help you use cash back rewards more effectively. Choose a card that fits your spending habits and financial goals.

Recommendations For Ideal Users

Cash back rewards can be highly beneficial for various types of users. Different cards cater to different spending habits and lifestyles. Below are some recommendations for the ideal users of cash back credit cards, categorized by their spending preferences.

Best Cash Back Cards For Everyday Spending

For users who frequently spend on everyday items, certain cards offer superior benefits. These cards typically provide higher cash back percentages on groceries, gas, and other daily purchases.

| Card Name | Cash Back Rate | Bonus Categories |

|---|---|---|

| Blue Cash Preferred® Card | 6% on groceries | Groceries, streaming services |

| Chase Freedom Flex℠ | 5% on rotating categories | Groceries, gas, and more |

Best Cash Back Cards For Travel And Dining

For those who love to travel and dine out, some cards offer excellent rewards in these categories. These cards often include additional perks such as no foreign transaction fees and travel insurance.

- Chase Sapphire Preferred® Card – 2x points on travel and dining

- Capital One® Savor® Cash Rewards – 4% cash back on dining

Best Cash Back Cards For Online Shopping

Online shoppers can benefit greatly from cards that offer high cash back rates on online purchases. These cards make it easy to save money while shopping from the comfort of your home.

- Amazon Prime Rewards Visa Signature Card – 5% cash back on Amazon purchases

- Discover it® Cash Back – 5% cash back on rotating categories, often including online shopping

Choosing the right cash back card depends on your spending habits. Evaluate your monthly expenses to determine which card aligns with your lifestyle.

Credit: www.shutterstock.com

:max_bytes(150000):strip_icc()/cash-back.asp-final-e756ec89261f4a61967131694a008c33.png)

Credit: www.investopedia.com

Frequently Asked Questions

What Are Cash Back Rewards?

Cash back rewards are incentives offered by credit card companies. They return a percentage of your purchases as cash. This can be used as a statement credit or deposited into your bank account.

How Do Cash Back Rewards Work?

Cash back rewards work by returning a small percentage of your purchase amount. Typically, this ranges from 1% to 5%. The rewards are accumulated and can be redeemed later.

Can Cash Back Rewards Expire?

Yes, cash back rewards can expire. The expiration period varies by credit card issuer. It’s important to check your card’s terms and conditions.

Are Cash Back Rewards Taxable?

Generally, cash back rewards are not taxable. They are considered a rebate on purchases. However, it’s best to consult a tax professional for specific advice.

Conclusion

Cash back rewards can truly benefit your financial journey. By choosing the right program, you maximize savings and rewards. For those looking to build credit, consider the Cheese Credit Builder Account. It offers credit building with no hidden fees and requires no credit check. Learn more about the Cheese Credit Builder here. Start saving, earning rewards, and building your credit today!