Financial Freedom For Businesses: Unlock Success and Growth

Achieving financial freedom for businesses is crucial in today’s competitive market. It allows companies to grow, innovate, and sustain themselves without constant financial strain.

Financial freedom means having control over your business finances. It means not worrying about cash flow or unexpected expenses. With the right tools and strategies, this goal is within reach for many businesses. One effective way to achieve this is by leveraging comprehensive financial solutions like the Flex Financial Platform. Flex offers integrated banking, credit, and expense management services. This platform simplifies financial operations and supports business growth. Ready to explore how Flex can help your business achieve financial freedom? Learn more about the Flex Financial Platform here.

Introduction To Financial Freedom For Businesses

Financial freedom is crucial for every business. It allows businesses to operate without financial stress and expand without hindrance. Achieving financial freedom means having enough revenue to cover expenses, invest in growth, and save for the future.

Understanding Financial Freedom

Financial freedom for businesses means having control over finances. This involves sufficient cash flow, manageable debt, and the ability to invest in new opportunities. Here are key aspects:

- Cash Flow Management: Ensuring steady income to cover costs and investments.

- Debt Management: Keeping debts at a manageable level.

- Investment: Allocating funds to grow the business.

Importance Of Financial Freedom For Business Success

Financial freedom impacts business success significantly. Here are some reasons:

- Stability: Provides a cushion during economic downturns.

- Growth: Enables investment in new projects and technologies.

- Peace of Mind: Reduces financial stress for business owners and employees.

Flex Financial Platform Features And Benefits

The Flex Financial Platform is designed to help businesses achieve financial freedom. Key features include:

| Feature | Description |

|---|---|

| Flex Banking | Simplified banking, payments, and expense management with high APY on cash balances. |

| Flex Credit Card | Net-60 on all purchases, 0% interest for 60 days, and credit limits that grow with your business. |

| Security | FDIC insurance, automated fraud monitoring, and MFA for account security. |

Using the Flex platform ensures streamlined financial operations. Businesses can enhance cash flow with net-60 terms and 0% interest for 60 days. The platform also offers high APY on cash balances, aiding in meeting profit objectives.

For more information, visit the Flex Financial Platform.

Key Features Of Achieving Financial Freedom

Achieving financial freedom for businesses requires a strategic approach. By focusing on crucial aspects like cash flow management, investment planning, debt management, and income diversification, businesses can create a stable and prosperous financial future.

Effective Cash Flow Management

Effective cash flow management is the backbone of financial stability. Businesses should regularly monitor their cash inflows and outflows. This ensures there is always enough liquidity to meet operational needs. Tools like the Flex Financial Platform offer streamlined banking and expense management. This helps in capturing receipts and issuing team cards seamlessly. Earning up to 2.99% APY on cash balances can also significantly enhance cash flow.

Strategic Investment Planning

Strategic investment planning is essential for long-term growth. It involves identifying profitable investment opportunities. Using platforms like Flex, businesses can benefit from high APY on cash balances. This aids in meeting profit objectives. Flex offers net-60 terms and 0% interest for 60 days on their credit card. This allows businesses to invest smartly without immediate financial pressure.

Debt Management Strategies

Effective debt management strategies are critical for maintaining financial health. Businesses should prioritize paying off high-interest debt first. Utilizing Flex’s credit card with net-60 payment terms can help manage short-term debts without accruing interest. This ensures that businesses can focus on growth rather than being burdened by debt.

Building Multiple Income Streams

Building multiple income streams provides financial security. Diversification reduces reliance on a single revenue source. Flex offers various financial services in one platform, enabling businesses to explore different income opportunities. This includes earning interest on cash balances and leveraging credit limits that grow with the business.

By implementing these key features, businesses can achieve financial freedom and foster sustainable growth.

Benefits Of Financial Freedom For Businesses

Achieving financial freedom is crucial for any business. It allows companies to operate without constant financial strain. This freedom provides several key benefits that can significantly enhance business operations and growth.

Enhanced Decision-making Capabilities

With financial freedom, businesses can make decisions more confidently and swiftly. The absence of cash flow issues means that investments in new projects or technologies can be made without hesitation. This leads to more strategic and effective decision-making.

Increased Business Stability

Financial freedom results in greater stability for businesses. Companies with solid financial foundations can better withstand economic downturns. They have the resources to navigate through tough times without compromising their operations. This stability is essential for long-term success.

Ability To Seize Growth Opportunities

Businesses with financial freedom can seize growth opportunities promptly. They can invest in new markets, products, or services without delay. This agility helps businesses stay competitive and expand their market presence.

Stress Reduction For Business Owners

Financial freedom reduces stress for business owners. Without constant financial pressures, owners can focus on strategic planning and innovation. This improves their overall well-being and productivity. A stress-free environment fosters better leadership and business growth.

| Feature | Benefit |

|---|---|

| Flex Banking | Streamlined financial operations with simplified banking and payments. |

| Flex Credit Card | Net-60 terms with 0% interest for 60 days, enhancing cash flow. |

For more information on how Flex can help your business achieve financial freedom, visit Flex Financial Platform.

Challenges In Achieving Financial Freedom

Businesses face numerous obstacles on the path to financial freedom. These challenges can hinder growth and stability, making it essential to understand and address them effectively. Below, we explore some of the common financial pitfalls, economic uncertainties, and unexpected expenses that businesses must navigate.

Common Financial Pitfalls

Many businesses struggle with managing cash flow effectively. Poor cash flow management can lead to liquidity issues, making it difficult to cover daily expenses and invest in growth opportunities. Another frequent pitfall is over-reliance on credit. While credit can provide a buffer during tough times, excessive borrowing can lead to significant debt and financial strain.

Additionally, businesses often face inefficient expense tracking. Without a streamlined system, tracking expenses can become overwhelming and lead to overspending. The Flex Financial Platform offers solutions like streamlined receipt capture and expense management to help businesses avoid these pitfalls.

Overcoming Economic Uncertainties

Economic uncertainties, such as market fluctuations and economic downturns, can pose significant challenges. Businesses need to adopt strategies to mitigate these risks. One effective approach is to diversify revenue streams. By not relying on a single source of income, businesses can better weather economic storms.

Another strategy is maintaining a healthy cash reserve. Having a financial cushion allows businesses to manage unexpected downturns without resorting to high-interest loans. The Flex Banking feature, with its high APY on cash balances, can help businesses build and maintain these reserves.

Managing Unexpected Expenses

Unexpected expenses can disrupt financial stability and growth plans. These can include emergency repairs, sudden regulatory changes, or unexpected market shifts. To manage these effectively, businesses should have a contingency plan in place. This plan should outline steps to take in response to various unexpected events.

Creating a dedicated emergency fund is also crucial. This fund should be separate from regular operating funds and only used for unforeseen expenses. The Flex Credit Card, with its net-60 terms and 0% interest for 60 days, provides a flexible solution for managing such expenses without incurring immediate debt.

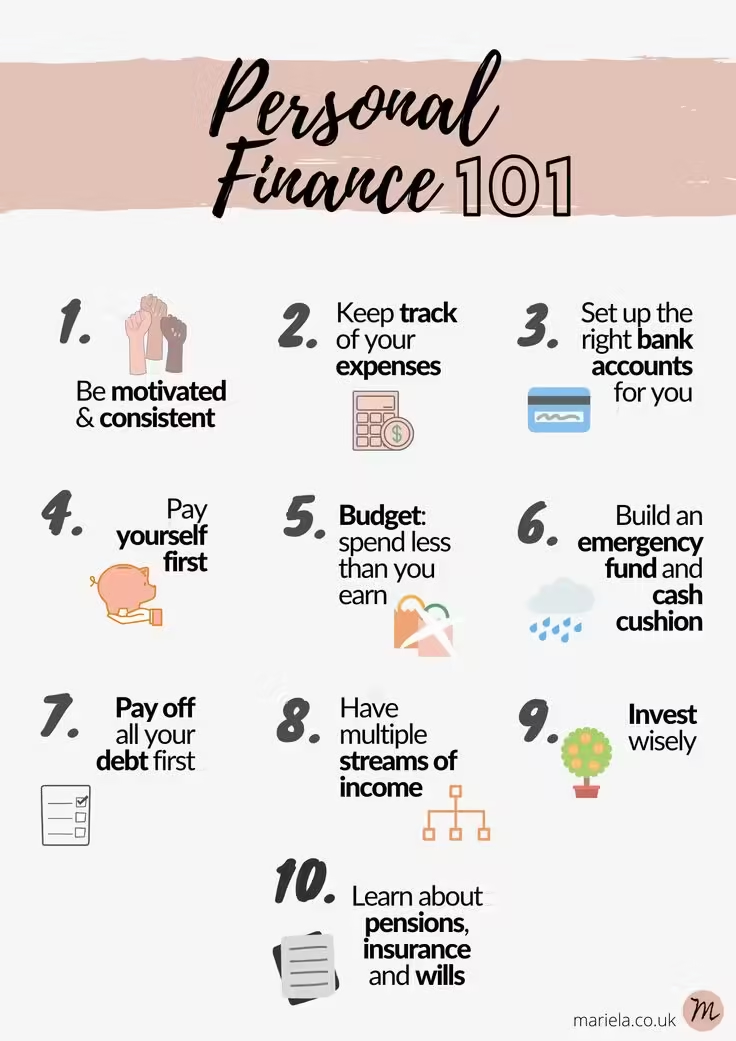

Steps To Attain Financial Freedom

Achieving financial freedom for your business is a crucial goal. It involves strategic planning and disciplined execution. Following these essential steps can help you reach your financial objectives and ensure long-term success.

Setting Clear Financial Goals

Define specific, measurable, achievable, relevant, and time-bound (SMART) goals. Clear financial goals provide direction and a roadmap for your business.

- Revenue Targets: Set annual revenue goals.

- Expense Management: Identify areas to reduce costs.

- Profit Margins: Aim for a specific profit percentage.

Creating A Detailed Financial Plan

A well-structured financial plan is essential. It includes revenue projections, expense forecasts, and cash flow analysis.

| Plan Element | Description |

|---|---|

| Revenue Projections | Estimate future sales and income sources. |

| Expense Forecasts | List all expected costs, both fixed and variable. |

| Cash Flow Analysis | Monitor cash inflows and outflows to ensure liquidity. |

Regular Financial Audits And Reviews

Conduct periodic financial audits to track progress and identify issues. Regular reviews help in making informed decisions and adjustments.

- Monthly Reviews: Analyze monthly financial statements.

- Quarterly Audits: Perform detailed quarterly audits.

- Annual Evaluations: Assess overall financial performance annually.

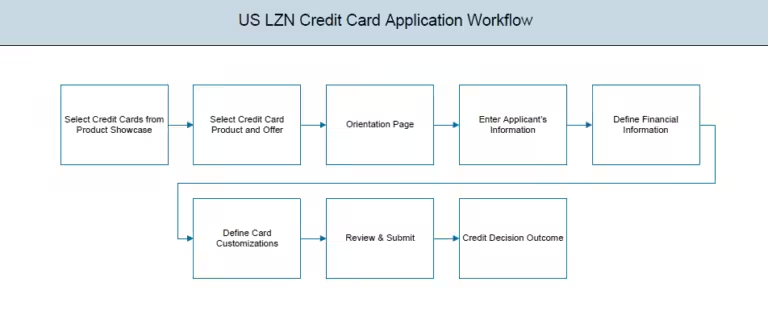

Utilizing Financial Tools And Software

Leverage financial tools to streamline operations. Flex Financial Platform is an excellent example.

- Flex Banking: Simplified banking, payments, and expense management.

- Flex Credit Card: Net-60 terms with 0% interest for 60 days.

- Advanced Security: Automated fraud monitoring and MFA.

Using such tools can significantly enhance your financial management capabilities.

Case Studies Of Successful Financial Freedom

Financial freedom is crucial for businesses of all sizes. Learning from those who have achieved it can provide valuable insights and strategies. Below are some case studies that highlight how both small businesses and large corporations have reached financial freedom.

Small Business Success Stories

Small businesses often face unique challenges on their journey to financial freedom. Here are a few success stories that demonstrate how they have overcome these hurdles:

- Local Bakery: By using the Flex Financial Platform, this bakery managed its expenses efficiently. They utilized the Flex Banking features for streamlined payments and expense management. This led to a significant improvement in cash flow.

- Freelance Graphic Designer: This freelancer used the Flex Credit Card to manage project expenses. The net-60 payment terms and 0% interest for 60 days allowed for better financial planning. As a result, the freelancer could take on more projects without worrying about immediate cash outflows.

Large Corporations Achieving Financial Freedom

Large corporations often have more resources but also face complex financial challenges. Here are some examples of how they have achieved financial freedom:

- Tech Startup: This startup integrated the Flex Financial Platform to consolidate its financial operations. They benefited from the high APY on cash balances and secure banking with FDIC insurance. This helped them meet their profit objectives while ensuring financial security.

- Retail Chain: The retail chain used individual employee cards from Flex to manage team expenses. This not only provided better expense tracking but also enhanced cash flow management. The automated fraud monitoring features ensured financial security.

Lessons Learned From Financially Free Businesses

Successful businesses teach us valuable lessons about achieving financial freedom. Here are some key takeaways:

- Efficient Expense Management: Using platforms like Flex for streamlined banking and expense management can significantly improve cash flow.

- Leverage Financial Tools: Utilizing credit cards with favorable terms, like the Flex Credit Card, can help manage expenses without incurring high-interest rates.

- Focus on Security: Ensuring secure and compliant banking practices, such as those offered by Flex, is essential for financial stability.

- Plan for Growth: Businesses that plan for growth and adjust their financial strategies accordingly are more likely to achieve financial freedom.

Pros And Cons Of Pursuing Financial Freedom

Achieving financial freedom for businesses can be transformative. It offers numerous advantages but also comes with potential drawbacks and risks. Understanding both sides helps in making informed decisions.

Advantages Of Financial Independence

- Enhanced Cash Flow: The Flex Credit Card provides net-60 terms and 0% interest for 60 days, improving cash flow.

- Streamlined Financial Operations: Flex integrates various financial services, simplifying banking, payments, and expense management.

- High APY on Cash Balances: Businesses can earn up to 2.99% APY on cash, aiding in meeting profit objectives.

- Security and Compliance: Flex ensures secure and compliant banking with FDIC insurance up to $3M, and up to $75M through the Treasury product.

- Automated Fraud Monitoring: Advanced security features like Multi-Factor Authentication (MFA) and robust encryption offer peace of mind.

- Flexible Credit Limits: Credit limits grow with your business, allowing for scalability and growth.

- Individual Employee Cards: Issuing individual employee cards at no extra cost helps manage expenses efficiently.

Potential Drawbacks And Risks

- Interest-Free Grace Period Conditions: The 0% interest for 60 days is only applicable if the full balance is paid within the grace period. Failing to meet this condition can lead to unexpected interest charges.

- Tiered APY Rates: The APY on cash balances is tiered based on balance amounts, which might not benefit all businesses equally.

- Strict Compliance Requirements: Adhering to the compliance and security measures, though beneficial, might require additional administrative efforts.

- Dependency on Financial Technology: Relying heavily on a financial technology platform may pose risks if there are technological issues or outages.

- Complex Terms and Conditions: Understanding the detailed terms in the Flex Commercial Cardholder Agreement and Flex Deposit Account Terms and Conditions is crucial to avoid potential pitfalls.

Ideal Scenarios And Recommendations

Achieving financial freedom for businesses involves understanding the best practices and guidelines suited for different stages and industries. By tailoring strategies, businesses can maximize growth and ensure financial stability.

Best Practices For Startups

Startups need to focus on building a strong financial foundation. Here are some key practices:

- Utilize a finance super app like Flex: Integrate various financial services into one seamless, easy-to-use platform.

- Streamlined banking and expense management: Simplify banking, payments, and expense management with tools such as Flex Banking.

- Leverage credit options: Use Flex Credit Card for net-60 on all purchases and 0% interest for 60 days to enhance cash flow.

- Monitor and manage cash flow: Keep track of expenses and income to avoid cash shortages.

Guidelines For Established Businesses

For established businesses, the focus shifts to optimizing financial operations and leveraging existing resources:

- Maximize APY on cash balances: Earn up to 2.99% APY on cash on hand with Flex Banking.

- Expand credit limits: Utilize Flex Credit Card’s growing credit limits to support larger expenditures.

- Automate expense management: Streamline receipt capture and payments to reduce manual effort.

- Enhance security: Use advanced security features like Multi-Factor Authentication (MFA) and robust encryption.

Tailored Strategies For Different Industries

Different industries have unique financial needs. Tailored strategies ensure each sector maximizes their potential:

| Industry | Recommended Strategies |

|---|---|

| Technology |

|

| Retail |

|

| Manufacturing |

|

Frequently Asked Questions

What Is Financial Freedom For Businesses?

Financial freedom for businesses means having sufficient resources to cover expenses, invest, and grow. It ensures stability and sustainability.

How Can A Business Achieve Financial Freedom?

Businesses can achieve financial freedom by managing cash flow, reducing debt, and investing in growth opportunities. Effective budgeting and planning are essential.

Why Is Financial Freedom Important For Businesses?

Financial freedom is crucial for businesses to ensure long-term stability and growth. It allows them to seize opportunities and withstand economic downturns.

What Are The Steps To Gain Financial Freedom?

To gain financial freedom, businesses should track expenses, create a budget, reduce debt, and invest wisely. Regular financial reviews are essential.

Conclusion

Achieving financial freedom for your business is within reach. Start by implementing strategic financial tools. A platform like Flex Financial Platform can simplify your financial management. Enjoy features like easy banking, high APY, and flexible credit terms. These tools can help streamline your operations and boost cash flow. Learn more about Flex here. Taking control of your finances today can set your business on the path to financial freedom. Make the right financial decisions now to secure a prosperous future.