Best Practices For Credit Building: Expert Tips for Success

Building credit is crucial for financial health. Good credit opens doors to better loans and lower interest rates.

Understanding the best practices for credit building can be overwhelming, but it’s essential for anyone looking to improve their financial standing. This blog post will guide you through effective strategies to enhance your credit score. Whether you are starting from scratch or seeking to rebuild, these practices are designed to help you achieve a stronger credit profile. One effective tool to consider is the Cheese Credit Builder Account. By following these strategies and using resources like Cheese, you can steadily improve your credit without the hassle of complex financial maneuvers. Let’s dive in and explore how to build your credit the right way. For more details on Cheese, visit Cheese Credit Builder.

Credit: www.bestegg.com

Introduction To Credit Building

Building credit is essential for financial health. A strong credit score opens doors to loans, credit cards, and better interest rates. Understanding how to build credit is the first step toward financial freedom. Let’s explore the importance of credit and the best practices for building it effectively.

Understanding The Importance Of Credit

Credit impacts many aspects of our lives. It influences loan approvals, interest rates, and even job opportunities. A good credit score means lower interest rates and better terms for loans and credit cards. Employers and landlords may also check credit scores before making decisions. Therefore, maintaining a healthy credit score is crucial.

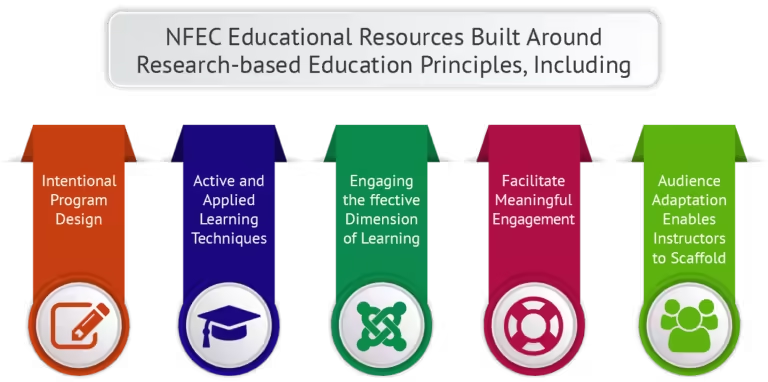

Overview Of Credit Building Practices

There are several ways to build and improve credit:

- Pay bills on time: Timely payments positively impact your credit score.

- Keep credit utilization low: Use less than 30% of your credit limit.

- Monitor your credit report: Regularly check for errors and dispute inaccuracies.

- Avoid opening too many accounts: Multiple inquiries can lower your score.

One effective tool for building credit is the Cheese Credit Builder Account. This product helps users build credit by making monthly deposits into a secure bank account. Here are its main features:

| Feature | Details |

|---|---|

| Build with all 3 credit bureaus | Reports to Experian, Equifax, and TransUnion |

| No admin or membership fee | No hidden charges |

| No credit check required | No impact on your credit score |

| Fixed and low APR | Check local APR rates |

| Credit monitoring | Track your progress |

With the Cheese Credit Builder Account, you can choose deposit amounts ($500, $1,000, or $2,000) and term lengths (12 or 24 months). You get your money back at the end of the term, minus interest. You can also cancel anytime without penalties.

For more information, visit the Cheese Credit Builder Account.

Credit: www.transcredit.com

Key Strategies For Building Credit

Building credit is essential for financial well-being. Good credit scores can help you secure loans and better interest rates. Let’s explore key strategies for building credit.

Establishing A Credit History

Having a credit history is crucial. Without it, lenders can’t assess your creditworthiness. One effective way to establish credit history is by using a credit builder account like the Cheese Credit Builder Account.

Cheese Credit Builder offers:

- Reports to all three credit bureaus

- No credit check required

- No admin or membership fee

By making monthly deposits into a secure bank account, you can build your credit over time. At the end of the term, you get your money back minus interest. It’s a safe, hands-off way to build credit.

Using Credit Cards Wisely

Credit cards can help build credit if used wisely. Pay your bills on time. Late payments can negatively impact your credit score. Keep your balances low.

Consider the following tips:

- Pay more than the minimum payment

- Avoid maxing out your credit card

- Set up automatic payments to ensure timely payments

Responsible credit card usage demonstrates good financial management, boosting your credit score.

Managing Credit Utilization Rates

Credit utilization rate is the ratio of your credit card balance to your credit limit. Keeping this rate low is vital. Ideally, it should be under 30%.

To manage your credit utilization:

- Monitor your credit card balances regularly

- Make multiple payments within a billing cycle

- Request a credit limit increase

Lower utilization rates show lenders that you’re not overly reliant on credit, which can positively impact your credit score.

Using these strategies, you can effectively build and maintain a healthy credit score.

Maintaining A Healthy Credit Score

Maintaining a healthy credit score is essential for financial stability. It impacts your ability to secure loans, credit cards, and even employment opportunities. Adhering to best practices can help you keep your credit score in good standing.

Timely Payments And Their Impact

Making timely payments is crucial for maintaining a healthy credit score. Each on-time payment positively affects your credit history. Late payments, on the other hand, can have a significant negative impact.

- Set up automatic payments to ensure you never miss a due date.

- Use reminders to keep track of payment deadlines.

Timely payments demonstrate reliability and financial responsibility. This boosts your credit score over time.

Monitoring Your Credit Report

Regularly monitoring your credit report helps you stay informed about your credit status. You can access your credit report from the three major bureaus: Equifax, Experian, and TransUnion.

- Check for inaccuracies and discrepancies.

- Review your credit accounts and their statuses.

Using tools like Cheese Credit Builder can assist in monitoring your credit. Cheese offers credit monitoring as part of its features, ensuring you stay updated.

Addressing Credit Report Errors

Errors on your credit report can negatively impact your score. It is important to address these errors promptly.

| Step | Description |

|---|---|

| 1 | Identify the error on your credit report. |

| 2 | Contact the credit bureau to dispute the error. |

| 3 | Provide supporting documentation to validate your claim. |

| 4 | Follow up until the error is corrected. |

Addressing these errors ensures your credit score accurately reflects your financial behavior.

By following these practices, you can effectively maintain a healthy credit score. Using tools like the Cheese Credit Builder can simplify this process, helping you build and maintain your credit effortlessly.

Credit: blog.umb.com

Advanced Credit Building Techniques

Building credit can be challenging, but there are advanced techniques to make it easier. These methods help boost your credit score effectively and efficiently. Let’s delve into some of these advanced techniques.

Diversifying Your Credit Mix

Diversifying your credit mix is crucial for improving your credit score. It involves having various types of credit accounts. This could include credit cards, mortgages, auto loans, and personal loans.

- Credit cards provide revolving credit.

- Mortgages and auto loans are examples of installment credit.

- Having a mix of both can positively impact your credit score.

Lenders prefer seeing a diverse credit portfolio. It indicates that you can handle different types of credit responsibly.

Secured Credit Cards And Their Benefits

Secured credit cards are a great tool for building credit. These cards require a deposit that serves as your credit limit. They are easier to obtain than traditional credit cards, especially for those with bad or no credit history.

| Benefits | Details |

|---|---|

| Easy approval | No credit check required. |

| Builds credit | Reports to all three credit bureaus. |

| Security | Your deposit is refundable. |

Using a secured credit card responsibly can help improve your credit score over time. Just ensure you make timely payments and keep your balance low.

Becoming An Authorized User

Another effective strategy is becoming an authorized user on someone else’s credit card. This involves being added to a primary cardholder’s account. You get a card to use, but the primary cardholder remains responsible for payments.

- Choose a responsible cardholder: Ensure they have good credit habits.

- Monitor the account: Regularly check the account activity.

- Communicate: Stay in touch with the primary cardholder about the account status.

Being an authorized user can help you build credit without the risk of default. It’s a low-risk way to improve your credit profile.

These advanced techniques can significantly enhance your credit-building efforts. Explore options like the Cheese Credit Builder Account for a hands-off approach to credit building. Cheese helps you build credit by making monthly deposits into a secure bank account, reporting to all three credit bureaus without requiring a credit check.

Common Pitfalls To Avoid

Building credit is a crucial step in achieving financial stability. Yet, many people fall into common traps that can derail their progress. Understanding these pitfalls can help you navigate your credit-building journey more effectively.

Overextending Credit

One of the biggest mistakes is overextending your credit. This occurs when you take on more credit than you can manage. High credit balances can negatively impact your credit score and lead to financial stress.

- Keep your credit utilization below 30%.

- Avoid taking on multiple credit cards at once.

- Focus on paying down existing balances before opening new lines of credit.

Ignoring Credit Inquiries

Another common pitfall is ignoring credit inquiries. Each time you apply for credit, a hard inquiry is recorded on your report. Frequent hard inquiries can lower your credit score.

To manage this, follow these tips:

- Limit the number of credit applications.

- Space out your credit applications over time.

- Use credit monitoring services, like Cheese Credit Builder, to keep track of your inquiries.

Closing Old Credit Accounts

Closing old credit accounts can also harm your credit score. Length of credit history is an important factor in your score calculation. Closing old accounts shortens your credit history.

Consider these strategies:

- Keep older accounts open, even if you don’t use them frequently.

- Use these accounts occasionally for small purchases to keep them active.

- Monitor these accounts to avoid inactivity fees.

By avoiding these common pitfalls, you can better manage your credit building efforts. Tools like the Cheese Credit Builder Account can help you stay on track with no credit check and no fees.

Expert Tips For Long-term Success

Building credit can seem daunting, but with the right strategies, you can achieve long-term success. Here are some expert tips to help you navigate the process and establish a strong credit foundation.

Setting Realistic Credit Goals

Start by setting realistic credit goals. Aim to improve your credit score gradually. Break down your goals into smaller, manageable steps. For instance, plan to increase your score by 20 points every three months. Use tools like the Cheese Credit Builder Account to track your progress.

| Goal | Timeframe |

|---|---|

| Increase credit score by 20 points | 3 months |

| Save $500 for emergencies | 6 months |

| Maintain on-time payments | Ongoing |

Regularly review your credit report for errors. Correcting mistakes can improve your score quickly.

Seeking Professional Advice

Consider seeking professional advice to guide you. Credit counselors can offer personalized advice based on your situation. They can help you create a budget, manage debt, and improve your credit score. The Cheese Credit Builder is a tool that can complement professional advice. It reports to all three credit bureaus, helping you build credit effectively.

Building Credit During Major Life Changes

Major life changes like marriage, having a baby, or buying a home can impact your credit. During these times, it’s essential to stay focused on your credit goals. Here are some tips:

- Marriage: Discuss financial habits and goals with your partner. Consider using joint accounts to build credit together.

- Having a baby: Plan for additional expenses. Keep making regular credit-building deposits with tools like the Cheese Credit Builder.

- Buying a home: Maintain a low credit utilization ratio. Save for a down payment while building credit.

Flexibility is key. The Cheese Credit Builder allows you to customize deposit amounts and term lengths. You can choose what fits your budget and life stage.

By following these expert tips, you can build and maintain a healthy credit score for long-term success.

Frequently Asked Questions

How Can I Start Building Credit?

Start building credit by opening a secured credit card. Make small purchases and pay off the balance monthly. Always pay bills on time. Keep your credit utilization low.

What Is A Good Credit Score?

A good credit score ranges from 670 to 739. Higher scores indicate better creditworthiness. Aim to maintain a good score for better financial opportunities.

How Long Does Credit Building Take?

Building credit can take six months to a year. Consistent, responsible credit usage improves your score over time. Patience and persistence are key.

Can I Build Credit Without A Credit Card?

Yes, you can build credit with installment loans, such as auto or student loans. Timely rent and utility payments can also be reported to credit bureaus.

Conclusion

Building credit takes time and patience. Follow these best practices consistently. Use tools like the Cheese Credit Builder for better results. It offers monthly deposits and reports to all three bureaus. No credit check required. Fixed, low APR. Safe and secure. Start small and watch your credit grow. Remember, your credit score impacts many aspects of life. Take control today.