Build Credit Score Fast: Proven Tips and Strategies

Building a good credit score is essential. It opens doors to financial opportunities.

Your credit score affects many aspects of your life. From getting a loan to renting an apartment, a solid score can make a big difference. But how do you build or improve your credit score effectively? This is where tools like the Cheese Credit Builder Account come in handy. This tool is designed to help you build your credit without the need for a credit card. It’s automated, low-cost, and reports to all major credit bureaus. No credit check is required, and you can set up autopay to ensure timely payments. Learn how this simple solution can help you achieve your financial goals. Discover more about the Cheese Credit Builder Account here.

Credit: www.creditsesame.com

Introduction To Building Credit Score Fast

Building a credit score fast is a common financial goal. Whether you are looking to make a big purchase, secure a loan, or simply improve your financial health, a good credit score is essential. The Cheese Credit Builder Account can help you achieve this goal quickly and efficiently.

Why A Good Credit Score Matters

A good credit score opens up many financial opportunities. It can help you get better interest rates on loans and credit cards. It also makes it easier to rent an apartment or even get a job. Most importantly, a good credit score can save you money in the long run.

How Credit Scores Are Calculated

Credit scores are calculated using a few key factors. Here is a breakdown:

- Payment History (35%): This is the most important factor. Making on-time payments is crucial.

- Credit Utilization (30%): This refers to the amount of credit you are using compared to your credit limit. Keeping this ratio low is important.

- Length of Credit History (15%): The longer your credit history, the better.

- Credit Mix (10%): Having a mix of different types of credit (loans, credit cards) can improve your score.

- New Credit (10%): Opening too many new accounts in a short time can lower your score.

Product Summary: Cheese Credit Builder Account

| Features | Details |

|---|---|

| Build with all 3 credit bureaus | Reports to all major credit bureaus. |

| No admin or membership fee | No additional charges for maintaining the account. |

| No credit check required | Opening an account does not require a credit check. |

| Automated payments | Set up autopay to ensure timely payments. |

| Build by saving | Funds are kept in a protected bank account and returned at the end of the term. |

| No hard pull | Does not negatively impact your credit score. |

| Low APR | Fixed and low annual percentage rate. |

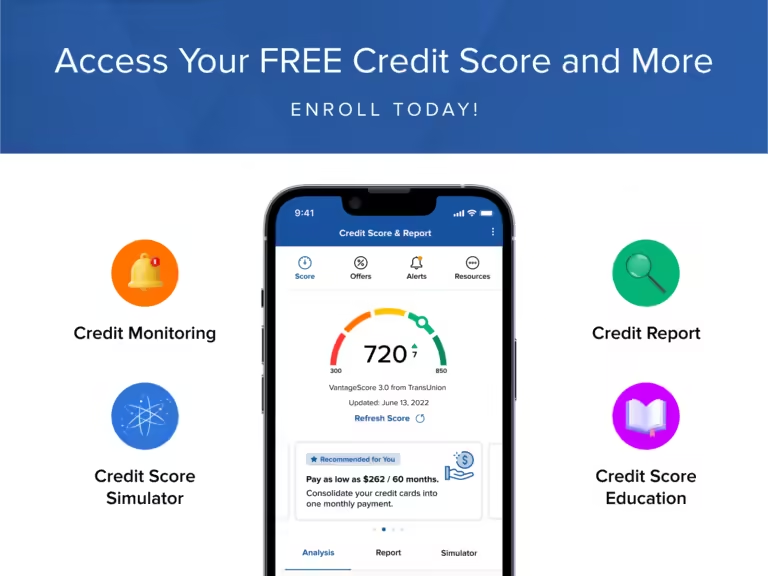

| Credit monitoring | Track your credit score and spot issues easily. |

The Cheese Credit Builder Account is designed to help you build or improve your credit score. It offers a simple, automated, and low-cost solution to build credit while saving money. With features like no credit check required, automated payments, and credit monitoring, it’s a great tool for anyone looking to improve their credit score fast.

Credit: www.velocitycommunity.org

Proven Tips To Improve Your Credit Score Quickly

Improving your credit score might seem challenging, but with the right approach, you can see quick results. These proven tips can help you boost your credit score efficiently and effectively.

Pay Your Bills On Time

One of the most critical factors in building a good credit score is paying your bills on time. Timely payments show lenders you are reliable. Consider setting up automated payments with services like the Cheese Credit Builder Account. Automated payments ensure you never miss a due date, helping you build a positive payment history.

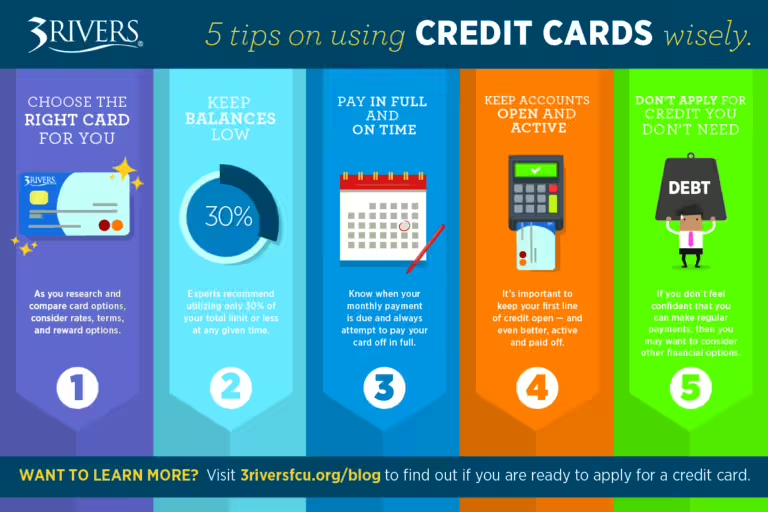

Reduce Your Credit Card Balances

High credit card balances can negatively impact your credit score. Aim to keep your credit utilization ratio below 30%. Paying down your balances is a quick way to improve your score. If you have multiple cards, focus on the ones with the highest interest rates first.

Avoid Opening New Credit Accounts Unnecessarily

Each time you open a new credit account, it can cause a temporary dip in your credit score. Avoid opening new accounts unless necessary. Instead, focus on managing your existing accounts well. The Cheese Credit Builder Account does not require a credit check, making it a great option for those who want to build credit without affecting their score.

Dispute Inaccuracies On Your Credit Report

Errors on your credit report can drag down your score. Regularly check your credit report for inaccuracies. Dispute any errors you find with the credit bureau. The Cheese Credit Builder Account offers credit monitoring, helping you spot issues easily and take action swiftly.

Become An Authorized User On A Credit Card

Becoming an authorized user on someone else’s credit card can help you build credit. Choose someone with good credit habits. As an authorized user, their positive payment history can reflect on your credit report. This can be a quick way to boost your credit score.

| Tip | Action |

|---|---|

| Pay Your Bills on Time | Set up automated payments with Cheese Credit Builder |

| Reduce Your Credit Card Balances | Keep utilization below 30% |

| Avoid Opening New Credit Accounts Unnecessarily | Focus on existing accounts |

| Dispute Inaccuracies on Your Credit Report | Check and dispute errors regularly |

| Become an Authorized User on a Credit Card | Join someone with good credit habits |

Effective Strategies For Sustained Credit Score Growth

Building a good credit score takes time and consistent effort. Employing effective strategies can help achieve sustained credit score growth. Below are some proven methods to enhance your credit score over time.

Diversify Your Credit Mix

Having a variety of credit types can improve your credit score. This includes a mix of credit cards, mortgages, auto loans, and personal loans. Diversifying your credit mix shows that you can manage different types of credit responsibly.

For example, the Cheese Credit Builder Account offers a unique way to build credit without a traditional credit card. This account reports to all three major credit bureaus and does not require a credit check, making it a great addition to diversify your credit mix.

Keep Old Accounts Open

Closing old credit accounts can negatively impact your credit score. The length of your credit history plays a crucial role in your score. Keeping old accounts open, even if you don’t use them often, helps maintain a longer credit history.

If you have an old credit card with no annual fee, consider keeping it open. This can help increase the average age of your accounts and positively impact your score.

Set Up Payment Reminders

On-time payments are essential for a good credit score. Setting up payment reminders ensures you never miss a due date. Most banks and credit card companies offer reminder services via email or SMS.

With the Cheese Credit Builder Account, you can set up automated payments to ensure timely payments. This feature helps you build your credit score by consistently making on-time payments.

Use Credit Monitoring Services

Credit monitoring services help track your credit score and alert you to any changes. These services can identify potential issues early, allowing you to take corrective action promptly.

Cheese Credit Builder Account includes a credit monitoring feature. It allows you to track your credit score and spot issues easily, helping you stay on top of your credit health.

| Strategy | Action |

|---|---|

| Diversify Your Credit Mix | Add different types of credit accounts. |

| Keep Old Accounts Open | Maintain old accounts to lengthen credit history. |

| Set Up Payment Reminders | Use reminders or auto payments for on-time payments. |

| Use Credit Monitoring Services | Monitor credit score and address issues quickly. |

Employing these strategies can help you achieve sustained growth in your credit score. Consider utilizing tools like the Cheese Credit Builder Account to simplify and automate parts of this process.

Understanding The Impact Of Different Financial Moves

Building a credit score is essential for financial health. Various financial actions can impact your credit score in different ways. This section explains how loans, credit utilization ratio, and hard inquiries affect your credit score.

How Loans Affect Your Credit Score

Taking out loans can have both positive and negative effects on your credit score.

- Positive Impact: Making on-time payments can improve your credit score.

- Negative Impact: Missing payments can lower your credit score.

Products like the Cheese Credit Builder Account help build credit by ensuring automated, on-time payments. This avoids the risk of missed payments.

The Role Of Credit Utilization Ratio

Your credit utilization ratio is the amount of credit you use compared to your credit limit. A lower ratio is better.

- Low Ratio: Using less than 30% of your credit limit is ideal.

- High Ratio: Using more than 30% can negatively impact your score.

The Cheese Credit Builder Account helps you build credit without a credit card, so it does not affect your credit utilization ratio.

Impact Of Hard Inquiries On Your Score

A hard inquiry occurs when a lender checks your credit report for a loan or credit card application. This can temporarily lower your credit score.

- Hard Inquiries: Each hard inquiry can drop your score by a few points.

- Soft Inquiries: Do not affect your credit score.

Opening a Cheese Credit Builder Account does not require a credit check, so there is no hard pull on your credit score.

By understanding these financial moves, you can better manage your credit score. Consider using tools like the Cheese Credit Builder Account to help you build credit securely and effectively.

Common Mistakes To Avoid When Building Credit

Building a strong credit score takes time and careful planning. Many people make avoidable mistakes that can hurt their credit score. Understanding these common pitfalls can help you build a better credit profile. Let’s dive into some key mistakes to avoid.

Missing Payments

Missing payments is one of the most damaging mistakes you can make. Payment history makes up 35% of your credit score. Late payments can stay on your credit report for seven years, impacting your score significantly.

To avoid this, consider using tools like Cheese Credit Builder. It offers automated payments, ensuring you never miss a due date.

Maxing Out Credit Cards

Maxing out your credit cards can negatively impact your credit utilization ratio. This ratio compares your credit card balances to your total credit limit. A high utilization ratio suggests you’re over-reliant on credit.

Keep your balances below 30% of your credit limit to maintain a healthy score. Using a credit builder account like Cheese can help manage your credit utilization effectively.

Closing Old Credit Accounts

Closing old credit accounts can hurt your credit score. The length of your credit history accounts for 15% of your score. Older accounts contribute to a longer credit history.

Instead of closing unused accounts, keep them open and use them occasionally. This practice helps maintain a longer credit history and improves your score over time.

Applying For Too Much Credit At Once

Applying for too much credit in a short period can lead to multiple hard inquiries on your credit report. Each hard inquiry can lower your score by a few points.

Space out your credit applications to avoid a negative impact. With Cheese Credit Builder, you can build credit without multiple hard inquiries, as it does not require a credit check to open an account.

Credit: www.transunion.com

Specific Recommendations For Different Scenarios

Building a credit score is crucial for financial stability. Different strategies work for various situations. Below are specific recommendations for students, individuals recovering from bankruptcy, and people with no credit history. These tips can help you improve your credit score effectively.

Students And Young Professionals

Starting early can make a big difference. Here are some tips:

- Consider using the Cheese Credit Builder Account. It reports to all three credit bureaus and does not require a credit check.

- Set up automated payments to ensure you never miss a due date.

- Keep your credit utilization low. Aim to use less than 30% of your available credit.

- Track your progress with credit monitoring features to spot issues early.

Individuals Recovering From Bankruptcy

Rebuilding credit after bankruptcy can be challenging, but not impossible:

- Use a secured credit card or a service like the Cheese Credit Builder Account. It does not require a credit check and helps build credit by making on-time payments.

- Focus on making timely payments. This is crucial for rebuilding your credit score.

- Keep your credit accounts active but manage them responsibly.

- Avoid applying for multiple new credit accounts at once to prevent hard inquiries on your credit report.

People With No Credit History

Establishing credit from scratch requires a strategic approach:

- Open a Cheese Credit Builder Account to start building credit. There is no credit check required, making it perfect for beginners.

- Consider a secured credit card or a credit-builder loan.

- Make small purchases and pay off the balance in full each month to establish a positive payment history.

- Monitor your credit report regularly to ensure accuracy and track your progress.

Utilizing tools like the Cheese Credit Builder Account can simplify the process. It offers flexible terms, secure savings, and a low APR, making it an excellent choice for anyone looking to build or rebuild their credit.

Frequently Asked Questions

How To Start Building Credit Score?

Start by applying for a secured credit card. Use it responsibly by making small purchases and paying the balance in full each month. This helps build your credit history.

Why Is A Good Credit Score Important?

A good credit score can help you get lower interest rates. It also improves your chances of loan approvals and better credit card offers.

How Long Does It Take To Build Credit?

Building a good credit score can take several months to years. Consistent, responsible credit usage and timely payments are key.

What Affects Your Credit Score The Most?

Payment history and credit utilization are the most important factors. Make timely payments and keep your credit card balances low to improve your score.

Conclusion

Building a good credit score is essential for financial health. Start today. Make on-time payments and manage your debts responsibly. Consider using tools like the Cheese Credit Builder Account. It’s an easy and low-cost way to build or improve your credit score. No credit checks and no membership fees. Automated payments ensure timely payments, building your credit history with all major bureaus. Take control of your credit journey now and secure your financial future.